U.S. Department of Transportation

Federal Highway Administration

1200 New Jersey Avenue, SE

Washington, DC 20590

202-366-4000

The Highway Trust Fund (HTF) was established by the Highway Revenue Act of 1956 as a mechanism to finance an accelerated highway program, including the Interstate Highway System. The taxes dedicated to the HTF are extended periodically by Congress. Each year, highway users pay billions of dollars in highway excise taxes, which end up in the Federal Highway Trust Fund. While motorists pay these taxes as they purchase the various taxed items, the U.S. Department of Treasury actually collects most of these taxes from large corporations located in a handful of States, and deposits the receipts into the Highway Trust Fund.

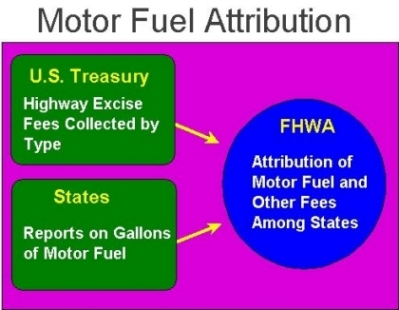

The U.S. Department of Treasury provides to FHWA documentation of the actual revenues received, by type of highway fee, into the Highway Account of the Highway Trust Fund. The States provides reports to FHWA on the gallonage of motor fuel recorded and taxed in each State, by type of fuel. FHWA, in cooperation with the States, developed procedures to attribute HTF revenues generated in each State using Motor Fuel data. The FHWA analyzes the State-generated data and develops the final attribution estimates for States based on the State data. Information can be found yearly in the Highway Statistics Series publication.

Each year, highway users pay billions of dollars in highway excise taxes, which end up in the federal Highway Trust Fund. While motorists pay these taxes as they purchase the various taxed items, the US Department of Treasury actually collects most of these federal taxes from large oil companies, deposits the receipts into the Highway Trust Fund, and provides to FHWA documentation of the actual revenues received, by type of highway fee, into the Highway Account of the Highway Trust Fund.

Federal legislation requires generally that funds paid into the Highway Trust Fund be returned to the States for various highway program areas in accordance with legislatively established formulas. Formulas for distributing Federal-aid highway funds for the Surface Transportation Program, the National Highway System Program, and for the Interstate Maintenance Program use motor fuel and other excise taxes attributed to each State as distribution factors. Furthermore, each State is guaranteed a threshold minimum return on its share of contributions. Since contributions by the highway users in each State cannot be directly measured, procedures have been developed to attribute funds to the States. Given the large amounts of funds involved in these programs, the accuracy of the attribution process is critical.

The States provide reports to FHWA on the gallons of motor fuel recorded and taxed in each State. States report on the consumption of each type of motor fuel: gasoline, gasohol, special fuels (mostly diesel), and other alternative fuels, and whether the gallons sold are fully taxed sales, exempt sales, partially exempt sales, full refunds, or fuels sold at reduced rates as provided by each States’ laws.

The FHWA has developed a set of procedures for attributing Highway Account revenues to the highway users in each State. FHWA’s primary concern is to have motor fuel data that represents, as accurately as possible, the number of gallons consumed by highway licensed vehicles operating on the highway. Because each State’s legislation and administrative procedures is unique, the data collected and submitted to FHWA differs by each State. FHWA instructs States to report the data according to specific rules from Chapter 2 of the Guide to Reporting Highway Statistics, and those instructions recognize and make accommodation for the variation in State data.

It is incumbent on FHWA, however, to make adjustments to the State motor fuel data to provide uniform definitions for off-highway uses of fuel. FHWA has developed a series of models to account for these factors as equitably as possible among the States. At the end of the adjustment procedures implemented by FHWA, a single dataset represents, as accurately and equitably as possible, the on-highway motor fuel use by the States, and when summed, a national total on-highway use.