A private developer purchased a property to build a rail-served industrial park with specialized grain-handling facilities, supporting regional economic development goals, but the site lacked the necessary highway access. A partnership between a county government and a private developer allowed the county to receive a low-interest loan through the State DOT infrastructure loan program for local governments to upgrade a gravel road to a concrete industrial access road. The loan is repaid by the tax increment from a TIF district, with risk to the county mitigated by a guarantee from the private developer to meet debt service obligations in years when the increase in property values does not generate sufficient tax increment to meet loan payments.

| Project name | Napa Junction Rail Industrial Park TIF |

|---|---|

| Location | Yankton County, South Dakota |

| Built environment | Rural |

| Economically distressed or opportunity zone | Opportunity Zone (contiguous, not distressed) |

| Type of infrastructure | Industrial service road |

| Total infrastructure cost | $7.725 million ($6 million for the industrial access road plus associated infrastructure, including an electrical substation) |

| Value capture instrument | Tax Increment Financing |

| Summary of funding plan | Yankton County obtained a $6 million, low interest infrastructure loan from the South Dakota DOT with a private property owner/developer as the guarantor; Yankton County established a TIF District for $7.25 million, using the tax increment to make debt service payments (with any shortfall paid by the developer in years when increment was insufficient to cover debt service) |

| Amount of value capture | $7.25 million |

| Duration of value capture | 2015-2035 (or until TIF District project amount is reached, whichever comes first) |

| Value capture innovation | The guarantor agreement between the private developer and county government shifted risk to the developer while allowing access to a low interest loan fund for government infrastructure |

| Notable outcomes | The economic success of this project motivated the SDDOT to formally add economic development impacts as factor considered for awarding loans through the State Highway Fund Loan for Local Governments program |

| Statutory/regulatory changes | None needed |

In 2010, the Dakota Plains Ag Center, LLC purchased a 192-acre parcel of land in Yankton County, South Dakota, with plans to establish a rail industrial park with a $40 million grain terminal. The property is served by the state-owned Dakota Southern Railway and Burlington Northern Santa Fe north-south rail lines and is approximately 3.3 miles from South Dakota Highway 50. However, the roadways between the state highway and the project site were gravel, unable to accommodate heavy truck traffic, and not federal-aid eligible.1

Yankton County is largely rural, with a 2019 population of approximately 22,720 concentrated in the City of Yankton (2019 population of 14,570),2 approximately 8 miles southeast of the Dakota Plains Ag Center site. Sioux Falls is approximately 80 miles northeast, Omaha, NE, is approximately 170 miles southeast, Pierre is 230 miles west, and Rapid City is 350 miles west.

According to the 2017 US Census of agriculture, farms make up approximately 97% of the county’s land area (329,607 acres), and about 70% of croplands produce corn, soybeans, forage, and wheat–products that rely on rail transportation for distribution. Yankton County farms produced over $105.8 million in sales of grains and related products in 2017, more than 65% of the county’s total agricultural sales and nearly a 50% increase over the county’s grain sales in 2007.3 All this illustrates that the rail industrial park serves an important and growing industry in the region and provides substantial benefits.

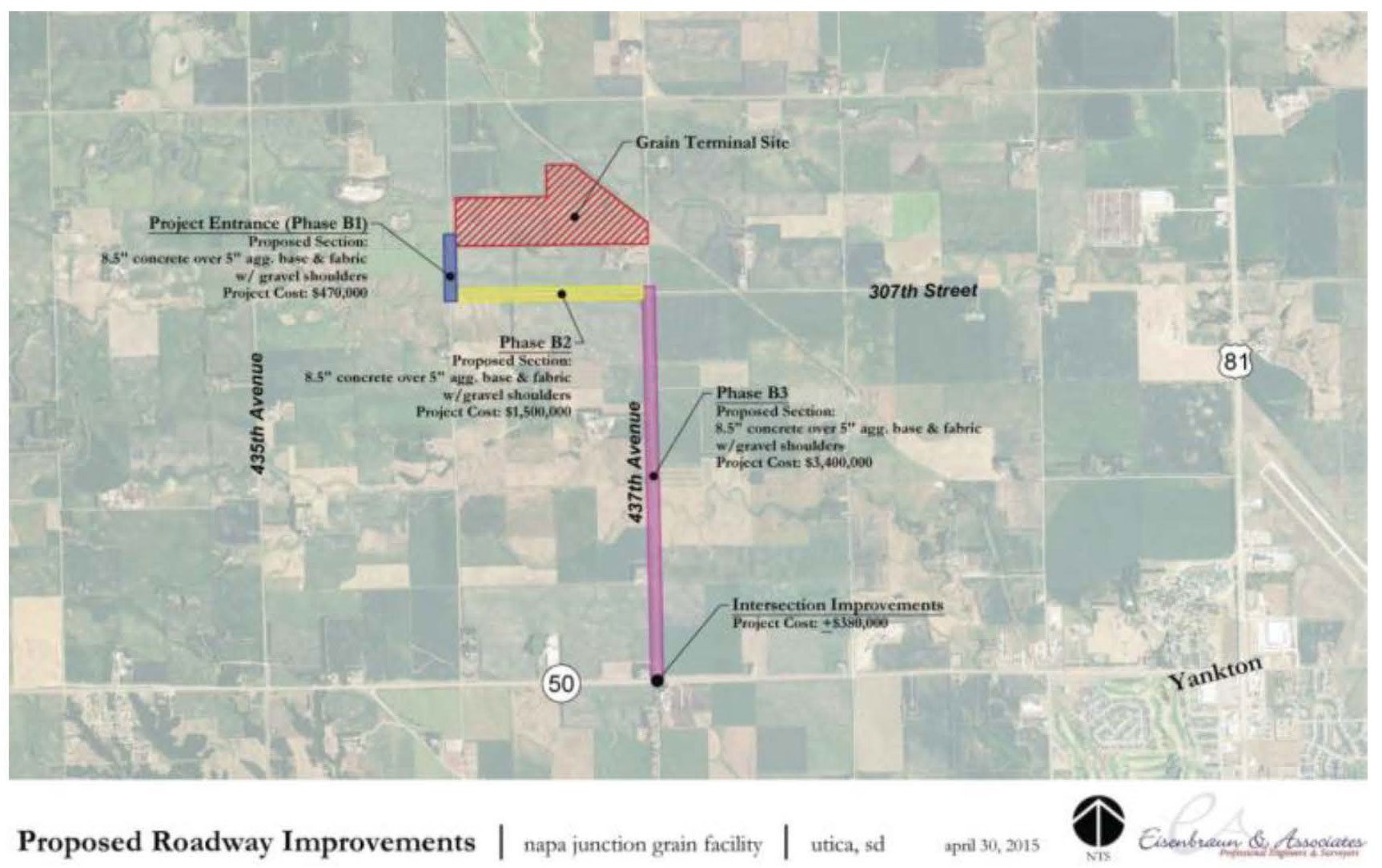

To accommodate the anticipated volume of heavy truck traffic, a concrete industrial service road was proposed for County Road 210/Deer Boulevard/437th Avenue (Between SD Highway 50 and 307th Street), 307th Street (between 436th and 437th Avenues), and a portion of 436th Avenue (from 307th Street to the rail-industrial park entrance). The 4 miles of improvements consist of 3.2 miles of Portland concrete and 0.8 miles of gravel with a total cost of $6.2 million (in 2015 $).4 Figure 1 illustrates the location and extent of the service road and rail industrial park (labeled “Grain Terminal Site”). Figure 2 shows available development sites made accessible by the service road.

To provide a sense of scale of the total project cost relative to county funds: The county’s total general fund budget for 2021 is $12.3 million and the county’s 2021 road and bridge fund is $4.9 million. Typically, highway projects in South Dakota are funded through the State Infrastructure Bank. However, in this case, the roadways needing improvement are not state roadways and not on the federal-aid highway system and were therefore ineligible for funds through state or federal grant or loan programs.

The property owner was motivated to construct the Dakota Plains Ag Center facility in this location because it had several advantages over other potential locations, yet the cost of private financing for the road was prohibitive. In addition to the purchase of the land ($3.975 million), site prep and engineering and rail facilities ($4.9 million), and costs of construction for the facility, the developer also assumed significant infrastructure costs associated with the establishment of an electrical substation and water infrastructure to serve the site and surrounding areas ($800,000).5

Figure 1. Napa Junction Service Road Location

Source: Tax Increment Project Plan (June 2015).

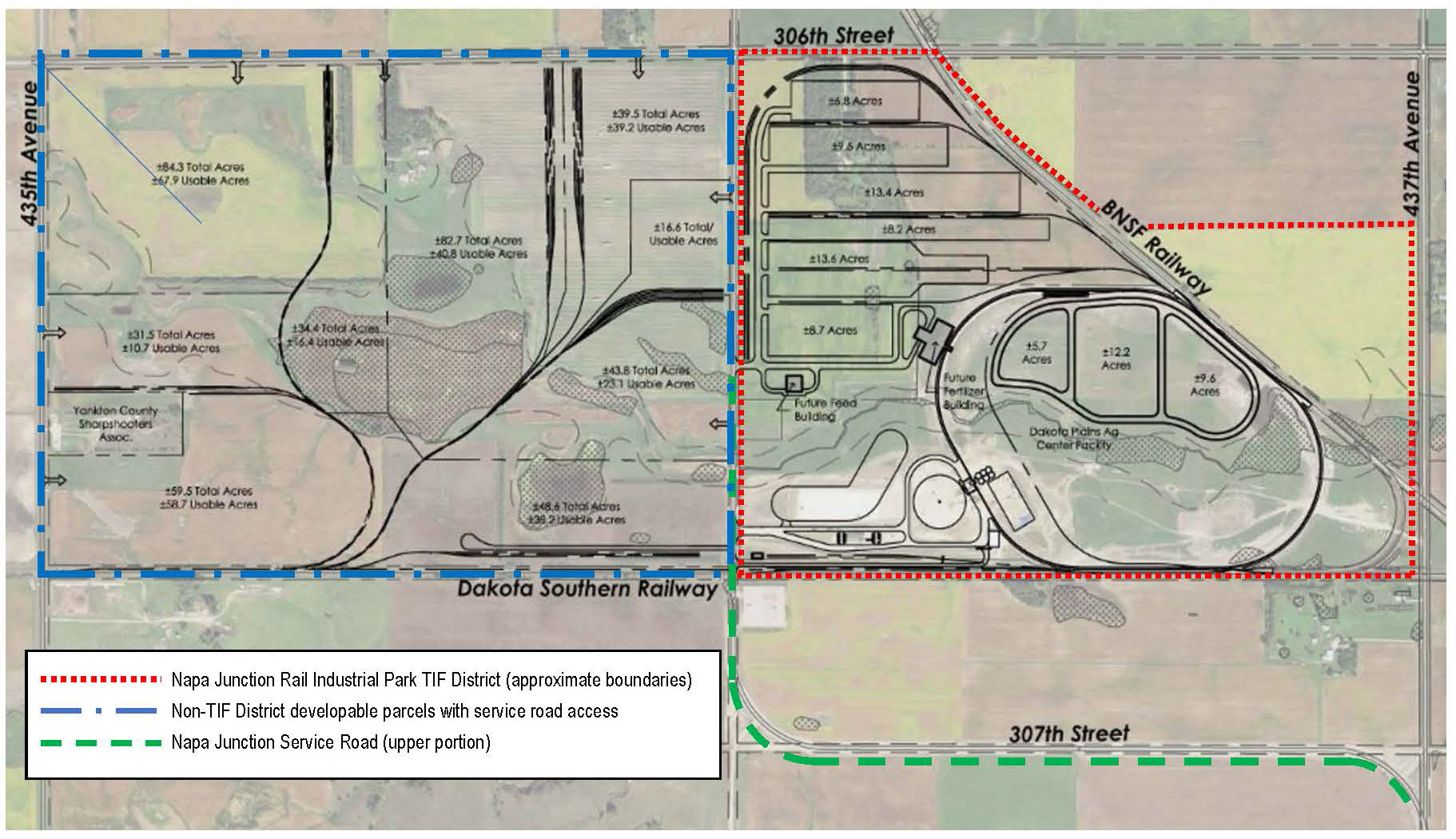

Figure 2. Napa Junction Rail Industrial Park Detail (map not to scale)

Source: Industrial park map courtesy of Yankton Area Progressive Growth, roadway and approximate TIF District/Non-TIF District available parcel boundaries added by EBP.

The industrial service road provides significant benefit to the property owner by enabling development of a rail industrial park that generates far more economic activity than it did as an agricultural parcel, greatly increasing the value of that property. The roadway will also increase property values along the improved roadway for all parcels that gain access to the state highway. However, the service road also serves a public purpose in that it provides a connection from a state highway to a rail line that serves a key industry in the surrounding community. Benefits and beneficiaries are summarized in Table 1.

| Beneficiary | Value Created | Private Benefit | Public Benefit |

|---|---|---|---|

| Rail Industrial Park property owner (“developer”) | Ability to develop, sell, and lease parcels | Increased property value |

|

| Ability to operate Dakota Ag Center facility |

|

|

|

| Other property owners | Improved access from property to state highway (and rail facility) | Increased property value (potential) | Property taxes |

| Farmers using rail industrial park | Improved access between state highway and rail facility with grain handling capacity |

|

|

| State DOT and local road owners* | Less wear and tear on state highways and local roads because of freight transfer to rail | Less road revenue required because of improved access to rail transportation | Lower road wear costs because of reduced truck traffic on state and local roads |

*Public road owner benefits were not captured but assume increased truck traffic would have used roads rather than rail to ship to distant markets.

Dakota Plains Ag Center, represented by a financial consultant experienced with tax increment financing,6 proposed that Yankton County obtain a State Highway Fund Loan for Local Governments from South Dakota Department of Transportation (these funds are available only to government entities, not private companies), repaid by tax revenues through creation of a TIF district. Table 2 presents a summary of key loan details.7

| Loan Details | Terms |

|---|---|

| Principal* | $6 million |

| Annual payments | $334,350 for 10 years, with a balloon payment of $3,128,895 (plus any accrued interest after the final payment has been made) in year 10 |

| Loan term | 10 years |

| Interest | 1% |

| Borrower | Yankton County |

| Guarantor | Dakota Plains Ag. Center, LLC |

| Collateral | (1) TIF revenue and (2) a guarantee from Dakota Plains |

| Start year | 2015 |

*The TIF district full anticipated project cost is $7,725,000 because it included additional infrastructure.

Source: Yankton County Audit Report for the Two Years Ended December 31, 2017.

To comply with the terms of the loan, Dakota Plains signed a developer’s agreement with Yankton County establishing Yankton County as a conduit borrower. Under South Dakota law, this constitutes a bond that obligates the County to act as a conduit of future tax increment revenues. The county is to pass on increment revenue in excess of loan payments to Dakota Plains, while Dakota Plains is the guarantor of the debt and liable in the event tax increment revenue is insufficient to cover debt service. Loan payments are made by the county and tracked in the county budget under the Napa Junction TIF Debt Service Fund line item. In years where TIF revenue falls short of the loan payment amount, Dakota Plains must pay the County the amount of the shortfall.

Although TIFs were not new to South Dakota or Yankton County, this was the first time a TIF was used to support a State Highway Fund Loan for infrastructure development.

This arrangement allowed Dakota Plains to access a lower interest rate than it could obtain as a private company and enabled the county to apply a portion of the property tax levy generated by the investment to debt service. The rail industrial park supports the county’s economic development with jobs and economic activity, and at the end of the TIF period, will generate increased property tax revenues for the county and school budgets.

TIF revenues are applied to construction cost only. The roads are owned and maintained by Yankton County.

South Dakota Codified Law Chapter 11-9 requires that the planning commission must adopt a project plan for the district and submit it to the governing body. The governing body must approve the project plan to establish the district. For the Napa Junction Industrial Park TIF District, Dakota Plains Ag Center retained a consultant with experience creating TIF districts in South Dakota to work with county officials to produce the project plan (Tax Incremental District, Yankton County, Tax Increment Project Plan, June 2015).

The TIF district boundaries originally proposed by Dakota Plains encompassed four parcels (the largest of which has since been subdivided into five parcels). By acres, about half of the land was owned by Dakota Plains (some of which has since been sold), a third was owned by another private party, and the balance was under other ownership. These boundaries were accepted by the County Commission.

The commission also accepted Dakota Plains’ proposed duration of 20 years,8 or until the TIF project cost of $7,725,000 is reached (whichever comes first). This is the maximum duration allowed under South Dakota law and is designed to allow ample time for property values to increase enough for total tax increment generated to meet the TIF project cost amount. If the amount of tax increment generated reaches the TIF project cost before 20 years, the TIF is dissolved early. Conversely, the TIF district will dissolve in year 20 regardless of whether total increment has reached total project cost. Under the agreement between the county and the developer, the developer assumed this risk.

Table 3 presents TIF-eligible9 project cost estimates from the project plan. The developer was responsible for nearly $8.9 million in other costs that were not covered by the TIF. The total amount of TIF requested, $7.7 million, is greater than the $6 million loan, because it includes funds for supporting electrical and water infrastructure necessary for the industrial park, but not eligible for SDDOT highway loan funds. After the loan is repaid in year 10, the tax increment accrues to the developer for the remainder of the TIF period, up to the amount of the TIF project cost.

| TIF Eligible Project Costs | Estimated Cost | TIF Requested |

|---|---|---|

| Land acquisition | $3,975,000 | - |

| Road improvement | $5,750,000 | $5,750,000 |

| Road construction contingency (20%) | $1,150,000 | $1,150,000 |

| Site preparation and grading | $800,000 | - |

| Rail terminal construction | $3,600,000 | - |

| Engineering | $500,000 | - |

| Electrical infrastructure | $450,000 | $450,000 |

| Water infrastructure | $350,000 | $350,000 |

| Yankton County administrative fee | $25,000 | $25,000 |

| Total project cost | $16,600,000 | $7,725,000 |

Source: Tax Increment Project Plan (June 2015).

Though the Napa Junction Rail Industrial Park and access road project met the eligibility criteria for creation of a TIF, it did not initially have the support of the Yankton County Commission. However, a new slate of Commissioners was elected in 2014, and the TIF district was approved in 2015. South Dakota Governor Dennis Daugaard and Secretary of Transportation Darin Bergquist were supportive of the project.

The South Dakota legislature created statutory authority for TIF in 1978 with SB 17. The original enabling legislation was available only to municipali¬ties, required a finding that not less than 25% of property in the TIF district was blighted, and limited TIF revenues to funding only “costs of public works or improvements.” The enabling legislation has been expanded and refined over the years, with counties gaining authorization to use TIF in 1991 (SB 1174), and elimination of the blight requirement in 2011 (SB 90), as well as changes to the way TIF revenue streams were treated in 1996, 2004, 2016, and 2018.

TIF is used widely in South Dakota. The 2020 Tax Increment Financing Annual Report produced by the State Department of Revenue states that there have been 369 TIF districts in the state since 1978, with 193 active. The state laws governing creation of TIF districts are laid out in South Dakota Codified Law Chapter 11-9.

TIF was not unknown in Yankton County at the time the Dakota Plains Ag Center and the county were trying to determine a way to pay for the road. The City of Yankton had established the Fox Run Tax Increment District in 1989 to complete a large, high-profile mixed-use project recognized for its role in revital¬izing that area of the city. And in 2015, the city was in the process of establishing the Westbrook Estates TIF to fund an affordable housing development. Neigh¬boring counties had also used TIF. Turner County used a TIF in 2006 to support development of an ethanol plant, Lincoln County used TIF in 2011 to support development of an industrial park and again in 2016 to support new affordable housing, Hutchinson County used TIF in 2012 for a project in Parkston, and Douglas County established a TIF in 2014 to support public infrastructure.

The Napa Junction Rail Park TIF is the first time in South Dakota that a TIF was used to borrow from the State DOT’s Highway Fund Loan for Local Governments.

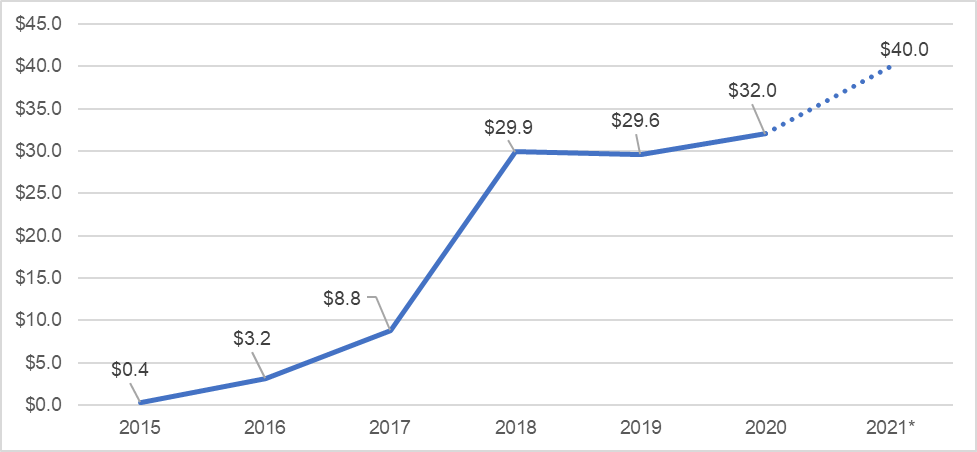

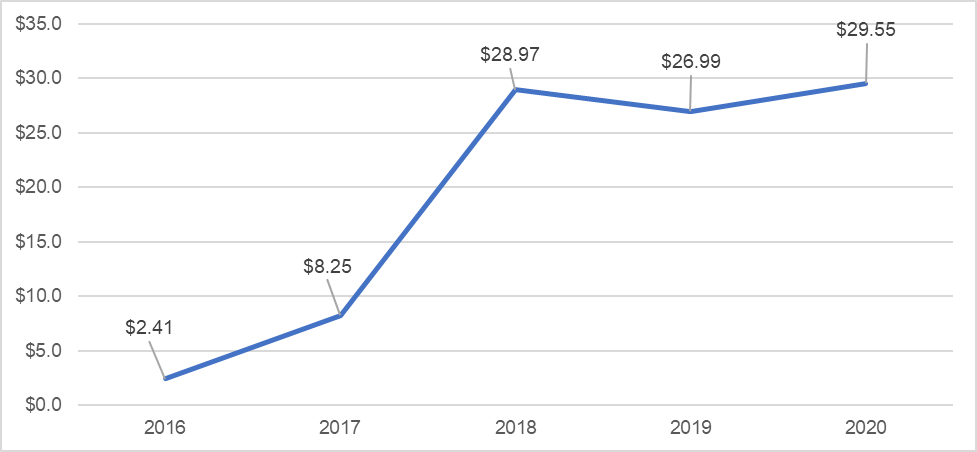

Before creation of the TIF, the 192-acre area was assessed at agricultural tax rates. The 2015 property tax bill for TIF district parcels, based on 2014 (pre-investment) property values, was just $3,400 on an assessed value of approximately $348,100.10 Figure 3 presents TIF district actual assessed value for 2015-2020 (from property tax records) and an estimate of assessed value for 2021 based on the completion of the Dakota Protein facility currently under construction.

By 2016, the assessed value increased by more than 750%, to $3.2 million, generating property taxes of $49,600. Another significant jump occurred in 2018 when the value increased to nearly $30 million, generating property taxes of nearly $438,000. Executive Director of Yankton Area Progressive Growth (the regional economic development organization), Nancy Wenande, stated that in 2018, Dakota Plains Ag Center, LLC property–just one of nine parcels that comprise the TIF district–had the highest property value in Yankton County.11 For reference, the total countywide property tax base is approximately $2 billion.12 (Assessed value decreased slightly in 2019 due to a countywide decrease in property values.)

Figure 3. Napa Junction Rail Park TIF District Assessed Value, 2015-2021 (2020 million $)

Note: Estimated value based on 2020 value and the estimated value of the completed Dakota Protein facility.

Source: Yankton County Equalization Department property tax records (via https://beacon.schneidercorp.com/),

Dakota Plains Ag Center, U.S. BLS CPI-U, calculations by EBP.

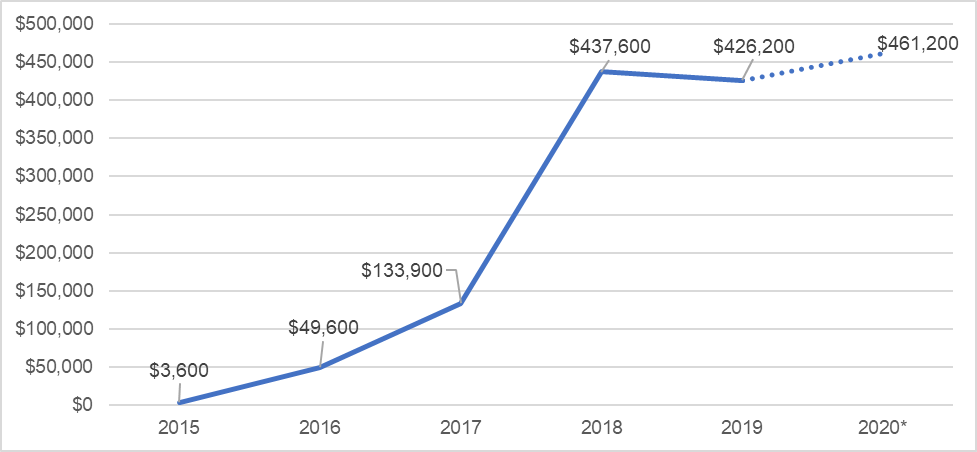

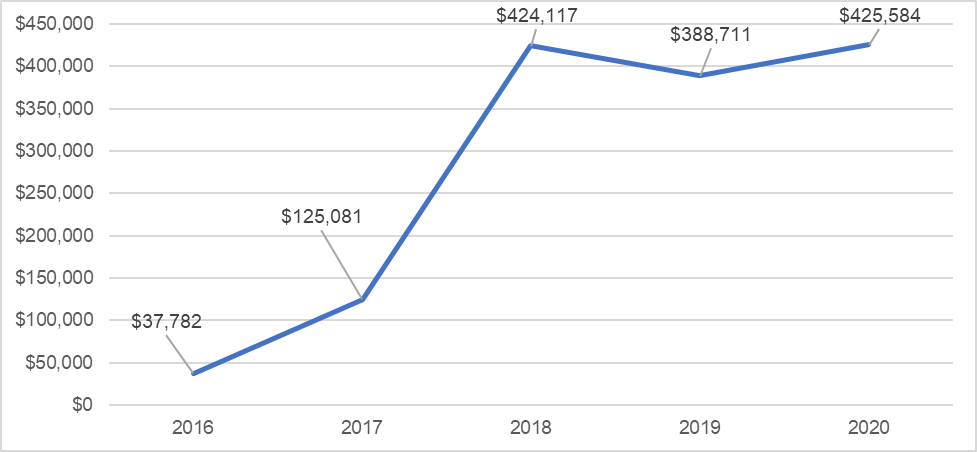

Figure 4 presents property taxes levied on TIF district properties 2015-2020 (2020 is an estimate based on applying the 2019 mill rate to the 2020 assessed value reported in tax records). Yankton County collects property taxes in arrears which means that property tax due on the 2020 assessed value will be collected in 2021. The amount shown for 2020 is an estimate made by applying the previous year’s mill rate to the actual 2020 assessed value from county property tax records.

Under the terms of the TIF district, property owners continue to pay property tax based on the property’s full assessed value (shown in Figure 4). The creation of the TIF district changes how the tax collected is allocated. The amount that would have been collected on the equalized base value of the district established when the district was created is allocated to the county General Fund as usual. The amount of tax collected on the “increment”, the amount of property value over the established equalized base value of the district is allocated to the County’s Napa Junction TIF Debt Service Fund.

Figure 4. Napa Junction Rail Park TIF District Property Tax, 2015-2020* (2020 $)

*2020 property tax estimated based on 2020 assessed value and implied mill rate from 2019.

Source: Yankton County Equalization Department property tax records (https://beacon.schneidercorp.com/), Dakota Plains Ag Center, U.S. BLS CPI-U, calculations by EBP.

The TIF district’s assessed value relative to equalized base value–the total current increment–is certified annually by the South Dakota Department of Revenue and reported in its Tax Increment Financing Annual Report (first published in 2016). Figure 5 presents the increment in value, while Figure 6 presents an estimate of tax collected based on the increment based on prevailing property tax rates in each year. The cumulative amount of property tax collected from the increment from the TIF’s inception through 2020 is estimated at $1.4 million. The increment created was insufficient to cover debt service until 2018. Yankton County billed Dakota Plains Ag. Center LLC for shortfalls in 2016 and 2017.

Figure 5. Napa Junction TIF District Property Value Increment, 2016-2020 (million 2020 $)

Source: South Dakota Tax Increment Financing Annual Reports 2016-2018, 2019 & 2020 Yankton County TIF

worksheet for SDDOR, current dollar values adjusted to 2020 dollars using U.S. BLS CPI-U, calculations by EBP.

Figure 6. Napa Junction TIF District Estimated Tax Revenue from Increment, 2016-2020 (million 2020 $)

Note: Tax revenues estimated using actual increment values and implied property tax mill rates calculated based on actual valuations and property tax assessments from Yankton County property tax records for TIF district parcels.

Source: South Dakota Tax Increment Financing Annual Reports 2016-2018 & 2020, 2019 Yankton County TIF worksheet for SDDOR, Yankton County Equalization Department property tax records (via https://beacon.schneidercorp.com/), current dollar values adjusted to 2020 dollars using U.S. BLS CPI-U, calculations by EBP.

Table 4 presents a comparison of estimated TIF revenues relative to annual debt service payments. As the table illustrates, tax revenue from the increment surpassed debt service beginning in 2018. As the final line of the table shows, the total amount of increment generated through 2021 is not yet sufficient to cover the total amount of debt service to be paid through 2021. Rough calculations suggest that the amount of TIF revenue will not yet exceed debt service by Year 10 when the final loan payment is to be made, but the increment will exceed the total amount paid to debt service by year 14 (2029), and total TIF expenses (including the electrical and water infrastructure costs) will be recouped around Year 16 (2031).13 This would dissolve the TIF district about 4 years ahead of schedule. These estimates are conservative in that they are based only on the existing development (including Dakota Protein, which is under construction). It is reasonable to expect the rail industrial park to attract additional development in the intermediate term, which would accelerate the recouping of expenses estimated here.

| Surplus or Deficit | 2016 | 2017 | 2018 | 2019 | 2020 | 2021* |

|---|---|---|---|---|---|---|

| Estimated tax revenue from increment (current $) | $35,800 | $120,400 | $416,300 | $387,200 | $425,600 | $540,800 |

| Debt service (current $) | ($334,400) | ($334,400) | ($334,400) | ($334,400) | ($334,400) | ($334,400) |

| Annual surplus/deficit (current $) | ($298,600) | ($213,900) | $81,900 | $52,800 | $91,200 | $206,500 |

| Annual surplus/deficit (2020 $) | ($310,047) | ($222,130) | $83,451 | $53,039 | $91,234 | $206,474 |

| Cumulative surplus or deficit ($2020 $) | ($310,000) | ($532,200) | ($448,700) | ($395,700) | ($304,500) | ($98,000) |

*2021 increment estimated based on 2020 value plus the anticipated value of the completed Dakota Protein facility and the 2020 implied property tax mill rate (see note below).

Note: Tax revenues estimated using actual increment values and implied property tax mill rates calculated based on actual valuations and property tax assessments from Yankton County property tax records for TIF district parcels.

Source: South Dakota Tax Increment Financing Annual Reports 2016-2018, 2019, and 2020 Yankton County TIF worksheet for SDDOR, Yankton County Equalization Department property tax records (via https://beacon.schneidercorp.com/), current dollar values adjusted to 2020 dollars using U.S. BLS CPI-U, calculations by EBP.

As a result of completion of the industrial service road and related infrastructure, Dakota Plains Ag. Center, LLC was able to develop a $40 million high-speed grain receiving facility and industrial park with sites available for development. The Dakota Plains Ag. Center Napa Facility, as it is called, employs 10 full time equivalent (FTE) employees with above average wages and an annual payroll of over $1 million.

In addition to the Dakota Plain Ag. Center’s own facility, two other businesses have purchased parcels in the industrial park:

Dakota Plains Ag., which owns the rail industrial park, also does the marketing and sales. The property is advertised with the South Dakota Governor’s Office of Economic Development site selection service (https://sdgoed.com/tools-resources/find-properties/) as well as Yankton Area Yankton Area Progressive Growth, the local economic development agency. Parcels are advertised at $30,000 per acre, which represents a premium over other industrial properties listed in Yankton County, which are advertised for between $15,000 and $20,000 per acre. The availability of accessible local feed supply is inducing further agricultural development.

Though the Napa Junction Census tract is not low income, the rail industrial park became a Qualified Opportunity Zone as contiguous to a low-income census tract in 2016. The opportunity zone designation confers preferential tax treatment for investment in businesses located there.14

The industrial park creates few demands on county services, so it does not add appreciable costs to the county budget. As in many communities, schools represent the largest budget line item. This project does not add school children to the school system and does not increase the region’s population. As a result, fiscal impacts are limited to the cost of maintaining the road, which is assumed by the County, with a negligible impact on other County services such as public safety (law enforcement), county courts, protective and emergency services, and general public administration. Because of this, diverting property tax increment created by the project does not divert critical resources from the County budget needed to meet the fiscal demands of the new development. Instead, when the TIF expires, the industrial park provides a significant new source of property tax revenue to the county budget.

As a result of the successful use of TIF to support a State Highway Funds for Local Governments loan, the South Dakota DOT revised guidelines for the loan program to include economic development potential as a factor for determining whether to award a loan.15 The revised guidelines, which went into effect in 2019, have already contributed to approval of a TIF-supported loan in Lyman County for an industrial service road providing access to a grain shuttle-loading facility constructed using TIGER Grant funds.

This value-capture implementation was successful for the following reasons:

Creation of this TIF district was relatively uncomplicated for the following reasons:

Although the use of TIFs in South Dakota to support this type of development is relatively common, the innovation was the agreement between the county and the developer that the county would be the borrower and the developer would be the guarantor in a public-private partnership. This eliminated the risk to the county if property values did not produce enough increment to cover debt service while providing the developer with a lower cost of capital than could be obtained in the private market, as well as the ability to apply a portion of property tax payments to debt service during a period of high construction costs and increased property taxes but before commensurate increases in revenues from operations would occur.

As shown in Table 1, the project creates three sources of value that could be captured, as well as other public benefits of reducing truck freight on state and local roads. Through this TIF, the project captures only the value that accrues to the industrial park’s property owner through the significant increase in that property’s value. It does not capture value that accrues to other landholders whose properties have also gained improved access to the state highway (as well as the rail facility), nor the value of lowered transportation costs that accrues to farmers using the roadway and rail facility to bring their product to market. This limited approach was appropriate for the scale of the project itself and the agricultural nature of the surrounding area. A value capture approach for a more expansive project in an urbanized area (i.e., affecting more property owners, businesses, and residents benefiting from lower transportation costs) might seek to use additional techniques to capture value from these other beneficiaries as well, if the value of the project can be communicated to these other stakeholders to gain their support (or avoid opposition).

1 According to the Yankton County Transportation Master Plan, half of the approximately 500 miles of roadways the Yankton County Highway Department is responsible for are unpaved or gravel.

2 U.S. Census Bureau, American Community Survey (ACS), DP05, 5-year estimate (2019).

4 The actual road construction cost of $6.2 million exceeded the estimated cost of $5.75 million but was well below the $6.9 million total budgeted for construction plus 20% construction contingency.

5 Tax Increment Project Plan for Yankton County TIF 1 (June 2015).

6 Toby Morris of Dougherty & Company (Dougherty & Company is now Colliers International).

7 Yankton County 2016-2017 Audit Report.

8 20 years is the maximum duration permitted under SDCL Ch. 11-9.

9 TIF-eligible costs are governed by South Dakota Codified Law (SDCL) §11-9-13.

10 Yankton County Equalization Department property tax records (via https://beacon.schneidercorp.com/).

11 “Napa Junction Community Investment”, Yankton Area Progressive Growth (https://www.yankton.net/opinion/editorials/article_be08589c-cd00-11e8-9dd7-efc11787022a.html )

12 Yankton County Equalization Department website (http://www.co.yankton.sd.us/custom/equalization).

13 Assumes existing property tax rates and valuations, including an estimated value of $8 million for the Dakota Protein facility currently under development but does not include an estimate of additional development beyond that.

14 Only 5% of a state›s Opportunity Zones can be outside low-income communities (“Non-LIC Contiguous”).

15 Administrative Rules of South Dakota Department of Transportation Article 70:14 State Highway Fund Loans for Local Governments Section 70:14:01:04 Factors for award.