The Regional Transportation Commission of Washoe County administers the Regional Road Impact Fee Program to accommodate the demand for transportation improvements associated with new developments. Since 1995, the City of Reno, the City of Sparks, and Washoe County have joined the commission in constructing $300 million of transportation improvements using revenue generated from these fees. The fees go to transportation improvements detailed in capital improvement plans, which include capacity-improving projects to support new developments in the region.

| Project name | Regional Road Impact Fee Program |

|---|---|

| Location | Washoe County, Nevada |

| Built environment | Urban, suburban, rural |

| Type of Infrastructure | Capacity-improving transportation facilities, such as new roads and intersection improvements. |

| Value capture instrument | Impact fee |

| Amount of value capture | $300 million |

| Duration of value capture | 1995 to the present |

| Value capture innovation | Under the Regional Road Impact Fee Program, the Regional Transportation Commission of Washoe County uses revenue for transportation improvements in the two service areas. |

| Statutory changes | Enabled Under NRS 278B.255 |

Impact fees are paid by developers to fund improvements in public services, such as transportation, prompted by new developments. Traffic impact fees, such as the Regional Road Impact Fee Program, target transportation improvements in road networks, such as transit expansions and roadway enhancements. Different municipalities use different terms for impact fees, from mitigation fees in California to system development charges in Oregon to mobility fees in Florida.1 At least 29 states have legislation involving impact fees, including California, Colorado, Florida, Georgia, Massachusetts, Missouri, Ohio, Oregon, Pennsylvania, Texas, and Virginia.2

New developments often place large burdens on public services. Municipalities administer impact fees to cover the costs associated with new developments, such as increasing demand for capacity on road networks. In the Nevada Regional Road Impact Fee Program, impact fees are based on the size and purpose of a new development and on trip generation. Impact fees are often integrated into municipal zoning and permitting processes.

Municipalities require developers to pay impact fees before completing new developments. Impact fees go toward improvements that mitigate the direct impacts associated with new developments. Such improvements, including a wide range of public services such as transportation, are often detailed in master plans. Impact fees reduce the burden of property taxation on existing residents by shifting costs associated with new developments directly to the new developments.3

Despite being legally viable in 29 states, the feasibility and efficacy of impact fees remain disputed. Nonetheless, impact fees are straightforward value capture methods for municipalities to generate revenue for public services. Impact fees can also be administered to encourage equitable community development, because impact fees are paid by developers who receive windfalls from improvements to public services. Impact fees can also be charged to new developments in communities that already have the infrastructure capacity to accommodate such developments. Impact fees have been found to increase the supply of land available for new developments, because municipalities can fund the public services necessary to produce and support parcels for such development.4

But developers argue that impact fees are detrimental to community development because they deter new development by increasing direct costs to developers and tenants. Developers also argue that municipalities use impact fees to finance public services that should be financed by entire communities rather than just beneficiaries of new developments, such as law enforcement and education.5 Nonetheless, impact fees are robust value capture measures, generating revenue for public services. Impact fees benefit entire communities, including the beneficiaries of new developments bearing the direct costs, and provide funds to offset the marginal costs associated with new municipal infrastructure or public services required because of new developments.

Nevada Revised Statutes, Chapter 278B, Impact Fees for New Development, provides the foundation for impact fee programs to generate revenue for public services in Nevada.6 and the State Interlocal Cooperation Act enables the formation of the Regional Transportation Commission by the City of Reno, the City of Sparks, and Washoe County.

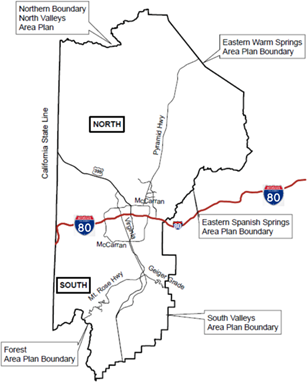

The Regional Road Impact Fee Program was implemented in 1995 and is administered by the RTC. The program is used to construct transportation improvements featured in the capital improvement plans in the North Service Area and the South Service Area (see Figure 1).

Figure 1. Regional Road Impact Fee Service Areas

Source: RTC. “Sixth Edition Regional Road Impact Fee Update.” www.renocitynv.iqm2.com/Citizens/FileOpen.aspx?Type=4&ID=19608&MeetingID=1863

Washoe County is the second-largest metropolitan area in Nevada and is expected to grow significantly in the next 20 years – according to RTC projections, by 120,000 residents and 117,000 employees –7 with most growth concentrated in Reno and Sparks.8 This growth corresponds with a rise in new developments in the region.

Since 1995, the RTC has dedicated more than $300 million to capacity improvements through the Regional Road Impact Fee Program, of which $204 million was provided by developers and $99 million was provided with revenue from impact fees. Improvements range from the Virginia Street BRT to the Pyramid-McCarran Intersection.

The Regional Road Impact Fee Program was designed to use one service area with three benefit districts: the Northwest Benefit District, the Northeast Benefit District, and the South Benefit District. In recent years, the RTC reconfigured the benefit districts to create a North Service Area and South Service Area, which are separated along Interstate 80.9 This was because Nevada Revised Statutes 278B.100 limited the incorporation of an entire city or county in a given service area. The RTC calculates rates based on parameters unique to the two service areas. The RTC administers and collects fees for transportation improvements in the same service area.

The Regional Road Impact Fee Program relies on capital improvement plans, which feature capacity-improving projects over 10-year time periods in the two service areas. Impact fees are administered and collected for transportation improvements in “street projects,” which are defined as arterial or collector roads designated by master plans, including the Regional Transportation Plan.10 In addition the program addresses safety and mobility concerns in these street projects that include improvements to transit and active transportation facilities.11 The Regional Road Impact Fee Program applies to most projects in the capital improvement plans, except limited-access highways and local streets.

The Regional Road Impact Fee Program is used to address funding gaps in transportation improvement projects. The funds necessary for a given regional transportation plan are determined as the difference between the costs of capacity-related projects and existing funding sources in the two service areas, as seen in “RRIF Share by Service Area” in Table 1.

| Description | North Service Area | South Service Area |

|---|---|---|

Capacity Related RTP |

$427,729,055 |

$301,352,036 |

Other Funding Sources |

($324,445,934) |

($228,584,992) |

RRIF Share by Service Area |

$103,283,121 |

$72,767,044 |

VMT Growth by Service Area |

322,046 |

232,352 |

Cost/VMT for RRIF Share |

$320.71 |

$313.18 |

Source: Sixth Edition Regional Road Impact Fee Update.” RTC. www.renocitynv.iqm2.com/Citizens/FileOpen.aspx?Type=4&ID=19608&MeetingID=1863.

These impact fees are also based on the expected travel growth as measured in vehicle miles traveled (VMT) in the two service areas. These growth patterns are determined by the Land Development Model set forth by the Truckee Meadows Planning Agency, which identifies the expected housing and employment capacity of vacant parcels in the service areas. The model allocates the expected housing and employment capacity and growth to traffic analysis zones, which are superimposed on the road network. In doing so, the RTC determines the expected VMT growth and ultimately, the needed capacity-improving projects, associated with such housing and employment change.

When the gap in funding is determined (RRIF Share by Service Area) it is divided by growth in VMT in the service area to determine the cost per additional VMT. This estimate is the base Regional Road Impact Fee (see Table 1). This baseline value is applied to various land use types (residential, commercial) in both service areas, because different land use types have different trip and VMT generation potential. Table 2 shows the VMT generation and impact fee by unit or square foot for each land use category. These impact fees then enable the RTC to reduce funding gaps in regional road capacity improvement projects to accommodate the increasing demand associated with new developments.

In accordance with Chapter 278B, the impact fee schedule is adjusted for inflation regularly. The most recent edition of the impact fee schedule was updated in December 2020 according to the index from 2015 to 2019, increasing rates by 2.38 percent over the five-year period.

| Land Use | Unit | North Service Area | South Service Area | ||

|---|---|---|---|---|---|

VMT |

Dollars |

VMT |

Dollars |

||

Residential |

|||||

Single-Family |

Dwelling |

15.03 |

$4,820.27 |

14.22 |

$4,453.42 |

Multi-Family |

Dwelling |

10.23 |

$3,280.86 |

9.68 |

$3,031.58 |

Industrial |

|||||

General Light Industrial |

1,000 GFA |

5.05 |

$1,619.59 |

4.78 |

$1,497.00 |

Manufacturing |

1,000 GFA |

4.00 |

$1,282.84 |

3.79 |

$1,186.95 |

Warehouse |

1,000 GFA |

1.77 |

$567.66 |

1.68 |

$526.14 |

Mini-Warehouse |

1,000 GFA |

1.54 |

$493.89 |

1.46 |

$457.24 |

Commercial and Retail |

|||||

Commercial and Retail |

1,000 GFA |

22.94 |

$7,357.09 |

21.71 |

$6,799.14 |

Eating and Drinking Places |

1,000 GFA |

22.94 |

$7,357.09 |

21.71 |

$6,799.14 |

Casino and Gaming |

1,000 GFA |

46.90 |

$15,041.30 |

44.37 |

$13,895.80 |

Office and Other Services |

|||||

Schools |

1,000 GFA |

13.12 |

$4,207.72 |

12.41 |

$3,886.56 |

Day Care |

1,000 GFA |

13.12 |

$4,207.72 |

12.41 |

$3,886.56 |

Lodging |

Room |

3.41 |

$1,093.62 |

3.23 |

$1,011.57 |

Hospital |

1,000 GFA |

10.92 |

$3,502.15 |

10.33 |

$3,235.15 |

Nursing Home |

1,000 GFA |

6.76 |

$2,168.00 |

6.40 |

$2,004.35 |

Medical Office |

1,000 GFA |

35.44 |

$11,365.96 |

33.53 |

$10,500.93 |

Office and Other Services |

1,000 GFA |

9.92 |

$3,181.44 |

9.39 |

$2,940.76 |

Regional Recreational Facility |

Acre |

2.32 |

$744.05 |

2.20 |

$689.00 |

Source: RTC, “Regional Road Impact Fee Schedule.” www.washoecounty.us/csd/engineering_capitalprojects/Traffic%20and%20Roads/Regional-Road-Impact-Fee-Schedule.pdf.

Because VMT growth varies across land use types (such as residential and industrial), the RTC identifies different impact fees for different developments, as seen in Table 2. This methodology ensures that capacity improvements are proportional to the expected VMT growth induced by new developments, rather than distributing the financial burden on developments of varying land use types. In doing so, the RTC ensures that transportation improvements also benefit the beneficiaries of new developments, by reducing congestion to commercial and retail spaces, and providing an incentive for development.<

Before 2015, developers directly constructing transportation improvements received credits toward future improvements, which could exceed the estimated fee required for the development. Developers could collect these credits to use on their future developments or sell them to other developers for use on other projects. The credits could be used on developments of varying land use types and would offset the costs and construction of future improvements.

After 2015, the RTC issued waivers in lieu of credits, which ensured that developers constructed transportation improvements within the limits of the impact fee value equivalent. Developers can no longer exceed the impact fee value of improvements and credit such value toward future improvements. These waivers are only for projects identified in capital improvement plans, with impact fees based directly on the identified costs.

This program has been essential to supplementing capacity improvement projects necessitated by recent developments in the region. Through this program, developers contribute to capacity-improving projects through a more equitable system between developers, beneficiaries, and community members, in comparison to previous exaction systems. These impact fees have reduced funding gaps in several transportation improvement projects, many of which would not have been completed as successfully otherwise.

This program has also carried regional importance in Nevada, as benefits are distributed on a regional scale, rather than a municipal scale. This program has strengthened the road network between Reno, Sparks, and other municipalities within Washoe County and has spurred discussion in other parts of the state, including Carson City.

This program has proven successful in benefiting both developers and community stakeholders, as developers are able to contribute to improvements that benefit both their beneficiaries and other community members. Furthermore, the use of waivers encourages developers to construct such improvements without disincentivizing development, as waivers ensure that the value of fees do not exceed the value of improvements. This program provides an excellent framework for municipalities seeking to generate necessary revenues for transportation improvements, while managing transportation impacts related to capacity and congestion.

Regional Transportation Commission

Dale Keller, P.E., Engineering Manager

dkeller@rtcwashoe.com

Blaine Petersen, P.E., Project Manager

bpetersen@rtcwashoe.com

Thanks to Dale Keller and Blaine Petersen for their time and cooperation.

1 FHWA, “Value Capture.” www.fhwa.dot.gov/ipd/value_capture/defined/value_cap_faq_impact_fees.aspx

2 FHWA, “Value Capture.”

3 APA, “Policy Guide on Impact Fees,” www.planning.org/policy/guides/adopted/impactfees.htm

4 FHWA, “Value Capture.”

5 APA, “Policy Guide on Impact Fees”

6 State of Nevada, www.leg.state.nv.us/nrs/nrs-278b.html

7 RTC, “Regional Road Impact Fee Program Presentation” https://www.washoecounty.us/csd/planning_and_development/board_commission/planning_commission/2017/files/2017-06-06/CIAC%20-%20RTC%20Presentation.pdf.

8 RTC, “Sixth Edition Regional Road Impact Fee Update.” www.renocitynv.iqm2.com/Citizens/FileOpen.aspx?Type=4&ID=19608&MeetingID=1863.

9 RTC, “Regional Road Impact Fee System Capital Improvements Plan Sixth Edition.” www.rtcwashoe.com/wp-content/uploads/2019/12/6th-Edition-RRIF-CIP.pdf.

10 RTC, “Regional Road Impact Fee System Capital Improvements Plan Sixth Edition.”

11 RTC, “Regional Road Impact Fee System Capital Improvements Plan Sixth Edition.”