The Virginia Route 28 project illustrates how special tax districts can be used together with bond financing to fund highway construction.

The Virginia Route 28 special tax district financing improvements are the earliest - and to date only - example of value capture for Virginia roads. The special assessments were used to finance corridor improvements almost 30 years ago in two major phases. 1

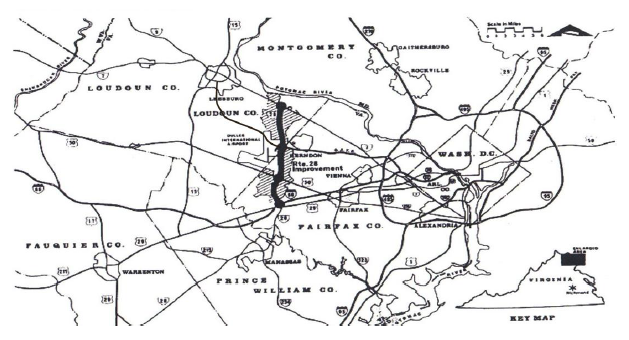

State Route 28 is a primary State highway that traverses the counties of Loudoun, Fairfax, Prince William, and Fauquier in Virginia. It is a major artery through Northern Virginia. Figure 1 shows the location of the corridor in the DC Metro area.

Map showing the location of State Route 28 that traverses the counties of Loudoun, Fairfax, Prince William and Fauquier in Virginia in the DC Metro Area.

The Dulles Corridor is the area along the 14-mile-long Dulles Toll Road between Washington Dulles International Airport and the Washington, DC, region's Capital Beltway (I-495). It is one of the fasting-growing commercial districts in the United States. It is home to dozens of national and regional offices of defense contractors, information technology companies, consulting firms, media conglomerates, accounting firms, communications companies, and other technology-related industries. Like much of Northern Virginia, the Dulles Corridor suffers from severe traffic congestion.

In the late 1980s, Route 28 was a two-lane country road that intersected the Dulles Corridor just east of Dulles International Airport. As a result of the region's growth, Route 28 had to be upgraded in order to handle the resulting traffic volumes. In 1985, VDOT hired an architecture and engineering consulting firm to prepare the design plans for widening Route 28. However, Virginia DOT (VDOT) lacked the resources to construct the project. 2

In 1987, Virginia authorized the creation of special tax districts to finance transportation improvements. The following year, Fairfax and Loudoun counties formed the first transportation improvement district (TID) in the Commonwealth, following a petition of the landowners representing 51 percent of the land zoned or used for commercial or industrial purposes in the proposed district, as is required by statute.

As part of the agreement forming the district, costs for the Route 28 expansion were to be split 75/25 between the TID and VDOT. Furthermore, a 20-cent surcharge per each $100 in commercial and industrial property value within the district was applied. The surcharge financed bonds to pay for improvements to Route 28. From 1989 to 1991, 14 miles of Route 28 were widened from two lanes to six, and interchanges were built at Route 50, Route 7, and the Dulles Toll Road. Initially, the debt service was supported by State construction allocations for the Northern Virginia District in the Six-Year Improvement Plan. 3

The primary regulatory issue was that implementing the value capture solution required action by the Virginia General Assembly.

The original authorization was passed by the legislature in 1988, and the same statutory authority was used in 2012 to authorize funding for an expansion project, based on the same revenue base. 4

The success of the project depended heavily on whether real estate market values would materialize to the extent required to support the new financing.

Initially, the tax district had some issues when the property market weakened in 1988 and 1989 and tax district revenue was insufficient to pay debt service. The rebound of real estate values in 1992 allowed for the refinancing of debt to take advantage of lower interest rates. Annual revenues have exceeded annual debt service since 2001, allowing the tax district to move forward with additional design and construction. 5

The capital costs were as follows:

The uses were as follows: 6

The tax district revenues supported the sale of tax-exempt bonds that were backed by the moral obligation of both Fairfax and Loudoun counties.

The authorizing legislation for the special assessment district was structured in such a way that it could not go into effect without a petition from 51 percent of the land area owners. As such, the project required extensive coordination and partnership between VDOT and the landowners along the corridor.

1 Laura Farmer, Value Capture: Route 28 Transportation Improvement District, Virginia Department of Transportation, 2015.

2 "Project Profile: Route 28 Corridor Improvements," Federal Highway Administration Center for Innovative Finance Support, https://www.fhwa.dot.gov/ipd/project_profiles/va_route28.aspx.

3 Farmer, "Value Capture: Route 28."

4 "Code of Virginia: Chapter 20. Local Transportation Districts," $50,620,000 Commonwealth of Virginia Transportation Contract Revenue Refunding Bonds Series 2012, Commonwealth Transportation Board (Route 28 Project), 2012, Virginia Legislative Information System, https://law.lis.virginia.gov/vacode/title33.2/chapter20/.

5 Farmer, "Value Capture: Route 28."

6 Farmer, "Value Capture: Route 28.'

7 Farmer, "Value Capture: Route 28."