The Camino Real Regional Mobility Authority (CRRMA) oversees two transportation reinvestment zones (TRZs) in El Paso, Texas. Since 2009, the CRRMA has used this value capture technique to fill a $70 million funding gap, enabling over $1 billion of transportation improvements. CRRMA has used TRZ funds to fill funding gaps for a range of transportation infrastructure, including the Americas Interchange Improvement Project, which serves a significant international trade gateway between the United States and Mexico.

| Project name | El Paso Transportation Reinvestment Zones |

|---|---|

| Location | El Paso, Texas |

| Built environment | Urban, Suburban |

| Value capture instrument | Transportation Reinvestment Zones (TRZ) |

| Amount of value capture | $70 Million |

| Duration of value capture | 2009 to Present |

| Value capture innovation | An innovation on traditional tax increment financing (TIF) that can be used for a broader range of transportation projects. |

| Statutory changes | Enabled Under SB 1266 |

TRZs are a type of transportation increment financing (TIF) that allows municipalities to collect tax increment revenues from new private development to finance transportation improvements that meet the needs of those developments.1 Since then, TRZs have been implemented throughout Texas, largely in Bexar, McAllen, Nueces, and San Patricio counties, as well as Utah .2 In Texas, TRZs have contributed to significant road and bridge improvements, such as the Americas Interchange in El Paso.

Although TRZs and traditional TIFs could be viewed as almost interchangeable value capture techniques, enabling legislation for TRZs in Texas allows for a broader range of transportation modes and project types and does not require creation of a governing board. TRZs have been praised for their flexibility and feasibility across transportation modes, particularly public transportation. Furthermore, the enabling legislation supports cross-jurisdictional implementation by allowing jurisdictions to create adjacent TRZs to fund transportation infrastructure that serves both areas.

Figure 1. TRZ Creation Process Overview

Source: Texas Department of Transportation, “Transportation Reinvestment Zones.” https://www.txdot.gov/government/programs/trz.html.

Despite the slight differences noted above, TRZsare implemented similarly to any other type of TIF in Texas. First, the sponsoring agency identifies infrastructure needs and establishes the geographic boundaries of the zone where investments will be made and from which the increment will be collected. If multiple municipalities want to implement TRZs for a transportation improvement across municipal boundaries, they may coordinate and implement adjacent TRZs. The proposed zone must be identified as underdeveloped, and the planned infrastructure investments must: (1) promote public safety; (2) facilitate the improvement, development, or redevelopment of property; (3) facilitate the movement of traffic; and (4) enhance the local entity’s ability to sponsor transportation projects.

The sponsoring jurisdiction holds a public hearing to receive comments on the proposed TRZ, then passes an ordinance to create it. At this point, the authority conducts a feasibility study to determine the conditions and baseline property values in the zone.3 At the end of this process, the authority identifies the appropriate financing mechanism for transportation improvements in the TRZ.4

TRZs fund infrastructure projects in three ways: Using existing revenues (“pay-as-you-go”), financing through bond issue, and financing through loans and credits from the State Infrastructure Bank (SIB). Under the pay-as-you-go approach, the authority uses existing revenues. This method avoids incurring interest but may lengthen project delivery time because funds are only available as the increment is created, which can be slow, particularly in the initial years.5 Instead, the authority may choose to issue bonds to obtain the full amount of capital needed for projects, to be repaid with interest from future TRZ revenues. This approach shortens the project time due to the upfront availability of capital but involves some risk. The third approach, depending on project type, 6 is to borrow from the SIB. As with a bond issue, this can shorten project time due to the initial availability of capital. Borrowed funds accrue interest, but at a lower rate than would be available on the private capital market which is often cost-prohibitive for TRZ projects.7 TRZ revenues are often used along with other sources, such as fuel tax revenues and toll revenues, to supplement needed or planned transportation improvements.

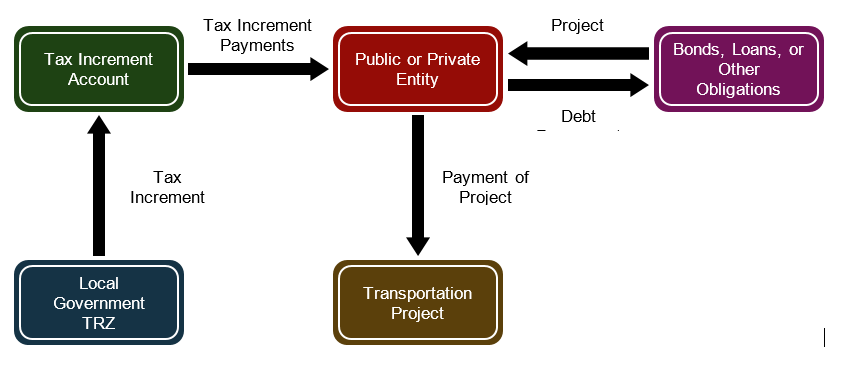

Figure 2 illustrates the movement of funds from the TRZ, as tax increment revenue and borrowed funds pass through the transportation agency, to complete the transportation project and repay debt obligations.

Figure 2.Transportation Reinvestment Zone Finances

Source: FHWA, Center for Innovative Finance, “Transportation Reinvestment Zones.”

www.fhwa.dot.gov/ipd/value_capture/capacity_building/webinar_series/2021/aldrete_20210714.pdf

El Paso was the first municipality to implement TRZs in Texas. Two TRZs are administered by the CRRMA, which has been involved in various roles to construct over $1 billion of transportation improvements detailed in the 2008 Comprehensive Mobility Plan. The projects in the Comprehensive Mobility Plan were prioritized by the Texas DOT, the El Paso Metropolitan Planning Organization, City of El Paso, and the CRRMA.

The Texas legislature enacted SB 1266 in 2007, which enabled the implementation of TRZs across the state. Since 2007, the Texas legislature has also passed several amendments to SB 1266, largely to expand the program across the state. The Texas legislature introduced three adjacent bills in 2013, including SB 971, which enabled Port Authority Transportation Reinvestment Zones, and SB 1747 and HB 2300, which enabled Energy Transportation Reinvestment Zones.8

The CRRMA is a regional mobility authority that holds various roles in transportation improvements in El Paso, from design to finance to operation and maintenance. As a regional mobility authority, the CRRMA is a partnering political subdivision with the Texas DOT and therefore lacks taxing authority. Thus, the transportation improvements detailed in the 2008 Comprehensive Mobility Plan receive funding from a sponsoring agency, rather than from the regional mobility authority directly.

The CRRMA also operates beyond the geographic boundaries of El Paso, given its location between New Mexico and Mexico. The CRRMA is authorized to adminsiter interstate and international transportation improvements in El Paso, New Mexico, and Mexico.9

The City of El Paso has implemented three TRZs since 2009, with the first TRZ rescinded due to compliance concerns regarding its geographic boundaries . The first TRZ included government-operated parcels, such as Fort Bliss and Franklin State Park, extending the TRZ into these parcels was not allowed by the statue.

This first TRZ was then redrawn and separated into two contiguous zones for compliance, and remains in use today. Although the CRRMA cannot directly fund projects in these zones, the CRRMA seeks funding sources and issues bonds that are then paid by the revenues captured in the TRZs. The revenue captured from the two TRZs are used to help finance over $70 million in finance gaps of $1 billion of transportation improvements in the 2008 Comprehensive Mobility Plan.10 These TRZs have helped fund significant infrastructure improvements in El Paso, including the Americas Interchange, Transmountain Lane Widening, and Zaragoza Direct Connectors.

The Americas Interchange Improvement Project is a major project successfully funded using the TRZ. El Paso is the largest metropolitan area on the United States and Mexico border, largely serving the trade, transportation, and large manufacturing sectors in the region. El Paso is also one of the most connected metropolitan areas in the United States, as the unique location allows El Paso to be accessible by markets in the United States and Mexico.11 Given the role and scale of manufacturing activity in and around El Paso, investments in transportation infrastructure bolster the industrial base, improve freight connections, and expand trade.

The Americas Interchange is located at the center of the manufacturing industry in El Paso, serving as a directional interchange for interstate and international travel between I-10 and Loop 375 east of downtown El Paso, Texas. Given this key location, the Americas Interchange also serves travel to four international ports of entry and a major state corridor and thus, contributes to the greater economic development of the region.

The America’s Interchange improvement project is separated into three phases of construction between I-10 and Loop 375, totaling eight connectors. Phase 1, completed in 2013, consisted of three connectors. The design and construction of Phase I cost $141 million, with funding sources outlined in Table 1. TRZ revenues have filled a significant funding gap that may have otherwise led the CRRMA to delay or reassess the project.

|

Funding Type |

Funding Total |

Share of Funding |

|---|---|---|

American Recovery and Reinvestment Act |

$96 M |

68% |

Coordinated Border Infrastructure |

$15 M |

11% |

State Infrastructure Bank Loan |

$20 M |

21% |

Total |

$141 M |

100% |

Source: “Project Profile: Americas Interchange Project.” FHWA.

Figure 1. Design Concept

Source: FHWA, Center for Innovative Finance Support, “Project Profile: Americas Interchange Project.” www.fhwa.dot.gov/ipd/project_profiles/tx_americas_interchange.aspx.

The Americas Interchange is one of the most significant examples of TRZs in use, using over $30 million from the State Infrastructure Bank (SIB) so far to be repaid by TRZ revenue.12 TRZ revenues are pledged to the CRRMA as the authority overseeing this project, who then repays the SIB loan. Furthermore, the City of El Paso backs these revenues, to reduce financial risk in the event that the TRZ revenues were insufficient.13 So far, however, revenue collection appears to exceed the initial forecasts of revenue generation. Thus, the revenues may very well repay both the loan and fund other project obligations in the future.14 The Americas Interchange is currently on Phase 3 of the initial project, which will include a direct connector from the westbound I-10 to northbound Loop 375. Given the flexibility and accessibility of TRZ funds, the CRRMA will likely also choose to continue including such revenues in the funding sources for this upcoming phase.

TRZs are often used due to their ease of implementation and wide support from stakeholders. This support comes from the increased value to private development based on the new or enhanced transportation infrastructure.

A disadvantage of TRZ, as with traditional TIFs, is that it is contingent on real estate prices and the pace of property value growth. Revenue growth can be slow in the initial years as private development responds to the new and planned infrastructure. Revenue projections should account for this possibility, particularly if bonds are issued that are to be repaid with TRZ revenue.15 If bonds and agreements are not structured properly, these low tax increment revenues may fall short of debt service needs and disrupt a transportation improvement.16 Revenues are also vulnerable to downturns in the real estate market. Municipalities may consider alternative or supplemental revenue sources to draw from if TRZ revenue projections are not realized. In some cases, another value capture technique, such as a special assessment district or sales tax district, could be used as a “back-stop” revenue source to meet debt repayment requirements.

Long-term changes in the real estate market can also affect a TRZ, creating uncertainty surrounding the expected tax increment revenues. Agencies often reduce uncertainty by identifying transportation improvements in capital improvement plans.17 Explicitly listing projects that the municipality intends to fund through a TRZ helps developers identify areas of future transportation investments and respond by choosing development sites likely to benefit from increased accessibility or improved connectivity.

TRZs are an excellent technique to complete funding gaps in large transportation improvements, as seen in the Americas Interchange in El Paso. The Americas Interchange is a large three-phased project, requiring extensive, consistent funding sources. The CRRMA was able to use funds from two TRZs for the initial phases, allowing the project to move forward without concern for funding gaps in between other sources. The use of revenues from TRZs, as seen in the Americas Interchange, has been a productive financing mechanism for El Paso and beyond.

As demonstrated through the America’s Interchange project, TRZs are not additional taxes on taxpayers or developers, which make it a rather palatable technique across stakeholders. This technique is an effective way to capture underutilized value in El Paso for transportation investments and continues to inspire other municipalities to implement similar techniques.

Camino Real Regional Mobility Authority

Raymond L. Telles | Executive Director

tellesrl@crrma.org

Thanks to Raymond L. Telles of CRRMA for his time and cooperation.

1 FHWA, Center for Innovative Finance Support, “Transportation Reinvestment Zones and Tax Increment Reinvestment Zones.” www.fhwa.dot.gov/ipd/value_capture/defined/value_cap_faq_tr_tir_zones.aspx.

2 NACTO, “Capturing the Value of Transportation to Finance Transportation: Case Studies from Texas. www.nacto.org/wp-content/uploads/2013/10/AldreteRafael_DesigningCitiesPHX.pdf.

3 FHWA, Center for Innovative Finance Support, “Transportation Reinvestment Zones.” www.fhwa.dot.gov/ipd/fact_sheets/value_cap_transportation_reinvestment_zones.aspx.

4 Ibid.

5 FHWA, Center for Innovative Finance Support, “Transportation Reinvestment Zones and Tax Increment Reinvestment Zones.” www.fhwa.dot.gov/ipd/value_capture/defined/value_cap_faq_tr_tir_zones.aspx.

6 Federal requirements limit SIB funds to Federal Aid Highways (Title 23 U.S.C. 602). As a result, local roadway, active transportation, and Complete Streets projects cannot be funded through SIB loans.

7 FHWA, Center for Innovative Finance Support, “Transportation Reinvestment Zones and Tax Increment Reinvestment Zones.” www.fhwa.dot.gov/ipd/value_capture/defined/value_cap_faq_tr_tir_zones.aspx.

8 TAMU TTI, “Transportation Reinvestment Zones: Texas Legislative History and Implementation. www.static.tti.tamu.edu/tti.tamu.edu/documents/PRC-15-36-F.pdf.

9 CRRMA, “Transportation Reinvestment Zones in El Paso, Texas.” www.fhwa.dot.gov/ipd/pdfs/value_capture/illinois_peer_exchange/crrma_trz_presentation.pdf.

10 NACTO, “Capturing the Value of Transportation to Finance Transportation: Case Studies from Texas.” www.nacto.org/wp-content/uploads/2013/10/AldreteRafael_DesigningCitiesPHX.pdf.

11 City of El Paso, “Economic Development.” https://www.elpasotexas.gov/economic-development.

12 FHWA, Center for Innovative Finance Support, “Project Profile: Americas Interchange Project.” www.fhwa.dot.gov/ipd/project_profiles/tx_americas_interchange.aspx.

13 Ibid.

14 Ibid.

15 FHWA, Center for Innovative Finance Support, “Transportation Reinvestment Zones and Tax Increment Reinvestment Zones.” www.fhwa.dot.gov/ipd/value_capture/defined/value_cap_faq_tr_tir_zones.aspx.

16 Ibid.

17 Ibid.