chapter 7

Potential Highway Capital Investment Impacts

Types of Capital Spending Projected by HERS and NBIAS

Alternative Levels of Future Capital Investment Analyzed

Highway Economic Requirements System

Impacts of Federal-Aid Highway Investments Modeled by HERS

Impacts of NHS Investments Modeled by HERS

Impacts of Interstate System Investments Modeled by HERS

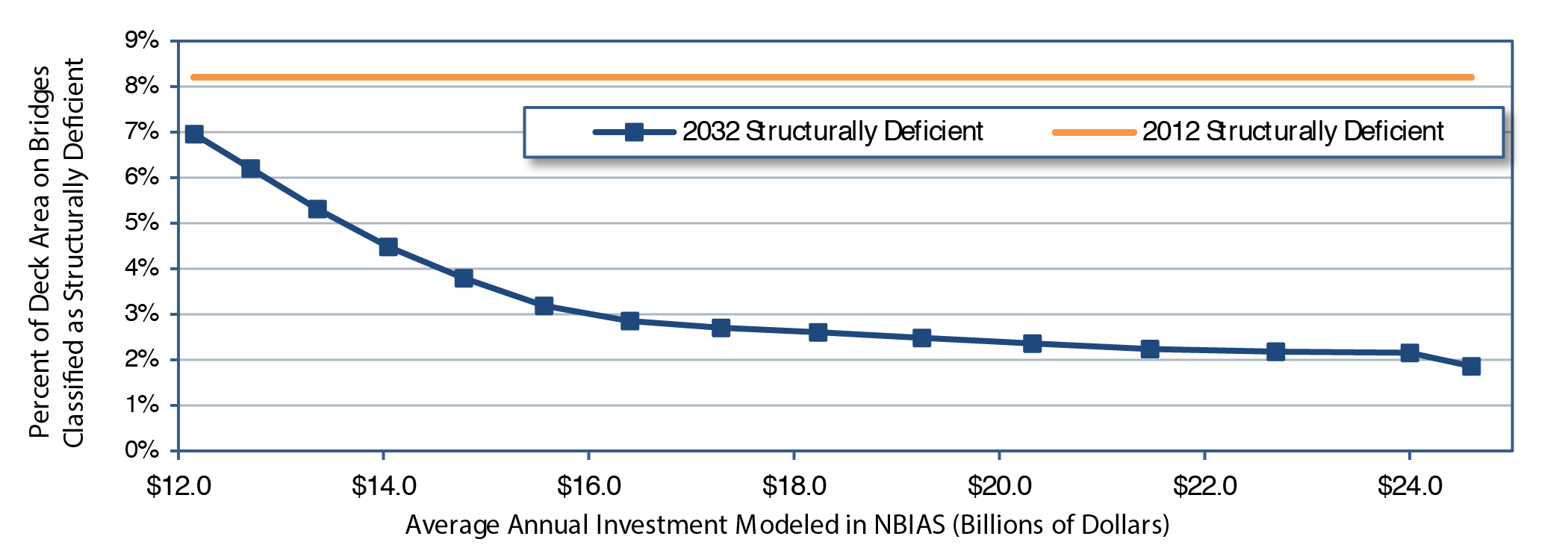

National Bridge Investment Analysis System

Impacts of Systemwide Investments Modeled by NBIAS

Impacts of Federal-Aid Highway Investments Modeled by NBIAS

Impacts of NHS Investments Modeled by NBIAS

Impacts of Interstate Investments Modeled by NBIAS

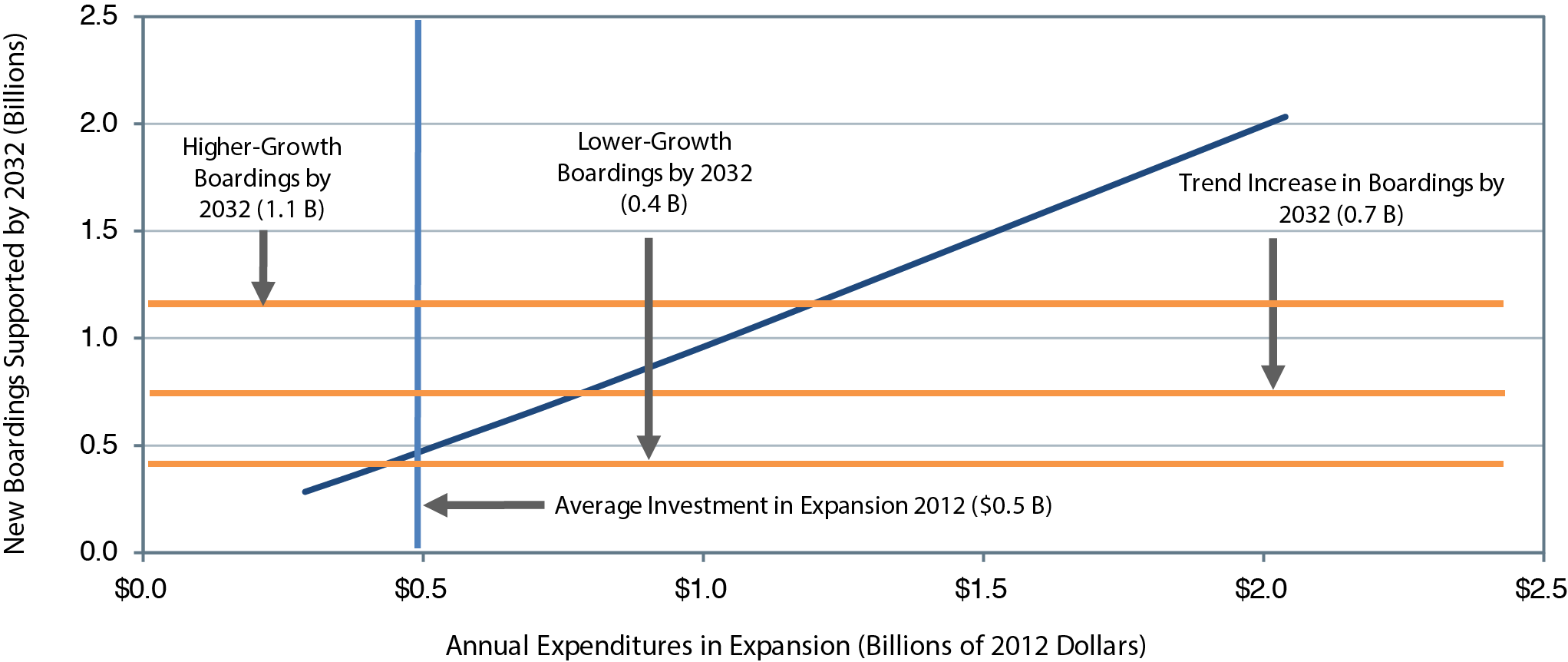

Potential Transit Capital Investment Impacts

Types of Capital Spending Projected by TERM

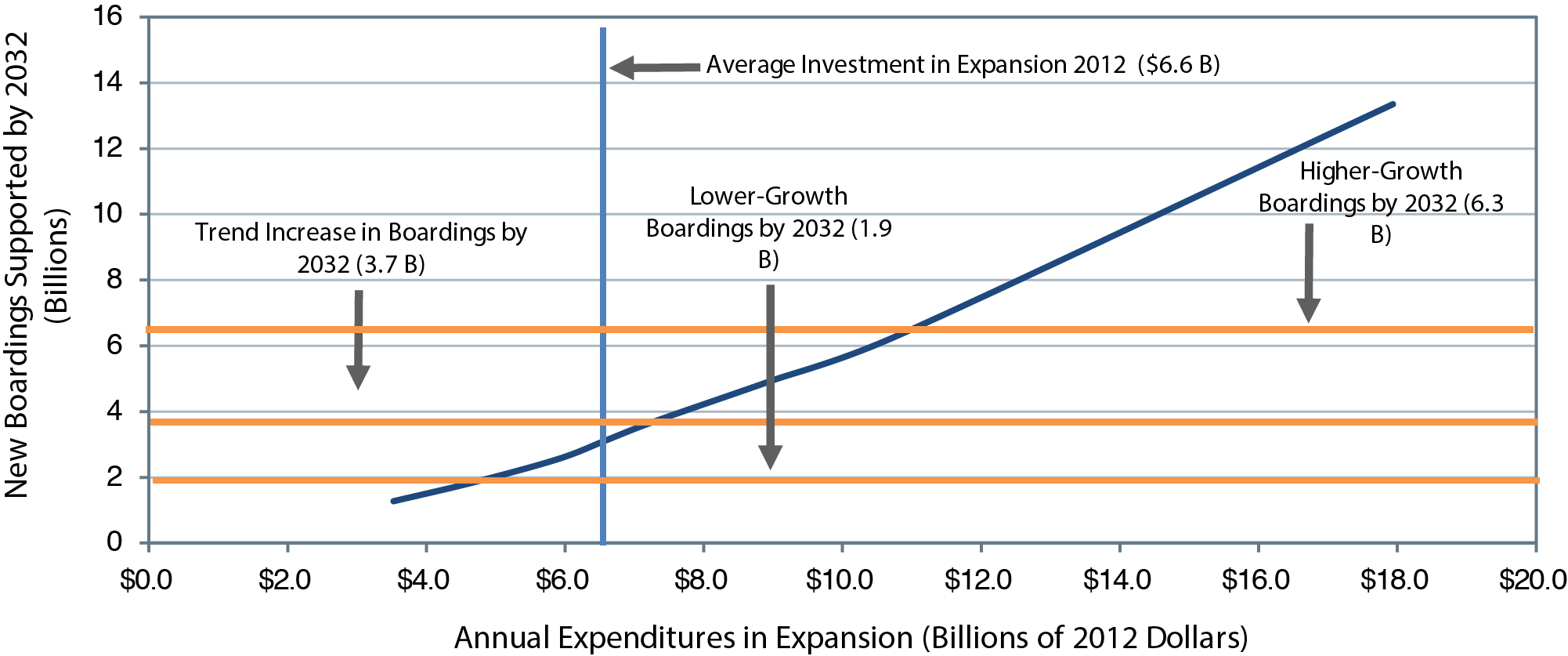

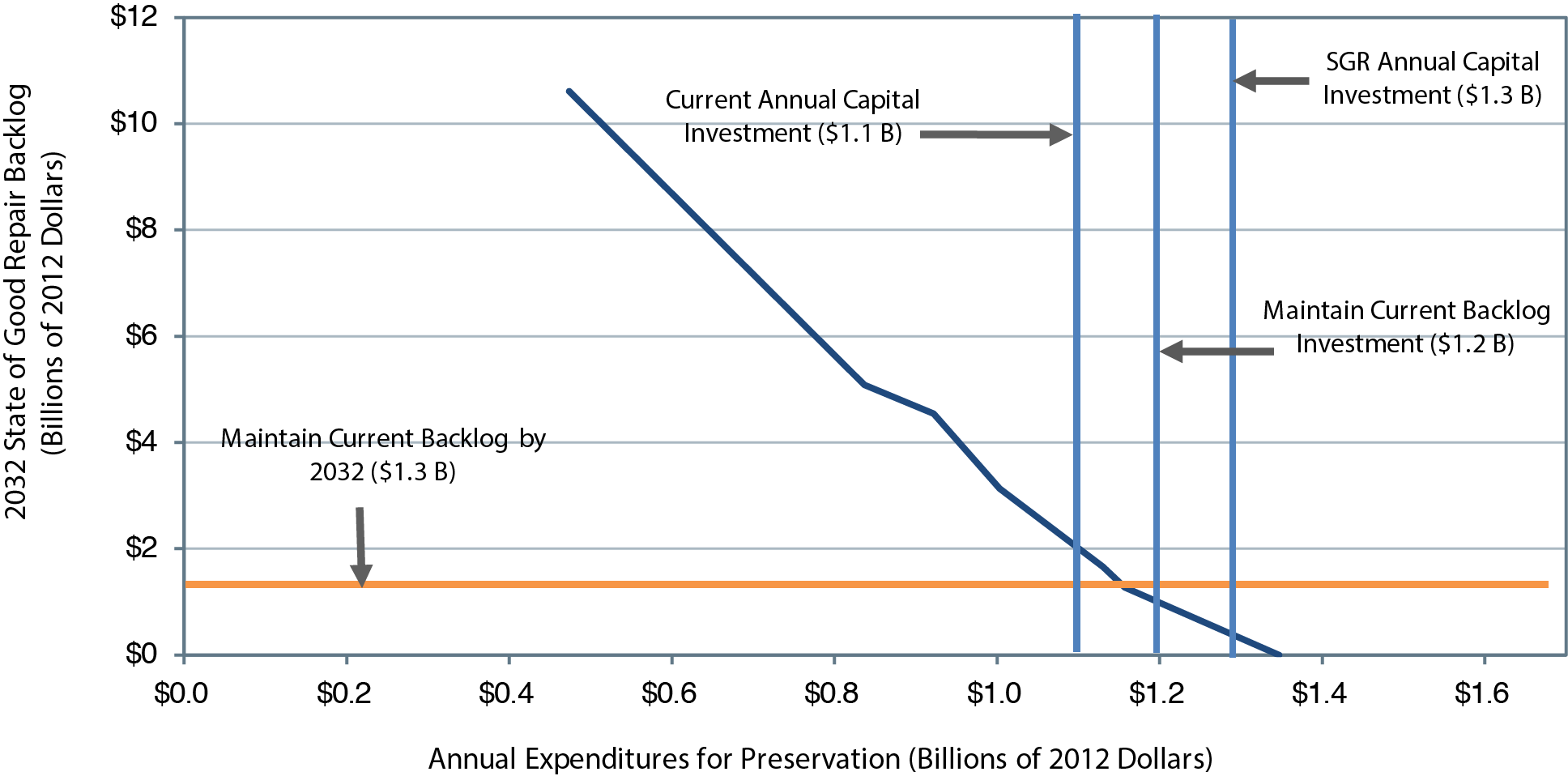

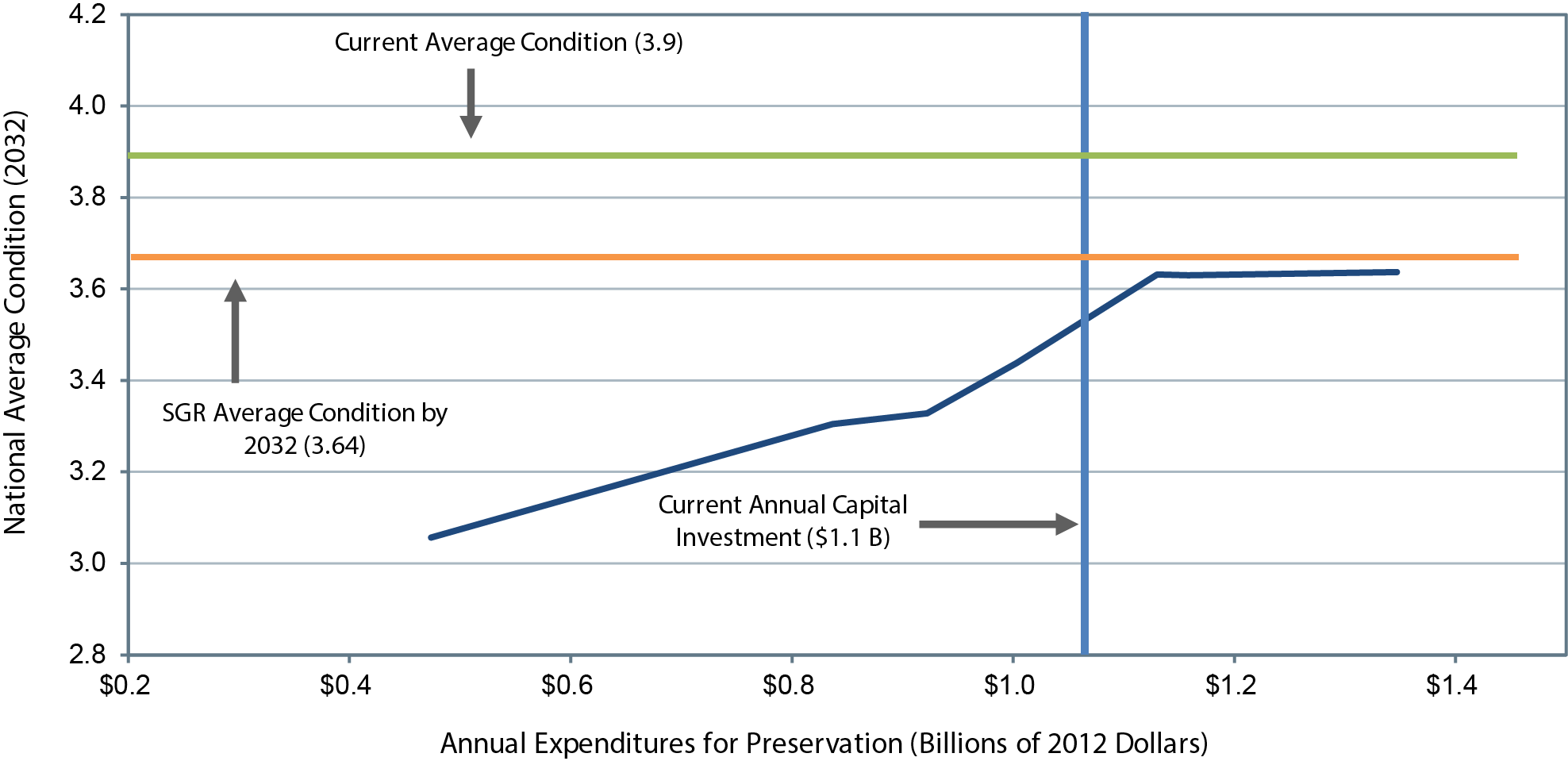

Impacts of Systemwide Investments Modeled by TERM

Impacts of Urbanized Area Investments Modeled by TERM

Potential Highway Capital Investment Impacts

The analyses presented in this section use a common set of assumptions to derive relationships between alternative levels of future highway capital investment and various measures of future highway and bridge conditions and performance. A subsequent section in this chapter provides comparable information for different types and levels of potential future transit investments.

This section examines the types of investment within the scopes of the Highway Economic Requirements System (HERS) and the National Bridge Investment Analysis System (NBIAS) and lays the foundation for the capital investment scenarios for highways presented in Chapter 8. The accuracy of the projections for highway investments in this chapter depends on the validity of the technical assumptions underlying the analysis, some of which are explored in the sensitivity analysis in Chapter 10. The analyses presented in this section make no explicit assumptions regarding how future investment in highways might be funded.

Types of Capital Spending Projected by HERS and NBIAS

The types of investments HERS and NBIAS evaluate can be related to the system of highway functional classification introduced in Chapter 2 and to the broad categories of capital improvements introduced in Chapter 6 (system rehabilitation, system expansion, and system enhancement). NBIAS relies on the National Bridge Inventory (NBI) database, which covers bridges on all highway functional classes, and evaluates improvements that generally fall within the system rehabilitation category.

HERS evaluates pavement improvements-resurfacing or reconstruction-and highway widening; the types of improvements included in these categories roughly correspond to system rehabilitation and system expansion as described in Chapter 6. In estimating the per-mile costs of widening improvements, HERS recognizes a typical number of bridges and other structures that would need modification. Thus, the estimates from HERS are considered to represent system expansion costs for both highways and bridges. Coverage of the HERS analysis is limited, however, to Federal-aid highways, as the Highway Performance Monitoring System (HPMS) sample does not include data for rural minor collectors, rural local roads, or urban local roads.

The term "nonmodeled spending" refers in this report to spending on highway and bridge capital improvements that are not evaluated in HERS or NBIAS; such spending is not included in the analyses presented in this chapter, but the capital investment scenarios presented in Chapter 8 are adjusted to account for them. Nonmodeled spending includes capital improvements on highway classes omitted from the HPMS sample and hence the HERS model. The development of the future investment scenarios for the highway system as a whole thus required supplementary estimation outside the HERS modeling process.

Nonmodeled spending also includes types of capital expenditures classified in Chapter 6 as system enhancements, which neither HERS nor NBIAS currently evaluate. Although HERS incorporates assumptions about future operations investments, the capital components of which would be classified as system enhancements, the model does not directly evaluate the need for these deployments. In addition, HERS does not identify specific safety-oriented investment opportunities, but instead considers the ancillary safety impacts of capital investments that are directed primarily toward system rehabilitation or capacity expansion. This limitation of the model owes to the HPMS database's containing no information on the locations of crashes and safety devices such as guardrails or rumble strips.

Exhibit 6-12 (see Chapter 6) provides a crosswalk between a series of specific capital improvement types for which data are routinely collected from the States and three major summary categories: system rehabilitation, system expansion, and system enhancement. The types of improvements covered by HERS and NBIAS are assumed to correspond with the system rehabilitation and system expansion categories. As in Exhibit 6-12, HERS splits spending on "reconstruction with added capacity" among these categories.

For some of the detailed categories in Exhibit 6-12, the assumed correspondence is close overall but not exact. In particular, the extent to which HERS covers construction of new roads and bridges is ambiguous. Although not directly modeled in HERS, such investments are often motivated by a desire to alleviate congestion on existing facilities in a corridor, and thus would be captured indirectly by the HERS analysis in the form of additional normal-cost or high-cost lanes. As described in Appendix A, the costs per mile assumed in HERS for high-cost lanes are based on typical costs of tunneling, double-decking, or building parallel routes, depending on the functional class and area population size for the section being analyzed. To the extent that investments in the "new construction" and "new bridge" improvement types identified in Chapter 6 are motivated by desires to encourage economic development or accomplish other goals aside from the reduction of congestion on the existing highway network, such investments would not be captured in the HERS analysis.

Some other comparability issues include:

- Some of the relocation expenditures identified in Exhibit 6-12 could be motivated by considerations beyond those reflected in the curve and grade rating data that HERS uses in computing the benefits of horizontal and vertical realignments.

- The bridge expenditures that Exhibit 6-12 counts as system rehabilitation could include work on bridge approaches and ancillary improvements that NBIAS does not model.

- HERS and NBIAS are assumed not to capture improvements that count as system enhancement spending, including the spending on the "safety" category in Exhibit 6-12. Some safety deficiencies, however, might be addressed as part of broader pavement and capacity improvements modeled in HERS.

- The HERS operations preprocessor described in Appendix A includes capital investments in operations equipment and technology that would fall under the definition of the "traffic management/engineering" improvement type in Chapter 6. These investments are counted among the nonmodeled system enhancements because they are not evaluated within the benefit-cost framework that HERS applies to system preservation and expansion investments.

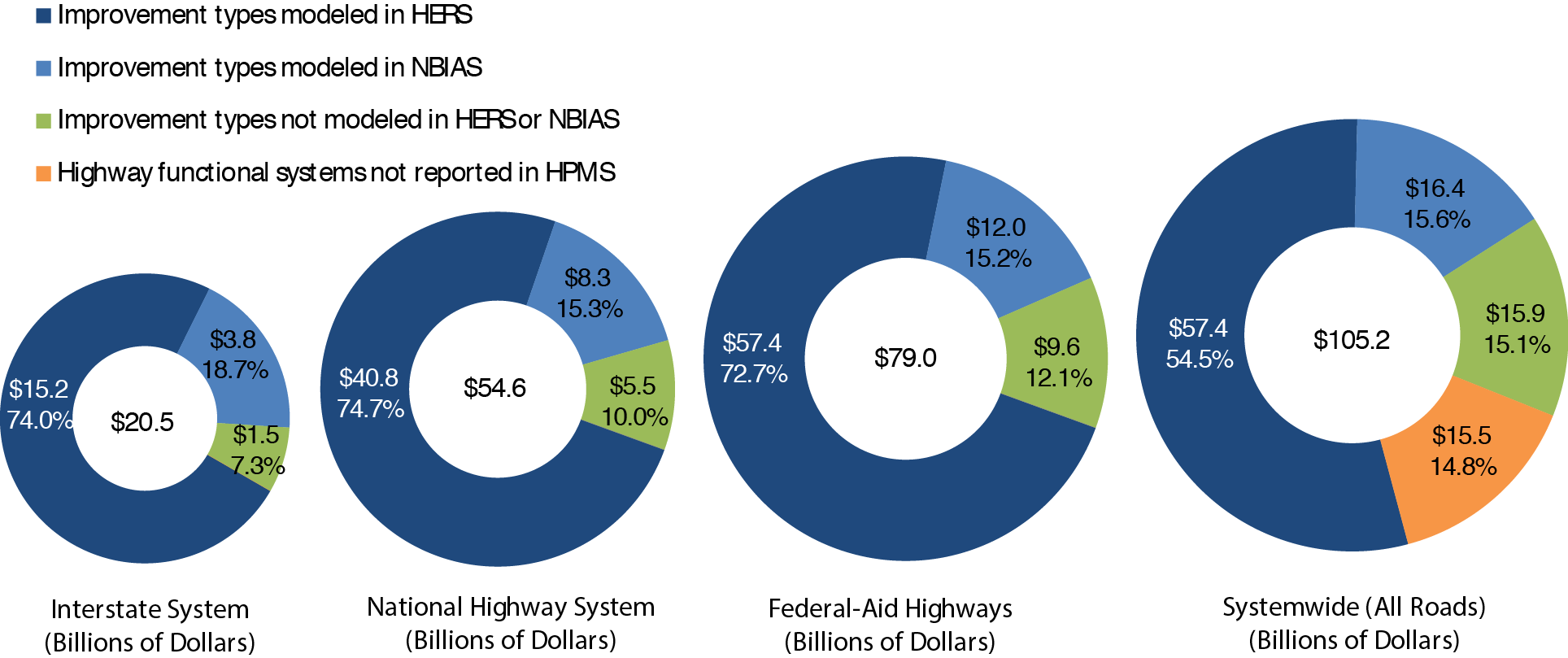

Exhibit 7-1 shows that, systemwide in 2012, highway capital spending was $105.2 billion, of which $57.4 billion was for the types of improvement that HERS models and $16.4 billion was for the types of improvement NBIAS models. The other $31.4 billion, which was for nonmodeled highway capital spending, was divided about evenly between system enhancement expenditures and capital improvements to classes of highways not reported in HPMS.

Exhibit 7-1 Distribution of 2012 Capital Expenditures by Investment Type

Source: Highway Statistics 2012 (Table SF-12A) and unpublished FHWA data.

Because the HPMS sample data are available only for Federal-aid highways, the percentage of capital improvements classified as nonmodeled spending is lower for Federal-aid highways than is the case systemwide. Of the $79.0 billion spent by all levels of government on capital improvements to Federal-aid highways in 2012, 72.7 percent was within the scope of HERS, 15.2 percent was within the scope of NBIAS, and 12.1 percent was for spending captured by neither. The percentage distribution differs somewhat for the Interstate System, with a slightly higher share within the scope of HERS and NBIAS (74.0 percent and 18.7 percent , respectively) and a smaller share captured by neither (7.3 percent ).

Of note is that the statistics presented in this chapter and in Chapter 8 relating to future National Highway System (NHS) investment are based on an estimate of how the NHS will look after its expansion pursuant to MAP-21, rather than as the system existed in 2012. Although the 2012 HPMS sample data incorporate the MAP-21-driven expansion of the NHS, the 2012 NBI data do not reflect the expanded NHS. As indicated in Chapter 6, combined highway capital spending by all levels of government on the NHS in 2012 totaled $44.6 billion. The NHS capital spending figure of $54.6 billion referenced in Exhibit 7-1 includes amounts spent on other principal arterials, as much of this mileage was be added to the NHS by MAP-21.

Treatment of Traffic Growth

For the HERS analysis in this report, growth in vehicle miles traveled (VMT) is based on two primary inputs: HPMS section-level forecasts of future annual average daily traffic that States provide and a national-level forecast developed from a new FHWA model. The national-level forecast serves as a control, which the sum of the forecast section-level changes in VMT must match. To match the national-level control, the section-level forecasts are scaled proportionally. For this report, the sum of the section-level forecasts yielded an aggregate average annual VMT growth rate of 1.42 percent that exceeded the national-level forecast of 1.04 percent per year, and thus were scaled proportionally downward to match the national-level forecast. Chapter 9 discusses the national-level forecast and reviews the accuracy of VMT projections in previous C&P Reports.

The national-level forecast includes separate VMT growth rates for light-duty vehicles, single-unit trucks, and combination trucks; these separate growth rates were applied in the HERS analysis. VMT in light-duty vehicles is forecast to grow at 0.92 percent per year. VMT for heavy-duty vehicles is forecast to grow at a rate more than twice that for light-duty vehicles (2.15 percent per year for single-unit trucks and 2.12 percent per year for combination trucks). The higher rate of forecast VMT growth for heavy-duty vehicles reflects a close relationship between heavy-vehicle VMT and economic output (GDP or gross domestic product). Economic factors (e.g., sensitivity of VMT demand to income and fuel prices) also influence the forecast of light-duty VMT, but to a weaker extent than the influence on heavy-duty vehicles. The difference in projected VMT growth rates for heavy-duty and light-duty vehicles reflects the direct role of freight transportation in facilitating the production and sale of outputs measured within GDP; increases in income associated with GDP growth do not influence light-duty VMT to the same degree.

The procedures used for estimating traffic growth in the NBIAS analysis presented in this report are similar to those used for HERS. For NBIAS, these forecasts build off bridge-level forecasts of future average daily traffic that States provide in the NBI. The sum of the bridge-level forecasts yielded an aggregate growth rate of 1.46 percent per year; growth rates for individual bridges were adjusted downward to match the 1.04 percent control total from the national-level VMT forecast model referenced above. Unlike the HERS analysis, the NBIAS analysis applied the same growth rate to all vehicle classes, as NBIAS is not currently equipped to handle separate growth rates by vehicle type.

An underlying assumption applied in both HERS and NBIAS is that VMT will grow linearly (so that 1/20th of the additional VMT is added each year), rather than geometrically (i.e., at a constant annual rate). With linear growth, the annual rate of growth gradually declines over the forecast period. Estimated VMT growth rates within each highway investment scenario deviate from the FHWA forecast values due to estimated changes in user travel cost, as discussed in the following section.

In previous reports, the State-reported travel growth forecasts in the HPMS and the NBI were applied directly (i.e., they were not scaled to match a national-level control). Chapter 10 considers an alternative in which VMT grows consistently with the State-reported forecasts.

Alternative Levels of Future Capital Investment Analyzed

Both the HERS and NBIAS analyses presented in this chapter assume that capital investment within the scopes of the models will grow over 20 years at a constant annual percentage rate, which could be positive, negative, or zero. Because future levels are measured in constant 2012 dollars, the rates of growth are real (inflation-adjusted). This "ramped" approach to analyzing alternative investment levels was introduced in the 2008 C&P Report. Analyses for previous editions either assumed a fixed amount would be spent in each year or set funding levels based on benefit-cost ratios, which tended to "front-load" the investment within the 20-year analysis period. Chapter 9 includes an analysis of the impacts on conditions and performance of these alternative timing patterns of investments and presents an example of how the ramping approach influences year-by-year funding levels for some of the highway investment scenarios presented in Chapter 8.

This chapter quantifies potential highway and bridge system outcomes under various assumptions about the rate of ramped investment growth. The particular investment levels were selected from among the results of a much larger number of model simulations. Each investment level presented corresponds to a particular target outcome, such as funding all potential capital improvements with a benefit-cost ratio above a certain threshold or attaining a certain level of performance for highways or bridges. Although each selected rate of change has some specific analytical significance, the analyses presented in this chapter do not constitute complete investment scenarios, but rather form the building blocks for such scenarios, which are presented in Chapter 8.

Highway Economic Requirements System

Simulations conducted with HERS provide the basis for this report's analysis of investment in highway resurfacing and reconstruction and for highway and bridge capacity expansion. HERS uses incremental benefit-cost analysis to evaluate highway improvements based on data from HPMS. HPMS includes State-supplied information on current roadway characteristics, conditions, and performance and anticipated future travel growth for a nationwide sample of more than 120,000 highway sections. HERS analyzes individual sample sections only as a step toward providing results at the national level; the model does not provide definitive improvement recommendations for individual sections.

HERS simulations begin with evaluations of the current state of the highway system using data from the HPMS sample. These data provide information on pavements, roadway geometry, traffic volume and composition (percentage of trucks), and other characteristics of the sampled highway sections. For sections with one or more identified deficiencies, the model then considers potential improvements, including resurfacing, reconstruction, alignment improvements, and widening or adding travel lanes. HERS selects the improvement (or combination of improvements) with the greatest net benefits, with benefits defined as reductions in direct highway user costs, agency costs for road maintenance, and societal costs from vehicle emissions of greenhouse gases and other pollutants. (The model uses estimates of emission costs that include damage to property and human health and, for greenhouse gases, other potential impacts such as loss of outdoor recreation amenities.) The model allocates investment funding only to those sections for which at least one potential improvement is projected to produce benefits exceeding construction costs.

HERS normally considers highway conditions and performance over a period of 20 years from the base ("current") year-the most recent year for which HPMS data are available. This analysis period is divided into four equal funding periods. After analyzing the first funding period, HERS updates the database to reflect the projected outcomes of the first period, including the effects of the selected highway improvements. The updated database is then used to analyze conditions and performance in the second period, the database is updated again, and so on through the fourth and last period. Appendix A contains a detailed description of the project selection and implementation process HERS uses.

Operations Strategies

Since the 2004 C&P Report, HERS has considered the impacts of certain types of highway operational improvements that feature intelligent transportation systems (ITS). The operations strategies HERS currently evaluates are:

- Freeway management: ramp metering, electronic roadway monitoring, variable message signs, integrated corridor management, variable speed limits, queue warning systems, lane controls.

- Incident management: detection, verification, response.

- Arterial management: upgraded signal control, electronic monitoring, variable message signs.

- Traveler information: 511 systems, advanced in-vehicle navigation systems with real-time traveler information.

Appendix A describes these strategies in detail and their treatment in HERS. Of importance to note is that HERS does not analyze the benefits and costs of these investments, nor does it directly analyze tradeoffs between them and the pavement improvements and widening options the model also considers. Instead, a separate preprocessor estimates the impacts of these operations strategies on the performance of highway sections where they are deployed. The analyses presented in this chapter assume a package of investments that continue existing deployment trends, and a sensitivity analysis presented in Chapter 10 considers the impacts of a more aggressive deployment pattern. HERS does not currently model applications of various developing vehicle-to-vehicle and vehicle-to-infrastructure communications because reliably predicting the impacts and patterns of their deployment is premature.

Cellular, Wi-Fi, and other dedicated short-range communication technologies are expanding the possibilities for a Connected Vehicle Environment. Communications among vehicles on the road (V2V)-and between these vehicles and infrastructure (V2I)-hold promise for substantial reductions in crashes and vehicle emissions and for enhanced mobility through more efficient management and operations of transportation systems. Adding to this potential are rapid advances in vehicle automation. For example, under advanced speed harmonization, vehicle speed would adjust automatically to speed limits that vary based on road, traffic, and weather conditions (an existing V2I application).

Additional examples of connectivity applications include blind spot monitoring/lane change warning, smart parking, forward collision warning, do-not-pass warning, curve speed warning, red light violation warning, transit pedestrian warning, cooperative adaptive cruise control, braking assist, and dynamic lane closure management.

Reaching the full potential of connected vehicles will require investment, coordination, and partnership with public and private entities. As development and implementation of connected vehicle applications proceed, additional information should make possible their representation in HERS. Research efforts by FHWA, Federal Transit Administration (FTA), National Highway Traffic Safety Administration (NHTSA), American Association of State Highway and Transportation Officials (AASHTO), and others that will measure benefits and costs of these applications include: (1) Applications for the Environment: Real-Time Information Synthesis Program; (2) AASHTO Connected Vehicle Field Infrastructure Footprint Analysis; (3) Connected and Automated Vehicle Benefit Cost Analysis; and (4) Measuring Local, Regional and Statewide Economic Development Associated with the Connected Vehicle program.

Travel Demand Elasticity

A key feature of the HERS economic analysis is the influence of the cost of travel on the demand for travel. HERS represents this relationship as a travel demand elasticity that relates demand, measured by VMT, to changes in the average user cost of travel that result from either: (1) changes in highway conditions and performance as measured by travel delay, pavement condition, and crash costs, relative to base year levels; the elasticity mechanism reduces travel demand when these changes are for the worse (e.g., an increase in travel delay) and increase travel demand when they are improvements (e.g., better pavement condition); or (2) deviations from the price projections built into the baseline demand forecasts. This report considers the latter deviations only in Chapter 10, where one of the sensitivity tests alters the projections for motor fuel prices.

HERS also allows the induced demand predicted through the elasticity mechanism to influence the cost of travel to highway users. On congested sections of highway, the initial congestion relief afforded by an increase in capacity will reduce the average user cost per VMT, which in turn will stimulate demand for travel; this increased demand, in turn, will reverse some of the initial congestion relief. The elasticity feature operates likewise with respect to improvements in pavement quality by allowing for induced traffic that adds to pavement wear. (Conversely, an initial increase in user costs can start a causal chain with effects in the opposite direction.) By capturing these offsets to initial impacts on highway user costs, HERS can estimate the net impacts.

Impacts of Federal-Aid Highway Investments Modeled by HERS

The HERS analysis for this edition of the C&P report starts with an evaluation of the state of Federal-aid highways in 2012-the base year. Exhibit 7-1 shows that capital spending on the types of improvements modeled in HERS for these highways in the base year was $57.4 billion (total highway capital spending was $105.2 billion). The analysis continues by considering the potential impacts on system performance of raising or lowering the amount of investment within the scope of HERS at various annual rates over 20 years. Spending in any year is measured in constant 2012 dollars, so that spending and its rate of growth are both measured in real, rather than nominal, terms. Chapter 9 includes an illustration of how future spending levels could be converted from real to nominal dollar levels under alternative assumptions about the future inflation rate.

Selection of Investment Levels for Analysis

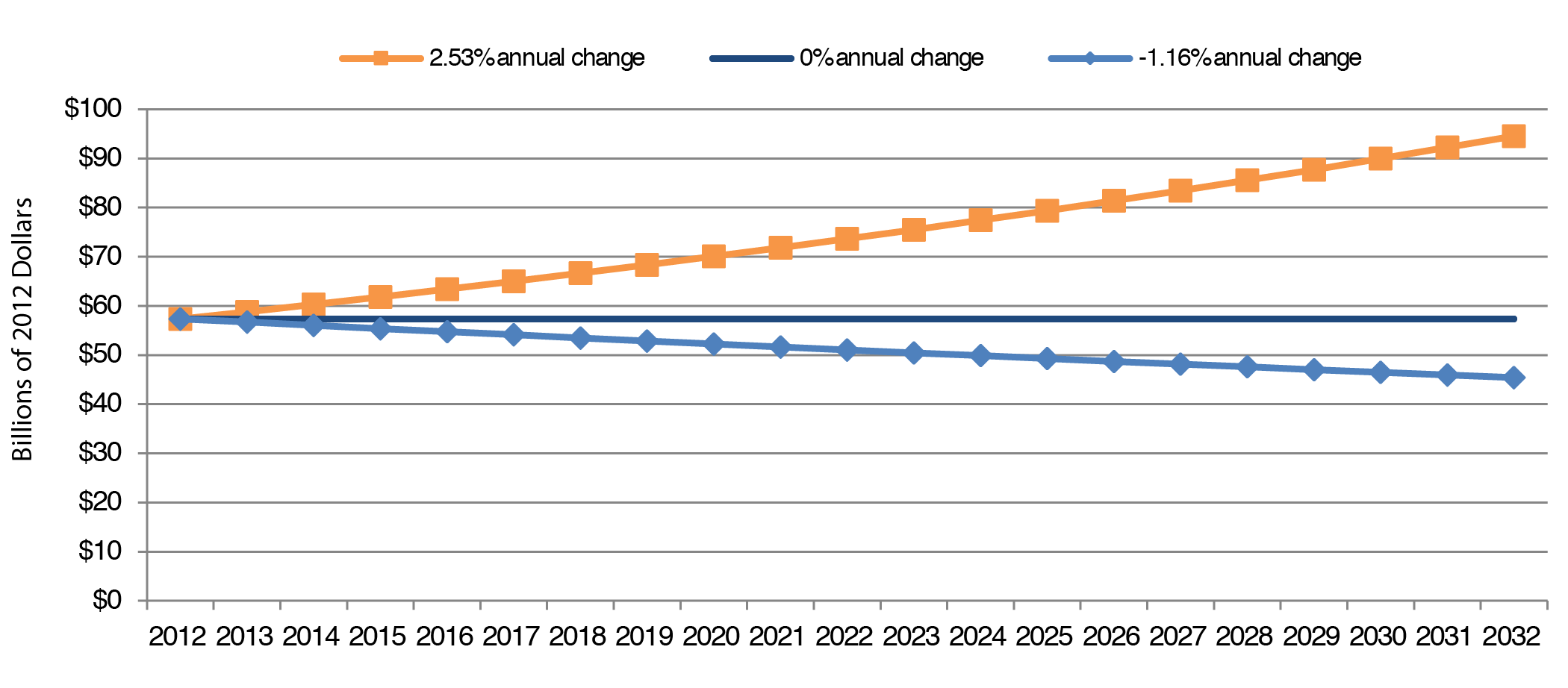

Exhibit 7-2 introduces the six investment levels presented in the next several exhibits to illuminate the relationship between the levels of investment modeled in HERS and the future conditions and performance of Federal-aid highways.

The highest level of spending shown in Exhibit 7-2 corresponds to the annual growth rate in real spending (2.53 percent ) associated with attaining a minimum benefit-cost ratio (BCR) of 1.0 over the 20-year analysis period. As explained in the introduction to Part II of this report, HERS ranks potential projects in order of BCR and implements them until the funding constraint is reached. The lowest BCR among the projects selected, the "marginal BCR," varies across the four funding periods, and HERS refers to the lowest of these values across the funding periods as the "minimum BCR." The attainment of a minimum BCR of 1.0 can be interpreted as having gradually implemented all potentially cost-beneficial projects (BCR ≥ 1.0) over 20 years. The "Improve C&P" reference in Exhibit 7-2 signifies that this level of investment feeds into the Improve Conditions and Performance scenario presented in Chapter 8.

Another funding level shown in Exhibit 7-2 represents the annual growth rate in real spending geared toward matching a specific level of performance in 2032; an average annual growth rate of -1.16 percent is projected to be adequate to allow average pavement roughness as measured by the International Roughness Index (IRI) in 2032 to match the level in 2012 (see discussion of IRI in Chapter 3) and for average delay to be at least as low in 2032 as it was in 2012. This "Maintain C&P" reference in Exhibit 7-2 signifies that this level of investment feeds into the Maintain Conditions and Performance scenario, also presented in Chapter 8.

The remaining four of the six funding levels shown in Exhibit 7-2 represent a range of annual growth rates in real highway spending above, at, and below 2012 funding (2, 1, 0, and -1 percent ). The "2012 Spending" reference in Exhibit 7-2 for the 0.00-percent growth rate row signifies that this level of spending feeds into the Sustain 2012 Spending scenario presented in Chapter 8.

Exhibit 7-2 HERS Annual Investment Levels Analyzed for Federal-Aid Highways

| Annual percent Change in HERS Capital Spending | Spending Modeled in HERS (Billions of 2012 Dollars) | Link to Chapter 8 Scenario | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Cumulative | Average Annual Over 20 Years | |||||||||

| 5-Year 2013 Through 2017 | 5-Year 2018 Through 2022 | 5-Year 2023 Through 2027 | 5-Year 2028 Through 2032 | 20-Year 2013 Through 2032 | Total HERS Spending1 | System Rehabilitation Spending2 | System Expansion Spending2 | |||

| 2.53% | $309 | $351 | $397 | $450 | $1,507 | $75.4 | $45.4 | $30.0 | Improve C&P | |

| 2.00% | $305 | $336 | $371 | $410 | $1,422 | $71.1 | $43.1 | $28.0 | ||

| 1.00% | $296 | $311 | $326 | $343 | $1,276 | $63.8 | $38.7 | $25.1 | ||

| 0.00% | $287 | $287 | $287 | $287 | $1,147 | $57.4 | $35.0 | $22.4 | 2012 Spending | |

| -1.00% | $278 | $265 | $252 | $239 | $1,034 | $51.7 | $31.5 | $20.2 | ||

| -1.16% | $277 | $261 | $247 | $233 | $1,017 | $50.9 | $30.9 | $19.9 | Maintain C&P | |

1 The amounts shown represent the average annual investment over 20 years that would occur if annual investment grows in constant dollar terms by the percentage shown in each row of the first column. 2 HERS splits its available budget between system rehabilitation and system expansion based on the mix of spending it finds to be most cost-beneficial, which varies by funding level. Source: Highway Economic Requirements System. | ||||||||||

The portion of each investment level that HERS directs to system rehabilitation versus system expansion is significant, as these types of investments have varying degrees of influence on different performance measures. Investment in system rehabilitation (ranging from $30.9 billion to $45.4 billion across reported investment levels) tends to have a stronger influence on physical condition measures such as pavement ride quality. Investment in system expansion (ranging from $19.9 billion to $30.0 billion across reported investment levels) has a more pronounced impact on operational performance measures such as delay.

The investment backlog represents all improvements that could be economically justified for immediate implementation, based solely on the current conditions and operational performance of the highway system (without regard to potential future increases in vehicle miles traveled or potential future physical deterioration of pavements).

HERS does not routinely produce rolling backlog figures over time as an output, but is equipped to do special analyses to identify the base-year backlog. To determine which action items to include in the backlog, HERS evaluates the current state of each highway section before projecting the effects of future travel growth on congestion and pavement deterioration. Any potential improvement that would correct an existing pavement or capacity deficiency and that has a benefit-cost ratio greater than or equal to 1.0 is considered part of the current highway investment backlog.

HERS estimates the size of the backlog as $463.1 billion for Federal-aid highways, stated in constant 2012 dollars. The estimated backlog for the Interstate System is $105.1 billion; adding other principal arterials produces an estimated backlog of $281.2 billion for the expanded NHS. The investment levels associated with a minimum benefit-cost ratio of 1.0 presented in this chapter would fully eliminate this backlog and address other deficiencies that arise over the next 20 years, when doing so might be cost-beneficial.

Of note is that these figures reflect only a subset of the total highway investment backlog; they do not include the types of capital improvements modeled in NBIAS (presented later in this chapter) or the types of capital improvements not currently modeled in HERS or NBIAS. Chapter 8 presents an estimate of the combined backlog for all types of improvements (see Exhibit 8-4)

Investment Levels and BCRs by Funding Period

Exhibit 7-2 illustrates how the six alternative funding growth rates for Federal-aid highways that were selected for further analysis in this chapter would translate into cumulative spending in 5year intervals (corresponding to 5-year analysis periods used in HERS). The portions of these investment levels relating to system rehabilitation and system expansion are also identified, as the former would be expected to have a greater impact on measures of physical conditions such as IRI, while the latter would be expected to have a greater impact on measures of operational performance, such as user delay.

As shown in Exhibit 7-2, achieving a minimum BCR of 1.0 is estimated to require $1.507 trillion over the analysis period. Achieving a minimum BCR of 1.0 would necessitate an increase in spending of $360 billion over the analysis period relative to a scenario in which 2012 spending levels were maintained from 2012 through 2032.

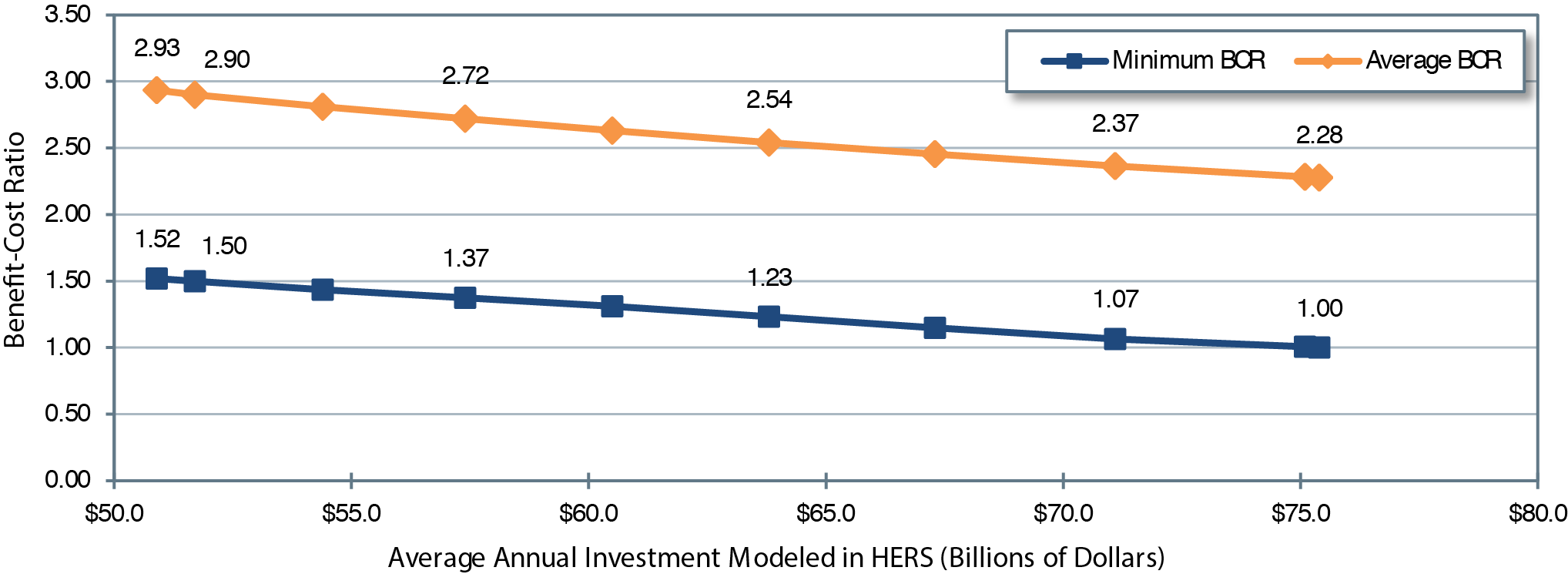

Exhibit 7-3 illustrates the marginal benefit-cost ratios (i.e., the lowest benefit-cost ratio among the improvements selected within a funding period) associated with the six alternative funding levels. Exhibit 7-3 also provides the minimum benefit-cost ratios across all funding periods (which is identical to the lowest marginal benefit-cost ratio) and the average benefit-cost ratios across all funding periods (i.e., the total level of benefits of all improvements divided by the total cost of all improvements). For positive growth rates in spending levels, the marginal BCR declines over time, reflecting the tendency in HERS to implement the most worthwhile improvements first; the minimum BCR over the entire 20-year analysis period, shown in the last column, equals the marginal BCR in the last 5-year period. Conversely, for negative (and zero) growth rates in spending levels, the minimum BCR equals the marginal BCR in the third 5-year period. This pattern reflects the impacts of funding constraints; the relative scarcity of funding toward the end of the analysis period is inadequate to keep pace with newly emerging needs, limiting the range of needs that can be addressed.

Exhibit 7-3 Minimum and Average Benefit-Cost Ratios (BCRs) for Different Possible Funding Levels on Federal-Aid Highways

| HERS-Modeled Investment on Federal-Aid Highways | Benefit-Cost Ratios1 | Link to Chapter 8 Scenario | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Average Annual Investment2 (Billions of 2012 Dollars) | Average Annual percent Change vs. 2012 | Average BCR 20-Year 2013 Through 2032 | Marginal BCR3 | Minimum BCR 20-Year 2013 Through 2032 | |||||

| 5-Year 2013 Through 2017 | 5-Year 2018 Through 2022 | 5-Year 2023 Through 2027 | 5-Year 2028 Through 2032 | ||||||

| $75.4 | 2.53% | 2.28 | 1.80 | 1.24 | 1.08 | 1.00 | 1.00 | Improve C&P | |

| $71.1 | 2.00% | 2.37 | 1.82 | 1.27 | 1.14 | 1.07 | 1.07 | ||

| $63.8 | 1.00% | 2.54 | 1.86 | 1.35 | 1.25 | 1.23 | 1.23 | ||

| $57.4 | 0.00% | 2.72 | 1.90 | 1.43 | 1.37 | 1.40 | 1.37 | 2012 Spending | |

| $51.7 | -1.00% | 2.90 | 1.94 | 1.52 | 1.50 | 1.59 | 1.50 | ||

| $50.9 | -1.16% | 2.93 | 1.95 | 1.53 | 1.52 | 1.62 | 1.52 | Maintain C&P | |

1 As HERS ranks potential improvements by their estimated BCRs and assumes that the improvements with the highest BCRs will be implemented first (up until the point where the available budget specified is exhausted), the minimum and average BCRs will naturally tend to decline as the level of investment analyzed rises. 2 The amounts shown represent the average annual investment over 20 years that would occur if annual investment grows in constant dollar terms by the percentage shown in each row of the first column. 3 The marginal BCR represents the lowest benefit-cost ratio for any project implemented during the period identified at the level of funding shown. The minimum BCRs, indicated by bold font, are the smallest of the marginal BCRs across the funding periods. Source: Highway Economic Requirements System. | |||||||||

Further evident in Exhibit 7-3 is the inverse relationship between the minimum BCR and the level of investment. At any given level of average annual investment, the average BCR always exceeds the marginal BCR. For example, at the highest level of investment considered, an average annual investment level of $75.4 billion, the average BCR of 2.28 exceeds the minimum BCR of 1.00.

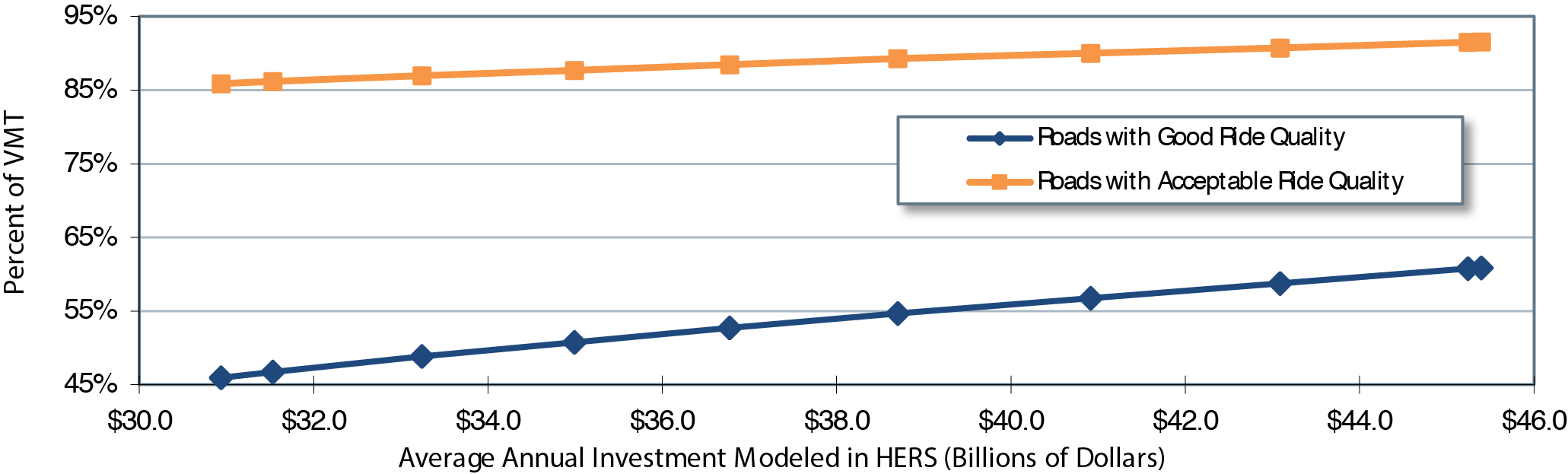

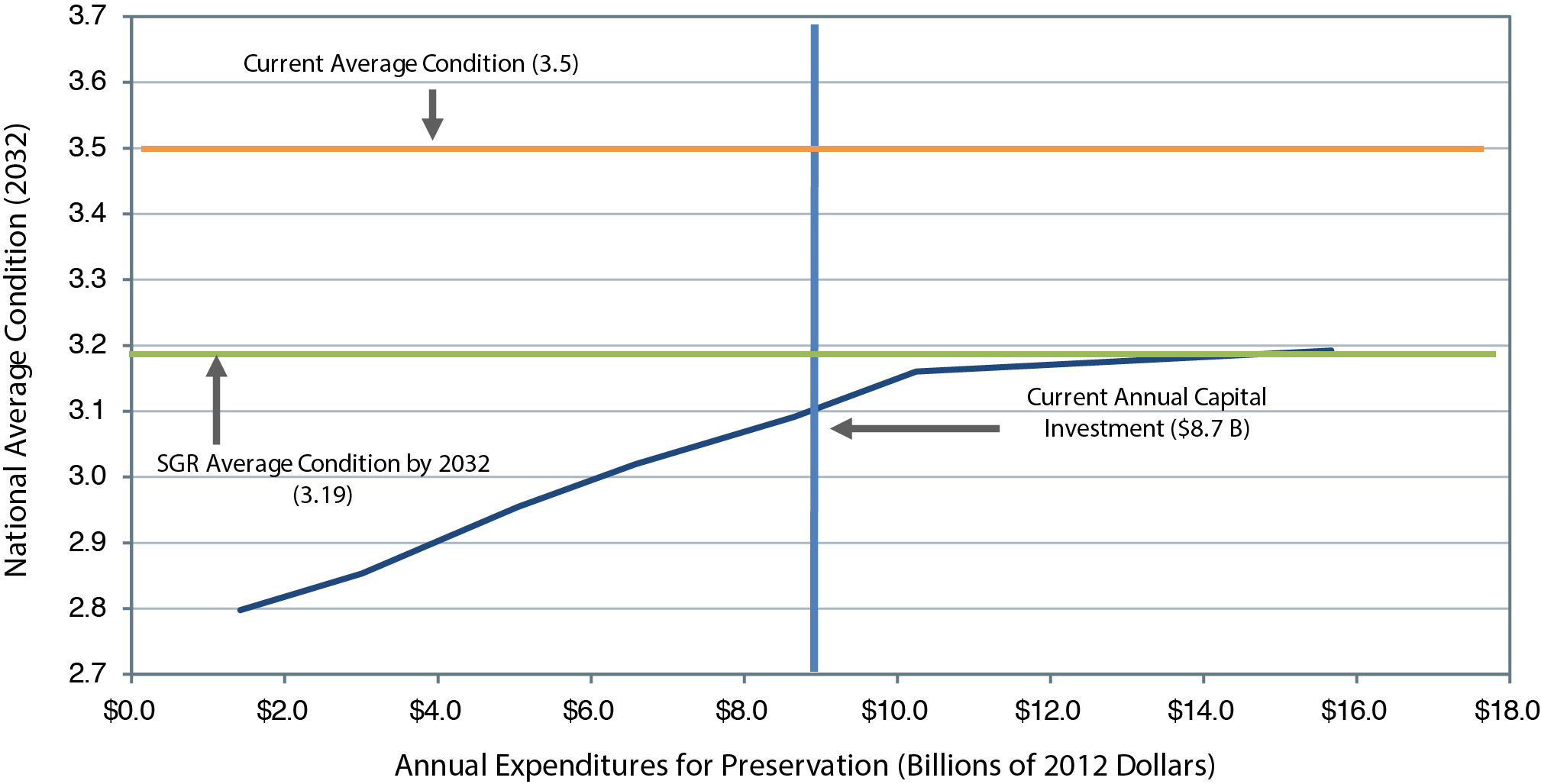

Impact of Future Investment on Highway Pavement Ride Quality

The primary measure of highway physical condition in HPMS is pavement ride quality as measured by IRI (defined in Chapter 3). The HERS analysis presented in this report focuses on VMT-weighted IRI values; the average IRI values shown thus reflect the pavement ride quality experienced on a typical mile traveled. Exhibit 7-4 shows how the projection for the average IRI on Federal-aid highways in 2032 varies with the portion of investment that HERS allocates to system rehabilitation, as identified in Exhibit 7-2; system rehabilitation is more significant than investment in system expansion in influencing average pavement ride quality. The levels of system rehabilitation analyzed range from an average annual investment level of $30.9 billion (which feeds the Maintain Conditions and Performance scenario in Chapter 8) to an average annual investment level of $45.4 billion (which feeds the Improve Conditions and Performance scenario in Chapter 8).

Exhibit 7-4 Projected 2032 Pavement Ride Quality Indicators on Federal-Aid Highways Compared with 2012 for Different Possible Funding Levels

| HERS-Modeled Capital Investment | Projected 2032 Condition Measures on Federal-Aid Highways1,2 | Link to Chapter 8 Scenario | |||

|---|---|---|---|---|---|

| percent of VMT on Roads With Ride Quality of: | Average IRI (VMT-Weighted) | ||||

| Average Annual for System Rehabilitation (Billions of 2012 Dollars)2 | Good (IRI<95)3 | Acceptable (IRI<=170)3 | Inches Per Mile | Change Relative to Base Year | |

| $45.4 | 60.9% | 91.5% | 100.7 | -14.0% | Improve C&P |

| $43.1 | 58.8% | 90.8% | 102.9 | -12.1% | |

| $38.7 | 54.7% | 89.3% | 107.4 | -8.3% | |

| $35.0 | 50.8% | 87.7% | 111.8 | -4.5% | 2012 Spending |

| $31.5 | 46.7% | 86.2% | 116.3 | -0.7% | |

| $30.9 | 46.0% | 85.9% | 117.1 | 0.0% | Maintain C&P |

| Base Year Values: | 44.9% | 83.3% | 117.1 | ||

1 The HERS model relies on information from the HPMS sample section database, which is limited to those portions of the road network that are generally eligible for Federal funding (i.e., "Federal-aid highways") and excludes roads classified as rural minor collectors, rural local, and urban local. 2 The amounts shown represent only the portion of HERS-modeled spending directed toward system rehabilitation, rather than system expansion. Other types of spending can affect these indicators as well. 3 As discussed in Chapter 3, IRI values of 95 and 170 inches per mile, respectively, are the thresholds associated with "good" and "acceptable" ride quality. Source: Highway Economic Requirements System. | |||||

For all investment levels presented in Exhibit 7-4, pavements on Federal-aid highways are projected to be smoother on average in 2032 than in 2012, with the exception of the lowest investment level, which matches the average base-year pavement condition exactly. VMT-weighted average IRI decreases by up to 14 percent across alternatives (from 117.1 to 100.7).

Exhibit 7-4 also shows the HERS projections for the percentage of travel occurring on pavements with ride quality that would be rated good or acceptable based on the IRI thresholds set in Chapter 3. Under all circumstances represented in the exhibit, the 2032 projection for the percentage of travel occurring on pavements with good ride quality exceeds the 44.9 percent that occurred in 2012; the improvement in the share of pavements with good ride quality increases roughly linearly with spending. The projections for 2032 range from 60.9 percent at the highest level of investment modeled (an average annual investment level for system rehabilitation of $45.4 billion) to 46.0 percent at the lowest level of investment (an average annual investment level for system rehabilitation of $30.9 billion).

In all the circumstances considered, Exhibit 7-4 reveals increases relative to the base-year level of 83.3 percent in the proportion of travel occurring on pavements with ride quality rated as acceptable. The projection for 2032 ranges from 91.5 percent at the highest level of investment modeled to 85.9 percent at the lowest. When no change from the 2012 level of investment is modeled, 87.7 percent of travel in 2032 in the forecast traffic growth case is projected to occur on pavements with acceptable ride quality. As noted in Chapter 3, the IRI threshold of 170 used to identify acceptable ride quality was originally set to measure performance on the NHS and might not be fully applicable to non-NHS routes, which tend to have lower travel volumes and speeds.

Two primary factors limit the extent to which future highway investment results in improvements in projected future pavement quality in this report relative to previous analyses. First, the rate of forecast growth in vehicle miles traveled is lower in this analysis than in previous analyses, resulting in the selection of fewer projects that generate improved pavement quality through surface widening. That is, the estimated benefits of widening lanes (with concurrent increases in pavement quality) are reduced relative to the past, because there are fewer projected users to whom benefits would accrue. Second, changes to the pavement model in HERS better reflect the effects of aging road infrastructure and the challenges associated with maintaining pavement quality over time. In particular, revisions to HERS have decreased the rate at which pavement quality is assumed to decline, dampening the estimated benefits of surface rehabilitation projects.

Impact of Future Investment on Highway Operational Performance

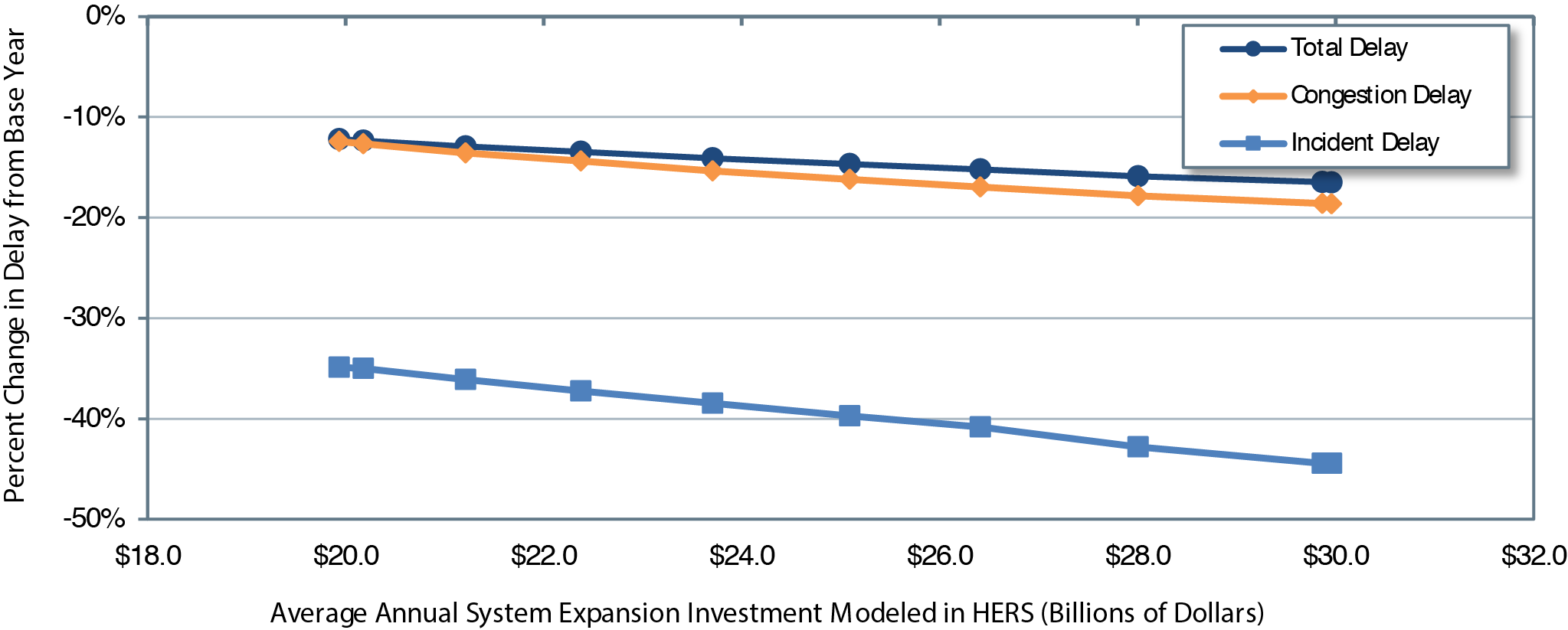

Exhibit 7-5 shows the HERS projections for the impact of investment levels on average speed and traveler delay. Exhibit 7-5 splits out the portion of that investment that HERS programs for system expansion (such as widening existing highways or building new routes in existing corridors), which tend to reduce congestion delay more than spending on system rehabilitation. The levels of system expansion analyzed range from an average annual investment level of $19.9 billion (which feeds the Maintain Conditions and Performance scenario in Chapter 8) to an average annual investment level of $30.0 billion (which feeds the Improve Conditions and Performance scenario in Chapter 8).

Exhibit 7-5 Projected Changes in 2032 Highway Travel Delay and Speed on Federal-Aid Highways Compared with Base Year for Different Possible Funding Levels

| HERS-Modeled Capital Investment | Projected 2032 Performance Measures on Federal-Aid Highways | Link to Chapter 8 Scenario | ||||

|---|---|---|---|---|---|---|

| Average Speed in 2030 (mph) | Annual Hours of Delay per Vehicle2 | percent Change Relative to Baseline | ||||

| Average Annual System Expansion (Billions of 2012 Dollars)1 | Total Delay per VMT | Congestion Delay per VMT | Incident Delay per VMT | |||

| $30.0 | 44.3 | 46.0 | -16.5% | -18.6% | -44.4% | Improve C&P |

| $28.0 | 44.3 | 46.3 | -15.9% | -17.8% | -42.8% | |

| $25.1 | 44.2 | 47.0 | -14.7% | -16.2% | -39.7% | |

| $22.4 | 44.0 | 47.6 | -13.4% | -14.4% | -37.2% | 2012 Spending |

| $20.2 | 43.9 | 48.2 | -12.4% | -12.7% | -35.0% | |

| $19.9 | 43.9 | 48.3 | -12.2% | -12.4% | -34.9% | Maintain C&P |

| Base Year Values: | 42.3 | 55.0 | ||||

1 The amounts shown represent only the portion of HERS-modeled spending directed toward system expansion rather than system rehabilitation. Other types of spending can affect these indicators as well. 2 The values shown were computed by multiplying HERS estimates of average delay per VMT by 11,707, the average VMT per registered vehicle in 2012. HERS does not forecast changes in VMT per vehicle over time. The HERS delay figures include delay attributable to stop signs and signals as well as delay resulting from congestion and incidents. Source: Highway Economic Requirements System; Highway Statistics 2013, Table VM-1. | ||||||

As noted above, HERS assumes the continuation of existing trends in the deployment of certain system management and operations strategies. Among these strategies are several that can be expected to mitigate delay associated with isolated incidents more than the delay associated with recurring congestion ("congestion delay"), such as freeway incident management programs. In line with this, Exhibit 7-5 shows the amount of incident delay decreasing strongly relative to congestion delay over the period 2012—2032. HERS projects incident delay per VMT on Federal-aid highways to decrease by between 34.9 percent (in the Maintain Conditions and Performance alternative) and 44.4 percent (in the Improve Conditions and Performance alternative) between 2012 and 2032. The results in Exhibit 7-5 also reveal investment within the scope of HERS to be a potent instrument for reducing congestion delay. HERS projects congestion delay to decrease by between 12.4 percent and 16.5 percent .

The strong tendency for delay costs to fall is driven by multiple factors. The relatively low forecast growth rate in vehicle miles traveled (VMT) reduces upward pressure on delay compared to previous analyses. Likewise, lower forecast VMT growth enables developments in intelligent transportation systems to mitigate delay more effectively as VMT increases. Improvements in data quality related to obstacles to implementing widening projects improve the ability of HERS to identify economically beneficial projects that add capacity.

Notably, changes to the pavement model have tended to reduce the estimated benefits of pavement improvements, leading to an increased selection rate for projects that add capacity at lower investment levels.

Across all scenarios presented in Exhibit 7-5, annual delay per vehicle in 2032 is lower than the 2012 level (55 hours), with reductions in delay ranging from 6.7 hours in the lowest level of investment analyzed to 9.0 hours in the highest. The projected reductions in delay are associated with relatively small variations in average vehicle speed, ranging from 43.9 miles per hour to 44.3 miles per hour, compared to the 2012 level of 42.3 miles per hour.

Some traffic basics are important to keep in mind when interpreting these results. In addition to congestion and incident delay, some delay inevitably results from traffic control devices. For this reason, and because traffic congestion occurs only at certain places and times, Exhibit 7-5 shows the variation in investment level as having less impact on projections for total delay and average speed than on the projections for congestion and incident delay. In addition, although the impacts of additional investment on average speed are proportionally small, these impacts apply to a vast amount of travel; hence, the associated savings in user cost are not necessarily small relative to the cost of the investment.

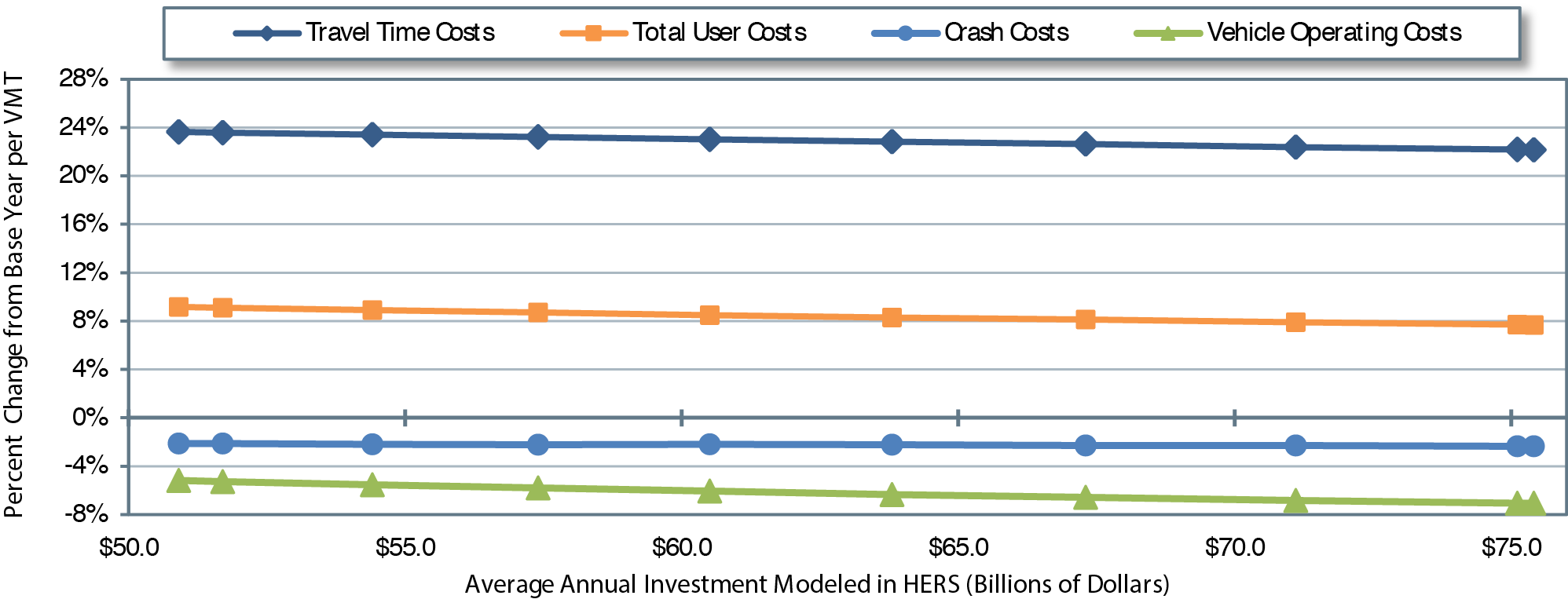

Impact of Future Investment on Highway User Costs

In HERS, the benefits from highway improvements are the reductions in highway user costs, agency costs, and societal costs of vehicle emissions. In measuring the highway user costs, the model includes the costs of travel time, vehicle operation, and crashes.

Exhibit 7-6 shows the projected changes from 2012 to 2032 in average user cost of travel on Federal-aid highways by cost component. For Federal-aid highways, HERS estimates that user costs-the costs of travel time, vehicle operation, and crashes-averaged $1.283 per mile traveled in 2012.

Average user cost per VMT is projected to increase at a lower rate at the spending level HERS indicates would be needed to fund all cost-beneficial projects (averaging $75.4 billion annually); under this spending level, average user cost per mile of VMT in 2032 is projected to be $1.382, or 7.7 percent higher than in 2012. Average user cost per VMT is projected to increase between 2012 and 2032 by 8.7 percent and 9.2 percent under the assumptions that real annual spending remains at the base-year level (average annual growth rate of 0.0 percent ) or, alternatively, decreases annually at the rate geared toward maintaining average pavement roughness (1.16 percent ).

Exhibit 7-6 Projected 2032 Average Total User Costs on Federal-Aid Highways Compared with Base Year for Different Possible Funding Levels

| HERS-Modeled Investment On Federal-Aid Highways | Projected 2032 Performance Measures on Federal-Aid Highways | Link to Chapter 8 Scenario | |||||

|---|---|---|---|---|---|---|---|

| Average Annual (Billions of 2012 Dollars) | Average Annual Change vs. 2012 | Average Total User Costs ($/VMT) | percent Change Relative to Baseline Average per VMT | ||||

| Total User Costs | Travel Time Costs | Vehicle Operating Costs | Crash Costs | ||||

| $75.4 | 2.53% | $1.381 | 7.7% | 22.1% | -7.1% | -2.3% | Improve C&P |

| $71.1 | 2.00% | $1.384 | 7.9% | 22.4% | -6.8% | -2.3% | |

| $63.8 | 1.00% | $1.389 | 8.3% | 22.8% | -6.3% | -2.2% | |

| $57.4 | 0.00% | $1.394 | 8.7% | 23.2% | -5.8% | -2.2% | 2012 Spending |

| $51.7 | -1.00% | $1.399 | 9.1% | 23.6% | -5.3% | -2.1% | |

| $50.9 | -1.16% | $1.400 | 9.2% | 23.6% | -5.2% | -2.1% | Maintain C&P |

| Base Year Values: | $1.283 | ||||||

|

Source: Highway Economic Requirements System. | |||||||

The cost of crashes is the user cost component with the lowest absolute sensitivity to the assumed level of highway investment, which as an annual average varies between $50.9 billion (which feeds the Maintain Conditions and Performance scenario in Chapter 8) and $75.4 billion (which feeds the Improve Conditions and Performance scenario in Chapter 8). Crash costs in 2032 are projected to be between 2.1 percent and 2.3 percent lower than in 2012.

The levels of spending in each scenario are limited to the types of improvements that HERS evaluates, which are basically system rehabilitation and expansion. Because HPMS lacks detailed information on the current location and characteristics of safety-related features (e.g., guardrail, rumble strips, roundabouts, yellow change intervals at signals), safety-focused investments are not evaluated. Thus, the findings presented in Exhibit 7-6 establish nothing about how such investments affect highway safety.

Crash costs also form the smallest of the three components of highway user costs. For 2012 travel on Federal-aid highways, HERS estimates the breakdown by cost component to be crash cost, 14.0 percent ; travel time cost, 48.3 percent , and vehicle operating cost, 37.8 percent . Research under way to update the vehicle operating cost equations in HERS (see Appendix A) might alter the split among these costs somewhat, but crash costs will remain a small component. Although highway trips always consume traveler time and resources for vehicle operation, only a small fraction involves crashes. In addition, most crashes are non-catastrophic: Particularly on urban highways, many crashes involve only damage to property with no injuries.

The projections for travel time costs are less sensitive to the assumed level of investment than are the projections for vehicle operating costs. The projected 2012—2032 change in travel time cost per VMT ranges from an increase of 22.1 percent at the highest level of assumed investment to an increase of 23.6 percent at the lowest. These projections indicate that investing at the highest level rather than the lowest level would reduce the time cost of travel per VMT in 2032 by 1.2 percent , saving travelers hundreds of millions of hours per year in aggregate. The projected impacts on travel time costs in this report differ from the corresponding projected impacts in the 2013 C&P Report, which projected a small decrease in travel time cost under high levels of investment. This distinction was driven by assumptions about increasing real travel time costs in future years, as noted previously; the revisions incorporate projected increases in real income, which is a central input to estimated values of travel time savings.

Exhibit 7-6presents measures of average user costs per vehicle mile traveled (VMT), rather than projections of aggregate, national-level user costs. To identify monetized impacts of changes in investment levels on national-level user costs, national VMT in 2032 can be multiplied by differences in average user costs across investment levels. At the highest level of investment (an annual average of $75.4 billion), average total user costs are projected to be $1.381 per VMT. Average total user costs at the highest level of investment represent decreases in average total user costs of $0.013 per VMT when spending is held at the base-year level ($57.4 billion per year) and $0.019 per VMT at the lowest level of investment (an annual average of $50.9 billion).

Investing at the highest level is projected to result in a decrease in total user costs in 2032 of between $59.6 billion and $60.0 billion relative to the lowest level of investment, depending on the measure of projected VMT specified in the calculation (i.e., the choice of projected VMT among investment levels). Investing at the highest level is projected to result in a decrease in total user costs in 2032 of $40.9 billion relative to investing at the base-year level, for the projected VMT when investing at the lowest level.

Approximately half the projected national-level impacts on average user costs can be attributed to impacts on vehicle operating costs. At the highest investment level, average vehicle operating costs per VMT in 2032 are projected to be $0.009 lower than under the lowest investment level and $0.006 lower than when spending is held at the base-year level. Investing at the highest level is projected to result in a decrease in total vehicle operating costs in 2032 of $28.3 relative to the lowest level of investment, based on projected VMT for the lowest investment level in 2032. Investing at the highest level is projected to result in a decrease in total vehicle operating costs in 2032 of $18.9 billion relative to investing at the base-year level, based on projected VMT for the lowest investment level in 2032.

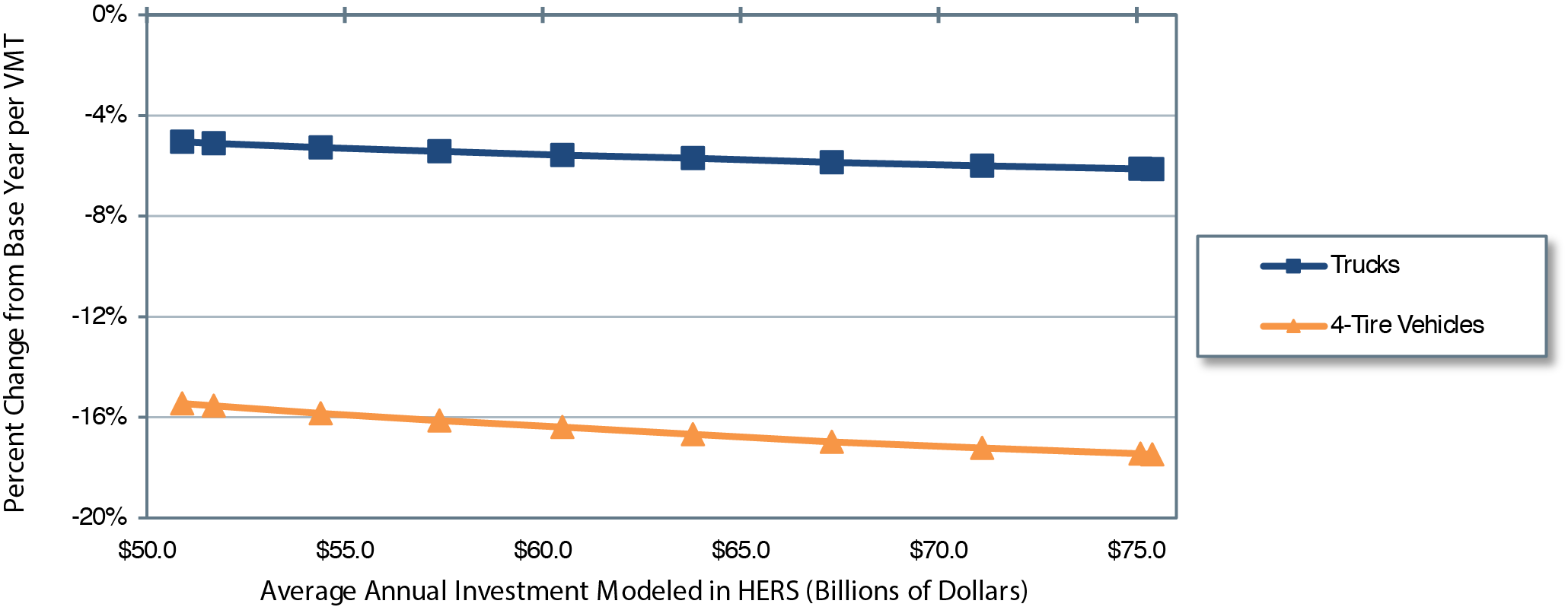

Impact on Vehicle Operating Costs

Exhibit 7-7 presents projections for vehicle operating costs per VMT, including separate values for four-tire vehicles (light-duty vehicles) and trucks (heavy-duty vehicles). The projected 2012—2032 change in vehicle operating costs per VMT ranges from a decrease of 5.2 percent at the lowest level of assumed investment (from $0.485 to $0.460 per VMT) to a decrease of 7.0 percent at the highest (from $0.485 to $0.451 per VMT). These projections indicate that investing at the highest level rather than at the lowest level would reduce the operating cost of travel per VMT in 2032 by 2.0 percent (from $0.460 to $0.451 per VMT).

Exhibit 7-7 Projected 2032 Vehicle Operating Costs on Federal-Aid Highways Compared with Base Year for Different Possible Funding Levels

| HERS-Modeled Investment on Federal-Aid Highways | Projected 2032 Performance Measures on Federal-Aid Highways | Link to Chapter 8 Scenario | ||||||

|---|---|---|---|---|---|---|---|---|

| Average Annual Investment (Billions of 2012 Dollars) | Average Annual percent Change vs. 2012 | Average Vehicle Operating Costs | percent Change Relative to Baseline | |||||

| All Vehicles ($/VMT) | 4-Tire Vehicles ($/VMT) | Trucks ($/VMT) | 4-Tire Vehicles | Trucks | ||||

| $75.4 | 2.53% | $0.451 | $0.342 | $1.087 | -17.5% | -6.1% | Improve C&P | |

| $71.1 | 2.00% | $0.452 | $0.343 | $1.089 | -17.2% | -6.0% | ||

| $63.8 | 1.00% | $0.454 | $0.346 | $1.092 | -16.7% | -5.7% | ||

| $57.4 | 0.00% | $0.457 | $0.348 | $1.096 | -16.1% | -5.4% | 2012 Spending | |

| $51.7 | -1.00% | $0.459 | $0.350 | $1.099 | -15.5% | -5.1% | ||

| $50.9 | -1.16% | $0.460 | $0.351 | $1.100 | -15.5% | -5.1% | Maintain C&P | |

| Base Year Values: | $0.485 | |||||||

|

Source: Highway Economic Requirements System. | ||||||||

The projected impacts on vehicle operating costs are larger for four-tire vehicles than for trucks when compared to both the 2012 values and the adjusted baseline. When comparing the vehicle operating cost projections to the adjusted baseline, the magnitudes of the impacts are much larger; isolating the effects of future highway investment reveals that vehicle operating costs per mile are projected to decline by between 15.5 percent and 17.5 percent for four-tire vehicles, and by between 5.1 percent and 6.1 percent for trucks from 2012 to 2032.

The projected reductions in vehicle operating costs per VMT are driven by projected increases in fuel efficiency across the analysis horizon. The assumed paths of fuel efficiency are based on projections from the Energy Information Administration's Annual Energy Outlook 2014. The average price of gasoline is assumed to decrease between 2012 and 2032 by 4.7 percent relative to the consumer price index, while the average price of diesel fuel is assumed to increase by 9.2 percent relative to the consumer price index. The projected changes in fuel prices are added to the fuel cost savings that would result from the improvements in vehicle energy efficiency that the Energy Information Administration projects for this same period; these changes are represented in HERS as increases in average miles per gallon (mpg) of 54.6 percent for light-duty vehicles, 53.9 percent for two-axle trucks, and 15.5 percent for trucks with three or more axles. These projections incorporate the effect of increases in Corporate Average Fuel Economy (CAFE) standards and U.S. Environmental Protection Agency (EPA) standards for emissions of greenhouse gases by automobiles and light trucks through model year 2025. The projections also account for new standards for fuel efficiency and greenhouse gas emissions for medium- and heavy-duty trucks through model year 2018 adopted by the U.S. Department of Transportation and EPA.

On May 7, 2010, the National Highway Traffic Safety Administration (NHTSA) and U.S. Environmental Protection Agency (EPA) jointly adopted Corporate Average Fuel Economy (CAFE) and carbon dioxide (CO) emission standards for cars and light trucks produced during model years 2012 through 2016. In combination with NHTSA's previous actions, this rule raised required fleet-average fuel economy levels for cars from 27.5 miles per gallon (mpg) in model year 2010 to 37.8 mpg for model year 2016, and those for light trucks from 23.5 mpg in 2010 to 28.8 mpg for 2016. On August 28, 2012, the two agencies adopted new rules that further increased CAFE standards for model year 2021 to 46.1 to 46.8 mpg for automobiles and to 32.6 to 33.3 mpg for light trucks; this most recent action also established tentative CAFE standards for model year 2025 of 55.3 to 56.2 mpg for cars and 39.3 to 40.3 mpg for light trucks. All of the adopted and tentative CAFE standards apply to the vehicle fleet as a whole, and are minimum standards for the vehicle fleet.

The impacts of these standards on the fuel economy of the overall vehicle fleet will continue to grow for many years beyond 2025, as new vehicles meeting the higher fuel economy requirements gradually replace older, less fuel-efficient vehicles. In announcing the most recent increases in CAFE standards, NHTSA estimated that the cumulative effects of its actions would be to save more than 500 billion gallons of fuel and to reduce COemissions by 6 billion metric tons over the lifetimes of cars and light trucks produced in 2011 through 2025. The agency also estimated that its standards would save the Nation's drivers more than $1.7 trillion in fuel costs over these vehicles' lifetimes.

In 2011, NHTSA and EPA also established new fuel efficiency and COemission standards for medium- and heavy-duty trucks produced from 2014 through 2018. These standards are expected to reduce fuel consumption by an additional 22 billion gallons, while further reducing COemissions by nearly 270 million metric tons.

Impact of Future Investment on Future VMT

As discussed above, the travel demand elasticity features in HERS modify future VMT growth for each HPMS sample section based on changes to highway user costs. In the absence of information to the contrary, previous C&P reports assumed that the HPMS forecasts represented the level of travel that would occur if user costs did not change. Because the baseline VMT forecasts used in this report are tied to a specific VMT forecasting model with known inputs, this assumption was changed. For this report, HERS was programmed to assume that the baseline projections of future VMT already accounted for anticipated independent changes in user cost component values.

In computing the impact of user cost changes on future VMT growth on an HPMS sample section, HERS compares projected highway user costs against assumed user costs that would have occurred had the physical conditions or operating performance on that highway section remained unchanged. This concept is illustrated in Exhibit 7-8. Based on the 2012 values assigned to various user cost components (e.g., value of travel time per hour, fuel prices, fuel efficiency, truck travel as a percentage of total travel), HERS computes baseline 2012 user costs at $1.283 per mile. If the 2032 values assigned to those same user cost components were applied in 2012, however, HERS would compute 2012 user costs to be $1.437 per mile. This "adjusted baseline" is the relevant point of comparison when examining the impact of user cost changes on VMT.

Exhibit 7-8 Projected 2032 User Costs and VMT on Federal-Aid Highways Compared with Base Year for Different Possible Funding Levels |

||||||||

|---|---|---|---|---|---|---|---|---|

| HERS-Modeled Investment on Federal-Aid Highways | Projected 2032 Indicators on Federal-Aid Highways | Link to Chapter 8 Scenario | ||||||

| Average Annual Investment (Billions of 2012 Dollars) | Average Annual percent Change vs. 2012 | Average Total User Costs1 | Projected VMT2 | |||||

| ($/VMT) | percent Change | Trillions of VMT | Annual percent Change vs. 2012 | |||||

| vs. Actual 2012 | vs. Adjusted Baseline | |||||||

| $75.4 | 2.53% | $1.381 | 7.7% | -3.9% | 3.160 | 1.15% | Improve C&P | |

| $71.1 | 2.00% | $1.384 | 7.9% | -3.7% | 3.157 | 1.15% | ||

| $63.8 | 1.00% | $1.389 | 8.3% | -3.3% | 3.151 | 1.14% | ||

| $57.4 | 0.00% | $1.394 | 8.7% | -3.0% | 3.145 | 1.13% | 2012 Spending | |

| $51.7 | -1.00% | $1.399 | 9.1% | -2.6% | 3.140 | 1.12% | ||

| $50.9 | -1.16% | $1.400 | 9.2% | -2.6% | 3.139 | 1.12% | Maintain C&P | |

| Base Year Values: | $1.283 | 2.513 | 1.04% | |||||

| Adjusted Baseline: | $1.437 | |||||||

1 The computation of user costs includes several components (value of travel time per hour, fuel prices, fuel efficiency, truck travel as a percent of total travel, etc.) that are assumed to change over time independently of future highway investment. The adjusted baseline applies the parameter values for 2032 to the data for 2012 so that changes in user costs attributable to future highway investment can be identified. 2 The operation of the travel demand elasticity features in HERS cause future VMT growth to be influenced by future changes in average user costs per VMT. For this report, the model was set to assume that the baseline projections of future VMT already took into account anticipated independent future changes in user cost component values; hence, it is the changes versus the adjusted baseline user costs that are relevant. Since the percentage change in adjusted total user costs declined for each of the investment levels identified, the annual projected VMT growth was higher than the 1.04-percent baseline projection in all cases. Source: Highway Economic Requirements System. | ||||||||

Although user costs are projected to increase in absolute terms from 2012 to 2032, they are projected to decline relative to the adjusted baseline by between 2.6 percent (at the lowest level of investment analyzed) and 3.9 percent (at the highest level of investment analyzed in 2032). Because the percentage change in adjusted total user costs declined for each investment level identified, the effective annual projected VMT growth associated with each investment level was higher than the 1.04 percent baseline projection in all cases, ranging from 1.12 percent to 1.15 percent .

Impacts of NHS Investments Modeled by HERS

As described in Chapter 2, the NHS includes the Interstate System and other routes most critical to national defense, mobility, and commerce. As noted earlier, the NHS analyses presented in this section are based on an estimate of what the NHS will look like after its expansion pursuant to MAP-21, rather than the system as it existed in 2012.

This section examines the impacts that investment on NHS roads could have on future NHS conditions and performance, independently of spending on other Federal-aid highways. The analysis presented in this section centers on HERS runs that used a database consisting only of NHS roads. This process differs from that used in previous reports, in which the levels of future investment in NHS roads were extracted from analyses that compared potential investments across a database of all Federal-aid highways. The estimated annual growth rates of investment levels for the NHS are different from those of Federal-aid highways above, because the trade-offs among costs and corresponding benefits of potential improvements are not identical across the two sets of roadways. The investment levels presented in this section were selected by applying the operational constraints used in the analysis of all Federal-aid roads (e.g., average annual spending growth rates, minimum BCR, maintaining pavement roughness, and average delay at the base-year level) to the NHS-specific database.

Impact of Future Investment on NHS User Costs and VMT

Exhibit 7-9 presents the projected impacts of NHS investment on VMT and total average user costs on NHS roads in 2032. Average user costs are projected to be lower in 2032 than for the adjusted baseline ($1.367 per VMT) for all investment levels presented. When increasing spending gradually over 20 years to implement all cost-beneficial projects (the highest level of investment, an annual average of $53.0 billion), average total user costs are projected to be 5.0 percent lower ($1.299 per VMT) than in 2012. At the lowest level of investment presented (an annual average of $36.5 billion), average total user costs are projected to be 3.4 percent lower ($1.320 per VMT) than in 2012.

Projected VMT growth on NHS roads is relatively insensitive to the range of investment levels presented in Exhibit 7-9. At the highest level of investment presented in Exhibit 7-9 (an annual average of $53.0 billion), VMT is projected to grow at an average annual rate of 1.18 percent from 2012 to 2032 (2.071 trillion VMT in 2032 versus 1.638 trillion VMT in 2012). At the lowest level of investment presented in Exhibit 7-9 (an annual average of $36.5 billion), VMT is projected to grow at an average annual rate of 1.14 percent from 2012 to 2032 (2.056 trillion VMT in 2032 versus 1.638 trillion VMT in 2012).

Exhibit 7-9 HERS Investment Levels Analyzed for the National Highway System and Projected Minimum Benefit-Cost Ratios, User Costs, and Vehicle Miles Traveled |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| HERS-Modeled Investment On the NHS | Projected NHS Indicators | Link to Chapter 8 Scenario | |||||||||

| Average Annual percent Change vs. 2012 | Average Annual Over 20 Years | Minimum BCR 20-Year 2013 through 20323 | Average 2032 Total User Costs ($/VMT)4 | Projected 2032 VMT (Trillions)5 | |||||||

| Total HERS Spending1 | System Rehabilitation Spending2 | System Expansion Spending2 | |||||||||

| 2.52% | $53.0 | $29.8 | $23.2 | 1.00 | $1.299 | 2.071 | Improve C&P | ||||

| 2.00% | $50.0 | $28.4 | $21.7 | 1.06 | $1.302 | 2.068 | |||||

| 1.00% | $44.9 | $25.4 | $19.5 | 1.20 | $1.308 | 2.064 | |||||

| 0.00% | $40.4 | $22.8 | $17.6 | 1.29 | $1.314 | 2.060 | 2012 Spending | ||||

| -0.38% | $38.9 | $21.9 | $17.0 | 1.33 | $1.316 | 2.059 | Maintain C&P | ||||

| -1.00% | $36.5 | $20.4 | $16.0 | 1.39 | $1.320 | 2.056 | |||||

| Base Year Values: | $1.222 | 1.638 | |||||||||

| Adjusted Baseline: | $1.367 | ||||||||||

1 The amounts shown represent the average annual investment over 20 years that would occur if annual investment grows in constant dollar terms by the percentage shown in each row of the first column. 2 HERS splits its available budget between system rehabilitation and system expansion based on the mix of spending it finds to be most cost-beneficial which varies by funding level. 3 As HERS ranks potential improvements by their estimated BCRs and assumes that the improvements with the highest BCRs will be implemented first (up until the point where the available budget specified is exhausted), the minimum BCR will naturally tend to decline as the level of investment analyzed rises. 4 The computation of user costs includes several components (value of travel time per hour, fuel prices, fuel efficiency, truck travel as a percent of total travel, etc.) that are assumed to change over time independently of future highway investment. The adjusted baseline applies the parameter values for 2032 to the data for 2012, so that changes in user costs attributable to future highway investment can be identified. 5 The operation of the travel demand elasticity features in HERS cause future VMT growth to be influenced by future changes in average user costs per VMT. For this report, the model was set to assume that the baseline projections of future VMT already took into account anticipated independent future changes in user cost component values; hence, it is the changes versus the adjusted baseline user costs that are relevant. Source: Highway Economic Requirements System. | |||||||||||

Across the investment levels presented in Exhibit 7-9, HERS allocates between $20.4 billion and $29.8 billion in average annual spending on NHS roads to system rehabilitation and between $16.0 billion and $23.2 billion in average annual spending on NHS roads to system expansion.

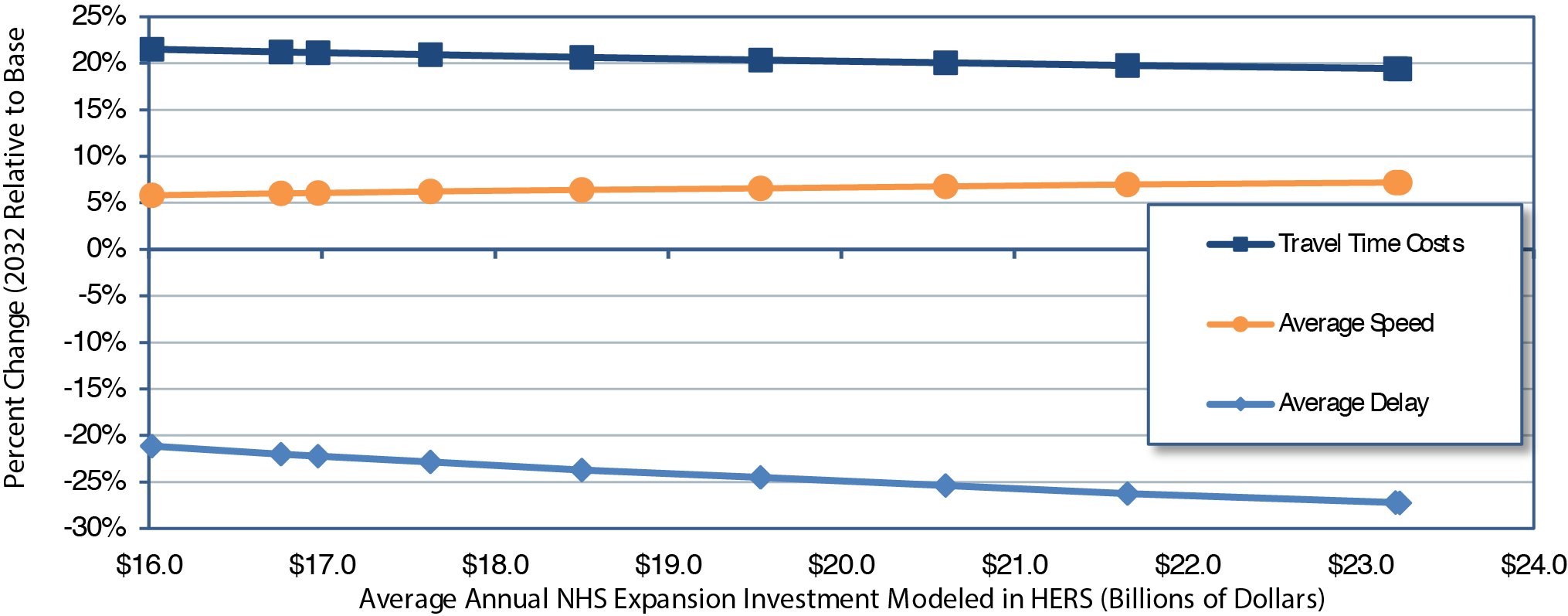

Impact of Future Investment on NHS Travel Times and Travel Time Costs

Exhibit 7-10 presents the projections of NHS averages for time-related indicators of performance, along with the spending amount that HERS programs for NHS expansion projects (which have stronger effects on time-related indicators of performance than preservation projects have). For all investment levels presented in Exhibit 7-10, average travel speed in 2032 exceeds average travel speed in 2012 (48.3 miles per hour). The range of average travel speeds is narrow across the investment levels. At the lowest level of investment in system expansion presented in Exhibit 7-10 (an annual average of $16.0 billion), the average travel speed in 2032 is projected to be 51.1 miles per hour. At the highest level of investment in system expansion presented in Exhibit 7-10 (an annual average of $23.2 billion), the average travel speed in 2032 is projected to be 51.8 miles per hour.

Exhibit 7-10 Projected Changes in 2032 Highway Speed, Travel Delay, and Travel Time Costs on the National Highway System Compared with Base Year for Different Possible Funding Levels

| HERS-Modeled Investment on the NHS | Projected 2032 Performance Measures on the NHS | Link to Chapter 8 Scenario | |||

|---|---|---|---|---|---|

| Average Annual for System Expansion (Billions of 2012 Dollars)1 | Average Speed (mph) | percent Change Relative to Baseline | |||

| Average Speed | Average Delay per VMT | Travel Time Costs per VMT2 | |||

| $23.2 | 51.8 | 7.2% | -27.2% | 19.4% | Improve C&P |

| $21.7 | 51.7 | 7.0% | -26.3% | 19.8% | |

| $19.5 | 51.5 | 6.6% | -24.5% | 20.3% | |

| $17.6 | 51.3 | 6.2% | -22.9% | 20.9% | 2012 Spending |

| $17.0 | 51.2 | 6.1% | -22.2% | 21.1% | Maintain C&P |

| $16.0 | 51.1 | 5.8% | -21.2% | 21.5% | |

| Base Year Values: | 48.3 | ||||

1 The amounts shown represent only the portion of HERS-modeled spending directed toward system expansion, rather than system rehabilitation. Other types of spending can affect these indicators as well. 2 Travel time costs are affected by an assumption that the value of time will increase by 1.2 percent in real terms each year. Hence, costs would rise even if travel time remained constant. Source: Highway Economic Requirements System; Highway Statistics 2013, Table VM-1. | |||||

The global increase in average travel speed across investment levels corresponds with large decreases in average delay per VMT across investment levels. At the highest level of investment in system expansion presented in Exhibit 7-10, average delay per VMT in 2032 is projected to be 27.2 percent lower than in 2012. At the lowest level of investment in system expansion presented in Exhibit 7-10, average delay per VMT in 2032 is projected to be 21.2 percent lower than in 2012.

Due to increases in the value of time from 2012 to 2032, the projected increases in average travel speed do not correspond to decreases in travel time costs per VMT. Travel time costs per VMT in 2032 are projected to increase across the investment levels presented. Travel time costs per VMT in 2032 are projected to increase by 19.4 percent relative to 2012 at the highest investment level and to increase by 21.5 percent at the lowest level of investment.

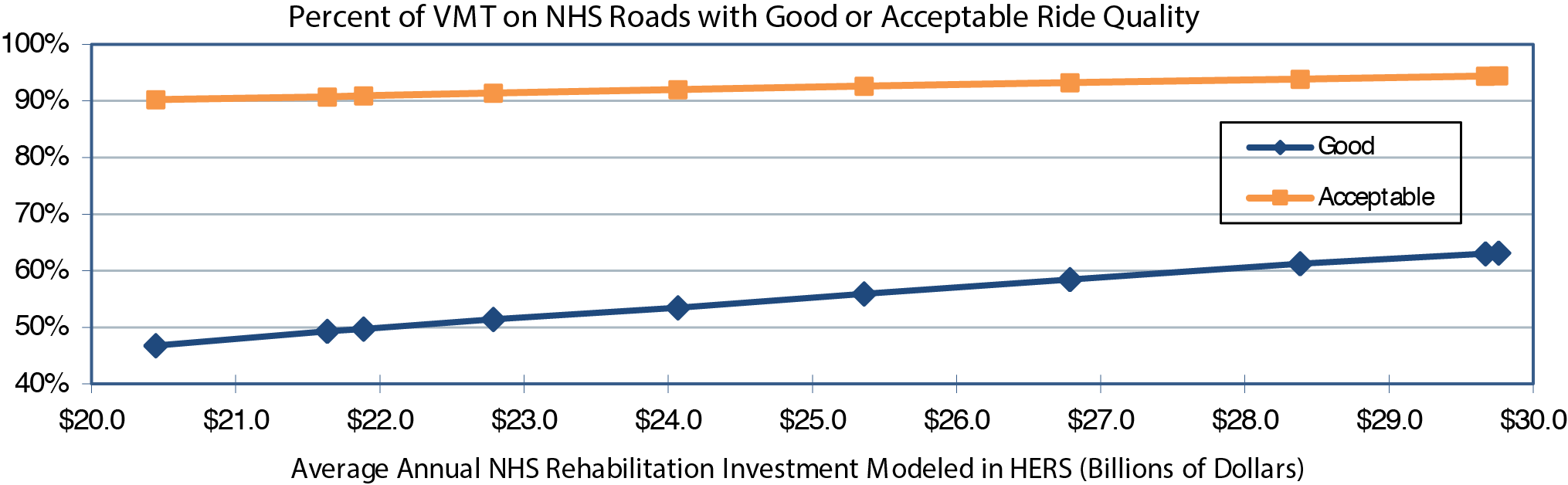

Impact of Future Investment on NHS Pavement Ride Quality

Exhibit 7-11 shows the portion of modeled NHS spending that HERS allocates to rehabilitation projects (which influence average pavement quality more than expansion projects do). The projected average pavement roughness of NHS roads is sensitive to the level of investment on NHS roads. At the highest level of investment presented in Exhibit 7-11 (an annual average of $29.8 billion allocated to system rehabilitation), the model projects average pavement roughness on the NHS to be 12.0 percent lower in 2032 than in 2012. At the lowest level of investment presented in Exhibit 7-11 (an annual average of $20.4 billion allocated to system rehabilitation), the model projects average pavement roughness on the NHS to be 2.5 percent higher in 2032 than in 2012.

Exhibit 7-11 Projected 2032 Pavement Ride Quality Indicators on the National Highway System Compared with 2012 for Different Possible Funding Levels

| HERS-Modeled Investment on the NHS | Projected 2032 Condition Measures on the NHS1 | Link to Chapter 8 Scenario | |||

|---|---|---|---|---|---|

| Average Annual for System Rehabilitation (Billions of 2012 Dollars)2 | percent of VMT on Roads With Ride Quality of: | Average IRI (VMT-Weighted) | |||

| Good (IRI<95) | Acceptable (IRI<=170) | Inches Per Mile | Change Relative to Base Year | ||

| $29.8 | 63.1% | 94.4% | 94.6 | -12.0% | Improve C&P |

| $28.4 | 61.2% | 93.8% | 96.5 | -10.2% | |

| $25.4 | 55.9% | 92.6% | 101.5 | -5.6% | |

| $22.8 | 51.4% | 91.4% | 105.8 | -1.6% | 2012 Spending |

| $21.9 | 49.7% | 90.9% | 107.5 | 0.0% | Maintain C&P |

| $20.4 | 46.8% | 90.2% | 110.2 | 2.5% | |

| Base Year Values: | 57.1% | 89.0% | 107.5 | ||

1 As discussed in Chapter 3, IRI values of 95 and 170 inches per mile, respectively, are the thresholds associated with "good" and "acceptable" pavement ride quality on the NHS. 2 The amounts shown represent only the portion of HERS-modeled spending directed toward system rehabilitation, rather than system expansion. Other types of spending can affect these indicators as well. Source: Highway Economic Requirements System. | |||||

At the highest level of investment presented in Exhibit 7-11, the model projects that pavements with an IRI below 95, which was the criterion in Chapter 3 for rating ride quality as "good," will carry 63.1 percent of the VMT on the NHS, up from the 57.1 percent estimated for 2012. At this investment level, the average IRI of the system would be 94.6, achieving the classification of providing good ride quality at the aggregate level. Furthermore, at the highest level of investment presented in Exhibit 7-11, HERS projects that 94.4 percent of VMT on the NHS would be on roads with an IRI at or below 170, which was the criterion in Chapter 3 for rating ride quality as "acceptable." This projection represents an improvement of 5.4 percentage points in the share of NHS roads with acceptable ride quality relative to the base year (89.0 percent of NHS roads with acceptable ride quality).

At the lowest level of investment presented in Exhibit 7-11, the model projects that pavements with an IRI below 95 will carry 46.8 percent of the VMT on the NHS, down from the 57.1 percent estimated for 2012. At this investment level, the average IRI of the system would increase to 110.2, which fails to achieve the classification of providing good ride quality at the aggregate level. The share of NHS roads with acceptable ride quality is projected to increase slightly by 2032 at the lowest level of investment presented in Exhibit 7-11; HERS projects that 90.2 percent of VMT on the NHS would be on roads with an IRI at or below 170, which is slightly higher than the share of NHS roads with acceptable ride quality in 2012 (89.0 percent of NHS roads with acceptable ride quality).

Based on these modeling results, additional investment to bring the percentage of NHS VMT on roads with "good" or "acceptable" ride quality closer to 100 percent would be economically inefficient, as the costs would exceed the benefits. A key factor leading to this result is that some improvements are not cost-beneficial until IRI rises above the threshold for acceptable ride quality by a sufficient margin. Thus, for some roads with an IRI above 170, improvements would not generate benefits exceeding costs. A further restriction in achieving a state in which all roads have an IRI at or below 170 is that, at any given point, some pavements will be under construction.

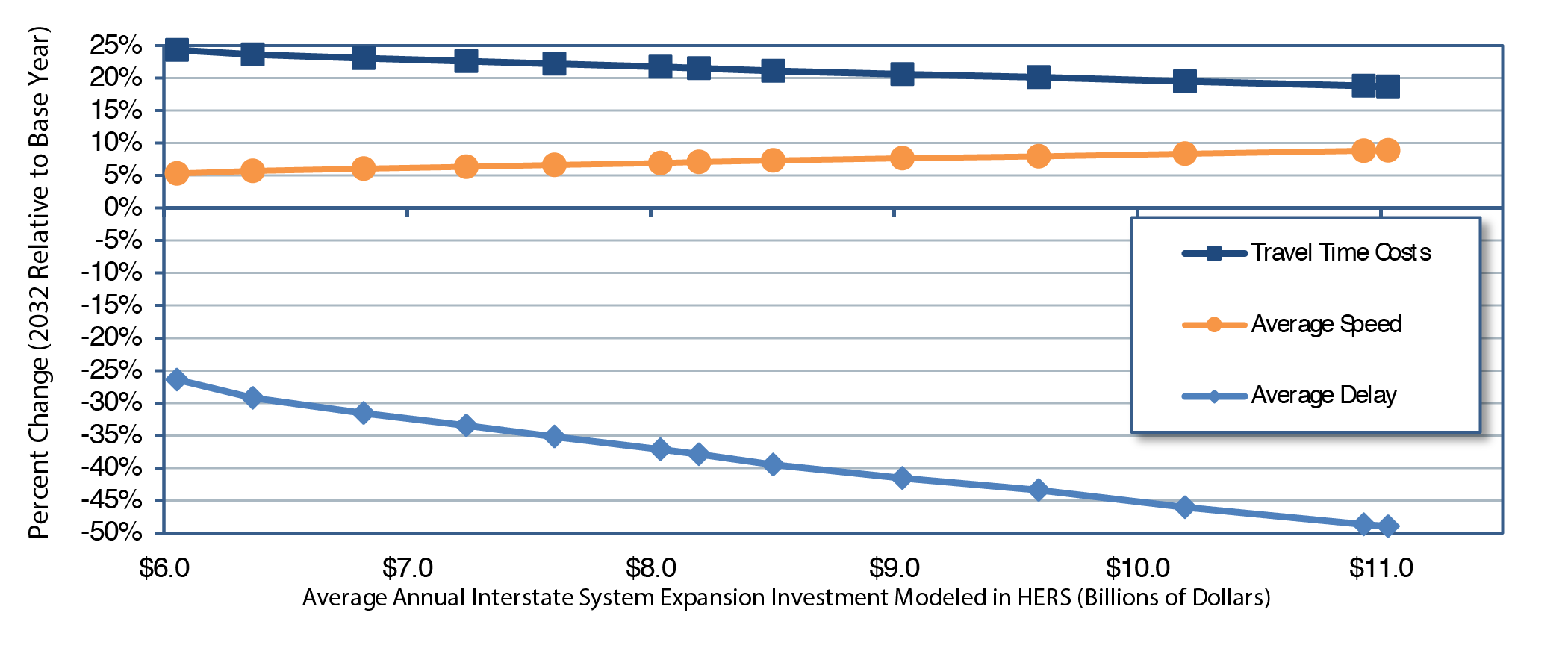

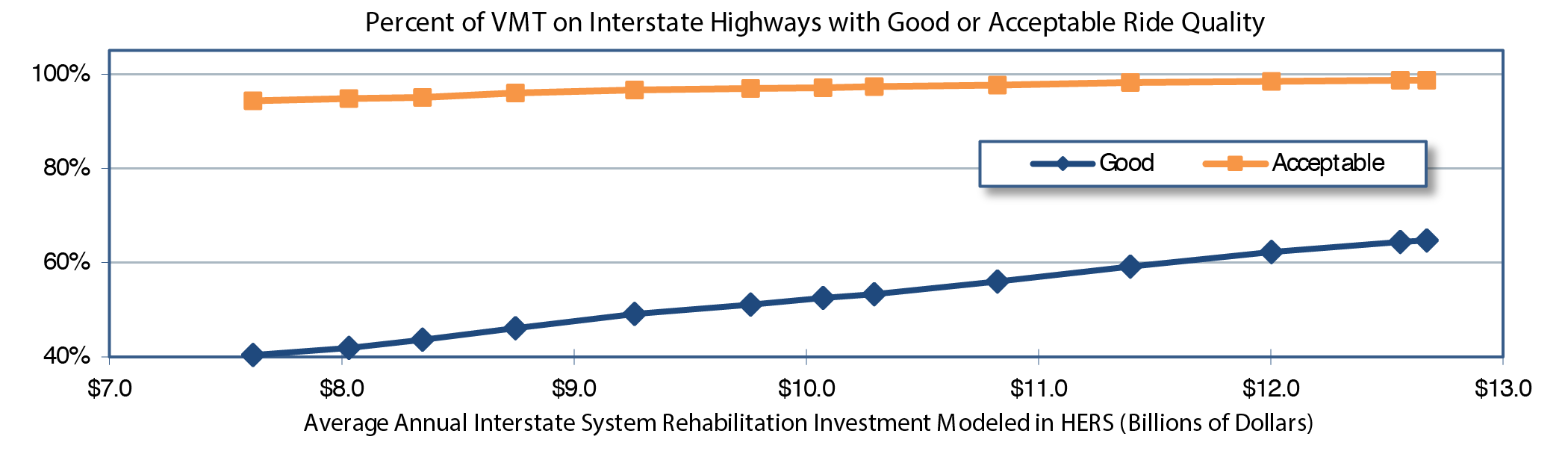

Impacts of Interstate System Investments Modeled by HERS

The Interstate System, unlike the broader NHS of which it is a part, has standard design and signage requirements, making it the most recognizable subset of the highway network. This section examines the impacts that investment in the Interstate System could have on future Interstate System conditions and performance, independently of spending on other Federal-aid highways. The analysis presented in this section centers on HERS runs that used a database consisting only of Interstate System roads. This process differs from that used in previous reports, in which the levels of future investment in the Interstate System were extracted from analyses that compared potential investments across a database of all Federal-aid highways.

The Interstate investment levels presented in this section were selected by applying the operational constraints used in the analysis of all Federal-aid roads (e.g., average annual spending growth rates, minimum BCR, maintaining pavement roughness, and average delay at the base-year level) to the Interstate System-specific database.

Impact of Future Investment on Interstate User Costs and VMT

Exhibit 7-12 presents the projected impacts of highway investment on VMT and total average user costs on Interstate roads in 2032, along with the amount that HERS allocates to Interstate projects. Average user costs are projected to be lower in 2032 than the adjusted baseline ($1.267 per VMT) for all investment levels presented. At the highest level of investment presented in Exhibit 7-12 (an annual average of $23.7 billion), average total user costs are projected to be 4.9 percent lower ($1.205 per VMT) than in 2012. At the lowest level of investment presented (an annual average of $13.7 billion), average total user costs are projected to be 2.1 percent lower ($1.241 per VMT) than in 2012.

Exhibit 7-12 HERS Investment Levels Analyzed for the Interstate System and Projected Minimum Benefit-Cost Ratios, User Costs, and Vehicle Miles Traveled |

|||||||

|---|---|---|---|---|---|---|---|

| HERS-Modeled Investment On the Interstate System | Projected Interstate Indicators | Link to Chapter 8 Scenario | |||||

| Average Annual percent Change vs. 2012 | Average Annual Over 20 Years | Minimum BCR 20-Year 2013 through 20323 | Average 2032 Total User Costs ($/VMT)4 | Projected 2032 VMT (Trillions)5 | |||

| Total HERS Spending1 | System Rehabilitation Spending2 | System Expansion Spending2 | |||||

| 4.08% | $23.7 | $12.7 | $11.0 | 1.00 | $1.205 | 0.926 | Improve C&P |

| 4.00% | $23.5 | $12.6 | $10.9 | 1.01 | $1.205 | 0.926 | |

| 3.00% | $21.0 | $11.4 | $9.6 | 1.12 | $1.212 | 0.923 | |

| 2.00% | $18.8 | $10.3 | $8.5 | 1.25 | $1.219 | 0.921 | |

| 1.74% | $18.3 | $10.1 | $8.2 | 1.26 | $1.222 | 0.920 | Maintain C&P |

| 1.00% | $16.9 | $9.3 | $7.6 | 1.37 | $1.226 | 0.919 | |

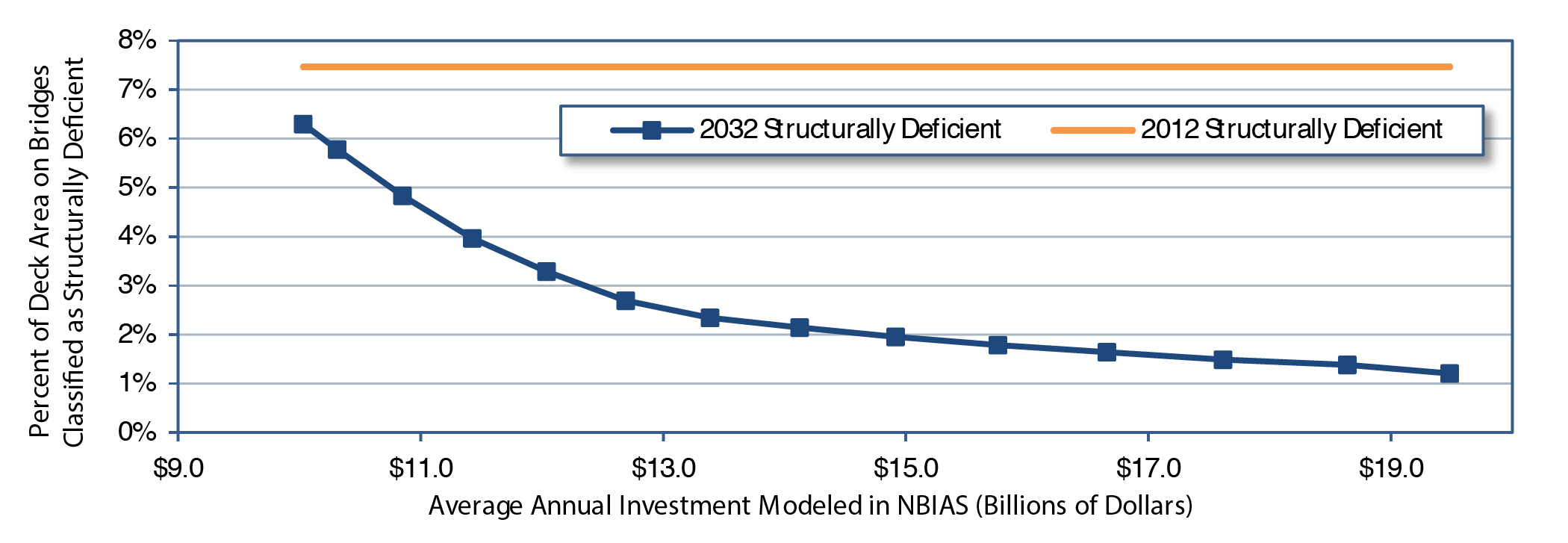

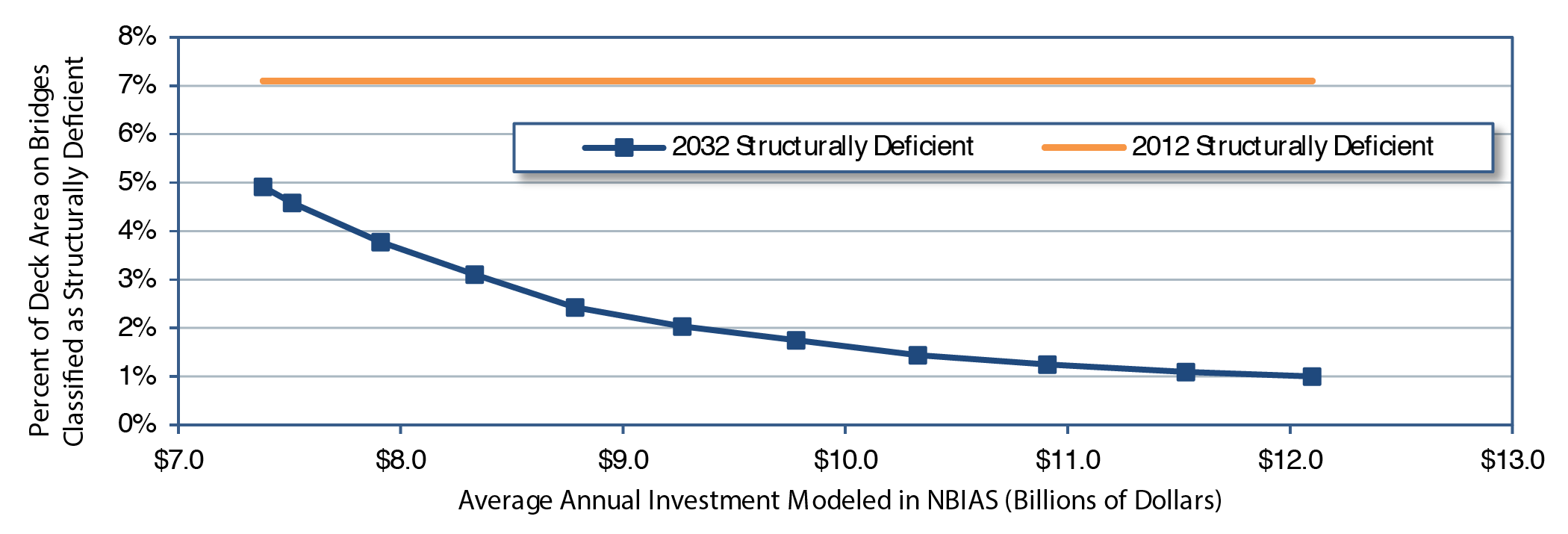

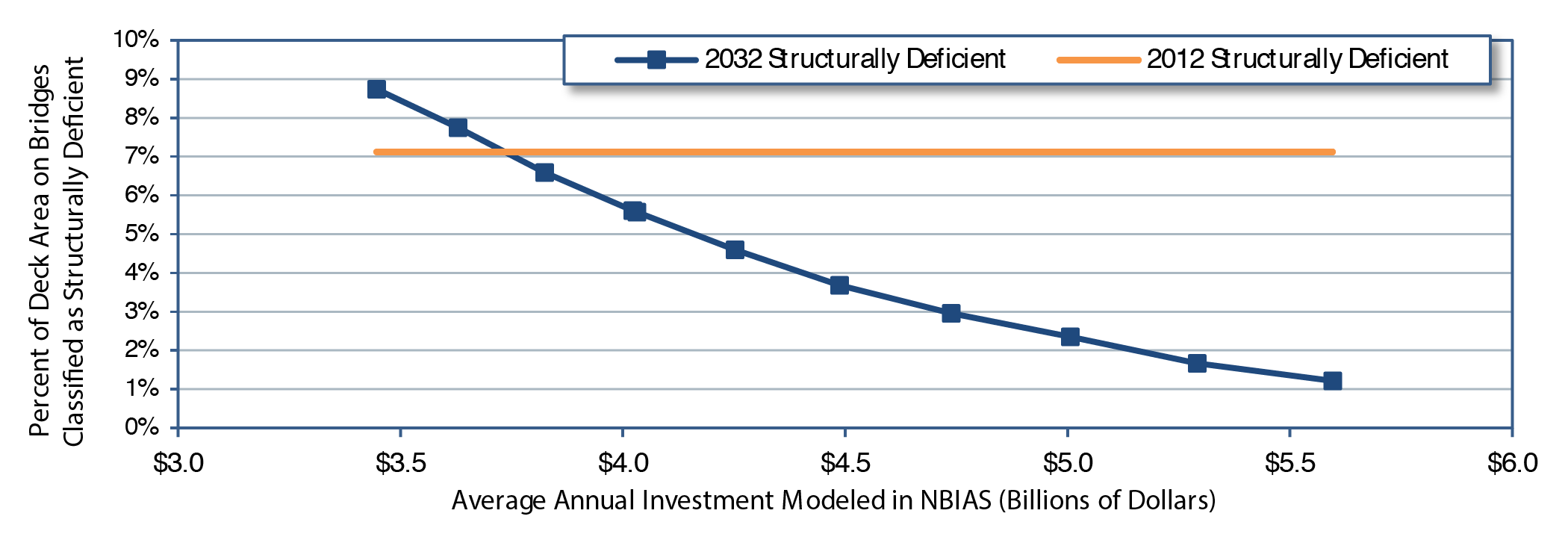

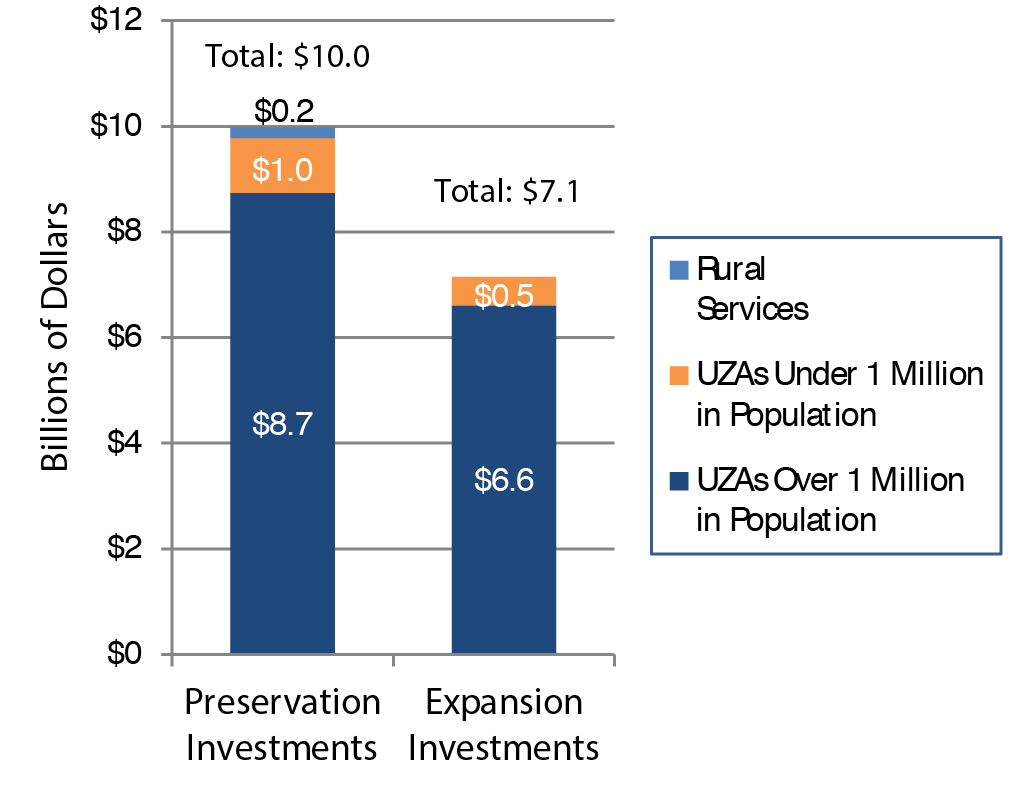

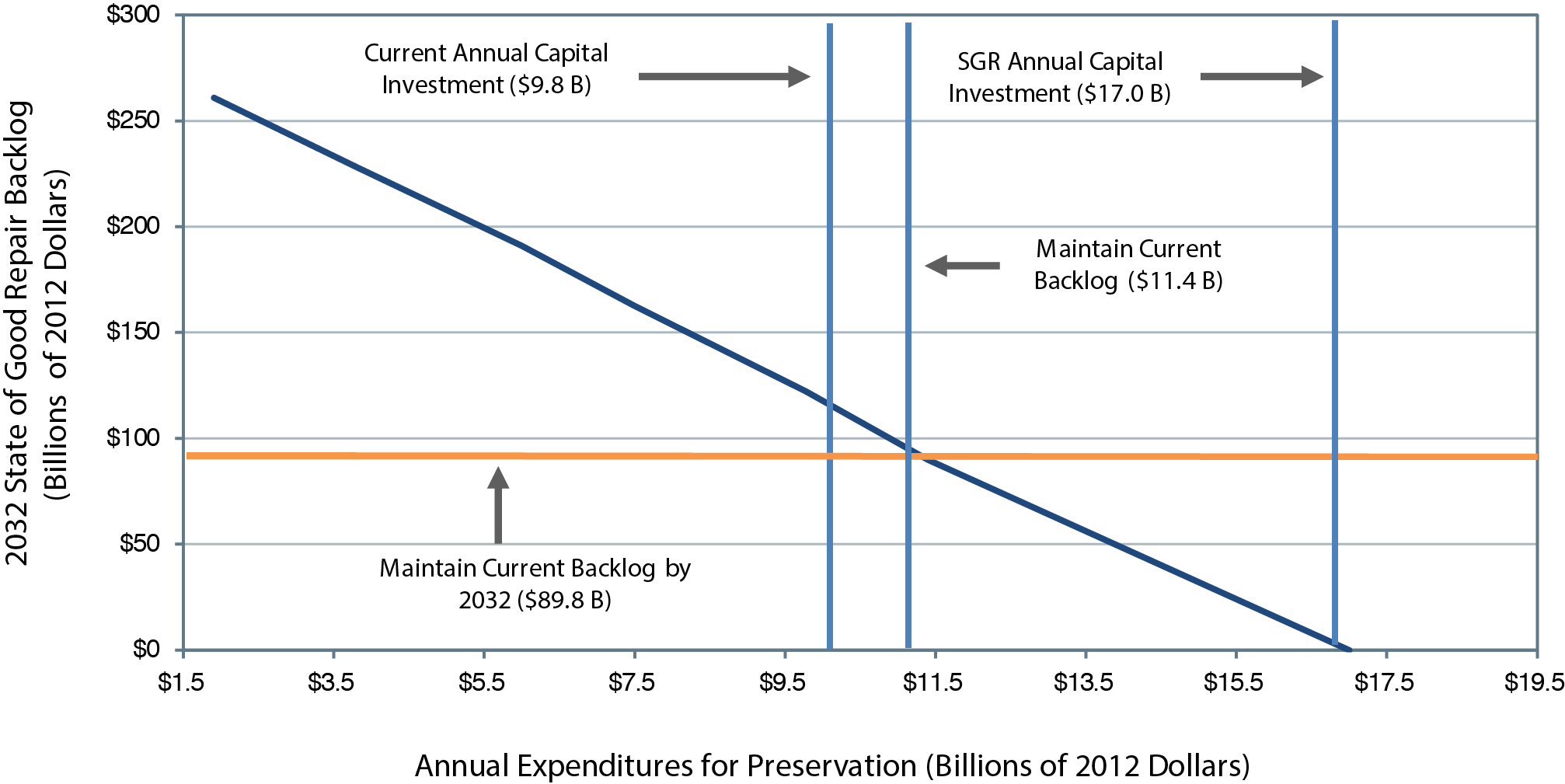

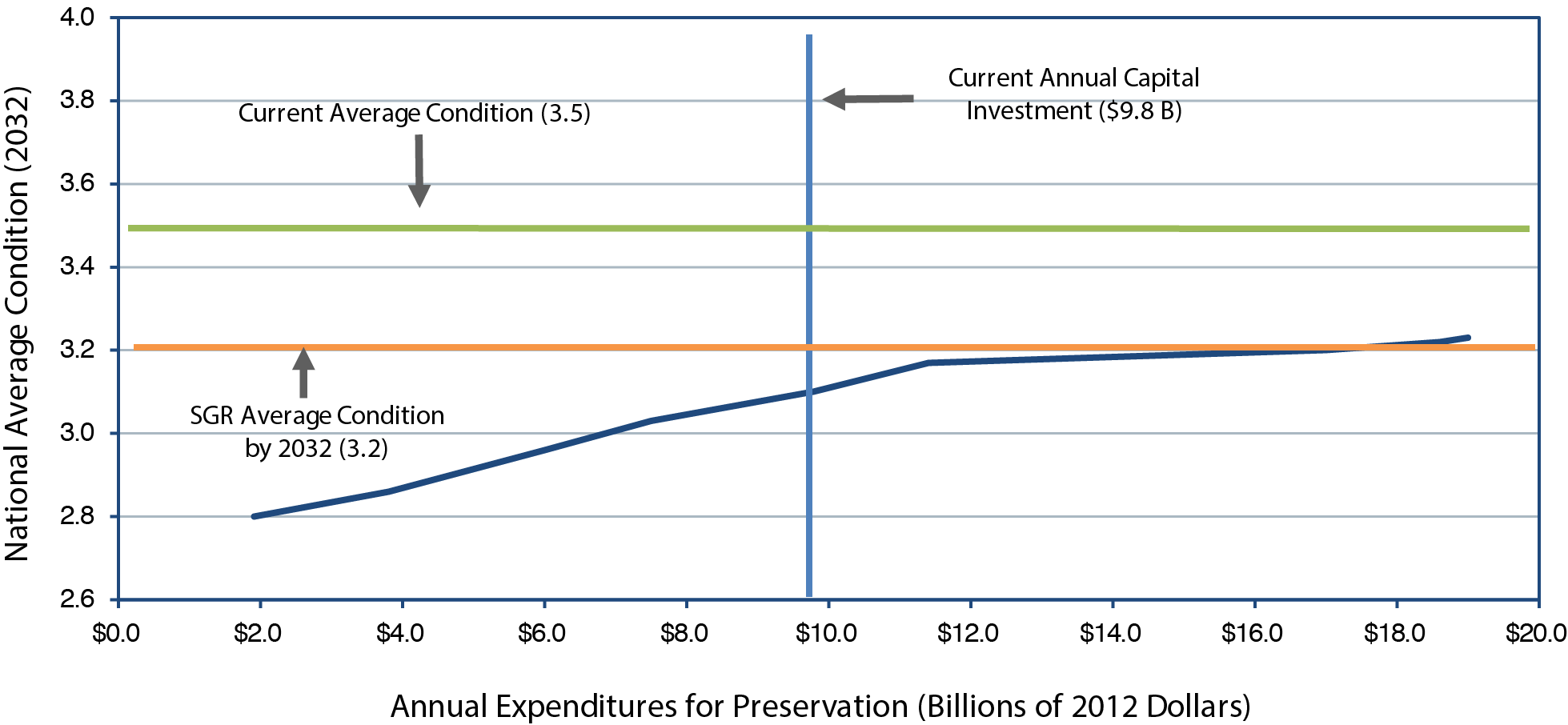

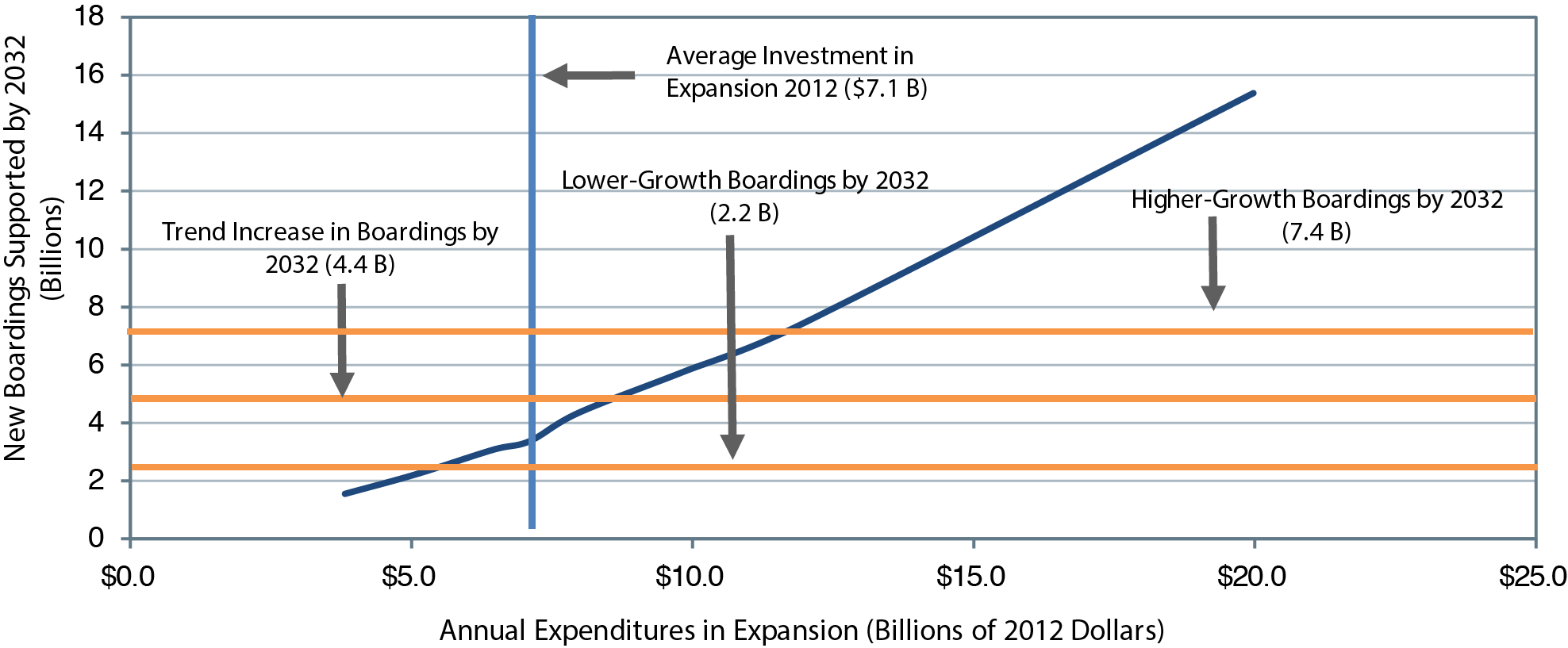

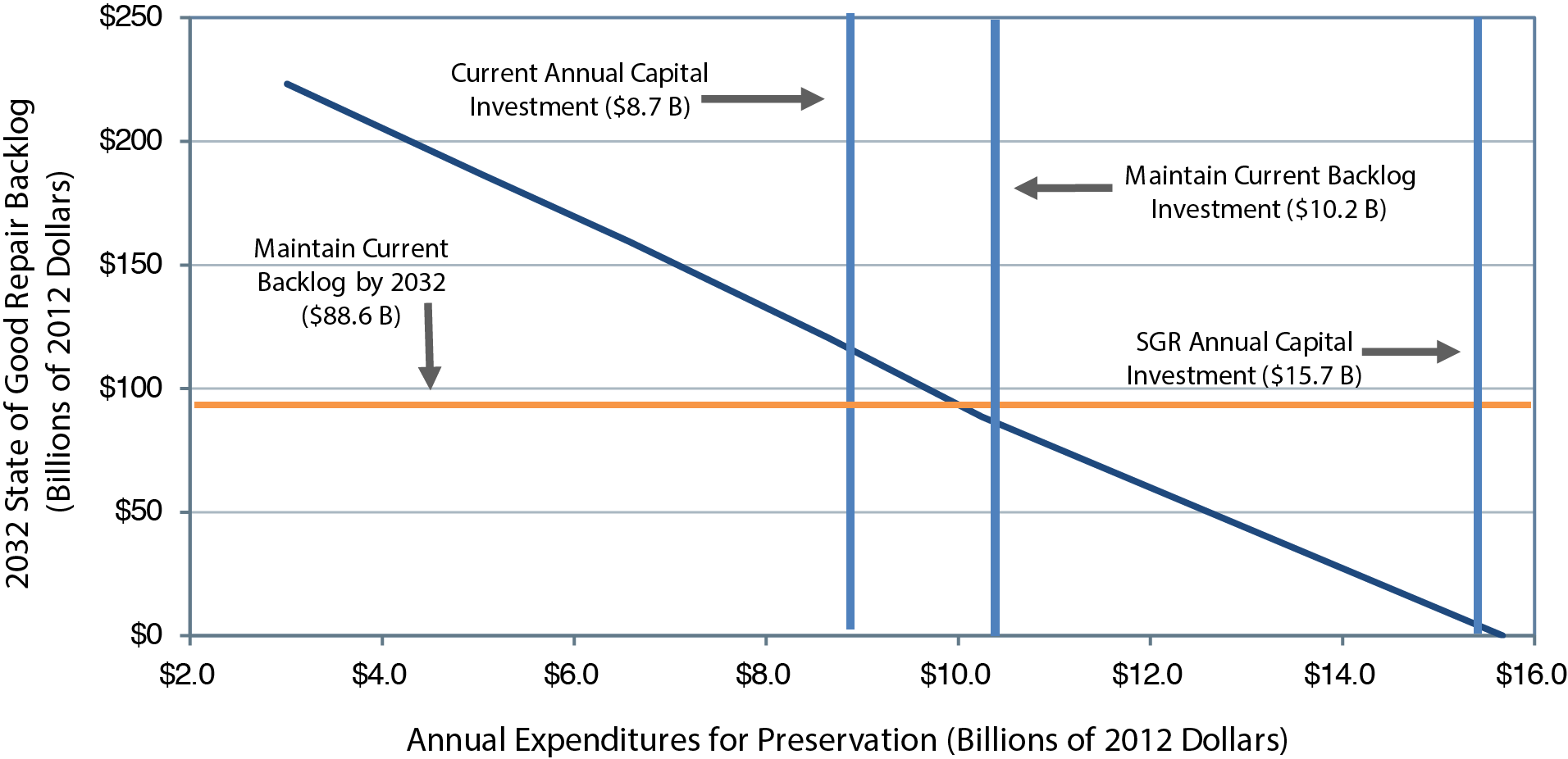

| 0.00% | $15.2 | $8.3 | $6.8 | 1.54 | $1.234 | 0.917 | 2012 Spending |