Atlanta's 5th Street is a central thoroughfare in the Midtown District adjacent to the campus of the Georgia Institute of Technology. Community and business leaders have identified multimodal infrastructure improvements as a top priority for the district's continued livability and economic vitality. In 2016, Atlanta voters approved a proposal to fund transportation projects through a sales tax. Complete Streets is one of five project types funded by the sales tax revenue. Construction on 5th Street is slated to begin in 2022. The 5th Street project is ineligible for federal funding and receives a majority of its funding from value capture techniques - the Midtown Improvement District and Transportation Special Purpose Local Option Sales Tax (TSPLOST).

| Project Name | 5th Street Complete Street |

|---|---|

| Location | Atlanta, Georgia |

| Built Environment | Urban |

| Type of Infrastructure | Active Transportation Improvements |

| Value Capture Instrument |

|

| Summary of Value Capture and Infrastructure Cost |

|

| Duration of Value Capture | 5 years |

| Value Capture Innovation | An innovative combination of value capture techniques, Community Improvement District and Strategic Sales Tax Implementation that can be used for a broad range of transportation improvements. |

| Notable Outcomes | $128 million in TSPLOST revenue for projects throughout Atlanta. |

| Statutory and Regulatory Changes | Transportation Investment Act and Georgia Senate Bill 369 granted authority to vote on TSPLOST in Atlanta. |

Midtown Atlanta is a vibrant neighborhood that takes pride in being a growing cultural and economic hub in Georgia. Fifth Street is located in Midtown, adjacent to the Georgia Institute of Technology. In 2016, the segment of 5th Street between Williams Street and Myrtle Street was identified as needing multimodal improvements to keep pace with the walkable conditions found elsewhere in the Midtown neighborhood.1

The 5th Street Complete Street project aligns with the goals of the Midtown Alliance - an organization dedicated to fostering the urban experience in Midtown Atlanta - to incentivize walking and cycling by creating a more welcoming environment.2 The Midtown Alliance seeks to implement the following improvements on 5th Street:

Fifth Street Complete Street is in the design and engineering phase and has been in the public engagement process since 2018. This process and public feedback have resulted in modifications to the streetscape design (see Figure 1). The Midtown Alliance expects to begin bidding for the construction work in 2022.4

The improvements require significant local funding, which will be provided by three sources, which this case study examines. The case study also examines the general trend in Georgia of local value capture techniques being used to fund transportation infrastructure that supports economic growth and vitality. The case study also touches on the history of efforts to implement sales tax funding for infrastructure in Georgia.

Figure 1. Rendering of Proposed Multimodal Improvements to 5th Street

Midtown Alliance, "5th Street Complete Street." https://www.midtownatl.com/project/5th-street-complete-street

As of 2021, this project has received funds from three sources: Midtown Improvement District, Georgia Transportation Infrastructure Bank, and TSPLOST. Funding from the Georgia Transportation Infrastructure Bank was awarded through a competitive grant program available throughout Georgia. The Midtown Improvement District and TSPLOST supplement the grant funding (see Table 1).5

The Atlanta BeltLine receives funding from seven sources, with one of the largest funding sources being the tax revenues collected by the TAD. Table 1 reveals the funding distribution for the Atlanta BeltLine as of 2014.

| Funding Source | Amount ($) | Share of Project Funding |

|---|---|---|

| Midtown Improvement District | $750,000 |

25% |

| Georgia Transportation Infrastructure Bank | 750,000 |

25% |

| Transportation Special Local Option Sales Tax | 1,530,000 |

50% |

| Total | $3,030,000 |

100% |

Midtown Alliance, "5th Street Complete Street."

The first source of funding through a value capture technique for 5th Street Complete Street comes from a community improvement district, a type of special assessment district. A community improvement district is a zone where additional property taxes are levied on buildings receiving direct benefits from public infrastructure investments in the zone.6

The Midtown Improvement District is a community improvement district. Like special assessment districts, community improvement districts partially fund public infrastructure and services, from parks and recreation to the public transportation system. Special assessment districts are found throughout the United States, but community improvement districts are used in Missouri and Georgia.

Community improvement districts require the consent of a majority of the property owners in the zones to be subject to assessments and taxes, which are usually collected along with property tax payments.7 Assessments in community improvement districts are imposed only on commercial or industrial properties in the zone. Property owners choose when they pay assessments - immediately or over a specified timeframe.

In Georgia, uniquely, community improvement districts are administered by nonprofit organizations or downtown development authorities like the Midtown Alliance.8 Administrators usually follow a district plan, which identifies infrastructure improvements over a specified timeframe.

Most community improvement districts in Georgia are located in the Atlanta Metropolitan Area, but the Midtown Improvement District is one of the few located in the City of Atlanta.9 The Midtown Alliance manages the Midtown Improvement District, providing the staffing and operations for programs and projects in Midtown Atlanta.10 Governing the Midtown Improvement District is a board of directors. Property owners in the zone elects some board members and the mayor of Atlanta and the president of the Atlanta City Council appoint three members.11 The board of directors encourages engagement, support, and inclusion of property owners and businesses throughout the public planning process, because they are the beneficiaries of these transportation improvements.

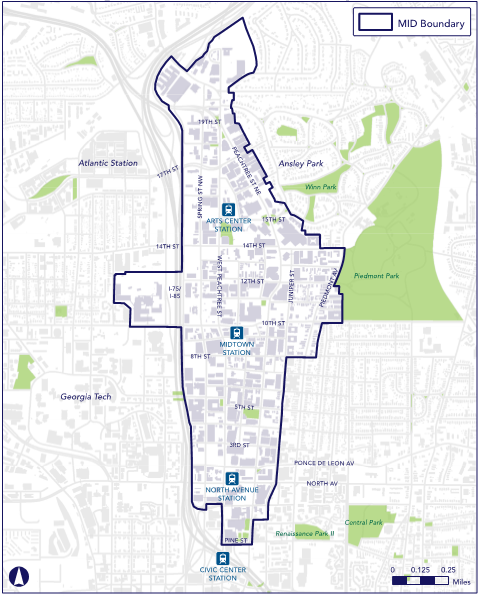

The City of Atlanta levies taxes on commercial property throughout the Midtown Improvement District, shown in Figure 2, at a rate of 0.5% to capture property tax revenues for transportation improvements. In 2020, the assessed value of commercial property in the Midtown Improvement District was $2.3 billion, which yielded $11.3 million in tax revenues.12

Figure 2. Midtown Improvement District Boundary

Source: Midtown Alliance, "Midtown Resource Center."

https://www.midtownatl.com/about/resource-center/midtown-alliance-and-improvement-district

The TSPLOST is the second value capture technique used to fund the 5th Street Complete Street project, covering 50% of the project’s total cost. The use of a sales tax to fund transportation infrastructure was enabled by the passage of municipal and regional transportation investment legislation. In 2010, the Transportation Investment Act authorizing the implementation of regional sales taxes to fund transportation improvements was approved by voters in three regions in Georgia.13 In 2018, voters in another region also approved the Transportation Investment Act, suggesting that the technique has gained popularity in Georgia. In 2015, the Georgia legislature also authorized the implementation of county sales taxes to fund transportation improvements, which enabled Fulton County to implement TSPLOST.

Implementation of TSPLOST by counties and municipalities in Georgia requires voter authorization; in 2016, 68% of voters in Atlanta authorized the TSPLOST.14 The City of Atlanta projected revenue of $379 million by imposing a 0.4% sales tax for five years.15 The proposal dedicated $75 million, or 21% of total project budget, to Complete Streets - more than any other project type. The 5th Street project was one of 15 Complete Streets projects to receive funding from TSPLOST.16 Funding from TSPLOST for this project was necessary to fill the funding gap between the Midtown Improvement District and the Georgia Transportation Infrastructure Bank.

| Project Type | Proposed Funding Allocation ($) | Share of Proposed Funding |

|---|---|---|

| Complete Streets | $75,398,139 | 21% |

| Sidewalks and Streetscapes | 69,611,838 | 19% |

| Atlanta Beltline and Multi-Use Trails | 65,900,000 | 18% |

| Signal Coordination | 40,000,000 | 11% |

| Street, Capacity and Vehicular Improvements | 37,797,500 | 11% |

| Multi-Use Trails | 18,475,152 | 5% |

| Neighborhood Greenways | 4,107,013 | 1% |

| Project Scoping and Engineering Studies | 4,000,000 | 1% |

| Relay Bike Share | 3,000,000 | 1% |

| Partnership and Matching Funding | 40,000,000 | 11% |

| Total | $358,289,641 | 100% |

Source: City of Atlanta, "TSPLOST and MARTA Transportation Funding Referenda Fact Sheet." www.atlantaga.gov/home/showpublisheddocument/23281/636245709418400000

The TSPLOST was part of a larger initiative in the Atlanta metropolitan region to leverage funding for transportation improvements. Voters approved two other transportation sales tax initiatives in 2016:

The following initiatives emerged from three legislative events:

As of November 2020, many counties and regions in Georgia had used the TSPLOST to supplement transportation funding. The TSPLOST in Atlanta is set to expire in 2022. By 2020, $128 million of TSPLOST revenue had been spent on transportation improvements, including $2.5 million on Complete Streets.21 Although the TSPLOST revenue dedicated to Complete Streets has not been exhausted, Complete Streets received more funding in the recent reallocation; thus, the future for Complete Streets, including 5th Street, is promising.

| Project Type | Proposed Funding Allocation ($) | Share of Proposed Funding | 2019 Reallocation ($) | Share of Reallocation | 2020 Expended ($) | Share of Expended |

|---|---|---|---|---|---|---|

| Complete Streets | $75,398,139 | 20% | $74,767,236 | 29% | $2,477,868 | 2% |

| Sidewalks and Streetscapes | 69,611,838 | 18% | 12,373,823 | 5% | 9,031,400 | 7% |

| Atlanta Beltline and Multi-Use Trails | 65,900,000 | 17% | 65,900,000 | 25% | 57,067,278 | 45% |

| Signal Coordination | 40,000,000 | 11% | 19,145,274 | 7% | 3,751,445 | 3% |

| Street and Vehicular Improvements | 37,797,500 | 10% | 4,287,500 | 2% | 0% | |

| Multi-Use Trails | 18,475,152 | 5% | 15,325,702 | 6% | 3,849,034 | 3% |

| Neighborhood Greenways | 4,107,013 | 1% | 0% | 0% | ||

| Project Scoping and Engineering Studies | 4,000,000 | 1% | 60,000 | 0% | 10,427 | 0% |

| Relay Bike Share | 3,000,000 | 1% | 1,500,000 | 1% | 0% | |

| Partnership and Matching Funding | 40,000,000 | 11% | 34,075,404 | 13% | 29,545,509 | 23% |

| Program Management | 17,914,482 | 5% | 32,565,061 | 13% | 22,407,264 | 17% |

| Total | $376,204,124 | 100% | $260,000,000 | 100% | $128,140,225 | 100% |

Sources: City of Atlanta, "Transportation Special Local Option Sales Tax (TSPLOST) 2020 Year End Report." www.assets.website-files.com/6009dcb93fd7208338f02067/6080e9c98300e422e379c3b6_2020-Year-End-TSPLOST-Report-Final-Version-Revision-12.17.20.pdf

The 5th Street Complete Street project demonstrates how multiple value capture techniques can be implemented simultaneously to support state and other local funding for transportation improvements. The project uses revenues collected from the Midtown Improvement District, administered by the Midtown Alliance, and revenues collected from the TSPLOST, which was implemented by the City of Atlanta to support funding for transportation improvements. With funding from the Georgia Infrastructure Bank, the City of Atlanta has brought 5th Street to the top of its priorities, with construction expected to start in 2022.

Although the application of the TSPLOST was initially contentious among stakeholders in Atlanta, the TSPLOST ultimately proves that value capture techniques generate revenue for necessary improvements. Though the transportation improvements on 5th Street have yet to break ground, the City of Atlanta has collected the revenue necessary to provide funding for project implementation. Given the remaining revenues dedicated for Complete Streets in Atlanta, 5th Street remains promising for future transportation improvements necessary for an even more vibrant Midtown Atlanta.

1City of Atlanta, "City of Atlanta Proposed TSPLOST Purposes and Recommended Projects." www.atlantaga.gov/home/showpublisheddocument/22900/636245709418400000.

2Midtown Alliance. "Midtown Transportation Plan." www.ctycms.com/ga-midtown/docs/midtown-transportation-plan-feb-2017.pdf

3Midtown Alliance, "5th Street Complete Street."www.midtownatl.com/project/5th-street-complete-street

4Midtown Alliance, "5th Street Complete Street."

5Midtown Alliance, "Midtown Alliance Receives $750K Grant from SRTA for 5th Street 'Complete Street' Project." www.midtownatl.com/about/news-center/post/midtown-alliance-receives-750k-grant-from-state-road-and-tollway-authority-for-5th-street-complete-street-project-1.

6FHWA, Center for Innovative Finance Support, "Special Assessments" www.fhwa.dot.gov/ipd/value_capture/defined/special_assessments.aspx

7FHWA, Center for Innovative Finance Support, "Special Assessments."

8FHWA, Center for Innovative Finance Support, "Community Improvement Districts."www.fhwa.dot.gov/ipd/value_capture/defined/community_improvement_districts.aspx

9Georgia State University, "What You Need to Know About Georgias Community Improvement Districts." https://cslf.gsu.edu/2016/11/28/key-facts-about-community-improvement-districts-in-georgia/..

10Midtown Alliance, "Midtown Improvement District: Putting Your Investment to Work." www.midtownatl.com/about/midtown-alliance/midtown-improvement-district

11Midtown Alliance, "Midtown Improvement District: Putting Your Investment to Work."

12Midtown Alliance, "Report of Midtown Community Improvement District of Proposed Millage Rate."ctycms.com/ga-midtown/docs/mid-millage---2020v2.pdf

13Georgia State Financing and Investment Commission, "Transportation Investment Act." www.gsfic.georgia.gov/financing-and-investment-division/transportation-investment-act..

14Transportation for America, "Transportation Vote 2016" www.t4america.org/maps-tools/state-policy-funding/2016-votes/

15City of Atlanta, "TSPLOST and MARTA Referenda"www.atlantaga.gov/government/mayor-s-office/projects-and-initiatives/tsplost-and-marta-referenda

16City of Atlanta, "Proposed TSPLOST Purposes and Recommended Projects."www.atlantaga.gov/home/showpublisheddocument/22900/636245709418400000.

17Transportation for America, "Transportation Vote 2016." www.t4america.org/maps-tools/state-policy-funding/2016-votes/

18Atlanta Journal-Constitution, "Voters Reject Transportation Tax."www.ajc.com/news/state--regional-govt--politics/voters-reject-transportation-tax/fZB3UVE1IM5jMVlhZvpruN/

19Atlanta Magazine, "Where It All Went Wrong." www.atlantamagazine.com/great-reads/marta-tsplost-transportation/

20Atlanta City Council, "Resolution 19-R-3445" www.assets.website-files.com/6009dcb93fd7208338f02067/6080e74d4e2f1784bca632c2_Program-Prioritization-Legislation.pdf

21 City of Atlanta, "Transportation Special Local Option Sales Tax (TSPLOST) 2020 Year End Report." www.assets.website-files.com/6009dcb93fd7208338f02067/6080e9c98300e422e379c3b6_2020-Year-End-TSPLOST-Report-Final-Version-Revision-12.17.20.pdf