The Hays County transportation reinvestment zone (TRZ) project highlights the use of TRZs in funding and facilitating major highway projects. It highlights the need to do thorough analysis of potential legal threats to value capture initiatives.

The Growth of Hays County and San Marcos

Hays County, TX, is located about halfway between Austin and San Antonio, and the city of San Marcos is the county seat. San Marcos is also home to Texas State University, which has nearly 40,000 students. Both Hays County, with a population of 200,000, and San Marcos, with a population of 65,000, have grown rapidly over the last several years. Both have frequently ranked among the five fastest-growing jurisdictions in the United States, with San Marcos having registered the fastest growth rate in the country several times in the last few years. 1 The university's population has also increased significantly. It is a commuter school, with about 60 percent of its students living outside of the San Marcos area. The rapid growth of the city, the county, and the university has strained the region's roads, which are notorious for congestion.

To accommodate this growth, as well as to repair existing roads, the county adopted a transportation master plan in 2013. As part of this effort, it established the Hays County-Texas Department of Transportation (TxDOT) partnership. The partnership's projects sought to allow the county to keep up with the increased number of vehicles traveling on its roadways and have allowed Hays County to build roads today that would otherwise have taken 20 or more years to construct. 2 , 3

Formation of the Hays County and San Marcos TRZ

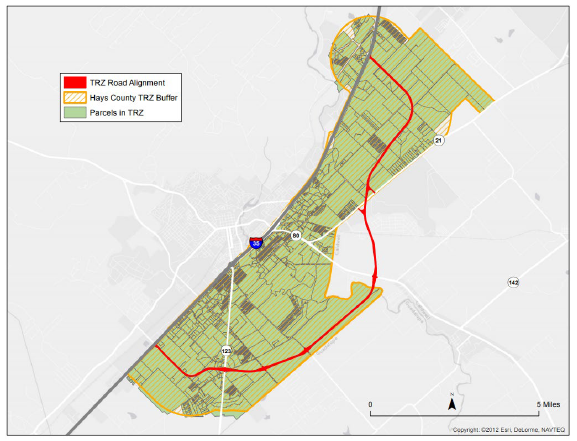

Local leaders pushed for implementation of TRZs soon after this legislation was passed. Two Hays County commissioners approached TxDOT's executive director about whether the new legislation could help a critical road project, farm-to-market (FM) road 110, which was a 13.1-mile loop (see Figure 1) that had been planned by the county and city since the 1960s.

The FM 110 project is the development of a key corridor through central Hays County with the goal of reducing congestion on existing connections such as I-35. This project was the county's "number one priority" 4 at the time it was approved. While the project was historically planned and critically important, TxDOT had no funding for FM 110, and it was not programmed for construction for over 10 years. Working with the city of San Marcos, a financial partner in the project, Hays County entered into a contract, known as an advance funding agreement, with TxDOT to implement a TRZ to fund FM 110. By 2014, Hays County and the city of San Marcos had created a TRZ to build FM 110. There was little or no opposition to the FM 110 project and TRZ creation, with Hays County voters twice overwhelmingly approving road bonds for portions of FM 110. Unique to this project as compared to other TRZs in the State was that both the county and city were involved.

TRZ Background

The Texas Legislature enabled TRZs in 2007 for counties and municipalities. The purpose of a TRZ is to allow a transportation project to capture a share of revenue from the incremental property and/or sales tax revenue growth in a designated area.

The following steps are required to form a TRZ:

TRZs do not increase taxes, but they capture additional tax revenue from increased property values, new development, and/or increased sales. When TRZs were initially created, they were only permitted for counties and municipalities receiving pass-through funding from TxDOT for transportation projects, but this is no longer the case. Several updates to Texas's TRZ law have occurred since its initial 2007 creation. In most cases, the legislature expanded use of the tool. The following are the most notable legislative updates to TRZs: 6

Driving Factors behind TRZ Legislation

In 2003, the Texas Legislature approved House bill 3588, which established a pass-through financing system in the transportation code. This system allowed public or private entities to construct State highways and receive payment from TxDOT following project completion based on the anticipated volume of traffic on a road. The State found that its pass-through program was extremely popular, as it helped many localities get projects off the ground faster. However, the program did not have the resources to sustain itself, as the high demand from localities exceeded the funds available. Therefore, TRZs were considered as a way to shore up the pass-through program with a dedicated local revenue source. House bill 3588 was championed most heavily by then-State Senator Eliot Shapleigh from El Paso, which was the first jurisdiction in Texas to establish a TRZ.

Texas had other forms of value capture, including tax increment financing (TIF) districts, prior to establishing TRZs. However, under Texas law, traditional TIF could be time-consuming and expensive to create and manage. All taxing jurisdictions in a city or county, including school districts, junior colleges, hospital districts, and others are required to sign a participation agreement and have a seat on a TIF board, even if they do not financially participate. The plan of finance for a TIF district can also be time-consuming to manage. As Texas TIF laws require votes to form a majority of any TIF board to make any key decisions, a local municipality can easily lose control of a TIF district, posing risks to any project for which such a district is established. While the complexity of the decision-making structure of TIF districts provided many key stakeholders with a voice in these projects, it was cumbersome for local elected officials to administer. Because of this, TRZs were created in part to allow counties and cities to quickly and effortlessly create a tax increment district. TRZ legislation ensured that these arrangements would be relatively simple and quick to establish and manage. As such, TRZs serve a similar purpose as TIF districts, without their complications. 7

Under the terms of the 2014 advance funding agreement with TxDOT, Hays County paid for 100 percent of the project development, including construction plan development, right-of-way acquisition, utility relocation, and preliminary engineering and construction activities for FM 110, amounting to approximately $15.4 million. 8 The county funded these activities with voter-authorized general obligation bonds. In addition, TxDOT agreed to build the project and loan the county the money for 100 percent of the FM 110's $48 million construction cost through the Texas State Infrastructure Bank (SIB). Local officials recognized there would be significant economic development associated with FM 110 and were willing to commit part of their future tax base to repay TxDOT. Without the road, development in the area was likely to be constrained. The revenue from the Hays County TRZ was calculated on the incremental growth of the aggregate property values within the TRZ multiplied by local property tax rates, multiplied by 50 percent. Therefore, 50 percent of the new tax revenue was designated to FM 110, while the remaining revenue was to be allocated to existing city and county needs. 9

Hays County had enlisted a consulting firm to assess the viability of a TRZ. At the establishment of the TRZ in 2013, land values in the district were valued at $1.1 billion. The study analyzed potential boundaries, taxable ad valorem value, the duration of the TRZ (projected to not extend past 25 years), and different levels of tax increment from 25 to 100 percent. Underpinning this research was data on regional population growth, constraints to growth in the TRZ, employment growth, and real estate and housing market trends. The housing trends data included new construction, a mix of single- and multi-family housing and home prices data. The consultant also assessed the number of new developments that were already planned within the zone, as these would serve as a relatively low risk source of new property tax revenue - and thus TRZ revenue. Based on the study results, the city and county settled on TRZ boundaries and a 50 percent increment. After these parameters were set, the zone was estimated to be able to generate between $63.3 million and $74.9 million in net present value terms and, as such, could conservatively repay the $48.0 million SIB loan principal and interest in 22 years. 10 11

During the negotiations with TxDOT, there was an issue regarding the county paying interest on the $48.0 million TRZ loan. While TxDOT wanted to treat the loan as a SIB loan, the county pushed back on the loan interest rates and TxDOT's requirement that the loan be classified as a liability on the county's balance sheet. The county wanted the TRZ financing to be an off-balance sheet financing, in other words, non-recourse to the county. 12

A compromise was developed with then-TxDOT Finance Director James Bass that allowed the county to classify the obligation as "off-balance" sheet financing, while also reducing the risk to TxDOT. The county, using the consultant firm's financial feasibility study, developed a 20- to 30-year payment schedule with the county paying TxDOT 100 percent of collected TRZ revenues every year, regardless of the scheduled repayment. This way, if development in the TRZ was significant and the tax increment collected was larger than projected, the full amount of the 50-percent TRZ monies would flow to TxDOT. Monies that were in excess of the expected annual amounts to pay debt service were used as "prepayment," thereby allowing TxDOT to be repaid sooner than expected. Thus far, collected TRZ revenues significantly exceed the forecast. The long-term payback through the TRZ and variable annual payments were more favorable to the county than any alternative sources of financing. 13

The Hays County TRZ has experienced some complications. In 2015, after the Hays County TRZ was established and financing documents were executed, the Texas attorney general struck down county TRZs, stating they violated the "Equal and Uniform Taxation" clause in the Texas State Constitution. The clause requires that property owners within a particular county must all contribute the same share of their taxes to a county's general fund. 14 A TRZ would violate this clause, because while property owners within a TRZ were paying the same tax rate as other property owners within a county, fewer of their payments would go into the general fund because a share of their property taxes would flow to a separate project. 15 After this ruling, several Texas counties shelved their plans for TRZs or eliminated TRZs that they had already established. Similarly, the Hays County/ San Marcos arrangement was at risk.

Based on the Texas attorney general's opinion, the county and TxDOT had to devise an alternative way to repay TxDOT. The county and its advisors developed another approach, which consisted of dissolving the TRZ but continuing to set aside a 50-percent increment from the properties in the area. Those funds would all go into the county general fund, like all collected property taxes, and the county would then write a check to TxDOT to pay down project costs, as they have done under other advance funding agreements. Under this arrangement, the same payment schedule and term of the original advance funding agreement would remain. This device, which was approved by TxDOT, has allowed the payments to continue in the near term. In the long term, Hays County and other Texas counties are seeking an amendment to the constitution's Equal and Uniform Taxation clause to allow for implementation of county TRZs without such workarounds. 16

The county's repayment to TxDOT has had some impact on its economic development policies. As the FM 110 project opens the eastern part of the county to new development, many new residences and mixed-use retail/warehouse developments have opened, including a new Amazon fulfillment center, and thousands of new properties are expected to follow. Once the county and city each committed 50 percent of the property taxes from the zone, there was little room left for future tax abatements with new developments. There continue to be many companies proposing to locate in the new corridor, and many are requesting tax abatements as high as 80 percent, which is not possible with 50 percent of property taxes from the area already committed, especially since the remaining 50 percent of property taxes are needed to fund county and city services there. So far, that has not dissuaded businesses from locating in the area. 17

1 Chris Eudaily, "San Marcos Rate of Population Growth Leads Nation - Why It's Booming," Texas Public Radio, May 30, 2013.

2 Bailey Buckingham, "Hays County Continues to Lead Growth, Named Fastest Growing County in Texas." The University Star, 4 April 2016.

3 Buckingham, "Hays County."

4 Debbie Ingalsbe, Memo: Hays County-TxDOT Partnership Proposal, December 10, 2012.

5 "Transportation Reinvestment Zones in Hays County and the City of San Marcos," TXP, Inc., September 2013.

6 Interim Report to the 85th Texas Legislature. Texas House Committee on Transportation. January 2017.

7 Mike Weaver, Interview, October 10, 2018.

8 Hubert Stewart, Executed Advance Funding Agreement, Memorandum, Hays County and Texas Department of Transportation Contract Services Office, July 9, 2014.

9 W. Ferguson, "Hays County, San Marcos Partner on FM 110," Community Impact Newspaper, August 13, 2013,

10 "Hays County and San Marcos Partner on TRZs to Benefit Roads, FM 110," TXP, Inc., October 2013, .

11 Mike Weaver, Notes, November 12, 2018.

12 Mike Weaver, Notes, November 12, 2018.

13 Mike Weaver, Notes, November 12, 2018.

14 Ken Paxton, Texas Attorney General, to Joseph C. Pickett, Chair, Committee on Transportation, Texas House of Representatives. Opinion No. KP-0004. February 26, 2015.

15 Interim Report to the 85th Texas Legislature. Texas House Committee on Transportation. January 2017.

16 Mike Weaver, Notes, November 12, 2018, and December 17, 2018.

17 Mike Weaver, Notes, November 12, 2018.