Introductory Slide

Value Capture Incremental Growth Techniques and Case Studies

- Audio:

- Via Computer - No action needed

- Via Telephone - Mute computer speakers, call (800) 683-4564, passcode 406499#

- Presentations by:

- Thay Bishop, Senior Program Advisor, FHWA Center for Innovative Finance Support, thay.bishop@dot.gov

- Alan Ferguson, Senior Vice President, Community Development, Invest Atlanta, aferguson@investatlanta.com

- Rafael Aldrete, Director, Texas Transportation Institute, R-Aldrete@tti.tamu.edu

- Audience Q&A - addressed after each presentation, please type your questions into the chat area on the left side of the screen

- Closed captioning is available at: https://www.captionedtext.com/client/event.aspx?EventID=3996225&CustomerID=321

- Upcoming webinars:

- Recordings and Materials from Webinars:

Upcoming Webinars

| Topic | Date | Time | Register Online | Webinar Materials |

|---|---|---|---|---|

| Understand Value Capture Tools and Federal Resources | June 20, 2019 | Event completed |

Transcript: HTML Webinar: Listen online |

|

| Value Capture: Developer Contributions Techniques and Case Studies | June 27, 2019 | Event completed |

Webinar: Listen online |

|

| Value Capture: Capital Improvement Plan | July 18, 2019 | Event completed |

Webinar: Listen online |

|

| Value Capture: Special Assessment Techniques and Case Studies | July 24, 2019 | Event completed |

Webinar: Listen online |

|

| Value Capture: Incremental Growth Techniques and Case Studies | August 22, 2019 | Event completed | Webinar: Listen online |

|

| Value Capture: Joint Development, Use ROW Agreement, and Case Studies | September 19, 2019 | 1-2:30 pm ET | Register |

|

| Value Capture: Capture Value from Existing Assets to Fund Previously Unfunded Infrastructure Projects and Case Studies | October 24, 2019 | 1-2:30 pm ET | Register |

|

| Value Capture: Advertising, Naming Rights, and Case Studies | November 21, 2019 | 1-2:30 pm ET | Register |

|

Presentation 1

Value Capture: Incremental Growth Technique & Case Studies

Value Capture Techniques Summary

- Developer Contributions - One-time charges collected by local governments from developers to offset the cost of infrastructure and services necessitated by new development.

- Special Assessments - An additional fee or tax assessed on businesses or residents in specified geographic areas benefiting proximity to a highway or other transportation facility or corridor.

- Fees - Similar to a utility fee, transportation fees are assessed based on how individual businesses and households use transportation facilities.

- * Incremental Growth - A mechanism allocating back to infrastructure from some specified portion of increased property tax revenues fostered by new infrastructure - often for a specified period of time.

- Joint Development - Sale or lease of land or air rights on or adjacent to transportation facilities. This can include donations of land or other in-kind resources from the private sector in ongoing commercial operations.

- Concessions - Sale or lease of government owned assets - such as toll roads or bridges - to private-sector investors/operators.

- Advertising and Naming Rights - Sale of advertising space or naming rights on a transportation facility. Note: Commercial uses within Interstate Highway System right of way, including rest areas, is prohibited by law; however, they may be allowed on toll facilities and in transit stations.

* Topic of this webinar

Outline of Presentation

- Tax Incremental Finance Overview

- Why is There a Need for Incremental Revenues?

- Process to Create a TIF District

- Federal Roles

- Case Studies

- Q&A

Tax Incremental Finance Overview

Glossary of Terms

- Tax Incremental Financing (TIF): a revenue/funding tool available to local authorities to encourage economic development that would not occur without public assistance.

- A Tax Increment District (TID): the contiguous geographical area within a municipality consisting solely of whole units of property that are assessed for general property tax purposes.

- "Blight" - The legal term "blight" describes a wide array of urban problems, which can range from physical deterioration of buildings and the environment, to health, social, and economic problems in a particular area.

- Neighborhood blight and the presence of vacant and abandoned properties have profound negative impacts on afflicted communities. Blighted properties decrease surrounding property values, erode the health of local housing markets, pose safety hazards, and reduce local tax revenue.

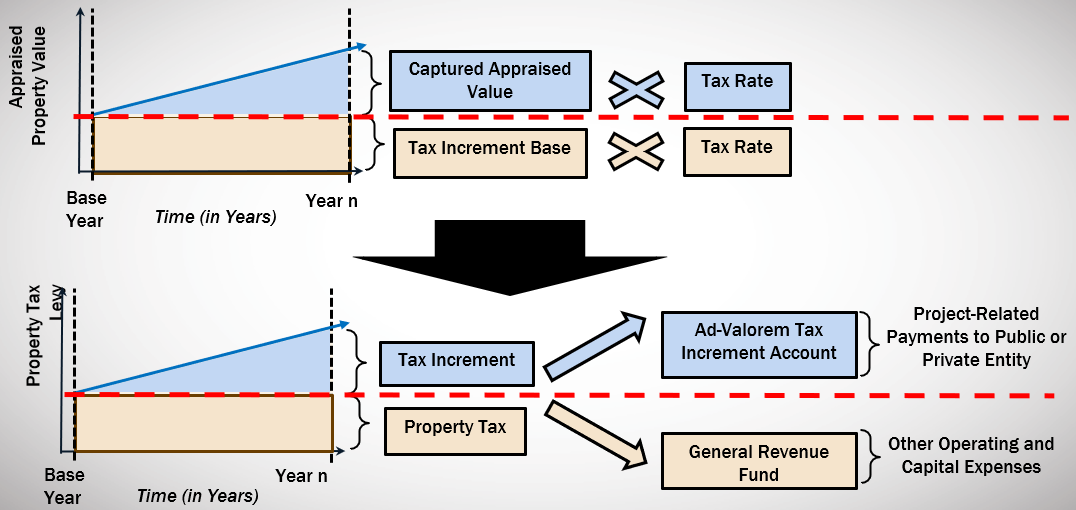

Glossary of Terms: Base & Incremental Revenues

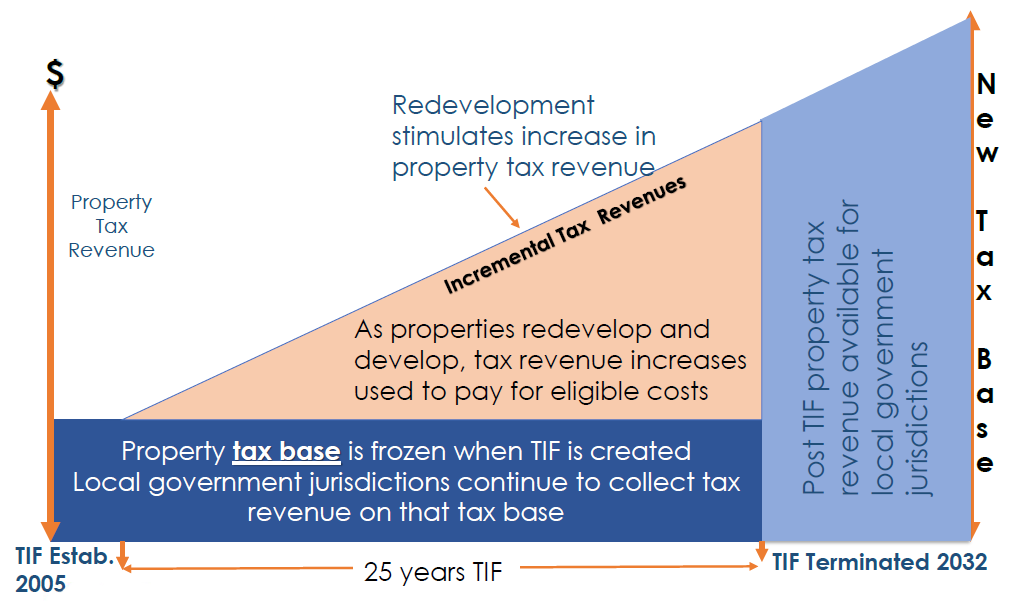

- TIF established in 2005, 25 year duration, terminated in 2032

- TIF takes in Property Tax Revenues

- Property Tax Base is frozen with TIF is created

- Local government juristictions continue to collect tax revenue on that tax base

- Incremental Tax Revenues also collected and increase as properties redevelop and develop, tax revenue increases used to pay for eligible costs

- Redevelopment stimulates increase in property tax revenue

- TIF takes in Property Tax Revenues

- At TIF Termination, Post TIF property tax revenue available for local government jurisdictions as part of the new tax base

Tax Incremental Finance by Other Names

- California: Redevelopment Agency (RDA)

- Georgia: Tax Allocation District (TAD)

- Massachusetts: District Improvement Financing (DIF)

- New Jersey: Revenue Allocation District (RAD)

- North Carolina: Project Development Financing

- Pennsylvania: Transportation Revitalization Investment Districts (TRIDs)

- Texas: Tax Increment Reinvestment Zones (TIRZ)

Overview of TIFs

- A revenue tool that captures and uses increased property tax revenues from new development within a defined geographic area to fund public infrastructure

- Available in 49 of 50 states and the District of Columbia

- Represents the new tax revenues generated from new development properties within the Tax Incremental District and are split into two components:

- Base Revenues

- Incremental Revenues

Incremental Revenues Financing Tools

- Pay-as-you-go financing: expenditures are undertaken as incremental revenue is realized

- Developer financing: Local reimburses the developer for TIF-eligible costs as it obtains incremental revenues

- Municipal financing:

- Revenue bonds & general obligation

- Taxable revenue bond

- Municipal financing with developer participation: Local authority issues bonds while the developer simultaneously pledges to purchase all or a significant portion of bonds

What is the Need for Value Capture: Tax Increment Financing?

Infrastructure Crisis

National Highway System Conditions (ASCE 2017)

- One out of every 5 miles of highway pavement is in poor condition

- 8% or 47,000 bridges rated in poor condition

- 43% or 260,209 bridges are over 50 years old

- $836 billion backlog of highway and bridge capital needs

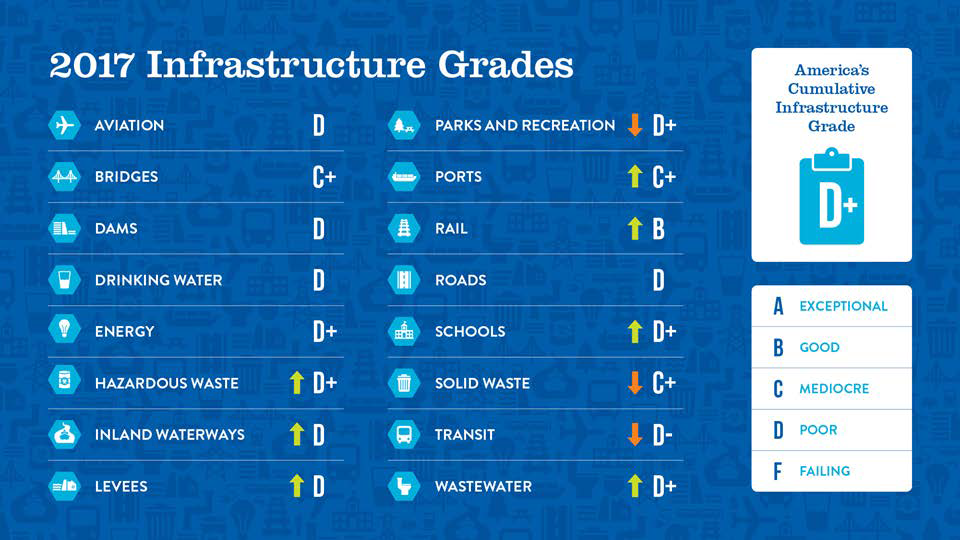

Text of 2017 Infrastructures Grades graphic

| 2017 Infrastructure Grades | |||

| Aviation | D | Parks and Recreation | ↓ D+ |

| Bridges | C+ | Ports | ↑ C+ |

| Dams | D | Rail | ↑ B |

| Drinking Water | D | Roads | D |

| Energy | D+ | Schools | ↑ D+ |

| Hazardous Waste | ↑ D+ | Solid Waste | ↓ C+ |

| Inland Waterways | ↑ D | Transit | ↓ D- |

| Levees | ↑ D | Wastewater | ↑ D+ |

America's Cumulative Infrastructure Grade - D+

A: Exceptional / B: Good / C: Mediocre / D: Poor / F: Failing

Funding Challenges

- Eroding infrastructure diminishes mobility, public safety, and quality of life

- State and local governments often struggle to mobilize necessary funds to maintain, rebuild, and expand their local transportation networks

- Revenues at federal or state levels may be insufficient

- Debt ceilings may prevent local authorities from financing capital costs

Benefits-Tax Incremental Finance District

- Promotes development which leads to job creation, increases in property values, helps eliminate blighted areas, and protects the local tax base

- Allows the local authority to undertake economic development activities or provide subsidies that otherwise might not be possible

- Used to combat blight or deterioration within city districts or neighborhoods

- Appealing tool for politicians because they do not require the local authority to raise tax rates

- Preservation and strengthening of tax base

Who Can Form a TIF District?

- Locals (City, County, Township, etc.)

- Economic Development Authorities or EDAs

- Housing and Redevelopment Authorities or HRAs

- Port Authorities

Process

How Tax Incremental Finance Works

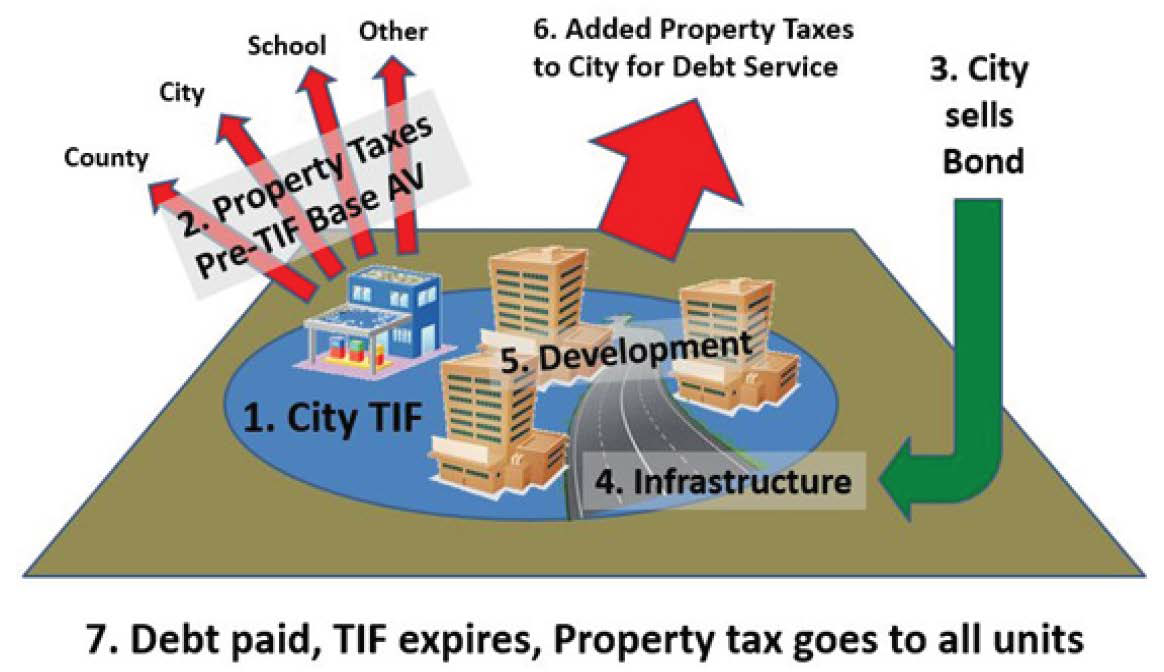

Text of "How Tax Incremental Finance Works infographic

- City TIF

- Property Taxes, Pre-TIF Base AV (County, City, School, Other)

- City Sells Bond

- Infrastructure

- Development

- Added Property Taxes to City for Debt Service

- Debt paid, TIF expires, Property tax goes to all units

Process to Create a TIF District

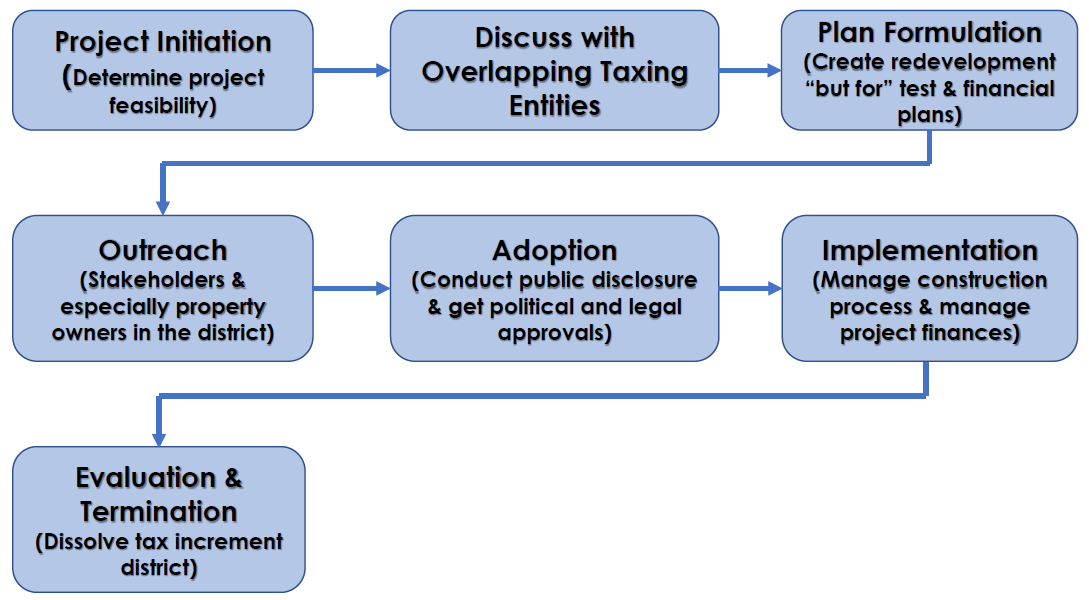

Text of "How to Create a TIF District" flow chart

- Project Initiation (Determine project feasibility)

- Discuss with Overlapping Taxing Entities

- Plan Formulation

(Create redevelopment "but for" test & financial plans)- Outreach

(Stakeholders & especially property owners in the district)- Adoption

(Conduct public disclosure & get political and legal approvals)- Implementation

(Manage construction process & manage project finances)- Evaluation & Termination

(Dissolve tax increment district)

- Evaluation & Termination

- Implementation

- Adoption

- Outreach

- Plan Formulation

- Discuss with Overlapping Taxing Entities

The "But For" Test

The "But-For" Test

- A key statutory requirement

- The fundamental purpose of TIF is to attract investment to an area in which little or no new development or growth would take place without the use of the TIF

- This is sometimes called the "but for" test - no growth/development would happen but for the use of TIF

TIF District Maintenance

- Annual TIF audited reports

- Update district database to provide information for interested parties

- On-going monitoring and continuing disclosure requirements

- Investor quarterly reports

Termination of Tax Incremental Finance District

- Reach the end of maximum Tax Incremental Finance District statutory life (25-30 years)

- A TIF District may be terminated by a resolution from the municipality's government

- The Department of Revenue must be notified

- A final accounting report (audited financial statement) must be completed

Challenges: Community Buy-In

- Redevelopment and economic development do not happen in a vacuum, and the process can be highly political

- Diversion of tax dollars for private development can be controversial

- Raises policy questions regarding the proper role of government

- Issuance of "public" debt for "private" development can be unsettling

- Tax revenue "diverted" from other municipal services

- The TIF mechanism can be difficult to understand

- Redevelopment can trigger emotional responses

Federal Roles

Federal Role in Value Capture Strategies

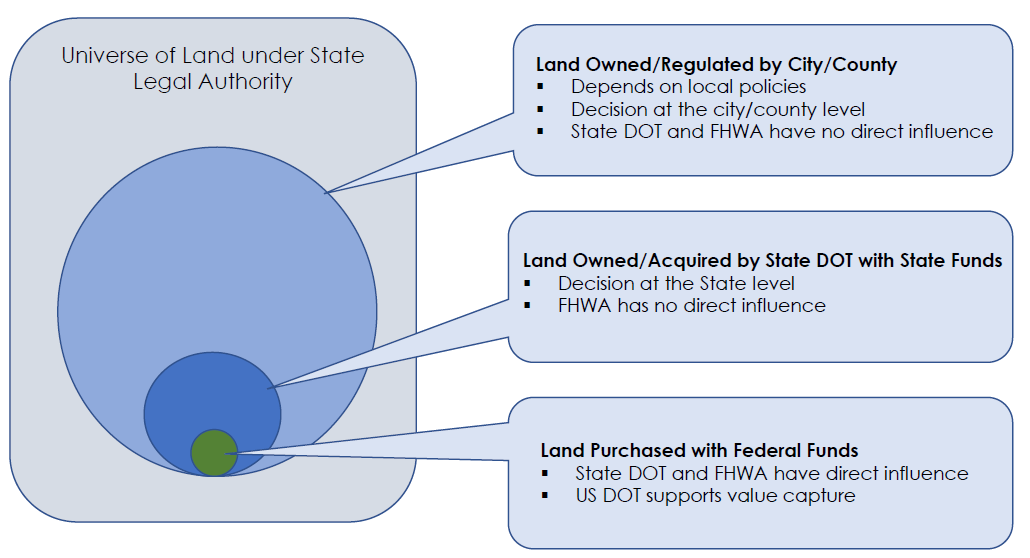

Text of "Federal Roles" Infographic

Universe of Land under State Legal Authority

Land Owned/Regulated by City/County

- Depends on local policies

- Decision at the city/county level

- State DOT and FHWA have no direct influence

-

Land Owned/Acquired by State DOT with State Funds

- Decision at the State level

- FHWA has no direct influence

Land Purchased with Federal Funds

- State DOT and FHWA have direct influence

- US DOT supports value capture

Value Capture Implementation Team

Co-Leads

- Thay Bishop, FHWA Center for Innovative Finance Support, OIPD

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- David Cohen, FHWA Office of Project Development & Env. Review

- John Duel, FHWA Office of Planning, Environment, and Realty

- Kathleen Hulbert, FHWA Infrastructure Office

- Andrea Kirk, FHWA Center for Local-Aid Support, OIPD

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Bingxin Yu, FHWA Transportation Policy Studies

VCIT Focus Areas

Communication - Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

Technical assistance - Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

Clearinghouse (website) - Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc

Value Capture Implementation Manual

1. Introduction

2. Assess Funding Options and Need for Value Capture

3-8. Select Appropriate Value Capture Technique

9. Develop Business and Economic Case and for Stakeholders

10. Address Real Estate Risk

11. Establish Regulatory Framework

12. Implement Funding and Financing Plan

Case Studies

Clearinghouse for Best Practices/Lessons Learned

EDC-5 Value Capture Sessions: https://www.fhwa.dot.gov/ipd/value_capture/resources/value_capture_resources/edc- 5_resources.aspx

Project Profiles: https://www.fhwa.dot.gov/ipd/value_capture/ project_profiles/

Factsheets: https://www.fhwa.dot.gov/ipd/fact_sheets/

Value Capture Resources: https://www.fhwa.dot.gov/ipd/value_capture/resources/value_capture_resources/

EDC-5 Funding Opportunities

State Transportation Innovation Council (STIC) Incentive

- Up to $100,000 per STIC per year to standardize an innovation

https://www.fhwa.dot.gov/innovation/stic/

Accelerated Innovation Deployment (AID) Demonstration

- Up to $1 million available per year to deploy an innovation not routinely used

https://www.fhwa.dot.gov/innovation/grants

Presentation 2

VALUE CAPTURE AROUND TRANSIT INVESTMENT

August 22, 2019

OUR VISION

OUR VISION IS TO MAKE ATLANTA THE MOST ECONOMICALLY DYNAMIC AND COMPETITIVE CITY IN THE WORLD.

OUR MISSION

TO ADVANCE ATLANTA'S GLOBAL COMPETITIVENESS BY GROWING A STRONG ECONOMY, BUILDING VIBRANT COMMUNITIES AND INCREASING ECONOMIC PROSPERITY FOR ALL ATLANTANS.

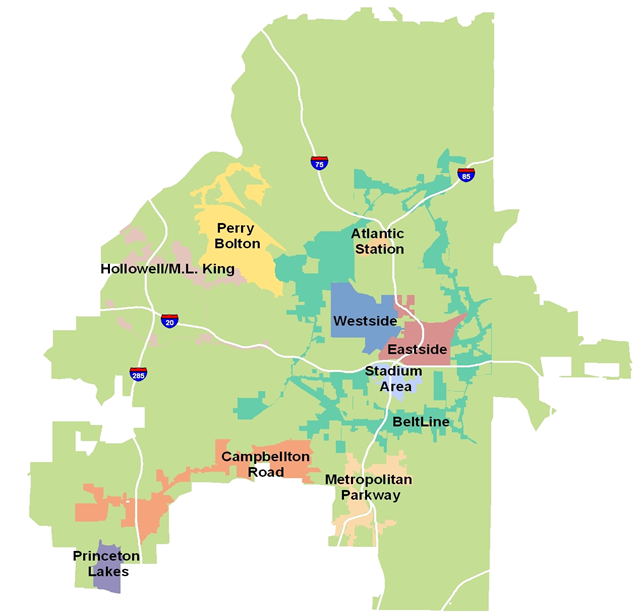

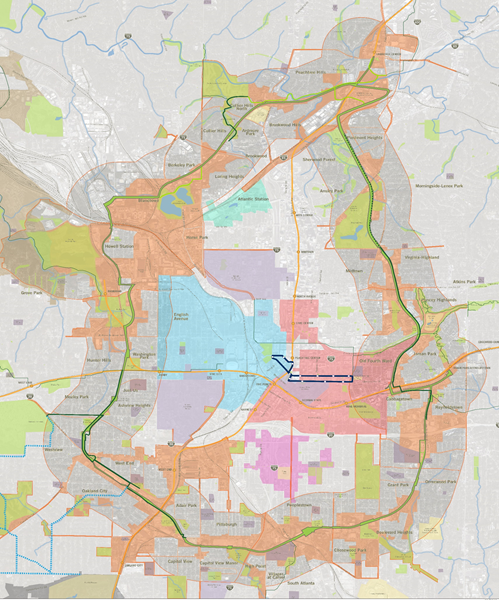

Tax Allocation Districts and Corridors

Atlanta's Tax Allocation Districts

- Westside (1992/1998 expanded)

- Atlantic Station (1999) - All proceeds pledged to debt repayment. No new projects

- Princeton Lakes (2002) - All proceeds pledged to debt repayment. No new projects

- Perry Bolton (2002)

- Eastside (2003)

- Atlanta BeltLine (2005)

- Campbellton Road (2006)

- Hollowell/ML King (2006)

- Metropolitan Parkway (2006)

- Stadium Area (2006) 3

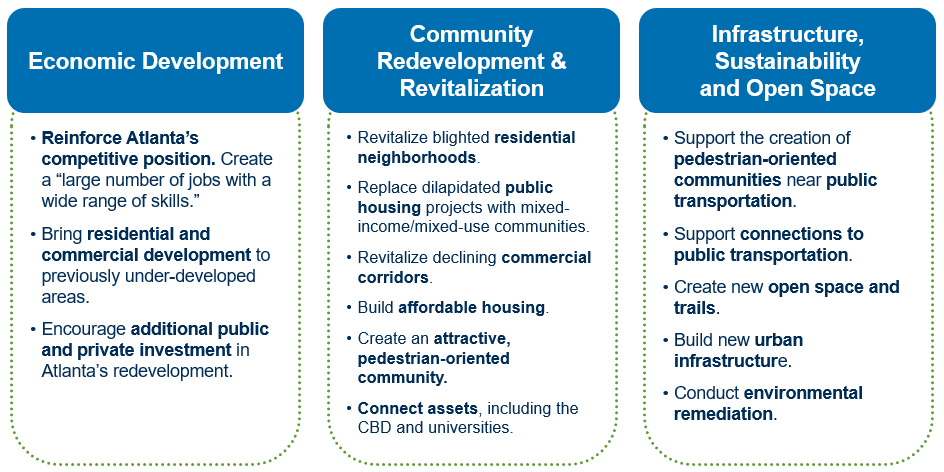

Objectives of Atlanta's TAD Program

Each TAD was established with a redevelopment plan that addresses specific challenges.

Text of TAD Challenges infographic

- Economic Development:

- Reinforce Atlanta's competitive position. Create a "large number of jobs with a wide range of skills."

- Bring residential and commercial development to previously under-developed areas.

- Encourage additional public and private investment in Atlanta's redevelopment.

- Community Redevelopment & Revitalization:

- Revitalize blighted residential neighborhoods.

- Replace dilapidated public housing projects with mixed-income/mixed-use communities.

- Revitalize declining commercial corridors.

- Build affordable housing.

- Create an attractive, pedestrian-oriented community.

- Connect assets, including the CBD and universities.

- Infrastructure, Sustainabilitt abd Open Space:

- Support the creation of pedestrian-oriented communities near public transportation.

- Support connections to public transportation.

- Create new open space and trails.

- Build new urban infrastructure.

- Conduct environmental remediation.

TAD Success Stories

TAD funding has been utilized to develop a wide array of residential, office, retail, hotel, and public amenity projects.

- Usage: TAD bonds and incremental tax revenues have been committed to or already provided gap funding to leverage over

$9.0 billion in private development. - Projects: TAD bonds and incremental tax revenues have helped fund or have been committed to:

- Over 12 million square feet of new residential development, producing over 12,000 units, more than 20% of which are affordable

- Over 7 million square feet of new commercial development, including hotels, stores, office buildings and a film production studio.

- The TAD program has also helped to fund two fire stations, several community and educational facilities, open space and trail projects, and infrastructure improvement projects.

Captions for photos in this collage

- Moores Mill Village - Perry Bolton

- Tribute Lofts - Eastside

- Center for Civil & Human Rights - Westside

- The Remington Senior Housing - Hollowell-ML King

How Have the TADs Performed?

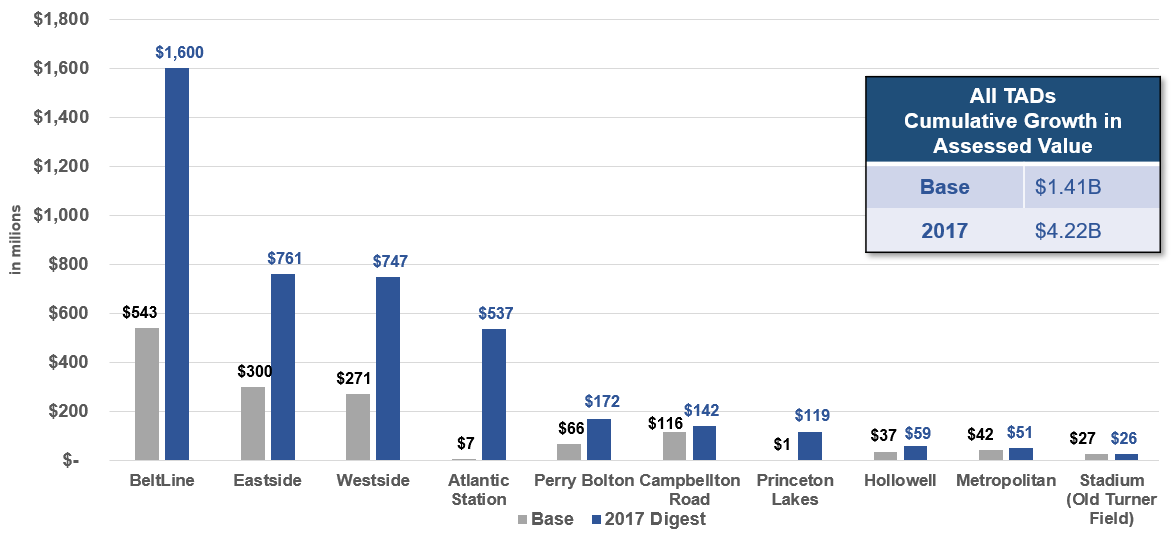

Growth in Assessed Value

Summary of TAD Cumulative Growth chart

| Base | 2017 Digest | |

|---|---|---|

| BeltLine | $543 | $1,600 |

| Eastside | $300 | $761 |

| Westside | $271 | $747 |

| Atlantic Station | $7 | $537 |

| Perry Bolton | $66 | $172 |

| Campbellton Road | $116 | $142 |

| Princeton Lakes | $1 | $119 |

| Hollowell | $37 | $59 |

| Metropolitan | $42 | $51 |

| Stadium (Old Turner Field) | $27 | $26 |

| Base | $1.41B |

| 2017 | $4.22B |

Since the creation of each TAD, the cumulative increment in assessed value for all TADs is $2.81B.

Atlanta Beltline

- Atlanta BeltLine, Inc. (ABI) was created in 2006.

- ABI is managing the planning, design and implementation of all aspects of the project.

- +/- 3,000 acres of underutilized land along the corridor will become available for public and private redevelopment opportunities.

- Funding for the Atlanta BeltLine project comes from a combination of federal, state, local, and private sources.

Atlanta Beltline & Transit

- A Coordinated Approach

- Two major efforts are underway to advance transit on the Atlanta BeltLine: the More MARTA program and federal NEPA studies. These support the Atlanta Streetcar System Plan (SSP), which focuses on connecting neighborhoods to key destinations and activity centers. The SSP is a supplement to the City's Connect Atlanta Plan and works in tandem with Atlanta BeltLine, Inc.'s Strategic Implementation Plan (SIP).

- More MARTA

- 16 projects throughout the City of Atlanta will be funded through the More MARTA sales tax. This includes approximately $1.2 billion in funding for Atlanta BeltLine transit projects.

- The Big Picture

- The plan calls for 50 miles of new streetcar routes and 12 miles of connected transit, which includes investment in other forms of public transportation to provide additional connectivity to the streetcar system. The SSP was adopted by the Atlanta City Council on December 8, 2015.

Atlanta Beltline Challenges

- AFFORDABLEHOUSING

- EQUITY & INCLUSION

- DISPLACEMENT

INVEST ATLANTA

Thank you

Presentation 3

Incremental Growth Techniques:

Transportation Reinvestment Zones

Federal Highway Administration

EDC-5 Value Capture Webinar

August 22, 2019

Outline

- Introduction and Background

- The Texas TRZ

- Evolution of the TRZ Legal Framework

- The TRZ Implementation Process

- Opportunities and Limitations

- Active Texas TRZs

Introduction

- Funding Transportation Needs

- Creative Thinking

- Doing more with less

- Alternative Funding sources

- Texas Legislature SB 1266 (2007) Created TRZs

- 14 Local TRZs Since 2007

Background

| Mechanism | Definition | Applicable Purpose | Examples (State) |

|---|---|---|---|

| Impact Fees (IF) |

|

Cost recovery |

|

| Special Assessment District (SAD) |

|

Capture of project expansion benefits |

|

| Sales Tax District (STD) |

|

Capture of project expansion benefits |

|

| Negotiated Exaction (NE) |

|

Capturing opportunity for value creation and cost recovery |

|

| Joint Development (JD or P3) |

|

Capturing opportunity for value creation and cost sharing and revenue sharing with private sector |

|

| Air Rights (AR) |

|

Capturing opportunity for value creation and cost sharing and revenue sharing with private sector |

|

| Land Value Tax (LVT) |

|

Capture of project expansion benefits |

|

| Transportation utility fees (TUFs) |

|

Cost recovery: operating and maintenance costs |

|

| Tax increment financing (TIF) |

|

Capture of project expansion benefits |

|

The Texas TRZ - Definition

- Texas TRZs

- Designated contiguous zone around a planned transportation improvement where properties are expected to benefit from the project through land development, value increases

- Legal arrangement to facilitate value capture via the property and sales tax mechanism and allow the local government to use incremental tax revenue as collateral

- Texas TRZs are not a new tax

- Tax rates do not change

- Revenue realized only if real property develops / increases in value

- TRZs Expedite Transportation Projects

- Local match contributions

- Multiple funding sources leveraged

- Local match contributions

- TRZ Legal Framework Has Evolved

- Process / requirements clarified

- Uses / types modified or expanded

- Three TRZ Types

- Municipal

- County

- Port Authority

The Texas TRZ - How it Works

The Texas TRZ - Financing Options

Three Financing Options Available for TRZ Revenue Funds

| Type | Form | Advantage | Disadvantage |

|---|---|---|---|

| Pay-as-you-go |

|

|

|

| Municipal bond financing |

|

|

|

| State Infrastructure Bank (SIB) |

|

|

|

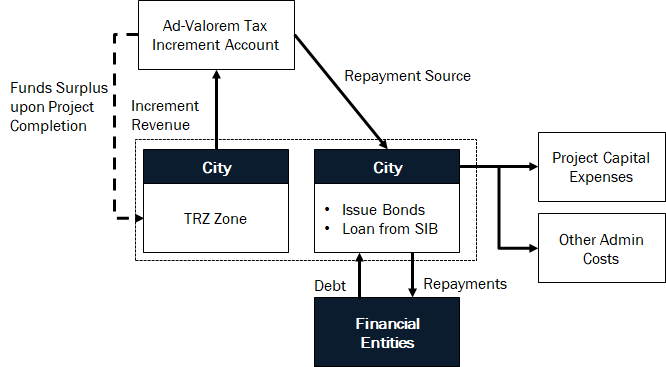

The Texas TRZ - How Funds Flow

Bond and SIB Loan Financing

Start: Public entity borrows money with TRZ revenue as collateral.

Construction: Government starts construction

Operation: Government repays debt using tax increment

Summary of TRZ Funds infographic

- Ad-Valorem Tax Increment Account is the Source of funds

- City - Issues Bonds, Loans from SIB

- City - uses those funds for Project Capital Expenses and Other Admin Costs, also sends repayments to Financial Entities

- City - TRZ pays back increment revenue into the Ad-Volorem Increment Account

- Financial Entities - Repayment income from the City, as well as debt paid back to the City

- Surplus funds upon project completion are given to the City TRZ Zone

- City - Issues Bonds, Loans from SIB

Evolution of the TRZ Legal Framework

| Categories | 2007 (SB 1266) |

2011 (HB 563) |

2013 (SB 1110 HB 2300 SB 971) |

2017 & (SB 1305) |

|---|---|---|---|---|

| Project Type |

|

|

|

|

| TRZ Type |

|

|

|

|

| TRZ Management |

|

|

|

TRZ Implementation Process

Five Steps: Initiation to Termination

- Initiation

- Zone Formation

- Public Hearing and Adoption

- TRZ Operation

- Termination

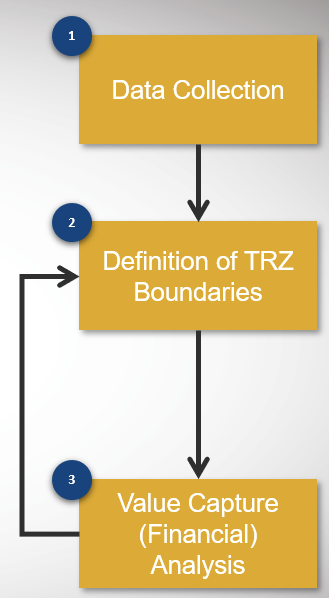

1. Initiation

- Data Collection

- Definition of TRZ Boundaries

- Value Capture (Financial) Analysis

- Project Identification and Need

- Specific development/economic benefits from project(s)

- Determine area eligibility/preliminary boundaries

- Conduct preliminary feasibility analysis

- Developing Stakeholder Relations and Champions

2. Zone Formation

| Refine | Establish | Provide Notice | Analyze |

|---|---|---|---|

Refine Boundaries, Zones, Parcels

|

Establish Benchmark Year for Tax Increment Collection | Provide 60-day Notice

|

Refine Value Capture Revenue Analysis |

3. Public Hearing and Adoption

| Public Hearing Timing | 30 Days after Hearing |

|---|---|

|

|

4. Operation

| Every Year after TRZ Adoption | Monitoring, Evaluation Become Critical |

|---|---|

|

|

5. Termination

| Dissolution of TRZ | OR | Dissolution of TRZ |

|---|---|---|

| Dec. 31 of compliance year with contractual requirement | Dec. 31 of the 10th year after establishment if not used |

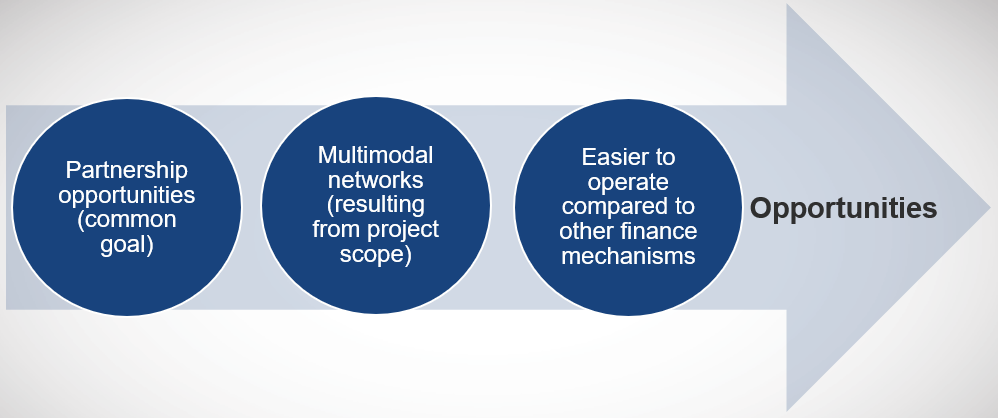

TRZs: Opportunities

- Partnership opportunities (common goal) »

- Multimodal networks (resulting from project scope) »

- Easier to operate compared to other finance mechanisms »

- Opportunities

- Easier to operate compared to other finance mechanisms »

- Multimodal networks (resulting from project scope) »

TRZs: Limitations

- Limitations

- « Constitutional restrictions on counties

- « SIB: only cost-effective lending Institution

- « Constitutional restrictions on counties

Active TRZs - 14 in Planning or Operation Phase (2017)

| TRZ Name and Location | TRZ Type | Date Established |

|---|---|---|

| City of El Paso TRZ No. 2 | Municipal | December 2010 |

| City of El Paso TRZ No. 3 | Municipal | December 2010 |

| City of El Campo TRZ No. 1 | Municipal | December 2012 |

| Town of Horizon City TRZ No. 1 | Municipal | November 2012 |

| City of Socorro TRZ No. 1 | Municipal | October 2012 |

| City of San Marcos TRZ No. 1 | Municipal | December 2013 |

| Cameron County, TRZ No. 6 | County | December 2015 |

| Hidalgo County TRZ No. 2 | County | December 2011 |

| El Paso County TRZ No. 1 | County | December 2012 |

| Hays County TRZ No. 1 | County | December 2013 |

| Port of Beaumont TRZ No. 1 | Port Authority and Navigation District | December 2013 |

| Port of Arthur TRZ No. 1 | Port Authority and Navigation District | December 2013 |

| Sabine-Neches Navigation District TRZ No.1 | Port Authority and Navigation District | December 2013 |

| Port of Brownsville TRZ No. 1 | Port Authority and Navigation District | December 2013 |

Active Texas TRZs:

City of El Paso TRZ

- Comprehensive Mobility Plan 2008 ~ $1 Billion investment in federal, state and local funds

- TRZ Contribution: $70M (7%)

- Four project types:

- Capacity expansion on existing roadways

- Aesthetic improvements to I-10 corridor

- Bus rapid transit corridors on arterials

- New toll roads

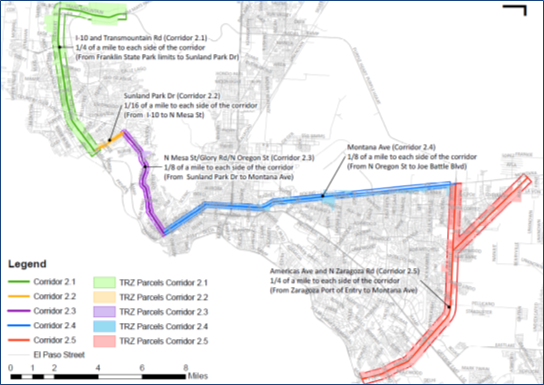

Transportation Reinvestment Zone No. 2

- Boundaries:

- Between 1/16 - 1/4 miles from corridor centerline

- Area: 4,434 Acres

- Project: direct connectors from Loop 375 to I-10 (Americas Interchange and Zaragoza DC)

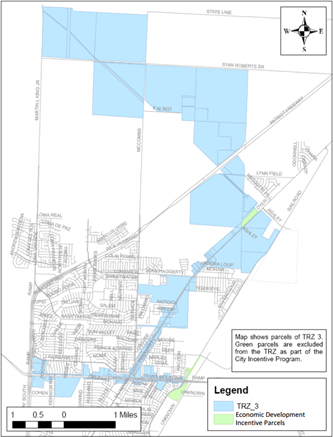

Transportation Reinvestment Zone No. 3

- Boundaries:

- 1/16 - 1/4 mile from centerline

- TRZ No.3: 5,513 Acres

- Project: Loop 375 Transmountain NE Mainlane Expansion

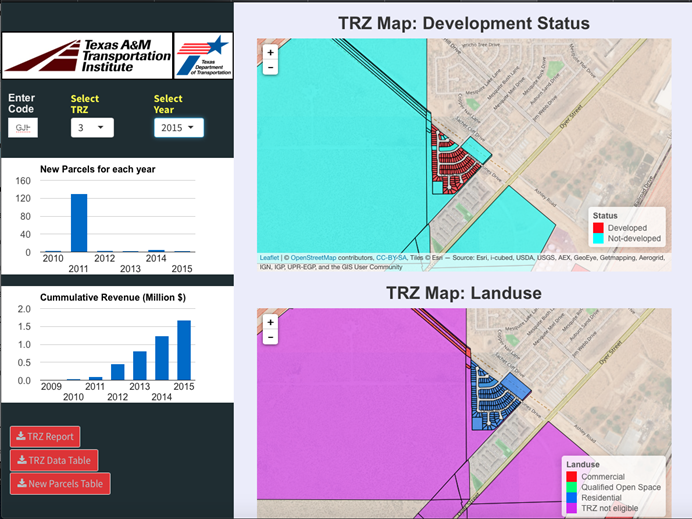

TRZ Monitoring Dashboard

Link:

https://tti-tamu-edu.shinyapps.io/TRZtool_New/

User Code:

GJH9Z1QDFATNECQ1UE22762LT 821U2

Questions

Rafael Aldrete, Ph.D.

Senior Research Scientist

(915) 532-3759 Ext. 14101

r-aldrete@tti.tamu.edu