In 2008 the Hillsboro City Council established a Transportation Utility Fee (TUF)–a monthly fee charged to property owners to support citywide investments in pavement condition and bicycle and pedestrian facilities. The city collects TUF fees from all residential, business, government agency, school, and nonprofit property owners through regular city utility bills. The size of the fee is based on the estimated use of the road system by property type and size. In the City of Hillsboro›s fiscal year 2020-21(July 1, 2020-June 30, 2021), the TUF will generate an estimated $3.8 million for the city’s Pavement Management Program and $1.2 million for the Bicycle and Pedestrian Capital Improvement Program.

| Project name | Transportation Utility Fee (TUF); Bicycle & Pedestrian Capital Improvement Program (BPCIP); Pavement Management Program |

|---|---|

| Location | Hillsboro, Oregon |

| Built environment | Urban |

| Type of infrastructure | Pavement quality and state-of-good-repair; bicycle and pedestrian facilities |

| Total infrastructure cost | ~$5.0 million (estimated) in the City’s fiscal year 2020-2021 |

| Value capture instrument | Transportation Utility Fee |

| Summary of funding plan | The City of Hillsboro collects the TUF directly from property owners through regular city utility bills. The size of the fee varies according to estimated roadway usage, based on property type and size. The city provides discounts for property owners that demonstrably reduce their impact of the city’s transportation system. |

| Amount of value capture | ~$5.0 million annually |

| Duration of value capture | Utility fee collection began in 2009 |

| Value capture innovation | While several other cities and municipalities in Oregon have implemented TUFs, Hillsboro is unique in the fact that a portion of TUF funds is dedicated to bicycle and pedestrian improvements. With annual revenues of approximately $5 million, Hillsboro is also one of the largest TUFs in the state. Most other TUFs generate less than $1 million per year.1 |

| Notable outcomes | Hillsboro expects their TUF will allow the city to clear its entire $7.5 million backlog of street maintenance projects by 2024. |

| Statutory/regulatory changes | TUFs are currently authorized by state law in Oregon. As such, Oregon localities have the authority to implement them for local projects. In Hillsboro, Subchapter 3.32 of the Municipal Code enables implementation of the city’s TUF program. |

TUFs, also known as street user fees or road maintenance fees are ongoing fees paid by real estate occupants (i.e., owners or tenants) according to the intensity of transportation use. These fees are typically used to pay for a transportation facility or system’s operation and maintenance but do not seek to recover capital costs. A TUF may be applied across an entire jurisdiction or within a specified benefit area.

Fees are based on the cost of estimated transportation utilization rather than actual or observed use. Estimated transportation utilization is calculated based on the character and density of property occupants, and on assumptions about their use of transportation facilities such as roads, public transportation, or parking. In many localities with TUFs, the intensity of transportation system use is based on estimated trip generation rates from the Institute of Transportation Engineers (ITE). ITE conducts surveys and develops trip generation rates for different types of land use activities (e.g., retail stores, theaters, apartments, restaurants, offices, single-family homes). In addition to trip generation rates, localities may calculate fees based on property characteristics linked to the intensity of use, such as length of street frontage, number of employees, value of sales, amount of employee compensation, or other factors linked to the intensity of use of the facilities, as appropriate.

The major advantage of TUF programs is that they provide new revenue streams based directly on the estimated use of a city’s transportation network. Furthermore, TUF programs allow implementing agencies to incentivize behavior that reduces stress on the transportation network, such as travel by foot, bicycle, or transit.

However, like other land value return methods, TUF fees involve new administrative and institutional requirements. For example, a TUF based on the number of parking spaces on a property may be difficult for a locality to implement and administer because parking spaces are not a typical basis for taxation by local governments. Furthermore, TUFs require political will and stakeholder support, as well as enabling legislation. As a result, it is practiced in relatively few localities, although local TUF authorities exist in Oregon, Florida, and Montana. Oregon TUF programs were among the first in the United States.

Hillsboro, Oregon, is a small city on the west side of the Portland metropolitan area, with a 2019 population of approximately 109,000. Hillsboro is home to several large technology companies, most notably Intel, which contributes to the city’s reputation as a major jobs center in the Silicon Forest. Hillsboro is a fast-growing community, adding approximately 20,000 residents to its population in the past decade. By 2035, the city anticipates a 20 percent increase in population and 31 percent increase in jobs, creating demand for investments in the city’s transportation multimodal network.2

As population and employment growth continues countywide, the number of daily trips in the area is expected to increase 43 percent by 2035, with a larger share of trips being made by biking and walking (54 percent and 52 percent, respectively).3 Currently, small but significant shares of Hillsboro workers travel to work on foot (2 percent) or by bicycle (2 percent). Bicycle lanes or other bicycle facilities are available on 53 percent of the major streets in Hillsboro.

Like other Oregon cities, Hillsboro has turned to new local revenue sources to help address the growing backlog of road maintenance and preservation needs in the face of growing demand and stagnant revenue. Despite inflation, the state gas tax rate did not increase from 1993 to 2011. Furthermore, Oregon’s 1990 Ballot Measure 5 placed limits on property taxes, with property taxes for non-school purposes capped at one percent of real market value. This limitation has made it harder for municipalities to devote property tax revenues to street maintenance. TUFs offer one option to fill these gaps.

Keeping Hillsboro roadways and sidewalks safe and well maintained is a top priority for the City of Hillsboro. To this end, the Hillsboro City Council established the TUF in 2008. TUF fees were first collected in 2009. The City Council’s TUF policy was created at the recommendation of the community’s Transportation Funding Committee. This committee was appointed the prior year to consider how much money the TUF should raise, how fees should be divided between residential and nonresidential customers, and how fees should be adjusted over time. Ongoing oversight of the TUF program is assigned to the Hillsboro City Council’s Transportation Committee, with advisory consultation provided by the Transportation Advisory Committee.

The new TUF was a monthly user fee based on use of the road system and paid through the city’s utility bill, which also includes charges for sanitary sewer, water, and community service fees for park development. The fees collected provide a consistent source of funding for maintaining local roadways. In 2015, the City Council adopted a stepped rate increase to be implemented incrementally over five years. The goal of this increase was to fully fund the city’s pavement program and to allow the city to clear its backlog of street maintenance projects by 2024. Since its implementation, the TUF program has allowed the city to reduce its maintenance backlog from $7.5 million to $5.8 million.4

TUF rates are based on estimated trip generation rates from the Institute of Transportation Engineers. Residential properties in two categories, single-family and multifamily, are charged flat monthly fees. Nonresidential properties pay a base charge of $8.20 per month plus a calculated charge according to property type category, and in most cases, square footage. TUF revenue from nonresidential customers goes to the Pavement Management Program (PMP), while TUF revenue from residential customers is divided between the PMP and the Bicycle and Pedestrian Capital Improvement Program (BPCIP). Table 1 shows TUF rates by property type category and program supported.

| Property Type | Example | Program Supported | Rate* | Type of Assessment |

|---|---|---|---|---|

| Single-family residential customer | Detached home | PMP | $6.48 | Monthly fee |

| BPCIP | $2.63 | |||

| Total TUF | $9.11 | |||

| Multifamily residential customer | Midrise apartment | PMP | $5.83 | Monthly fee |

| BPCIP | $2.37 | |||

| Total TUF | $8.20 | |||

| Nonresidential customer (All) | -- | PMP | $8.20 | Base monthly fee |

| Nonresidential customer (Property Type 1) |

Manufacturing facility | PMP | $0.27 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 2) |

Single tenant office building | PMP | $0.73 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 3) |

Shopping center | PMP | $2.32 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 4) |

Sit-down restaurant | PMP | $5.26 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 5) |

Convenience market | PMP | $14.67 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 6) |

Fast-food restaurant | PMP | $37.50 | Monthly fee per 1,000 ft2 |

| Nonresidential customer (Property Type 7) |

Gas station | PMP | $0.06 | Monthly fee per trip** |

*Rates are effective as of March 1, 2020.

**Per-trip fees charged for a maximum of 1,500 trips (maximum of $90)

Source: City of Hillsboro, Adopted Budget Fiscal Year 2020-2021. https://www.hillsboro-oregon.gov/home/showpublisheddocument?id=26027 (accessed 9 April 2021)

Hillsboro offers discounts, waivers, and utility bill assistance to qualifying residential and nonresidential customers. Customers can qualify for discounts or waivers if their property is vacant of if they take steps to reduce use of Hillsboro roadways.

There are three residential TUF discount and waiver programs. First, through the Vacancy Waiver Program, TUF fees are automatically suspended when residential water service is also suspended. Second, through the Motor Vehicle Discount Program, households without motor vehicles receive a 30 percent TUF discount. Finally, through the Transit Pass Discount program, households receive a 30 percent discount if at least one member can document a purchase of an annual TriMet transit pass.

There are also three nonresidential discount and waiver programs. As with residential customers, the Vacancy Waiver Program automatically suspends TUF if a property’s water service is suspended. Second, the Employer Transit Pass Discount program offers employers credit if they purchase annual transit passes for their workers. Finally, through the Employer ECO Program Discount program, employers receive a credit for workers with approved commute-option programs, in compliance with state rules. The discount is equivalent to the percentage of trips reduced demonstrated in a required employee travel survey.

Additionally, residents facing financial hardship can take advantage of the city’s Utility Bill assistance program. This program offers flexible payment plans to the qualified residents, as well as bill relief for residents who participate in government assistance programs or have income below 185 percent of the federal poverty limit.

The City of Hillsboro recently completed a TUF calculation review. Through this review, the city considered topics such as how the TUF is calculated for each customer category and appropriate discounts for the program to offer. As a result of the review, the city adopted a TUF adjustment that more fairly distributed costs among customers by increasing the TUF for some customers and decreasing it for others. These changes occurred in a revenue-neutral way that did not alter city revenues. The adopted adjustment went into effect on March 1, 2020. The city is required to review rates in this way every five years. To learn more about the TUF review process, read the October 15, 2019, memo to the City Council.

TUF revenue provides funding for two programs: The Pavement Management Program (PMP) and the Bicycle and Pedestrian Capital Improvement Program (BPCIP).

The City of Hillsboro owns and maintains more than 240 miles of roadway. Under the PMP program, the city inspects and evaluates the condition of these roads, identifies necessary pavement maintenance projects, and implements pavement improvements. Staff evaluate major roadways annually and local streets every three years. While planning pavement maintenance projects, the city considers a road’s Pavement Condition Index score, budget considerations, and opportunities for coordination with other utility and roadway projects. PMP projects may include crack seals, slurry seals, overlays, and asphalt or concrete replacement. In addition to TUF funding, the PMP is funded through a mixture of state and county gas taxes and vehicle registration fees.

The BPCIP is a 10-year plan that guides transportation investments in the city. The BPCIP prioritizes sidewalk, bike lane, and enhanced crossing projects, with priority given to areas in school walk zones or near transit stops. The BPCIP has an annual budget of about $1.5 million, with $1.2 million coming from residential TUF fees.

The city is currently identifying bicycle and pedestrian projects for construction in the next 10 years for its 2020-2029 BPCIP project list. The 2010-2019 BPCIP supported many projects to improve bicycling and walking conditions, including several sidewalk and bicycle facility improvements, hundreds of new Americans with Disabilities Act-compliant pedestrian ramps, and enhancement of many pedestrian crossings with rectangular rapid flashing beacons.

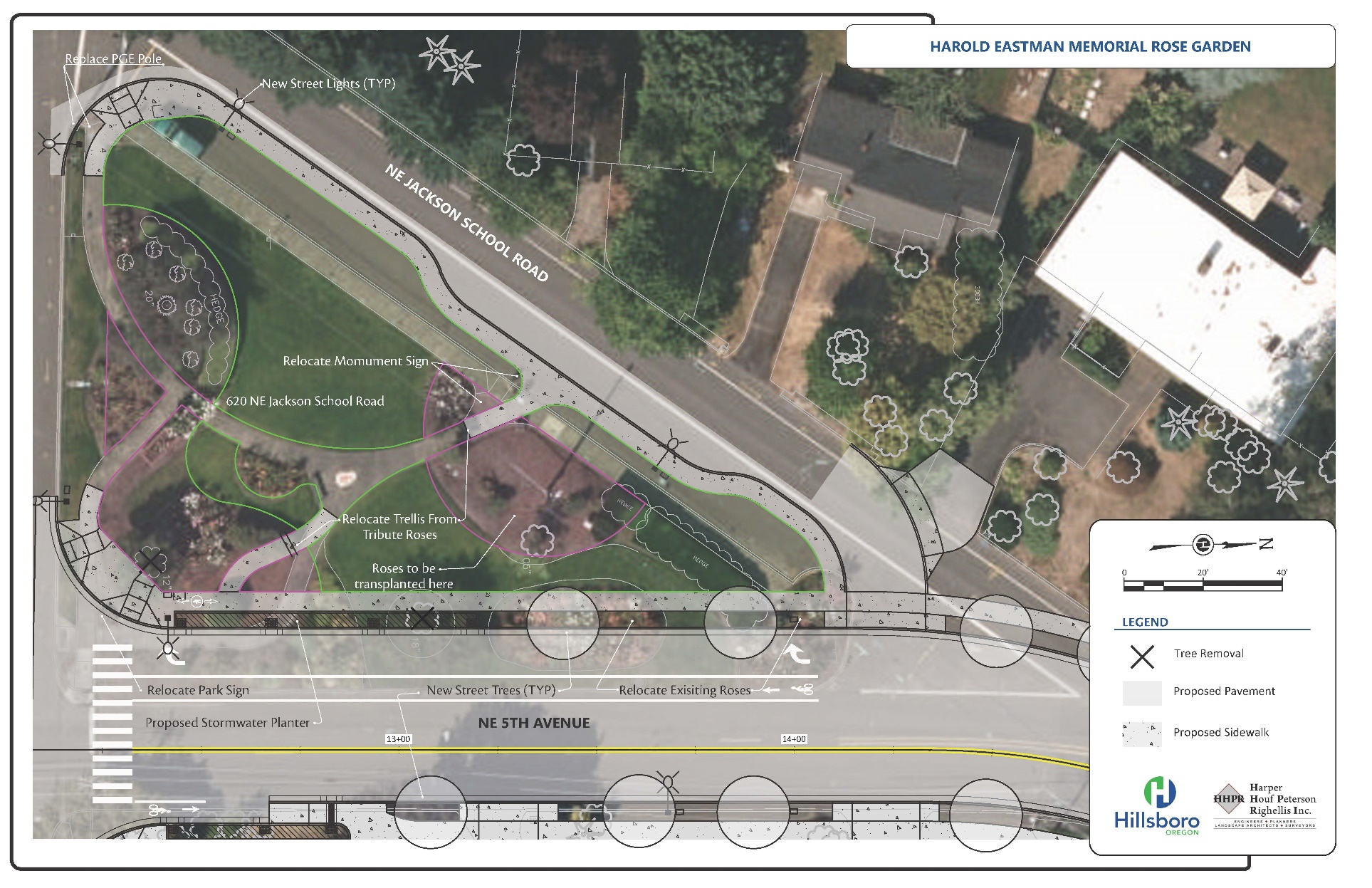

Figure 3 presents an example of a project funded through the TUF-supported BPCIP program. This effort, known as the Jackson School Road Project, will make needed improvements to a two-lane roadway with intermittent center turn lanes, incomplete sidewalks, limited roadway lighting, and no bicycle lanes. Planned improvements include sidewalks, a cycle track, a center left-turn lane, street lighting, a swale culvert replacement, storm system upgrades, and landscaped planter strips with street trees. With construction costs of about $21.5 million, project funding comes from TUF and nine other local sources.

Figure 3. Planned Jackson School Road Improvements, funded in part by the city’s Transportation Utility Fee.

Source: City of Hillsboro Jackson School Road Project webpage.

Transportation utility fee programs allow cities to charge property owners fees based on their estimated use of the local transportation system. Although TUF may not be the best solution for every community, the Hillsboro experience demonstrates that TUFs can be an effective means of partially achieving funding goals. This value-capture technique is successful because:

City of Hillsboro Department of Public Works

Tina Bailey, PE | Assistant Director

City of Hillsboro, Oregon | Public Works

tina.bailey@hillsboro-oregon.gov

Thanks to Tina Bailey for her time and cooperation.

1 League of Oregon Cities, Gas Tax & Transportation Utility Fee Survey Results. 2015, p. 4. https://www.bendoregon.gov/home/showpublisheddocument?id=40379

2 City of Hillsboro, Transportation Fact Sheet, 2018. https://www.hillsboro-oregon.gov/home/showdocument?id=18652.

3 Washington County Travel Options Assessment, February 2017. https://www.wta-tma.org/uploads/1/1/2/6/112615523/wa-county-travel-options-assessment_final-report_mar2017_clean.pdf

4 City of Hillsboro Transportation Utility Fee Rates, Effective March 1, 2020. Accessed 8 April 2021. https://www.hillsboro-oregon.gov/home/showpublisheddocument?id=1051

5 League of Oregon Cities, TUF Solutions for Local Street Funding: A Survey on Transportation Utility Fees. 2008, p. 5.