Pasco County's mobility fee is a one-time capital charge to recover the proportionate cost of transportation improvements needed to serve the demand generated by new development projects. In replacement of the 2007 Transportation Impact Fee, it funds mobility improvements to roads, mass transit, sidewalks, trails, and bicycle paths; pays for the impacts of new development; promotes infill development and discourages sprawl to focus infrastructure resources on the urban service boundary. The Multimodal Mobility Fee Program has given Pasco County an efficient way to pay for new transportation infrastructure, reduce sprawl, and promote economic development.

| Project name | Pasco County Multimodal Mobility Fee Program |

|---|---|

| Location | Pasco County, Florida |

| Built environment | Urban, suburban, and rural |

| Economically distressed or opportunity zone | There are 17 Qualified Opportunity Zones in Pasco County. |

| Type of infrastructure | All transportation capital projects (roads, transit, bicycle, pedestrian) |

| Value capture instrument | Transportation Mobility Fee |

| Summary of funding plan | Mobility fees are supported by three additional revenue sources: tax-increment financin (a 30% set-aside for transportation), “Penny for Pasco†local sales tax (40% allocated to transportation), and a 5-cent second local option gas tax. |

| Amount of value capture | Estimated revenues of $627 million between 2025 and 2045. |

| Duration of value capture | Ongoing; revenue collection planned through 2045. |

| Value capture innovation | Three other revenue sources are used in conjunction with mobility fee revenues to allow developers to buy down mobility fees for land uses identified in the county's transportation plan. |

| Notable outcomes | Received the 2012 Future of the Region award recognizing the program as a model for other communities in the region. |

| Statutory and regulatory changes | The program is enabled by the Florida Growth Management Act of 1985 and the Florida Impact Fee Act (SB410). Amendments to Pasco County's Comprehensive Plan establishing tiered growth management districts provide supportive local land use policy. |

_________________________________

Note: Transit-oriented development is compact, mixed-use development centered around or located near a transit station. Focusing growth around a transit station capitalizes on public investment in transit and provides benefits such as improved safety for pedestrians and cyclists through nonmotorized transportation infrastructure, neighborhood revitalization, fewer automobile trips and thus congestion relief, and economic returns to nearby landowners and businesses (Federal Transit Administration). Traditional neighborhood development involves a variety of housing types, a mix of land uses, a walkable design, and usually a transit option, in a compact area. It is inspired by traditional village development. Its benefits include walkable neighborhoods, open-space protection, more multimodal options, and a reduction in vehicle congestion (National League of Cities).

Pasco County's Multimodal Mobility Fee Program was adopted in July 2011 as a substitute for the county's 2007 Transportation Impact Fee. The motivations for replacing the impact fee with the mobility fee were economic conditions, municipal interest in developing multimodal transportation systems in Pasco County, and changes in state growth management legislation.1

The unemployment rate for the area around the time Pasco County was adopting the Mobility Fee Program (in 2010) was 12 percent, the highest in the region.2 Pasco County has long been a bedroom community for Hillsborough and Pinellas counties; in 2010, about 70 percent of Pasco County residents were employed and commuted outside county boundaries.3 But the area was also seeing unsustainable growth and sprawl, and its tax base depended heavily on residential development.4 To diversify the tax base, Pasco County began attracting new businesses that offered high-paying jobs in desirable fields and shifted a portion of the tax burden from residential development to business and commercial uses.

Because the 2007 transportation-impact fee applied only to road infrastructure projects, the county lacked flexibility in how it used fee revenue. As Pasco County became more densely populated, more mobility choices (transit, bicycling, and walking) became feasible and helped the county meet its commitment to bicycle and pedestrian facilities and multiuse paths.5 The county therefore incorporated flexibility into the Mobility Fee Program, allowing capital funds to be used for motor vehicle, transit, bicycle, and walking infrastructure.

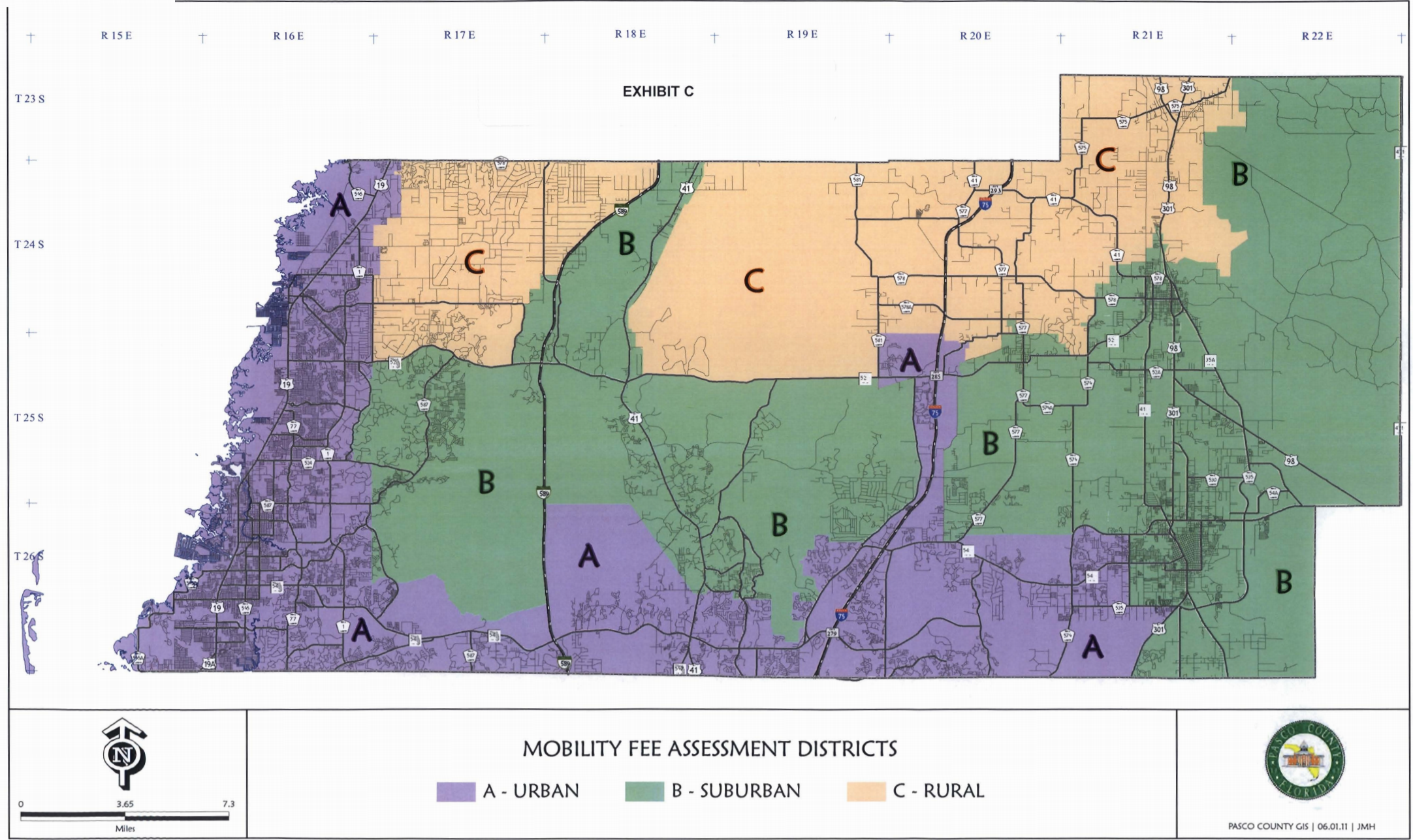

Amendments to the Pasco County Comprehensive Plan provided the framework for the Mobility Fee Program. They included the adoption of geographically tiered growth management districts (i.e., urban, suburban, and rural) and mobility strategies. The geographic districts help keep growth focused in certain areas of the county, where compact, walkable, transit-ready forms of development are encouraged and where transit exists (or is planned).This framework enabled the Mobility Fee Program to implement a funding mechanism consistent with the strategy for development density and mobility for each geographic district.

The Mobility Fee Program's success is due to the efforts Pasco County made before creating the program. Not only did the county establish clear goals and intended outcomes from the beginning of the process, but it also participated in efforts that helped it secure the passage of the program and withstand potential judicial challenges:

Program goals were driven by the climate of economic uncertainty and slow growth. To address this economic problem, the county wanted to use the mobility fee to encourage development in urban areas, attract certain types of job-creating and transit-ready land uses by providing incentives, and provide more flexibility in the use of collected funds for vehicles, transit, bicycles, or walking. The goals were reflected in the program's fee schedule and collection structure.

Because the Multimodal Mobility Fee Program would make up only part of the capital and operations and maintenance requirements of its transportation network, Pasco County had to identify other funding sources to fill the gap. It also had to be able to provide incentives for specific land uses. The county identified three revenue sources to complement the Mobility Fee program: tax-increment financing (TIF), sales tax (Penny for Pasco) revenue, and a fuel tax.

A combination of state legislation and constitutional authorization provided the support Pasco County needed to levy impact fees. Florida's Home Rule provisions, Growth Management Act of 1985, and Impact Fee Act are the legal precedents that enabled the program (Table 1).

| Legal Precedents | Description |

|---|---|

| Florida's Home Rule Provisions | The Florida Constitution grants local governments broad home rule powers. Impact fees are home rule revenue sources that can be imposed pursuant to a local government's police powers. This home rule power enabled Pasco County to impose impact fees and customize them to their region. |

| Total Florida Impact Fee Act | This act requires a county, municipality, or special district to base an impact fee's calculation on recent, local data and detailed accounting and reporting of collections and expenditures. |

| Florida's Growth Management Act of 1985 | Also known as the Local Government Comprehensive Planning and Land Development Regulation Act, this act requires local governments to adopt a comprehensive plan to guide growth and development. It also requires local governments to maintain adequate service levels for public facilities and prohibits approval of development that would cause a reduction in service level. It also requires local governments to provide public facilities that are consistent with the community's land use plan. The act has been amended several times, with notable changes in 2011. One of these changes was the elimination of the mandate for concurrency for transportation, schools, and parks and recreation facilities.6 Pasco County's concurrency facilities include drainage, potable water supply, sanitary sewer, solid waste, parks and recreation, and school facilities; transportation facilities are evaluated under the Mobility Fee Program.7 |

Sources: 2011 Florida Senate Bill Analysis for SB410 on Impact Fee, https://www.flsenate.gov/Session/Bill/2011/410/Analyses/2011s0410.rc.PDF

Florida's Impact Fee Act, https://m.flsenate.gov/statutes/163.31801

To withstand potential judicial challenges to the Multimodal Mobility Fee Program, Pasco County designed the program to pass the dual rational-nexus test. This test includes two requirements: needs prong and benefits prong. Pasco County was able to address challenges relating to the test through the use of other funding sources and by referring to studies conducted elsewhere that justified the mobility fee approach. Table 2 breaks down how the Mobility Fee Program passed the dual rational nexus test in more detail.

| Test | Description | Challenge | Solution |

|---|---|---|---|

| Needs prong | There must be a reasonable connection (or rational nexus) between the proposed development and the need for additional capital facilities for which the fee is imposed. | The needs prong limited Pasco County to using the program revenue for capital facility costs; operations and maintenance could not be assessed. This was problematic because the county's transportation network includes transit, and transit tends to be operation-and-maintenance intensive. | Used tax increment revenue as a separate funding source for transit operations and maintenance. |

| Benefits prong | There must be a reasonable connection between the expenditure of the funds collected and the benefits accruing to the development. | It was difficult to promote or discount compact, mixed-use development because all developments should pay for the same needs (level of service), and fee differentials are generally based on trip generation. | Relied on California Department of Transportation's studies showing that transit-oriented development and traditional neighborhood development generate fewer vehicle miles traveled because people are more likely to walk, bike, or ride transit in those developments. Greater density around transit stations allows households to spend less time commuting by car. |

Sources: Pasco County Government, Mobility Fees

in Pasco County Presentation; 1,000 Friends of Florida. (2013).

Transportation Mobility Systems: An Alternative to Concurrency in Florida

[Video]. https://vimeo.com/79716807

One of the first steps Pasco County took in implementing the Mobility Fee Program was to determine the appropriate geographic scale. The county adopted mobility fees countywide, and for the assessment fee divided the county into the three assessment districts (urban, suburban, and rural) identified in Pasco County's Comprehensive Plan.8 A map of the districts is shown in Figure 1.

Mobility fee. When an applicant requests a building or development permit from Pasco County, the county imposes a one-time mobility fee, which is determined by assessment district. Each assessment district has its own fee schedule for different land uses, with the lowest fees in urban areas. The urban area focuses on transit-oriented and multimodal mobility, while the suburban and rural areas focus more on roadway improvements.

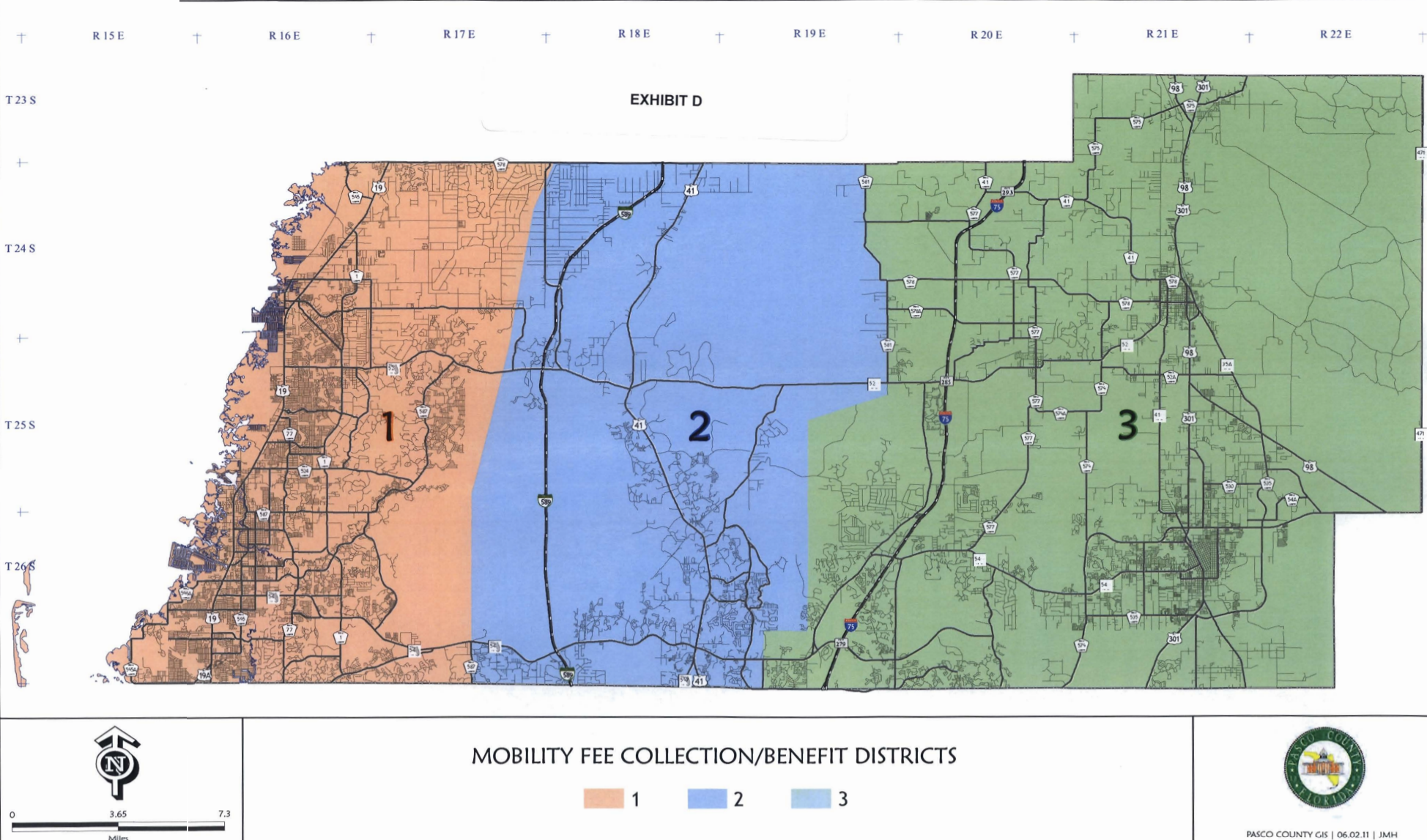

Assessment fee. Assessment fees are collected and expended depending on geographic boundaries that are different from the assessment districts (Figure 2). The expenditure of fees is based primarily on the county's long-range transportation plan, Mobility 2045. Mobility 2045 establishes the mobility fee program's transportation improvement priorities and schedule, in concert with planned growth in the county's Comprehensive Plan. The program is designed to be flexible in a way that allows for application to roadways, transit, bicycle and pedestrian facilities, and roadway facilities in Florida's Strategic Intermodal System (SIS).9

Because the county's multimodal mobility fee revenues are expended on specialized systems such as the area's transit system and the SIS, Pasco County partners with public agencies, such as the Florida Department of Transportation (DOT) and Pasco County public transportation agency, to coordinate efforts in expending mobility fee revenue for the SIS roads and transit capital projects.

Pasco County's Mobility Fee Program is calculated using the most current local data (as required by the Florida Impact Fee Act) and the equation shown below:10

Net Mobility Fee = Total Impact Cost – Self Credits – Incentives

Eleven input components are used in the fee equation: number of daily trips generated, length of those trips, proportion of travel that is new travel, cost per person-mile of capacity, capacity addition ration, credits for revenues generated by development, facility life, interest rate, fuel efficiency, effective days per year, and interstate or toll facility adjustment factor.11 After the impact fees are calculated, a mobility fee schedule is assigned in which development is charged on the basis of the proportion of person-miles of travel (demand) it is expected to generate for the transportation system, thus satisfying the proportionality concept of the dual rational-nexus test. The fee schedule is typically paired with individual land uses and corresponding mobility fees. The 2020 mobility fee schedule is shown in Table 3.

One of the goals of the program is to use the mobility fee to provide incentives for and encourage development in urban areas and attract certain types of job-creating and transit-ready land uses. The county accomplishes this by reducing mobility fees for certain land uses that meet certain criteria. Incentive strategies that are currently incorporated into the fee structure is shown in Table 4.

Figure 1. Mobility Fee Assessment Districts

Source: Pasco County Government

Figure 2. Mobility Fee Collection /Benefit Districts

Source: Pasco County Government

| Land Use | Unit | Net Mobility Fee | ||

|---|---|---|---|---|

| Urban Standard | Suburban Standard | Rural Standard | ||

| Residential | Dwelling unit | $448–$6,329 | $821–$9,312 | $978–$10,723 |

| Recreation | Varies | $646–$15,451 | $888–$20,155 | $1,047–$23,542 |

| Institutions | Varies | $271–$8,384 | $522–$9,986 | $717–$13,763 |

| Retail | Varies | $411–$56,790 | $533–$63,929 | $636–$69,131 |

| Industrial, lodging, office | Varies | $0 | $0 | $0 |

| Mining | Cubic yard | $48 | $47 | $56 |

The mobility fee required for each land use is the Net Mobility Fee multiplied by the number of units for which the development is seeking a building or development permit. The prices shown under Net Mobility Fee are range from lowest to highest. This table shows a simplified version of the Mobility Fee Program's fee schedule. The full fee schedule breaks down each land use into different Institue of Transportation Engineers  land use categories. (Source: Pasco County Government)

| Criteria | Incentive Strategy |

|---|---|

| Office, industrial, lodging | Not charged a mobility fee in any geographic district |

| Harbors and West Market area | Redevelopments in these areas are not charged a mobility fee. |

| Mixed-use, travel-reducing measures (MUTRM) | Fees for urban and rural developments exhibiting MUTRM are 75 percent of the standard fee rates. |

| Traditional neighborhood development | For the purpose of supporting the county's goal of creating concentrated growth, fees for urban and rural traditional neighborhood development are 50 percent of the standard fee rates. |

| Transit-oriented development | For the purpose of supporting the county's goal of creating growth around transit stops, fees for urban transit-oriented development are 25 percent of the standard fee rate. |

| MUTRM, transit-oriented development, and traditional neighborhood development in suburban districts | Reduced fees for suburban district MUTRM, traditional neighborhood development, and transit-oriented development match the corresponding urban fee district rates. |

Source: Pasco County Government 2018 Mobility Fee (2019). Pasco County Government website.

These incentives are achievable through the use of the mobility fee buy-down incentive program. The revenue sources that would help generate the county's buy-down budget include tax increment financing (TIF) funds, county-controlled gasoline taxes, and Penny for Pasco revenue generated by the population and employment base. The diversity of funding helps to ensure the success of the Mobility Fee Program. Table 5 describes each revenue source.

| Source | Description |

|---|---|

| Sales tax (Penny for Pasco) |

This tax was adopted in 2004 and renewed in 2012 through 2024. At 1 cent per dollar per sale (up to a sales amount of $5,000), it provides designated funds for economic development, public safety vehicles and equipment, conservation of land and natural resources, transportation infrastructure improvements, and improvements to facilities of the Pasco County School District, and other needs. Forty percent of this tax is allocated to transportation-related improvements.1 |

| Gas tax | Revenue from Pasco County's 5-cent second local option gasoline tax is allocated to transportation system capacity expansion. According to the 2018 estimate, this source of revenue would contribute $138.9 million (2018 dollars) to mobility fee subsidies over 25 years. |

| TIF | In conjunction with the 2011 Mobility Fee Update Study, Pasco County implemented a TIF program for transportation funding. The tax-increment area consists of the unincorporated areas of Pasco County (excluding the Lacoochee/Trilby Community Redevelopment Area).1 The program locks the county's valuation at a certain level (2012 taxable value) and allocates a portion of the annual value increase for transportation improvements. Approximately one-third of the tax increment increase is set aside for transportation in the unincorporated areas of the county (including the Lacoochee/Trilby Community Redevelopment Area). TIF funds are applied first to meet bond obligations, then to fund the buy-down of mobility fees and transit operations, and then to transportation capital or O&M needs. |

1 Pasco County, https://www.pascocountyfl.net/453/Penny-for-Pasco

2 Pasco County, Multimodal Tax Increment Ordinance

Memo (2011), https://www.pascocountyfl.net/DocumentCenter/View/295/Multi-Modal-Tax-Increment-Ordinance-Agenda-Memo?bidId=

3 Tindale-Oliver & Associates, Inc, Mobility 2045

Long Range Transportation Plan, Pasco County Metropolitan Planning Organization

(2020), https://www.pascocountyfl.net/3621/Mobility-2045-LRTP

The Interlaken Road Extension Project, located in the Odessa area of unincorporated Pasco County, was a $5.4 million roadway extension project subject of a joint participation agreement between Pasco County and Florida DOT. Improvements included a new two-lane roadway from Community Drive to Gunn Highway, a 5-foot sidewalk, an 8-foot multiuse path, and a traffic signal at Interlaken Road and Gunn Highway. Project planning and design started in fiscal 2011, and construction was completed in fiscal 2016.

Florida DOT, through the Florida Transportation Infrastructure Program (Section 339.08, Florida statutes) gave Pasco County $3.47 million for the study, design and permitting, right-of-way acquisition, and roadway construction. The project also receive funding the Second Local Option Gas Tax ($592,000). Multimodal Mobility Program fees provided $1.35 million for the Interlaken Road Project–25 percent of total funding.

The Pasco County Mobility Fee Ordinance requires updating of the mobility fee every three years to evaluate changes in growth rates, transportation revenue programs, costs of providing transportation facilities, and inflation or deflation. Updates must be approved by the Board of County Commissioner. Pasco County updated the mobility fees in 2020 and decided to continue to expand incentives for land uses that generate employment, support tourism, reduce trip length, and improve non-automobile transportation efficiency.

Pasco County's Mobility Fee Program has been successful since it was implemented in 2011. One of the most notable successes is that because the fee program was tailored to the county's land use goals of smart growth and enhancing the business environment, the county is able to satisfy the state's growth management objective of reducing sprawl.12 The coordination of the location of transportation improvements with the identification of growth areas and use of development incentives in designated areas have positively influenced the location of new growth. Positive outcomes include reduction in development pressure on the county's rural areas that are planned for conservation and preservation, and concentrated economic growth in urban and suburban areas where the majority of mobility improvements are planned.

When the Mobility Fee Program was adopted, Pasco County envisioned it to be a funding source and tool for growth management and economic development. The county has used this program with that vision in mind and has thus seen growth in areas where growth was planned. As of 2018, the county had attracted companies such as TRU Simulation + Training Incorporated, TouchPoint Medical Incorporated, Welbilt Incorporated, and Meopta U.S.A.13

Pasco County received the Future of the Region Award in 2012 from the Tampa Bay Regional Planning Council, which recognized the Mobility Fee Program as a model for other communities that struggle with transportation infrastructure needs and growth management.

(Source: Pasco County Government Website: Mobility Fees)

The Mobility Fee Program should generate over $627 million in revenue between 2025 and 2045, of which $579 million would go toward roadway projects, $30 million toward congestion management and technology projects, $16 million toward bicycle and pedestrian projects, and $3 million toward transit capital projects.14

The Mobility Fee Program is an efficient mechanism to fund new transportation infrastructure, reduce sprawl, support compact transportation-efficient development, and promote economic development in Pasco County.

Broad lessons learned from Pasco County's program include:

1 Tindale-Oliver & Associates, Inc., Pasco County Multi-modal Mobility Fee Study Final Report, Pasco County Government (2011). https://www.pascocountyfl.net/DocumentCenter/View/330/Mobility-Fee-Final-Report

2 U.S. Bureau of Labor Statistics, "Unemployment Rate in Pasco County, FL (2010)," https://fred.stlouisfed.org/series/FLPASC5URN

3 U.S. Census Bureau, Center for Economic Studies, LEHD, "OnTheMap: Inflow/Outflow Job Counts in 2010," https://onthemap.ces.census.gov/

4 1,000 Friends of Florida, Transportation Mobility Systems: An Alternative to Concurrency in Florida [Video] (2013), https://vimeo.com/79716807

5 Tindale-Oliver & Associates, Inc., Mobility 2045 Long Range Transportation Plan, Pasco County Metropolitan Planning Organization(2011), https://www.pascocountyfl.net/3621/Mobility-2045-LRTP

6 Linda Loomis Shelley and Karen Brodeen, "Home Rule Redux: The Community Plan Act of 2011," The Florida Bar (2011). https://www.floridabar.org/the-florida-bar-journal/home-rule-redux-the-community-planning-act-of-2011/

7 Pasco County, Land Development Code, Chapter 1300, Concurrency and Impact Fees, https://www.pascocountyfl.net/DocumentCenter/View/3944/LDC-Seciton-1301-Concurrency?bidId=

8 If boundaries are amended after an update of the mobility fee, the boundaries of the assessment districts will also be amended to be consistent with the update in the Comprehensive Plan before or concurrently with the next re-evaluation and update of the Mobility Fee Program.

9 Florida established the SIS in 2003 to focus transportation resources on facilities most significant for interregional, interstate, and international travel. U.S. Route 19, State Road 589, Interstate 75, and State Road 54 in Pasco County are part of the SIS.

10 Total impact cost is the demand for travel on the transportation system multiplied by the unit cost of providing the travel at a prescribed quality of service. Self credits are revenues generated by new development itself and allocated to transportation system capacity expansion. Incentives are fee reductions to encourage certain forms and locations of development (Tindale-Oliver & Associates, Inc., Final Report: Multi-modal Mobility Fee Study, Pasco County Government (2011)).

11 Pasco County Government, 2018 Mobility Fee Update (2019) Pasco County Government website.

12 According to Smart Growth America, there are 10 principles that are the foundation of a smart growth approach: (1) mixed land uses, (2) compact design, (3) diverse housing opportunities and choices, (4) walkable neighborhoods, (5) communities with a strong sense of place, (6) open space preservation, (7) development within existing neighborhoods, (8) diverse transportation options, (9) supportive environment for development of pedestrian-oriented/mixed-use projects, and (10) an equitable community engagement process.

13 D'Ann Lawrence White, It Just Got Cheaper to Build in Pasco County, Patch.com (2018), https://patch.com/florida/newportrichey/it-just-got-cheaper-build-pasco-county.

14 Tindale-Oliver & Associates, Inc., Mobility 2045 Long Range Transportation Plan, Pasco County Metropolitan Planning Organization (2020), https://www.pascocountyfl.net/3621/Mobility-2045-LRTP.