The 202 South Mountain freeway is a 22-mile, 8-lane freeway that completes the Loop 202 and Loop 101 freeway system in the southwestern quadrant of the Phoenix metropolitan area. The largest single project in Arizona history, Loop 202 provides important connections and alleviates traffic congestion in downtown Phoenix. This project was enabled by Maricopa County’s half-cent retail sales tax that was reauthorized for 20 years in 2004.

Project name |

Loop 202 South Mountain Freeway |

|---|---|

Location |

Phoenix, AZ |

Built environment |

Urban/Suburban |

Type of infrastructure |

Highway |

Value capture instrument |

Sales Tax District |

Summary of value capture and infrastructure cost |

$702.4 million in sales tax revenue funded the Loop 202 Freeway, 38% of the total project cost |

Duration of value capture |

1985-2025 (reauthorized in 2004) |

Value capture innovation |

Proposition 400, a countywide half-cent retail sales tax authorized by the state legislature for 20 year provides funding for projects in Maricopa Association of Governments (MAG) Regional Transportation Plan. |

Notable outcomes |

A substantial source of local funding for transportation projects in the RTP in Maricopa County. |

Statutory and regulatory changes |

HB 2292 and HB 2456 enabled the local ballot initiative to ultimately pass the sales tax. |

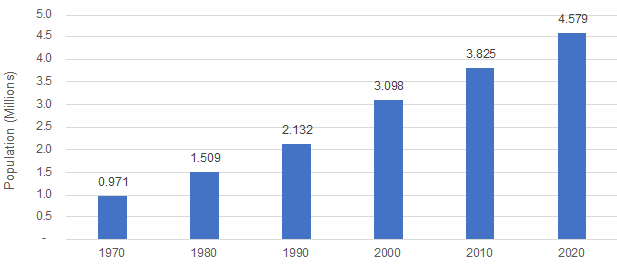

The population of Maricopa County, Arizona, has grown exponentially in the past 50 years. From 1970 to 1980, the number of residents grew 55%, from 971,230 to over 1.5 million. Figure 1 illustrates the rapid population growth in Maricopa County. By the early 1980s, the Maricopa County Association of Governments (MAG) recognized the need to expand the road network in the region to accommodate recent population growth and to prepare for anticipated future growth. To do so, regional transportation planners knew that they would need to supplement state and federal transportation funding with an additional revenue source.

Figure 1. Maricopa County Population, 1970–2020

Source: US Census Bureau via St. Louis Federal Reserve, https://fred.stlouisfed.org/series/AZMARI3POP.

In 1985, voters in Maricopa County, Arizona passed Proposition 300, a ballot initiative to impose a half-cent sales tax on all retail activities county-wide. Revenues from this sales tax are collected into the Regional Area Road Fund (RARF) and administered by the Arizona Department of Transportation for transportation projects in Maricopa County. The sales tax was slated to run for 20 years and fund mostly freeway expansion projects across the county.

With the half-cent sales tax set to expire in late 2005, Maricopa County voters were asked in 2004 to reauthorize this value capture program to continue to fund area transportation projects, with an additional focus on arterial roads and transit projects. Proposition 400 passed in November 2004, setting up another 20 years of expanded transportation funding for the county, from 2006 to 2026.

The Arizona State assembly passed enabling legislation prior to the public voting on the sales tax ballot initiative. House Bill 2292 was signed by Arizona’s governor in May 2003 and directed MAG to put forward a Regional Transportation Plan (RTP) that would be the basis for project selection and prioritization under the new funding scheme. In February 2004, House Bill 2456 passed, which approved of the RTP and set the stage for the subsequent ballot initiative to be put to the voters.1

The half-cent sales tax does differ slightly from a traditional sales tax district value capture technique in two ways. The main reason is that proposition 400 is a county wide tax and does not require a special taxing district to be formed to levy the tax because Arizona law does not allow for special taxing districts to be formed. Second, proposition 400 is a specific authorization for the countywide sales tax for a defined period of time and provides revenue only for the RTP. State legislation is very specific on how funds can be used, how funds are managed, and which agencies are allowed to use the funds.

At the municipal level, there are other taxes and special taxing districts that are allowed in Arizona, including negotiated exactions, but they do not allow for the formation of multijurisdictional districts and are primarily used for arterials within a municipality. Therefore, the half-cent sales tax remains an important funding technique for highway projects and other projects spanning across multiple jurisdictions.

The small sales tax collected across the county creates a significant revenue stream that may not have been possible through a property tax, which is not legally viable in Arizona, and may have been politically infeasible. This method solves timing and funding availability for major projects with long lead times. It also allows a significant stream of revenue to be collected in a dense populous region but could also be used to collect more modest amounts in rural areas.

Theoretically, a property tax could be considered more equitable, because property owners would have contributed a fair share of their property value’s increase, on the basis of the property’s relationship to the new transportation improvement. But the scale of the funding potential, the small burden on consumers, voter support, and existing collection mechanisms make the half-cent sales tax an effective transportation funding technique.

Proposition 400 in 2004 established a new funding split by transportation project type for revenue collected through the half-cent sales tax: 56.2% to freeways, 10.5% to arterial roads, and 33.3% to public transportation. Funds for both freeway and arterial road projects are collected into the RARF and administered by ADOT. The Public Transportation Fund (PTF) is handled separately by Valley Metro Regional Public Transit Authority.2 Table 1 shows the total historical excise revenue generated from fiscal 2006 through fiscal 2020.

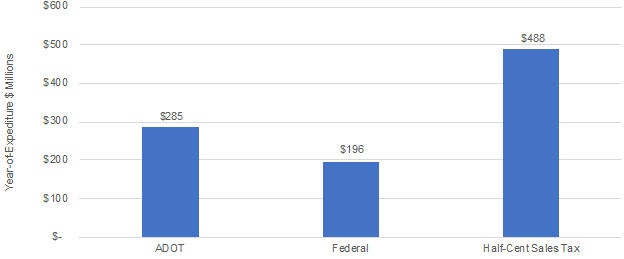

The MAG region’s transportation projects are funded by three main sources: ADOT, federal funds, and the half-cent sales tax (see Figure 2). In FY 2020, the half-cent sales tax accounted for 50% of the total transportation revenue for the region, which demonstrates the importance of this funding stream and how it can deliver large-scale projects needed for a growing region.

Fiscal Year |

RARF for Freeways (56.2%) |

RARF for Arterial Streets (10.5%) |

Public Transportation Fund (33.3%) |

Total |

|---|---|---|---|---|

2006 |

$86.3 |

$16.1 |

$51.1 |

$153.6 |

2007 |

$219.7 |

$41.1 |

$130.2 |

$391.0 |

2008 |

$213.2 |

$39.8 |

$126.3 |

$379.4 |

2009 |

$184.0 |

$34.4 |

$109.0 |

$327.4 |

2010 |

$167.7 |

$31.3 |

$99.4 |

$298.4 |

2011 |

$173.3 |

$32.4 |

$102.7 |

$308.4 |

2012 |

$182.1 |

$34.0 |

$107.9 |

$324.0 |

2013 |

$192.0 |

$35.9 |

$113.8 |

$341.7 |

2014 |

$205.5 |

$38.4 |

$121.8 |

$365.7 |

2015 |

$214.9 |

$40.1 |

$127.3 |

$382.3 |

2016 |

$221.5 |

$41.4 |

$131.3 |

$394.3 |

2017 |

$231.2 |

$43.2 |

$137.0 |

$411.3 |

2018 |

$245.0 |

$45.8 |

$145.2 |

$436.0 |

2019 |

$262.4 |

$49.0 |

$155.5 |

$466.9 |

2020 |

$275.1 |

$51.4 |

$163.0 |

$489.6 |

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa Association of Governments.

Figure 2. Total Transportation Funding in MAG Region by Source, Fiscal 2020

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa Association of Governments.

The legislative time limits (20 years) on the half-cent tax on retail and the need for reauthorization provide an opportunity for voter and legislative approval of future taxes and incentive for providing high-quality transportation projects for the region. Additionally, the revenue stream is stable and planned for, as forecasts of population and retail sales growth can be used to determine approximate future revenue, as shown in in Table 2.

|

Fiscal Year |

RARF Freeways (56.2%) |

RARF Arterial Streets (10.5%) |

Public Transportation Fund |

Total |

|---|---|---|---|---|

2021 |

$297.8 |

$55.6 |

$176.6 |

$529.8 |

2022 |

$313.3 |

$58.5 |

$185.6 |

$557.4 |

2023 |

$328.7 |

$61.4 |

$194.7 |

$584.8 |

2024 |

$345.4 |

$64.5 |

$204.6 |

$615.5 |

2025 |

$362.3 |

$67.7 |

$214.7 |

$644.6 |

2026 |

$222.4 |

$41.6 |

$131.8 |

$395.7 |

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa Association of Governments.

Projects must be identified in the MAG Regional Transportation Plan to be eligible for RARF funding. Table 3 provides the breakdown of the half-cent sales tax revenue allocation and the estimated revenue over the 20-year period by project type. If the sales tax is not renewed, future transportation funding for the region will be reduced significantly and fewer projects will be funded. With the loss of this funding and the reconstruction of I-17, limited funds would be available for other projects if the state resources for transportation funding remained the same.

Project Type |

Percentage of Revenue Allocated |

Estimated Revenue over 20 years (year-of-expenditure dollars in billions) |

|---|---|---|

RARF for highways |

56.2% |

$8.1 |

RARF for arterial roads |

10.5% |

$1.5 |

Transit |

33.3% |

$4.7 |

Total |

100.0% |

$14.3 |

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa County Association of Governments.

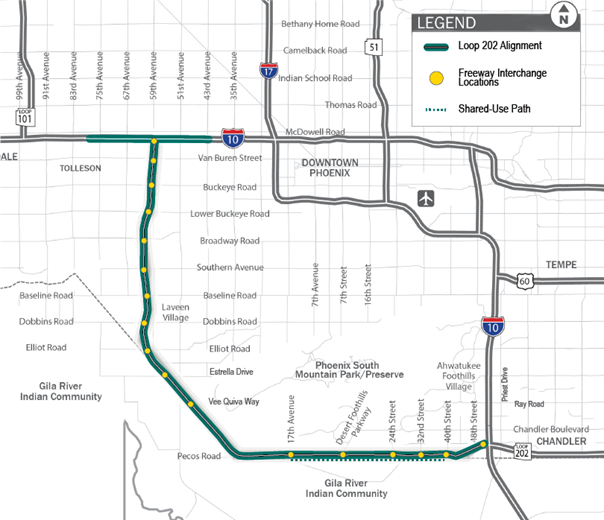

The completed South Mountain Freeway is a 22-mile stretch of 8-lane freeway in the southwest quadrant of the Phoenix metropolitan area. The largest single project in Arizona transportation history, it connects the western and southern portions of I-10 and completes the 101/202 highway loop around the city, alleviating traffic in downtown Phoenix. The South Mountain Freeway project included improvements along the western section of I-10 and a 6-mile shared-use path for cyclists and pedestrians. Figure 3 shows the scale of the 202 South Mountain Freeway alignment and connections to I-10.

Figure 3. South Mountain Freeway Project Area Map

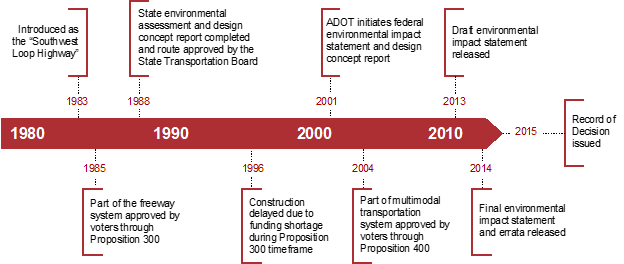

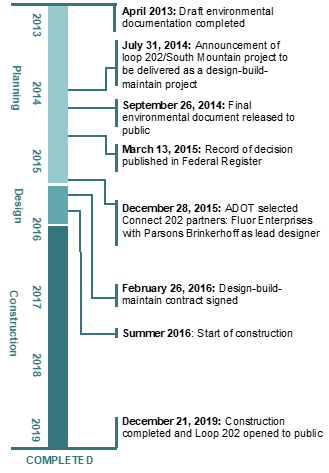

The Loop 202 South Mountain Freeway project involved many steps of project planning, design, and funding strategies. As with many mega-projects, a vision existed long before all the necessary approvals finally fell into place for construction to begin. Figure 4 shows critical developments leading to construction breaking ground in 2016.

Construction of the South Mountain Freeway was completed in 2020. The entire 22-mile segment of new highway, as well as the 6-mile mixed use pathway, are now open for travelers. Figure 5 is a timeline of the project’s permitting and regulatory compliance, construction, and eventual completion in 2019. The South Mountain Freeway project was the largest single transportation project in the history of the state of Arizona, providing critical connections to the Phoenix metropolitan area and alleviating downtown traffic. Considering the size of the project and project cost of $1.8 billion, a consistent and reliable transportation source of local funding was necessary to be used in unison with federal and state contributions. The half-cent sales tax for the county was crucial in that regard. This project’s financing and timeline, and other RTP projects would have been impacted if not for the half-cent sales tax.

Figure 4. Pre-construction timeline of the South Mountain Freeway Project

Source: AZDOT, https://azdot.gov/node/14739

Figure 5. South Mountain Freeway Project Timeline, Construction to Completion

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa County Association of Governments.

Most funding for the South Mountain Freeway Project came from the RARF sales tax revenue (62%), with federal and state funds supplementing (27% and 11% respectively) (see Table 4).

|

Funding Source |

Amount ($ million) |

Share of Funding |

|---|---|---|

Federal funds |

$493.80 |

27% |

State Highway User Revenue Fund |

$205.90 |

11% |

Regional Area Road Fund (1/2 cent sales tax) |

$702.40 |

38% |

Regional Area Road Fund Bonds |

$435.30 |

24% |

Total |

$1,837.40 |

100% |

Source: 2020 Annual Report, Implementation Status of Proposition 400. Maricopa County Association of Governments.

ADOT and Maricopa County engaged Connect 202 Partners to design, build, and maintain the South Mountain Freeway. This joint venture, made up of Fluor Enterprises, Granite Construction, and Ames Construction, is responsible for the upkeep of the freeway for 20 years. This partnership was an innovative contracting method that consolidated the design, build, and long-term maintenance into a single PPP, but the contracting activities were separate from the initial financing of the freeway. According to ADOT, this saved 3 years and $100 million.3

Proposition 400 was based on Proposition 300 and passed with 58% of the vote in November 2004.4 It had support from the mayors of many of the municipalities in Maricopa County and included a process to provide information to the public and garner support. Political opposition centered on proposed light rail projects (which would use only 15% of the revenue raised by the reauthorization of the sales tax) and was funded entirely by one individual seeking office, indicating a lack of grassroots support. A 2009 study found that Proposition 400 was supported by the business community, advocacy organizations, and the public by a large margin.5, 6 In 1985 Proposition 300 passed by a two-to-one margin.

Other regions with large transportation funding gaps caused by a deteriorating system or rapid population and economic growth may find success using similar approaches to funding transportation improvements. Although research has shown the symbiotic relationship between job growth and transportation network expansion, Maricopa County made this relationship direct through the half-cent sales tax funding of transportation projects. When the current authorization ends, the tax will come up for renewal, and voters will have to decide whether to continue the program for delivering large road projects such as South Mountain Freeway and I-17, smaller but critical projects, and key transit investments.

Thanks to Arminta Syed and Ted Brown of the Maricopa Association of Governments for their time and cooperation.

1 NCHRP 20-24(62). “Maricopa County Sales Tax Referendum Case Study,” September 2009.

2 Maricopa Association of Governments. “2020 Annual Report, Implementation Status of Proposition 400,” December 2020.

3 Arizona Department of Transportation, https://azdot.gov/node/14650

4 AZ Central, “Officials: Extension Needed for Transportation Tax,” December 2014.

5 https://www.eastvalleytribune.com/news/voters-say-yes-to-proposition-400/article_a7214e53-b21c-5079-ba8a-a77a9bd96360.html

6 NCHRP 20-24(62). “Maricopa County Sales Tax Referendum Case Study,” September 2009.