U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

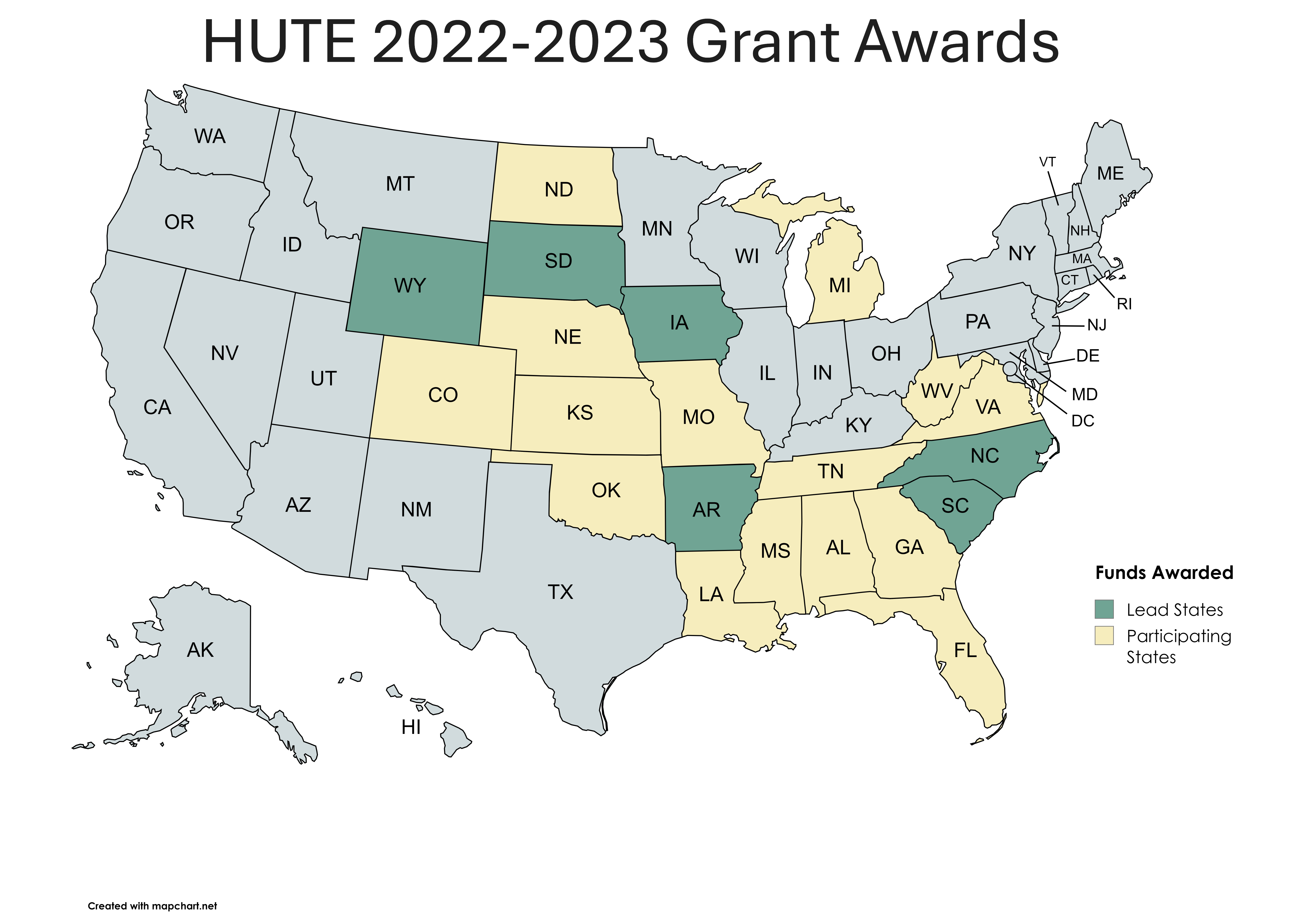

| Applying Agency | State | Amount | Project Description |

|---|---|---|---|

| Arkansas Department of Transportation | AR | $ 550,000 | This request is for expenses related to travel and attendance for the 2025 and 2026 International Fuel Tax Agreement (IFTA) Educational Forum, from the States as a training experience for administrators, auditors, and enforcement personnel. |

| Arkansas Department of Transportation | AR | $ 622,800 | This project will continue the work of the Southern Regional task force (as defined by the Federation of Tax Administrators, that were established to allow for a sharing of information and best practices for the States to identify and combat evasion of highway use taxes |

| Iowa Department of Transportation | IA | $ 80,000 | Iowa Motor Vehicle Division (MVD) of the State Department of Transportation is requesting HUTE funding to directly support this subproject for outreach to Iowa’s agricultural community to increase compliance with transportation provisions, including the proper collection of highway fuel taxes when applicable. |

| North Carolina Department of Transportation | NC | $ 1,172,300 | This proposal has three primary projects. First is to hire additional support staff for the State's participation in the Joint Operations Center for National Fuel Tax Compliance (JOC) with the internal Revenue Service (IRS). The second is to fund additional work in the areas of audit and enforcement. Finally, work would be continued with neighboring States to identify areas of non-compliance. |

| South Carolina Department of Motor Vehicles | SC | $ 443,509 | This proposal includes several planned training initiatives externally for Motor Carriers in the State and internal South Carolina Department of Motor Vehicles (SCDMV) staff. |

| South Dakota Department of Transportation | SD | $ 116,593 | This project will continue the work of the Midwest Regional task force (as defined by the Federation of Tax Administrators, that were established to allow for a sharing of information and best practices for the States to identify and combat evasion of highway use taxes |

| Wyoming Department of Transportation | WY | $ 90,870 | This project will use funds to hire and train six fuel tax examiners over a three-year period. |