The Silver Line/Dulles Metrorail project highlights the use of a special tax district to pay for a significant portion of a major transit project. The project also involved significant support and cooperation from the local business community. 1

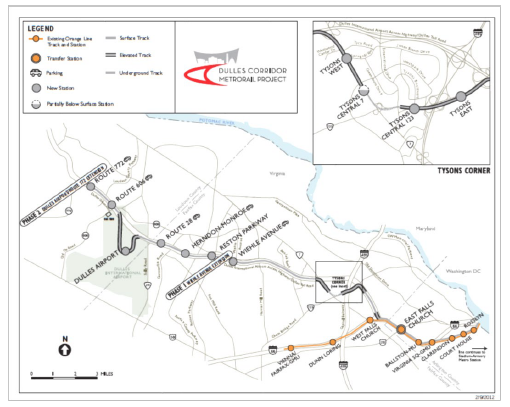

The Dulles Metrorail Corridor Project, also known as the Silver Line, is a 23-mile extension of the Washington, DC, region's Metro system. The project is being designed and built in two phases by the Metropolitan Washington Airports Authority (MWAA). Phase 1 consists of 11.7 miles of rail and five stations, connecting some of the DC region's largest employment centers to downtown Washington, DC. Phase 2 will add 11.4 miles of rail and six stations, including a station at Dulles International Airport. Now operational since July 2014, Phase 1 has been transferred to the Washington Metropolitan Area Transit Authority. That phase is now known as the Silver Line, a designation that will also apply to Phase 2. Figure 1 shows a map of the project.

In total, the project will increase the size of the Metro system by over 20 percent. Value capture sources have funded approximately one-fifth of the project. Overall, the two phases of the project, totaling $5.7 billion, are being funded with a combination of tolls, commercial tax districts, and Federal and State grants, as shown in Table 1.

| Source of Capital | Phase 1 | Phase 2 | Total Budget | Project Budget (%) | TIFIA1 Loan |

|---|---|---|---|---|---|

| Federal Grant | $900 | N/A | $900* | 15.8% | N/A |

| Commonwealth of Virginia | $252 | $323 | $575* | 10.1% | N/A |

| Fairfax County | $400 | $515 | $915 | 16.1%** | $403 |

| Loudoun County | N/A | $273 | $273 | 4.8%** | $195 |

| MWAA (Aviation Funds) | N/A | $233 | $233 | 4.1%** | N/A |

| MWAA (Dulles Toll Road) | $1,354 | $1,434 | $2,788 | 49.0%*** | $1,277 |

| Total Sources of Funds | $2,906 | $2,778 | $5,684 | 100.0% | $1,876 (33% of total) |

1 Transportation Infrastructure Finance and Innovation Act

*Fixed amount, **Fixed percentage of total cost, ***Residual

Local funding responsibility was allocated as follows:

This case focuses on the contribution from Fairfax County, particularly the first of its two transportation improvement districts (TIDs), the Phase 1 TID, which provided most of the project's value capture funding. The Phase 1 TID set the precedent for the Phase 2 TID and the Loudoun tax district.

Fairfax County's 16.1 percent share of the project is estimated to be approximately $915 million (the amount will be known once Phase 2 is complete in 2019). Fairfax County is expected to contribute the following:

Dulles Metrorail stakeholders initiated a variety of planning changes following the Phase 1 TID formation. In general, these changes were made to allow denser, urban-like developments around the Dulles Metrorail stations within the Phase 1 and Phase 2 TIDs. Many of these changes were expected to benefit some of the landowners since, with greater density, their property would become more valuable.

In 2010, Fairfax County adopted the Comprehensive Plan for Tysons Corner. Concurrently, Fairfax County adopted a zoning ordinance amendment that established a new district called the Planned Tysons Corner Urban District. These included several transportation initiatives, including redesign of the street grid to make it more urban, reengineering of major intersections, and implementation of a bike share program. 5

Fairfax County also made planning changes under a comprehensive plan amendment that affected the three Metrorail stations that were part of the Phase 2 TID. It adopted a new plan for street grids and bike lanes and new overpass planning. 6

Furthermore, in 2011 Fairfax County, in collaboration with developers, created a new non-profit called Tysons Partnership that sought to move forward a comprehensive approach to redevelopment that included marketing and branding, transportation, urban design/planning, public facilities and community amenities, and finance. 7

Securing the funding for the Dulles Rail Corridor was a pre-requisite for enacting the Comprehensive Plan for Tysons. Since the adoption of this plan, 15 major redevelopment proposals have been approved or are pending approval within Tysons. These projects are primarily located within a quarter of a mile of a Metrorail station and represent 61 million square feet of development. 8

The additional $0.19 Phase 1 TID tax has increased the base tax rate for property owners in the area by 22 percent, not including other tax costs, such as for stormwater, leaf collection, and water, that are assessed in certain parts of Fairfax County. In theory, this could have been a competitive disadvantage, but developer representatives believe that competing locations throughout the Washington, DC, region have similar all-in tax burdens. Furthermore, the tremendous development at Tysons and in other parts of the Dulles Metrorail Corridor in the last 5 years suggests that the tax rates have not been an obstacle. 9 Table 2 gives an overview of this timeline.

| Year | Project Stage |

|---|---|

| 1964 | The Federal Aviation Administration recommends reservation of median of Dulles International Airport Access Highway for future transit line. |

| 1985 | Dulles Access Rapid Transit sponsors study for transit line to Dulles International Airport, raising funds through assessments. |

| 1988 | Virginia General Assembly permits creation of special taxing districts for transportation for landowners along Route 28. |

| 2002 | The Federal Transit Administration announces that, due to funding limitations, project cannot be funded as a single project. |

| 2003 | City of Herndon turns down participation in special tax district out of concern as to whether its businesses would support a project that benefits Tysons area competitors while Phase 2 project would be delayed. |

| 2003 | Landowners submit Phase 1 TID petition. |

| 2004 | Fairfax County establishes Phase 1 TID. |

| 2009 | Fairfax County establishes Phase 2 TID. |

| 2010 | Fairfax County adopts Tysons Plan. |

| 2010 | MWAA issues $343 million of Dulles Toll Road bonds. |

| 2011 | Fairfax County issues $206 million Phase 1 TID bonds. |

| 2012 | Fairfax County issues $42 million Phase 1 TID bonds. |

| 2013 | Loudoun County creates Metro Service Districts. |

| 2014 | Washington Metropolitan Area Transit Authority opens Phase 1 Line for passenger service. |

| 2014 | Fairfax County and Loudoun County close TIFIA loans, in part supported by Fairfax County Phase 2 TID and Loudoun County Metro Service Districts. |

| 2019 | Phase 2 completion (expected). |

Legal Approach: Phase 1 TID

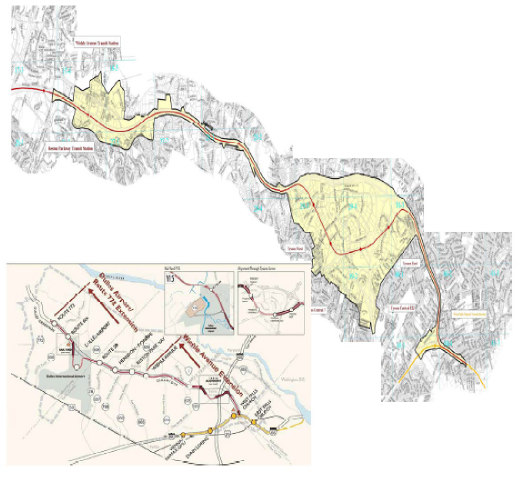

Fairfax County had an obligation to fund 16.1 percent of the $5.7 billion project, or $400 million for Phase 1 and $515 million for Phase 2. 14 The county established a special tax district on commercial and industrial properties in 2004 to fund its portion of the Phase 1 TID. The Phase 1 TID consisted of most of the Tysons Corner Urban Center and an area around the Phase 1 stations, as shown in Figure 2.

TIDs were authorized by the Commonwealth of Virginia. Commercial and industrial property within a TID can be taxed to raise funds for transportation improvements within its boundaries. A TID can be created upon the petition of the owners of at least 51 percent of the real property located within the proposed district that is zoned or used for commercial or industrial purposes, as measured by land area or assessed value. In a TID, most multifamily rental properties are also considered to be for "commercial purposes," and thus count toward land area and assessed value and are taxed. However, no other residential properties are taxed. The properties that signed the petition for the Phase 1 TID constituted more than 64 percent of such property as measured by assessed value. 15

The Phase 1 TID allows a tax level of up to $0.40 per $100 of assessed fair market value, but the Fairfax Board of Supervisors cannot adopt a plan of finance that would require a tax greater than $0.29 per $100 of assessed fair market value. 16 The most recent tax rate is $0.19 per $100 of assessed value. 17

The Phase 1 TID financing does not rely on the credit of either Fairfax County or the Commonwealth of Virginia and is therefore truly "non-recourse," 18 unlike the Route 28 financing nearby as discussed in the Virginia Route 28 case study.

The Dulles Corridor is a key portion of the Washington, DC, region and contributes heavily to its economic activity. The Dulles Corridor includes Tysons Corner, with approximately 37 million square feet of office, commercial, and retail space and five Fortune 5000 company headquarters, and the Reston-Herndon area, a fast-growing commercial district, among other key properties on the way to Dulles Airport. 19

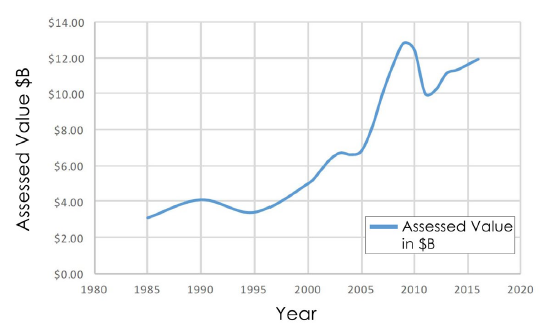

The DC region has benefited from the growth of the Federal Government and ancillary businesses, including aerospace, information technology, and telecommunications. As Figure 3 shows, the assessed value of the taxable commercial and industrial properties in the Phase 1 TID essentially doubled from 2001 to 2010 from $5.0 billion to $12.4 billion and grew at a compounded annual growth rate of 4.6 percent between 1985 and 2016, despite enduring several major real estate market downturns. This also included the impact of Federal Government budget cuts that reduced jobs at some major government contractors in defense and other sectors, some of which are located on the Dulles Corridor. 20

Furthermore, projections show that over the next 25 years, the population in the Dulles Corridor's Tysons Corner area is expected to grow by 45 percent, and the number of jobs in the area is projected to grow by 63 percent. 21

As shown in Figure 3 , the taxable property value in the Phase 1 TID has grown steadily from 2011 onwards, reflecting strong asset valuations in spite of a slight decrease in the tax rate from $0.22 in 2012 to $0.19 in 2016. 22

Due to the Phase 1 TID's robust revenues, its bonds were rated AA, Aa1, and AA by Fitch, Moody's, and Standard & Poor's, respectively. 23

The planning and organization that went into the Dulles Metrorail is complex, goes back decades, and is linked to the creation of the Dulles International Airport. The Dulles Metrorail, or a form of it, was always considered as part of the airport, but could not be realized for several decades due to a lack of funding. 24

Phase 1 Transportation Improvement District property assessed value (in billions) from 1985 until 2016.

One of the major initiatives to push the Dulles Metrorail forward was spurred by a group of developers in the Dulles Corridor who agreed to fund a portion of the local share of the project through special district tax financing. The group was called Landowners Economic Alliance for the Dulles Extension of Rail (LEADER) and consisted of early Tysons Corner landowners. This group began to evaluate the possibility of a rail connection to Tysons as early as the 1980s, putting money into planning studies. The work went through several economic slowdowns in the early 1980s and 1990s. 25 26

LEADER's work heated up in the late 1990s and into the early 2000s as it sought to recruit 50 percent of the landowners by assessed value in the Dulles Corridor to approve the Phase 1 TID. Convincing major landowners and lease holders to support the effort, including the large corporations in the corridor, was relatively straightforward, since they understood the benefits of providing employees and visitors with alternative transportation options in an increasingly congested corridor. Convincing smaller landowners was more difficult, since many of them owned or leased to small retail operations, including gas stations, strip malls, and auto dealers. These smaller landowners did not necessarily value the benefits of the Phase 1 TID or simply were not interested in participating in the process. Furthermore, some developers had long-term leases with major corporations that meant they were opposed to paying the higher Phase 1 taxes that would be passed through to them in the lease. 27

LEADER hired two well-known Virginia politicians to work with the group to convince the remaining landowners to support the TID. This effort was ultimately successful. 28

The project was very complex because, as Table 3 shows, it involved two major transportation agencies, two county governments, the Commonwealth of Virginia, and the Federal Government. These governmental bodies played various roles, including providing funding and financing and participation in key negotiations.

| Stakeholder | Description of Role |

|---|---|

| Washington Metropolitan Area Transit Authority (WMATA) | Transit agency that took over Phase 1 of the project and operates the Silver Line. WMATA is expected to do the same for Phase 2 once it becomes operational. |

| Metropolitan Washington Airports Authority (MWAA) | Airports authority that is overseeing the construction of the project. |

| Fairfax County, Loudoun County | Municipalities that have the primary public responsibility for value capture funding and financing through special districts. |

| Commonwealth of Virginia | State entity that provides project grants and has enacted legislation allowing for special districts. |

| LEADER | One of the major private developer groups that advocated for the project and helped organize the Phase 1 TID. |

| U.S. Department of Transportation (USDOT) | The USDOT's Federal Transit Administration gave a New Starts grant to and provided a loan to Phase 2 of the project. USDOT also played a role in bringing parties together to overcome Phase 2 challenges. |

The Dulles Metrorail, combining Phases 1 and 2, is one of the largest single U.S. transit rail projects and value capture efforts undertaken in the last two decades. As with all projects, there are several unique elements, but a number of this project's characteristics are also typical of large projects and broader value capture efforts. These include the following:

1 This case is based on material from Sasha Page et al., TCRP Report 190: Guide to Value Capture Financing for Public Transportation Projects, 88-96.

2 "What is Dulles Metrorail?" Dulles Corridor Metrorail Project, 2015, http://www.dullesmetro.com/about-dulles-rail/what-is-dulles-metrorail/

3 Dulles Corridor Metrorail Project, "What is Dulles Metrorail?"

4 Fairfax County, "Fund 40120: Dulles Rail Phase II Transportation Improvement District," FY 2017 Fairfax County Advertised Budget Plan, 2016, http://www.fairfaxcounty.gov/dmb/fy2017/advertised/volume2/40120.pdf.

5 Fairfax County Economic Development Authority, $173, 960,000 Fairfax County Economic Development Authority, Transportation District Improvement Revenue Refunding Bonds (Silver Line Phase I Project), Series 2016.

6 Fairfax County Economic Development Authority.

7 Fairfax County Economic Development Authority.

8 Fairfax County Economic Development Authority.

9 Interview with individual who worked with the developer group in Phase 1 TID, April 11, 2016.

10 Fairfax County, "Fund 40110: Dulles Rail Phase II Transportation Improvement District." FY 2017 Fairfax County Advertised Budget Plan, 2016, http://www.fairfaxcounty.gov/dmb/fy2017/advertised/volume2/40110.pdf.

11 Fairfax County, "Fund 40120: Dulles Rail Phase II Transportation Improvement District."

12 Fairfax County Economic Development Authority.

13 Dulles Corridor Metrorail Project, "What is Dulles Metrorail?"

14 Fairfax County, "Fund 40110: Dulles Rail Phase II Transportation Improvement District."

15 Fairfax County, "Fund 40110: Dulles Rail Phase II Transportation Improvement District."

16 Fairfax County Economic Development Authority.

17 Fairfax County Economic Development Authority.

18 Fairfax County Economic Development Authority.

19 Fitch Ratings, "Fitch Rates Fairfax County, VA Econ. Dev. Auth. Revs 'AA'; Outlook Stable," February 19, 2016, https://www.businesswire.com/news/home/20160219006017/en/Fitch-Rates-Fairfax-County-VA-Econ.-Dev.

20 Fairfax County Economic Development Authority.

21 Chrissy M. Nichols, "Value Capture Case Studies: Washington, DC Metro Expansion to Dulles Airport," Metropolitan Planning Council, April 12, 2012, https://www.metroplanning.org/news/6384/Value-Capture-Case-Studies-Washington-DC-Metro-expansion-to-Dulles-Airport.

22 Fairfax County Economic Development Authority.

23 Fairfax County Economic Development Authority.

24 Paul Dugan, "The Silver Line Story: A New Route is Born after Decades of Faulty Planning, Political Paralysis," The Washington Post, June 23, 2014, https://www.washingtonpost.com/local/trafficandcommuting/the-silver-line-story-a-new-route-is-born-after-decades-of-faulty-planning-political-paralysis/2014/06/23/bdf619c4-f894-11e3-a606-946fd632f9f1_story.html.

25 Interview with individual who worked with the developer group in Phase 1 TID.

26 Dugan, "The Silver Line Story."

27 Interview with individual who worked with the developer group in Phase 1 TID.

28 Interview with individual who worked with the developer group in Phase 1 TID.

29 Fairfax County, "Fund 40110: Dulles Rail Phase II Transportation Improvement District."

30 Fairfax County, "Fund 40120: Dulles Rail Phase II Transportation Improvement District."

31 Fairfax County Economic Development Authority.

32 Dulles Corridor Metrorail Project, "What is Dulles Metrorail?"