TABLE OF CONTENTS

Mitigation Tool |

|

|---|---|

|

Analyze Downsides |

|

Over-collateralize |

|

Build in reserve funds |

|

Collect revenues before project start |

|

Reduce early cash flow pressure |

Develop projects by phase |

|

|

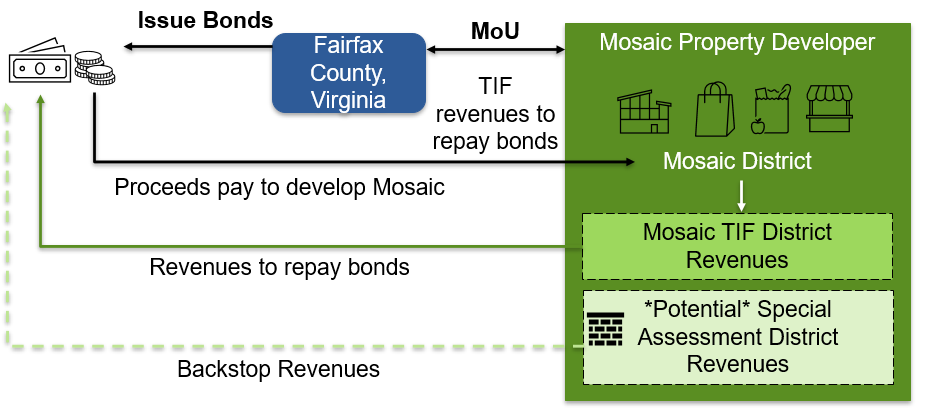

Backstop with creditworthy sources |

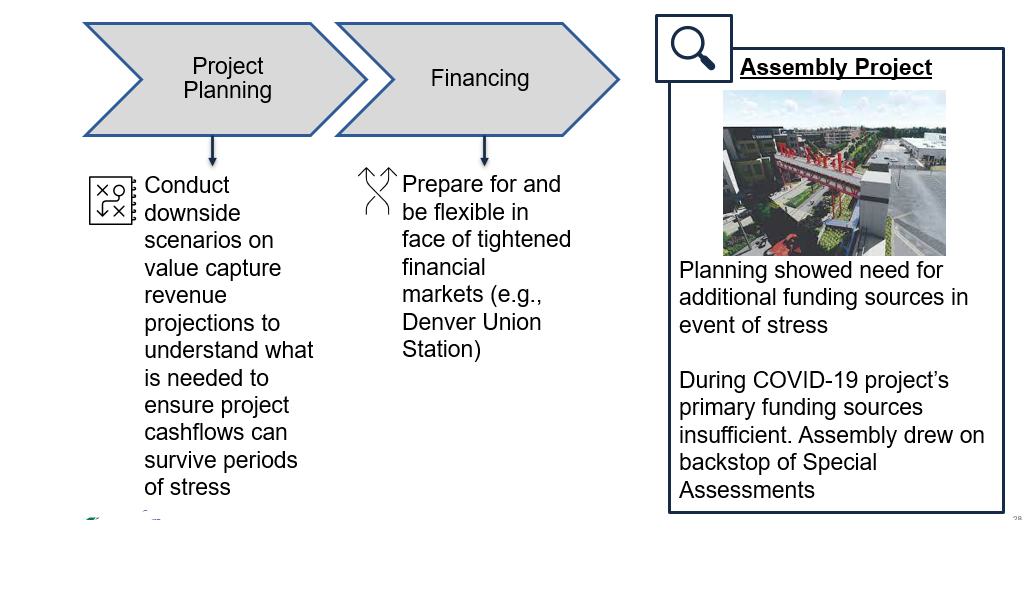

Conduct downside scenarios on value capture revenue projections to understand what is needed to ensure project cashflows can survive periods of stress

The next arrow - titled Financing - is connected to a block of text below:

Prepare for and be flexible in face of tightened financial markets (e.g., Denver Union Station)

A magnifying glass icon is above a block of information, titled 'Assembly Project.'

A photo of a real estate development. There's a gateway pictured with a sign that says 'The Yards.'

Planning showed need for additional funding sources in event of stress

During COVID-19 project's primary funding sources insufficient. Assembly drew on backstop of Special Assessments

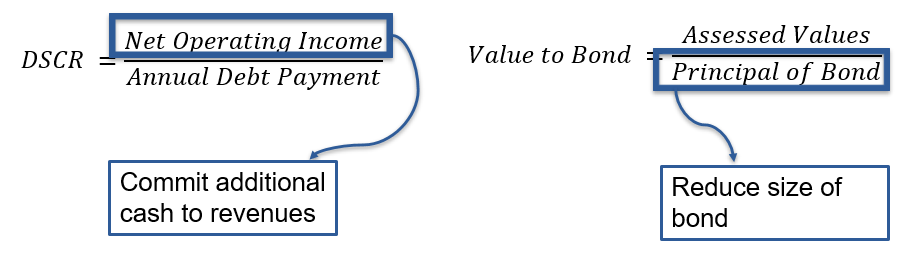

Increase the Debt Service Coverage Ratio (DSCR) & Value to Bond Ratio

An arrow comes down from the Net Operating Income box just read in the above formula and leads to a text block below.

Commit additional cash to revenues

There is a formula setup that demonstrates another idea. Value to Bond = Assessed Values over Principal of Bond. Principal of Bond is highlighted in a box.

An arrow comes down from the Principal of Bond box just read in the above formula and leads to a text block below.

Reduce size of bond

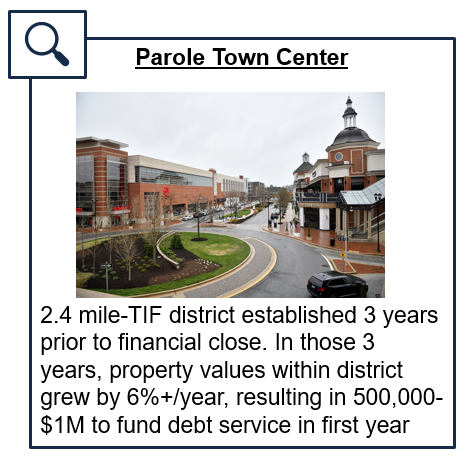

Source: Parole Town Center Project, Official Statement 2012, pp19-23

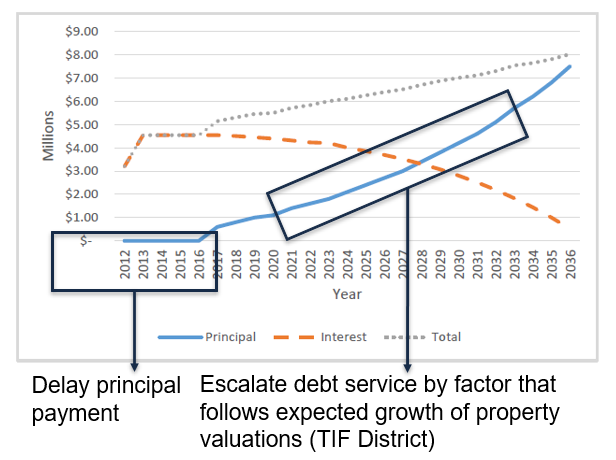

Mosaic Project Total Debt Service Payments 2012-2036

Capitalize interest one year; or multiple years through capital appreciation bond

Source for underlying data: “$65,650,000 Mosaic District Community Development Authority (Fairfax County, Virginia) Official Statement (OS),” May 26, 2011,p. 15

Colorado E-470

47-mile toll highway forming half of beltway around Denver, CO.

Built in segments in response to economic issues that affected toll and value capture related projects

For example, Mosaic shopping & dining complex deployed this tool in case of depression in property values