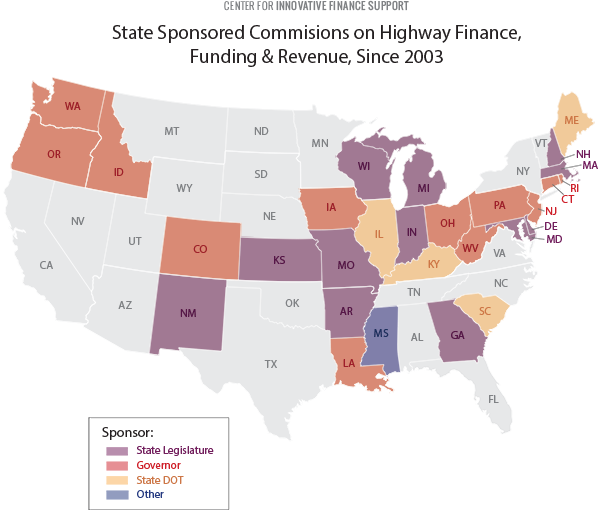

Many states have established commissions or study groups to investigate transportation funding gaps and suggest strategies for overcoming them. The map below identifies states that have established revenue commissions and study groups.

The following table provides information on the different commissions and study groups, together with summaries of their recommendations and links to the reports that they have produced.

Download full-sized version of map (pdf)

Findings Summaries

Arkansas

Blue Ribbon Committee on Highway Finance

In December 2010, this committee established by the State Legislature made a number of recommendations to increase transportation revenues in Arkansas. They include:

- A 10-year phased-in transfer sales tax revenues on the sale of new and used vehicles, tires, batteries, and vehicle parts and services from general revenues to the Highway Fund.

- Indexing the current per-gallon tax on motor fuels to Arkansas's Highway Construction Cost Index.

- A revenue measure for a 10-year, ½-cent general sales tax dedicated to a statewide, bond-financed highway improvement program.

- Implementing a new excise tax on the wholesale price of motor fuels.

- Authorizing, by public vote, the reissuance of GARVEE bonds to improve our Interstate highways.

- Modifying funding for the current State Aid County Road Program and creating a new State Aid City Street Program - continuing dedicated funding for the successful State Aid program for counties, creating a mirror-image, equally-funded

program for city streets, and providing revenue growth for these programs through indexing to the Arkansas Highway Construction Cost Index. Other Recommended Legislation

- Requiring a county minimum tax effort before a county or cities within that county can receive additional highway turnback funds - this would require counties to levy a minimum road tax on themselves before being allowed to share in

the growth of highway turnback funds paid by others.

- Referring a Constitutional Amendment to allow counties to raise the 3-mill limit on their road tax by a vote of the people

Colorado

Colorado Task Force on Transportation Finance

In an effort to further evaluate transportation funding needs, and to identify and recommend new and innovative funding sources for transportation, the Governor authorized the creation of the "Colorado Task Force on Transportation

Finance" in December 2003. The purpose of the Task Force is to make recommendations regarding the level of investment needed to provide a transportation system for the State of Colorado that would allow for opportunities of economic

development, and to maintain and/or improve the quality of life in Colorado. Additionally, the Task Force was asked to provide transportation financing options by focusing on existing funding sources that could be redirected to transportation

in order to meet that level of investment. These recommendations may include, but are not limited to, changes that require approval by the General Assembly or by a vote of the people.

The Task Force confirmed that the state's current sources of transportation funding will not address the needs identified. Traditional sources of revenue have not kept pace with inflation, and the state's current budget shortfalls have

restricted the possibility of other "non-traditional" sources of funding being allocated for transportation use.

The Task Force recommended:

- Expanding the use of design-build procurements

- Established candidate toll corridors

- Concentrating current funding on maintenance needs

- Accelerating environmental approvals

- Granting local government the ability to form regional authorities to fund transportation improvements

- Improving the state sales tax transfer process and using proceeds to bond and establish a revolving line of credit to support transportation improvement projects

- Expanding the State Infrastructure Bank

- Returning unused Colorado State Patrol and Ports of Entry funds to the Highway Users Tax Fund rather than the General Fund

Connecticut

Governor's Transportation Finance Panel Final Report

Governor Daniel Malloy appointed a nine-member Transportation Finance Panel in March 2015 to make recommendations on how to finance a $100 billion, 30-year Let's Go CT plan that seeks to modernize Connecticut's transportation

infrastructure. The report makes both policy and revenue recommendations. The policy recommendations are designed to "drive down costs, increase efficiencies, and ensure the investments made are sustained in a state of good repair."

Revenue options are structured to allow the state to carry out proposed projects through the first 15 years of the plan. The revenue options will then take the state further if the policy reforms are adopted.

Policy Recommendations:

- Enact a Constitutional Amendment that protects funds in the Special Transportation Fund (STF)

- Grant design-build authority and implement other alternative delivery methods

- Give local governments and regional entities the tools to reduce the state's burden to finance projects, such as regional options sales taxes

- Enhance state government planning functions to account for a growing number of large-scale transportation projects

- Consider establishing a volunteer-based VMT charge program

- Partner with the private sector whenever possible to capitalize on their ideas, reduce the state's burden on operations and its debt portfolio, and help deliver projects with greater efficiency

Funding Recommendations:

- Analyze what the appropriate rates for motor vehicle receipts, licenses, permits, and fees should be, given that many have been static for years, adjust them accordingly, and tie them to inflation

- Increase the gasoline tax (flat for 15 years) by 2 cents per year for 7 years, returning it to the purchasing level it had in the mid-1990s

- Increase the sales tax by half a percentage point and devote it to the STF, resulting in a full 1% going to transportation, or alternatively, retain the incremental increase in the General Fund and move all vehicle-related sales tax

to the STF

- Authorize and implement congestion-mitigation all-electronic tolling

- Unlock transportation real estate value through value capture and right-of-way leases

- Capitalize on sponsorship and advertising opportunities

Governor Malloy's Transition Team Transition Report

In January 2011, the Governor's Transition Team made the following recommendations:

- Develop dedicated state programs funded through specific revenue mechanisms to mitigate Connecticut's reliance on federal funding.

- Add 3Ps and other alternative delivery methods such as Design-Build and CMGC to the state's tool box.

- Gain state authorization legislation for P3s within six to 12 months.

- Key agency leads (DOT and DEP) must work together to streamline the process, which will enhance the use of all forms of project delivery to ensure expedient project development and construction, ultimately promoting job creation.

- Develop a cadre of employees with the mind-set and experience to develop and manage a robust 3P program.

- Develop tools to enable the State to ascertain and select those projects to be developed through a 3P or alternative delivery approach.

- Review how ConnDOT invests its funds for infrastructure improvement, with focus on how to prioritize projects and how to streamline the State Traffic Commission approval process for TOD projects.

- Review state assets (train stations, parking garages, state office buildings etc) to determine what is an essential public asset and what could be sold, leased or monetized through sale/lease back arrangements or other P3 arrangements.

- The STC approval process should be reviewed and revised to promote and prioritize Transportation Oriented Development. Outsource as much as possible from DOT to private sector, as appropriate, to expedite projects and reduces costs.

- Follow up on the 2008-2009 $1 million state-wide Congestion Pricing Study to promote a state-wide program of priced managed lanes.

Delaware

Transportation Trust Fund Task Force

In March 2011, the Transportation Trust Fund Task Force established by the State Legislature provided information on possible additional revenues to address potential gaps in capital funding for the Transportation Trust Fund.

- Originally established in 1988, the TTF was utilized solely as a pool of funds for capital projects, supported by a revenue structure sized to meet the State's infrastructure needs. Beginning in 1992, shifts of operating funding for

the Department of Transportation, the Delaware Transit Corporation and the Division of Motor Vehicles required approximately $3 billion in revenue that otherwise would have supported capital projects. Among the options for improving

the sustainability of the TTF is to consider shifting operating costs over a period of time back to the General Fund or providing additional General Fund contributions.

- Establishing a fare box recovery rate policy for all Delaware Transit Corporation (DTC) modes of travel.

- Indexing revenues to allow revenues to fluctuate with increases in costs, allowing Trust Fund revenues to grow annually in a way which off-sets expense growth and construction costs.

Georgia

Joint Study Committee on Critical Transportation Infrastructure Funding

In December 2014, the Joint Study Committee on Critical Infrastructure Funding released their findings on the "conditions, needs, issues, and problems associated with Georgia's critical transportation infrastructure and the means

of funding its construction, maintenance, and repair." The report:

- Finds that Georgia significantly relies on motor fuel taxes levied at both the state and federal levels to support transportation.

- Presents reasons why these sources of funding are becoming insufficient.

- Highlights the benefits of indexing motor fuel tax rates to keep up with inflation.

- Documents the need for more state-level investment in transportation to support expected population growth and economic development opportunities.

- Compares Georgia with peer state road expenditures per capita.

- Identifies a "funding gap" of $1.0-1.5 billion annually to merely maintain roads and bridges at acceptable levels.

- Identifies an additional investment of $2.1-2.9 billion annually is necessary to address critical transportation needs including "boosting regional mobility, increasing interstate highway capacity, expanding transit availability,

improving intermodal options, and building new interchanges".

- Itemizes the types of transportation projects that would go unfunded without increasing current state spending levels, and the probable outcomes in terms of service reductions and economic impacts.

- Finds that a minimum if $1.0-1.5 billion in new annual transportation infrastructure investment is needed and presents 12 options to achieve this target.

Idaho

Governor's Task Force on Modernizing Transportation Funding in Idaho

In January 2011, the Governor's Task Force on Modernizing Transportation Funding in Idaho submitted six recommendations to the Governor for consideration. The options were ranked in eight categories including revenue predictability, fairness

- Aligning revenue enhancements to improve cost equity among various vehicle classes based on State funds and the GARVEE "debt service" analysis provided in the 2010 Idaho Highway Cost Allocation Study, which shows automobiles

currently have an equity ratio of 1.08 and combination trucks have an equity ratio of .86 and consider phasing these changes over several years.

- Allowing local jurisdictions to increase public transportation revenue using the options outlined in the public-transportation portion of the Revenue Options Matrix.

- Examining new methods to allocate funds to local jurisdictions in a manner that incentivizes efficiency and ensures the funds are used efficiently.

- Continuing the 3% distribution from the state fuel tax to the Idaho Department of Parks and Recreation.

- Implementing a funding shift from the Idaho State Police to the State Highway Account, which causes the need for a new funding source for ISP.

Illinois

Illinois State Transportation Plan Special Report: Transportation Funding

This June 2007 report prepared by the Illinois State Department of Transportation identifies funding options that could help to bridge the gap between the state's transportation investment needs and available funding. The list of strategies

is not comprehensive and does not represent a commitment toward any strategy. Strategies identified include:

- Increasing traditional taxes and fees that support transportation at the federal and state levels

- Implementing structural adjustments to existing motor fuel taxes, such as indexing

- Considering mileage-based taxes rather than quantity-based fuel taxes

- Expanding uses of outsourcing on activities including maintenance contracts, management contracts, and vehicle and equipment leasing, combined with hedges on fuel and electricity and strategic sourcing of equipment including mobile

phones and other hand-held communication devices

- Combining public and private investments to make some transportation projects financially feasible

- Implementing local option impact fees in Illinois to help jurisdictions recover some of the costs related to the impacts of new developments on the transportation network. These beneficiary fees can include value capture fees, such

as tax increment finance districts, which generate funds from taxes related to the added value of sites around transportation improvements.

- Allowing regions, as opposed to the whole state, to take on stronger roles by establishing regional mobility authorities (RMAs) and strengthening inter-municipal authorities with toll authority in their regions

Indiana

Funding Indiana's Roads for a Stronger Safer Tomorrow Task Force

Indiana Legislative Council Resolution LCR16-01 established the Funding Indiana's Roads for a Stronger Safer Tomorrow Task Force and charged it with reviewing state highway and major bridge needs to achieve recommended pavement and bridge conditions and develop sustainable funding mechanisms. The Task Force met five times and heard testimony from national, state and local experts, as well as the public. The Task Force found that current funding levels are insufficient to meet the critical transportation infrastructure needs of the state and that additional sources of revenue must be identified and dedicated to road and bridge improvements by the General Assembly. The Task Force recommended that the General Assembly increase transportation funding during the 2017 legislative session and that the state develop a data-driven, comprehensive and sustainable long-term plan fur funding that state road and bridge infrastructure.

The Task Force recommended that the General assembly adopt legislation required the Indiana Department of Transportation to:

- Develop a set of generally accepted road and bridge metrics, including but not limited to metrics that measure asset condition, congestion, safety, and economic contribution.

- Benchmark Indiana's system of transportation infrastructure against similarly situated states using the generally accepted metrics.

- Develop a set of clearly articulated goals related to asset condition, congestion mitigation, safety improvement, and economic impact that can be measured and assessed on a regular basis.

- Develop and implement a unified, multi-variant statistical model that will be used to prioritize state transportation projects and predict future funding needs.

The Task Force recommended that the General Assembly consider the following options to increase funding for road and bridge improvements:

- Immediately increase the gasoline tax to recover some or all of the purchasing power lost since the gasoline tax was last increased in 2003.

- Immediately increase the special fuel tax to recover some or all of the purchasing power lost since the special fuel tax was last increased in 1988.

- Immediately increase the motor carrier surcharge tax to recover some or all of the purchasing power lost since the motor carrier surcharge tax was last increased in 1988.

- Index the rates for the gasoline tax, special fuel tax, and motor carrier surcharge tax on an annual basis to ensure funding stability.

- Implement road usage fees on alternative fuel vehicles, electric vehicles, and other vehicles which pay little or no fuel tax in support of their use of the roads.

- Explore options to implement equitable and modern tolling systems on state-controlled highways and interstates to fund major highway and interstate improvement projects.

- Implement a per vehicle fee on all vehicles registered in Indiana.

- Increase the tire disposal fee.

- Shift additional revenue generated from the use tax on gasoline from the state general fund to dedicated transportation funds.

- Improve over-weight truck enforcement through electronic monitoring of truck weight and permits.

- Increase fees that are subject to the International Registration Plan.

- Consider a limited restoration of the Indiana Finance Authority's ability to provide funding through smart debt financing - including highway revenue bonds, grant anticipation revenue vehicle bonds (GARVEE bonds), and transportation infrastructure and innovation act (TIFIA) bonds, provided that the expected life of the project to be financed exceeds the length of the debt repayment.

Iowa

Governor's 2020 Citizen Advisory Commission Report and Recommendations

This commission established by the Governor presented the following recommendations to address transportation funding shortfalls in November 2011:

- Increasing the state fuel tax rates across the board by eight to ten cents. It is estimated that this would raise $184 million to $230 million in annual income

- Increasing the five percent fee that is imposed on the sale of new and used motor vehicles and trailers to six percent, making it consistent with the state sales tax rate and raising an estimated $50 million in annual revenue

- Recommending a funding mechanism that applies to alternatively fueled, hybrid and high fuel efficiency vehicles to compensate for the fact that those vehicles pay no or limited fuel tax

- Directing new funding to the TIME-21 Fund up to the $225 million cap and distributing any additional funding in a manner consistent with the Road Use Tax Fund distribution formula.

- Following the requirements of the Iowa code for the Iowa DOT to "periodically review the current revenue levels of the road use tax fund and the sufficiency of those revenues for the projected construction and maintenance needs

of city, county, and state governments in the future. " The Commission recommends the Code of Iowa be changed to require this study be completed every two years timed to coincide with the biennial legislative budget appropriation

schedule, rather than at the current five year interval. This would enable the legislature to better respond to changing conditions, roadway needs and new technology.

- Convening annual meetings with cities and counties to review the operation, maintenance and improvement of Iowa's public roadway system and identify ways to jointly increase efficiency. Efficiency actions should be quantified, measured

and reported to the public on a regular basis.

- Directing Iowa DOT to undertake a study looking at vehicles and equipment that use Iowa's public roadway system but pay no user fees or substantially lower user fees than other vehicles and equipment. This study should result in an

assessment of whether fee structures could be modified and/or created so that all vehicles and equipment using Iowa's public roadways are pay equitable user fees.

Kansas

Kansas Joint Legislative Transportation Vision Task Force

On May 16, 2018, Kansas Governor Jeff Colyer approved a bill establishing the Joint Legislative Transportation Vision Task Force. The mission of the task force includes evaluating the progress of the state's current transportation programs, formulating recommendations on future transportation needs in Kansas, identifying additional necessary transportation projects. The task force will make recommendations on strategic issues regarding the state's transportation infrastructure. The task force is defining transportation needs and priorities, identifying the level of funding required to meet those needs and priorities, and assessing future funding options. Throughout this process, the task force is looking for ways to innovate in order to maximize transportation investments. The task force is comprised of committee leaders and members of the House and Senate, Kansas residents, industry stakeholders, local government representatives, and multiple cabinet secretaries. It will report its findings to the legislature by January 31, 2019

Kentucky

Enhancing Kentucky's Transportation Funding Capacity: A Review of Six Innovative Funding Options

This 2005 report prepared by the University of Kentucky for the Kentucky Transportation Cabinet identifies six innovative financing options that could be used to enhance Road Fund revenues or to finance specific transportation improvements

in the state. They include:

- Adjusting the indexing formula for the motor fuel tax to keep pace with inflation and account for changing vehicle fuel efficiency. The new indexing formula would provide a means for maintaining the purchasing power of motor fuel tax

revenues and afford greater revenue stability.

- Eliminating exemptions and special tax treatments that currently erode the Road Fund tax base. This strategy would close loopholes in the vehicle usage tax and the motor fuels tax.

- Imposing usage taxes on motor vehicle repair parts and labor. This would add stability to the Road Fund since it would be countercyclical with vehicle purchase trends. Motor vehicle parts are currently subject to the state sales tax.

Therefore, the imposition of the usage tax would reduce sales tax revenue directed into the General Fund.

- Establishing a supplemental vehicle enforcement fee to create a Motor Vehicle Safety enhancement Fund. This option would impose a supplemental fee on all motor vehicle violations as an add-on to existing fines. The resulting revenues

could be used to finance some portions of the Kentucky State Policy operations.

- Using tax increment financing for local transportation improvements, by having the Transportation Cabinet partner with city and/or county governments in joint financing for transportation projects.

- Utilizing tolling to provide new revenues for constructing, maintaining and operating new and existing roads and bridges. The best candidate facilities for tolling would be large bridges and highly traveled limited access highways.

Louisiana

Onward Louisiana: Governor-Elect John Bel Edwards' Transition Committee on Transportation

Governor John Bel Edwards' Transition Committee on Transportation made the following recommendations in January 2016 on the new administration's transportation agenda:

- Reform the administrative budgeting practices of the Transportation Trust Fund to reverse a trend of reduced funding to transportation infrastructure from inflation and transfer of funds to other entities.

- Examine the operating and administrative budget of the Department of Transportation and Development to determine if transportation dollars are being spent to accelerate project delivery.

- Commit to an annual construction letting volume of $1 billion to reduce a $12.7 billion in backlog of highway and bridge projects.

- Consider new state revenue for transportation from a host of options including tax and fee increases, VMT fees, fuel tax indexing, P3s, and tolls, along with strong voter education to adequately explain the need for funds and how they

will be allocated.

- Aggressively pursue all federal funding opportunities in 2015's federal transportation authorization, the FAST Act.

- Prioritize the work of the new office of multimodal commerce, including seeking federal funds for freight and passenger rail, airport and port expansion, while improving multimodal infrastructure throughout the state.

Maine

Sustainable Transportation Funding for Maine's Future

This January 2006 report prepared by the University of Maine for Maine DOT utilizes a literature review to identify twelve financing options, many of which are simultaneously aimed at generating revenue and addressing other transportation

issues such as congestion. They include taxes, road/direct pricing, tolls and fees. The different alternative financing options identified include:

- Indexing motor fuel tax rates to a measure of inflation

- Local option transportation taxes

- Levying a percentage tax on motor fuel sales, with the ensuing revenue directed to transportation funding

- Implementing a sales tax at the local or state level, with revenues dedicated to transportation

- Levying a weight-based charge on natural resource extraction

- Levying a payroll tax on businesses to finance transit

- Levying a tax on alternative fuels such as natural gas

- Cordon pricing - implementing a charge for operating vehicles in a specified area

- Implementing variably priced tolls dependent upon time of day and level of congesting

- Implementing distance based tolls

- Implementing priced managed lanes

- Value capture - requiring private developers to pay fees to capture the benefit of transportation improvements

- Implementing variably priced user fees on bridges and other facilities based on the level of congestion

- Implementing tolls on a facility or per-mile rate for heavy duty vehicles based on weight

- Implementing a variable vehicle registration fee based on miles of travel

- Levying variable user fees based upon vehicle energy efficiency and environmental emissions

In assessing these different options, the report suggests considering the following criteria:

- What is the revenue raising potential of this option?

- Will this option meet equity standards (do people with equal ability to pay, pay equally?)

- Will this project meet pay-as-you-use standards (i.e. will those who use the system more, pay more)?

- Will citizens still be able to use the roadways/transportation mode under this option, even if they have limited financial resources?

- Will this option be enforceable and able to capture out of state travelers?

- Is this option in alignment with other policy objectives?

- Is this option politically feasible?

Maryland

Final Report - Blue Ribbon Commission on Maryland Transportation Funding

This November 2011 report required by state statute addresses a wide range of recommendations concerning the structure of transportation funding in Maryland and the pressing need to infuse additional resources into the Transportation Trust

Fund to meet critical transportation system obligations. The Commission's recommendations reflect the importance of transportation to the State's economic competitiveness, mobility, and employment.

The recommendations are structured around five issue areas with several recommended actions:

Issue Area I. Protect the Transportation Trust Fund:

- Amend the Maryland Constitution to prohibit transfers out of the Transportation Trust Fund for non-transportation purposes (except in declared fiscal emergencies)

- Enact a statute that requires the Governor and the General Assembly to declare a fiscal emergency and to obtain approval of each house of the General Assembly, along with a repayment plan, before making a transfer of money from the

Transportation Trust Fund to the General Fund for non-transportation purposes

- Continue to require the local government portion of Highway User Revenues (HUR) be dedicated to transportation and maintain reporting and audit procedures to ensure expenditures comply with stated requirements

Issue Area II: Shore Up and Expand Core Transportation Funding

- Raise $870 million in Net New Annual Revenues for Transportation

- Restore the Annual Highway User Revenues (HUR) to the Local Governments

- Study Regional Transit Financing Authorities

- Reach the Transit Cost Recovery Ratio Goal of 35 Percent

- Establish a Methodology for Regular Adjustment of Transit Fares to Keep Pace with Inflation

- Eliminate Non-paying Transit Ridership

- Increase Bonding Capacity Commensurate with Revenue Adjustments

- Remove Cost Recovery Cap for Motor Vehicle Administration Fees

- Implement Tolls on Portions of Maryland Transportation Authority Roadways Where No Tolls are Currently Collected

- Explore Application of Possible Additional Tolls on New Facilities or New Capacity of Existing Facilities in Conjunction with Variable Pricing Techniques Facilitated by Recent Technology

- . Facilitate Goods Movement and Expand Investment in Freight Infrastructure through Additional Revenue Mechanisms

Issue Area III: Facilitate Smart Growth by Investing in Transportation in Growth Areas

- Establish a Strategic Framework for Transportation Investment Decisions to Ensure Transportation Infrastructure Investments Support Growth Areas and Preserve Rural Areas

- Work Cooperatively with Local Governments to Ensure County and Municipal Plans Reflect the State's Overall Growth Policies

Issue Area IV: Explore Policies and Legislation to Capture Value Created by Transportation Investments

- Identify Opportunities for Value Capture and Integrate Value Capture Analysis into Existing Transportation Decision-making Process

- Recognize Value Created by State Transportation Investments for Local and Private Entities and Work Collaboratively to Capture this Value to Help Facilitate Transportation Investment

- Seek Legislative Authority to Apply Tax Increment Financing Support to Highway Project Development, as Currently Provided for Targeted Transit Investment

Issue Area V: Explore Policies and Legislation to Facilitate Partnerships to Enhance Transportation Investment

- Establish Centralized Enabling Legislation for Public-Private Partnerships Outlining Efficient and Timely Legislative Reviews

- Revise the Transportation Public-Private Partnership Program Process

- Identify Future Public-Private Partnerships Opportunities and Integrate Public-Private Partnership Screening Analysis into Transportation Decision-making Process

- Engage Specialized Expert Assistance in the Development of a Transportation Public-Private Partnership Program

- Assess the Feasibility of Loaning State Funds to Localities and to Private Project Sponsors in Order to Facilitate Transportation Investment

- Prepare to Take Advantage of any National Infrastructure Bank Program

Massachusetts

Transportation Finance in Massachusetts: Building a Sustainable Transportation Financing System

The Massachusetts Transportation Finance Commission was established by Statute to analyze the State's long-term transportation capital and operating needs for the next 20 years. The Commission identified the funds expected to be available,

estimated the extent to which a gap exists; and made a series of 28 recommendation on closing the funding gap through potential cost savings efficiencies and strategies to raise new revenues.

The Commission made the following reform recommendations which it believes will save the state over $2.4 billion in annual transportation expenditures:

- Road and bridge investments should be selected and advanced based on rational and transparent criteria

- The Executive Office of Transportation and Public Works (EOTPW) should utilize alternative procurement methods and public private partnerships (P3)

- The use of private flagmen should be allowed on road and bridge projects

- Responsibility for the Department of Conservation and Recreation's (DCR) parkways and bridges should be transferred to MassHighway

- Maintenance Responsibilities for I-395, I-84 and I-291 should be transferred to the Massachusetts Turnpike Authority

- EOTPW should establish the position of Private Project Ombudsman

- The Commonwealth should end the practice of using bonded funds for operating personnel and expenses

- The Commonwealth should improve the predictability of highway funding and coordination of projects funded by multiple entities

- The rate of growth of MBTA fringe benefits costs should be reduced

- The unnecessary constraints on MBTA management should be removed

- The MBTA needs to fully fund its state of good repair program. This goal can and should be achieved by the Commonwealth assuming the debt from Central Artery/Tunnel transit commitments

- The Commonwealth should pay for all MBTA capital expansions, and before committing to a project, the MBTA should demonstrate that adequate revenues are in place to operate and maintain the expansions

- Regional Transit Authorities (RTAs) should be forward-funded

- The RTA's 2.5 percent per year cap in operating cost growth should be eliminated

- RTAs should be allowed to borrow with the full faith and credit of the Commonwealth

- The Secretary of Transportation should exercise a stronger coordinating role with respect to RTAs

- The Secretary of Transportation should have the authority to coordinate all aspects of the Commonwealth's transportation network

- The CEO of each Massachusetts transportation agency should institute a rigorous performance evaluation process

- All Massachusetts transportation agencies should have the same $100,000 tort liability limit as municipalities

- The vast majority of our funds for the foreseeable future should be devoted to maintenance and rehabilitation

- The Tobin Bridge should be transferred from Massport to the Metropolitan Highway System

- Transportation user fees must be dedicated to transportation uses

The Commission recognized the need to provide reliable sources of revenue sufficient in amount to erase the existing gap and to keep pace with rising costs over time. It found that significant new revenues were critically needed to simply

maintain our current system, let alone embark upon improvements and expansions. We have identified those six "revitalization" recommendations to generate new net revenues to support transportation needs:

- The state motor fuel tax should be increased by 11.5 cents and indexed to inflation

- The Massachusetts Turnpike should develop a balanced operating budget for the Western Turnpike that does not rely upon spending down its reserve fund

- The Massachusetts Turnpike should develop a balanced operating budget for the Western Turnpike that does not rely upon spending down its reserve fund

- Toll increases on the Turnpike Extension and Harbor Tunnels must be carried out

- The Commonwealth should move to a system of direct road user fees as the principal source of transportation funding using modern technology

- The Commonwealth should investigate whether public private partnerships are appropriate for the development and/or funding of our transportation infrastructure

Michigan

Transportation Solutions: A Report on Michigan's Transportation Needs and Funding Solutions

Established by the State Legislature, the Michigan Transportation Funding Task Force issued a report making a wide range of recommendations in November 2008. The report reviews investment needs by mode, identifies strategies to achieve

greater efficiency and recommends strategies to increase transportation funding. Transportation revenues in Michigan currently come from user fees such as motor fuel taxes and vehicle registration fees. The Task Force considered alternatives

involving both user fees and non-user fees, and found that a combination of alternatives would be required to achieve a "good" level of investment.

The Task Force identified the following revenue options.

- Increasing vehicle registration fees

- Eliminating registration discounts

- Increasing motor fuel taxes

- Taxing gasoline and diesel fuel at the same rate

- Abolishing the 1.5 percent cost of collection allowance on motor fuel taxes

- Enacting measures to control costs paid for with transportation funding through Inter-Departmental Grants.

- Increasing sales and use tax one percent and dedicate that additional revenue to transportation

- Directing all or a portion of the sales tax on fuel to the MTF

- Redirecting all or a portion of the Natural Resources Trust Fund to transportation

- Encouraging local investment in transportation by enabling a broad spectrum of local revenue options statewide. These could include:

- County registration fees

- County driver's license fees

- Local fuel taxes

- Allowing a region-wide, seasonal local fuel tax to provide additional revenue for winter maintenance

- Enabling corridor authorities to raise revenue along a certain alignment for a particular project that may span multiple counties or municipalities

- Enabling Public-Private Partnerships (P3s) for toll-financed reconstruction, expansion or new construction of freeways or other transportation systems

- Enabling toll-financed reconstruction, expansion, or new construction of freeways

Mississippi

Excelerate Mississippi

The Mississippi Economic Council's Blueprint Task Force was formed in June 2014 to study all aspects surrounding Mississippi's transportation infrastructure. The Task Force has confirmed that it is essential for Mississippi to increase its investment in state and local transportation infrastructure. Current funding levels are not adequate to meet the state's transportation investment needs maintain today's conditions. State and local governments cannot continue to maintain the state's roads and bridges to their current conditions. Rather they are managing the decline of the existing system and doing their best to slow the deterioration of the state's vital transportation network, while increased vehicle fuel efficiency and inflation are shrinking the purchasing power of Mississippi's motor fuel tax.

The Blueprint calls for the state to raise new revenues and act to preserve its transportation infrastructure. Nearly a third of the state bridges and almost half of local bridges require significant rehabilitation, with many of them unable to support the loads they were designed to carry and potentially dangerous. In addition, 90 percent of the state highway system and 82 percent of the highways and roads owned by counties and municipalities need maintenance to keep from deteriorating into critical condition.

This 10-year plan outlined by the Task Force does not address all needs, but accelerates the current plan and puts Mississippi on a solid foundation for preserving its transportation infrastructure. The Task Force recommends replacing all state bridges that cannot carry the weight and traffic they were designed to accommodate, and addressing the most vital pavement needs through rehabilitation and maintenance. This will allow the state to catch up on its rehabilitation needs over the next 10 years and create stability for the future.

The MEC Blueprint Mississippi Transportation Infrastructure Task Force determined that $375 million in new revenue - $300 million for state needs and $75 million for local needs - is required each year to respond to Mississippi's immediate transportation needs. The Task Force has considered relying on the following revenue sources to meet the state's transportation investment needs:

- Increasing the excise tax on motor fuel - raises $21.7 million for every cent per gallon

- Increasing vehicle registration fees - raises $27.5 million for each $10 increase

- General sales tax increase - raises $178 million for every .05% increase

- Sales Tax on gasoline and diesel fuel - raises $23.7 million for every .05% added

- Special fees on alternative fuels - raises up to 17,000

- Rental car fees - raises $2.5 million per 2% increase

- Tolls - there are currently no toll roads in Mississippi

- Vehicle Miles Traveled fees

The Task Force issued its report Ramping Up Mississippi's Economic Through Transportation in December 2015.

Missouri

Report of the 21st Century Missouri Transportation System Task Force

In 2017, the General Assembly adopted HCR 47, which established the 21st Century Missouri Transportation System Task Force, a 23-member bipartisan panel comprising participants from the House of Representatives, the Senate, the Executive Branch, and the private sector. The Task Force was directed to evaluate and make recommendations regarding the state's transportation system and its funding.

The report contains recommendations that had the general support of the Task Force members. They took the form of a three-part roadmap for funding and improving Missouri's transportation system. The roadmap envisions sets of short- and long-term strategies and steps for building and acting on a consensus around what that system looks like, how it operates, and how it should be funded. Meanwhile, the roadmap also calls for legislative action to improve highway safety and to improve the state's ability to better leverage existing transportation funding and emerging opportunities and innovations.

Part 1: Immediate Impact Investment

- Increase the state excise tax on gasoline by 10 cents and on diesel by 12 cents per gallon to raise approximately $430 million annually, on top of existing revenues of about $2.5 billion annually, to improve roads and bridges.

- Implement a dedicated revenue stream of $50-$70 million annually for the state's multimodal transportation needs (i.e., aviation, mass transportation, railroads, ports, waterways, waterborne commerce, and transportation of elderly and disabled persons) that would involve no additional taxation of Missouri citizens.

Part 2: Sustainable and Diversified Transportation Funding for the Future

- Consider many options for developing and implementing more sustainable and diversified transportation revenue, for example, among 11 options cited: increased registration fees for electric vehicles; indexed highway-user fees; better authorization for tolling on major bridges; and mileage-based road-user charges.

Part 3: More Efficient Project Delivery, Improved Highway Safety; and Innovation

- Explore transportation methods for project delivery that involve innovative partnerships and solutions.

- Improve safety by prohibiting distracted driving (in particular, texting while driving); requiring seat belt use, enforced as a primary offense; and providing more graduated driver's-license training requirements for young drivers.

- Examine opportunities to leverage innovation in transportation.

Blue Ribbon Citizens Committee on Missouri's Transportation Needs

In March 2012, the Speaker of the Missouri House of Representatives appointed a committee of citizens from throughout the state to create a report on the State's current and future transportation needs. The findings were developed based

on analysis of the current state of infrastructure across the State, future demographic and economic development, and seven regional meetings held across the state. Six overarching themes emerged when discussing infrastructure challenges.

They include:

- The existing transportation system must be maintained.

- Safety must continue to be a priority.

- State needs are multimodal.

- The state does not have the financial resources to strategically expand the system.

- A healthy and improved transportation system is critical to the State's economy.

- Missouri Department of Transportation is well regarded among the State's citizens.

The Committee's recommendations for addressing transportation needs include:

- An additional $600 million to $1 billion per year will adequately address the State's growing transportation needs. This investment is critical to the State's economic growth and is an opportunity that voters in Missouri should take.

- The Department will have to find additional ways to meet the needs of the future outside of cutting staff to find efficiencies. New opportunities will likely require a combination of solutions, rather than any one recommendation.

- The State should adopt a solution that is fair, accountable, and transportation to all citizens to ensure that everyone plays a role in its upkeep and improvement.

- Any new revenue created should be dedicated to transportation and spent as intended and not diverted to other uses.

New Hampshire

Final Report by the Commission to Study Future Sustainable Revenue Sources for Funding the Improvement of State and Municipal Highways and Bridges

New Hampshire statute established the Commission to Study Future Sustainable Revenue Sources for Funding Improvements to State and Municipal Highways and Bridges in 2009. The Commission delivered its findings to the governor and the State

Legislature in November 2010.

After an exhaustive accumulation of information enclosed in the Final Report, the Commission came to the conclusion that, at the present time, and for the next 10 to 15 years, there are only three sustainable and constitutionally allowed

revenue sources available to the State of New Hampshire:

- Motor vehicle fees and surcharges, including licensing and vehicle registration;

- The Road Toll/Gas Tax; and,

- Tolling

Under current operating and capital budgets, the Commission found that there is an immediate $124 million dollar shortfall in the Highway Fund projected for the next biennium. In terms of sustainable Highway Funds revenue to meet the current

and projected needs; the newly-elected General Court has three choices: 1) to raise the additional revenue from permanent registration fee increases, 2) to raise the additional revenue by increasing the road toll/gas tax rate, or 3)

some combination of 1 and 2.

In the longer term, to meet the projected ten year $1.2 billion Highway Fund combined operating and capital budget deficits (which does not include the $230 million I-93 widening) all three sustainable revenue sources are potentially available

to the Legislature. Toll revenues could indirectly fund the Highway Fund deficit through consolidation.

New Jersey

Recommendations for Ensuring a Strong Transportation Network for the 21st Century

Established in January 2003 by Governor James McGreevey, New Jersey Blue Ribbon Transportation Commission made recommendations on transportation funding and policy for a 10-year period. It found that significant new investment would be

required to meet core transit system. It recommended a combined annual capital investment program of $3.1 billion to meet highway and transit needs. Specific recommendations included:

- Increasing the State Motor Fuels tax by 12.5 to 15 cents per gallon, with the new revenue should be constitutionally dedicated to the Transportation Trust Fund Authority (TTFA).

- Increasing the TTF capital program to a 50/50 pay-as-you-go bonding ratio over the life of the program.

- Providing for inflationary protection by indexing the Motor Fuels tax.

- Dedicating full yield from new Motor Fuels Tax (currently $49.5 million/penny).

- Capturing revenues generated from heavy truck fees, good driver surcharges and contributions from toll road authorities to the TTFA over the next 10 years.

- Capping the diversion of revenue from capital to fund maintenance and operation costs at the current level, with the goal of eliminating this practice over the next 10 years.

- Capping the level of the annual capital program so as to not exceed the financial resources of the TTF based on the above limitations.

- Indexing NJ TRANSIT fares to inflation

- Encourage private-sector-like efficiencies within NJDOT and NJ TRANSIT.

New Mexico

New Mexico Transportation Infrastructure Futures Task Force

This report is not available on line.

Ohio

Final Report of Ohio's 21st Century Transportation Priorities Task Force

This report is not available on line.

Oregon

One Oregon: A Vision for Oregon's Transportation System

Governor Kate Brown's transportation vision panel prepared a 30-year vision and near-term recommendations for the future of the state's transportation system. Issued in May 2016 the Panel's report One Oregon: A Vision for Oregon's Transportation

System makes the following recommendations. The panel recommends:

- In the near term, Oregon can stem the immediate transportation funding crisis by passing a transportation funding package. A number of funding options are available, including the traditional suite of user taxes and fee increases,

as well as creating new fees where appropriate to ensure equitable contributions by transportation system users. Local governments can also be given greater ability to raise money for their transportation needs. Providing additional

funding for non-highway modes is also critical.

- In the mid term and long term, new revenue options to supplement traditional user fees should be explored to stabilize state funds and provide funding for all modes of transportation. As Oregon looks to future funding options, it should

explore modifications to the state constitutional dedication that limits Oregon's ability to invest in non-highway transportation modes. Reform the administrative budgeting practices of the Transportation Trust Fund to reverse

a trend of reduced funding to transportation infrastructure from inflation and transfer of funds to other entities.

- Increase funding sources and introduce new transportation funding sources. Short term sources would include a statewide property tax and directing lottery revenues to transportation, employer and employee payroll taxes, and cigarette,

alcohol and cannabis taxes.

- Longer term funding options include road and bridge tolling, per-mile road user charges and a carbon tax.

- A total of $964 million in annual investment is needed over the coming 30 years in order to meet mobility, environmental, seismic preparedness and resiliency needs in the state:

- Maintenance and Preservation: $324 million

- Seismic Resiliency $257 million

- Bottlenecks $250 million

- Transit: $108 million

- Bicycle and Pedestrian: $25 million

Pennsylvania

Transportation Funding Advisory Commission Final Report

To address the growing gap in transportation funding, Governor Tom Corbett of Pennsylvania established the Governor's Transportation Funding Advisory Commission (TFAC) in April 2011. The TFAC was specifically created to develop a comprehensive,

strategic proposal for addressing the transportation funding needs of Pennsylvania. The TFAC prepared a comprehensive listing of potential revenue sources as well as cost-saving modernization options that will support additional funding

for all transportation modes. The TFAC's recommendations include:

- Capping and/or moving the $570 million that the Pennsylvania State Police receive from the Motor License Fund, and migrating all or a portion of that amount to the General Fund

- Restructuring Act 44 decreases with contributions from the Pennsylvania Turnpike that are currently directed to highways and bridges being reassigned to transit

- Indexing all vehicle and drivers' fees to the Consumer Price Index, allowing them to keep pace with inflation over time

- Uncapping the Oil Company Franchise Task (AWP) over a five-year period. The potential revenue of the AWP is now more than double the ceiling. Removing the ceiling would increase revenue significantly. Revenues go to PennDOT, municipalities,

the Pennsylvania Turnpike Commission, counties and the Department of Conservation of Natural Resources

- Increasing traffic violation fines by $50, without adding points on the offender's license

- Implementing a $100 surcharge on license violations

- Increasing vehicle registration fees, with revenues going for local transportation improvements

- Increasing the local funding transit match that is required to receive state funds

- Dedicating up to 2 percent of all state sales tax proceeds to transit

- Allowing marketing and advertising in state-owned rights-of-way

- Migrating the Department of Revenue's point of collection for the motor fuel tax from the wholesale distributor level to the terminal, or "RACK"

Rhode Island

Blue Ribbon Commission, Rhode Island's Transportation Future: A Sustainable Approach to Transportation Funding

In recognition of the serious reduction in transportation funding and aging transportation infrastructure in critical need of repair or replacement, Governor Donald Carcieri of Rhode Island established a Blue Ribbon Panel in March of 2008

to assess the state's transportation needs and to identify options for potential funding sources. The panel's mission includes understanding transportation financing needs in Rhode Island, analyzing funding options, and recommending

funding a set of mechanisms.

Because of the state's delicate economy the Panel appropriate to present two scenarios that would provide target funding levels of $150 million (Scenario 1) and $300 million (Scenario 2) each state fiscal year.

Scenario 1 includes the following revenue sources:

- Increasing state motor fuel taxes by 5 cents in 2009 and an additional 5 cents in 2012

- Increasing bi-annual vehicle registration fees by $40 in 2009 to $100 and by an additional $20 in 2013

- Levying a new Petroleum Products Gross Receipts Tax equivalent to a 10 cent in the per-gallon fuel cost in 2010 and an additional 5 cents in 2014

- Tolling on I-95 at the Rhode Island border with Connecticut

- Transferring the Sakonnet River Bridge to the Rhode Island Turnpike and Bridge Authority (RITBA), with the RITBA refunding RIDOT the amount being expended for replacing the bridge

Scenario 2 derives revenue from most of the same sources as Scenario 1, with higher revenue levels from the gas tax, petroleum products gross receipts tax and from tolling at all Interstate highway borders in Rhode Island. Two new funding

mechanisms are included in Scenario 2: implementation of an annual vehicle mileage fee on all Rhode Island registered vehicles; and redirecting existing vehicle registry fees from the State's General Fund to the transportation trust

fund.

South Carolina

Transportation Funding Options for the State of South Carolina

In 2009 South Carolina DOT retained Clemson University to prepare a report on transportation funding options for the state. The report is the first of a series of reports from the Jim Self Center on the Future to address this issue of

funding transportation infrastructure needs. The report summarizes survey responses from 1,000 households in South Carolina to identify issues of particular concern and to determine the level of acceptance of alternative funding strategies

for transportation infrastructure.

The study explored public opinion on the following potential transportation revenue options:

- Impact Fees

- General Funds

- State Loan Pool

- Tolls on Roads and Bridges

- Sales tax on new automobile purchases

- Income taxes

- Motor fuel taxes

- Property taxes

The study also researched public opinion on who should pay for transportation revenues.

Washington State

Strategic Transportation Investments to Strengthen Washington's Economy and Create Jobs

The Connecting Washington Task Force issued its final report, Strategic Transportation Investments to Strengthen Washington's Economy and Create Jobs, in January 2012. Although the amount of new funding needed to address all of the Task

Force's objective is estimated at $50 billion, the Task Force recommends an investment of $21 billion in state funding during the next ten years to preserve the transportation system and make strategic investments in the corridors

that hold the key to job creation and economic growth.

To accomplish this, the Task Force recommended that the legislature considers new revenues derived from increases in fees that could be enacted by the legislature by a simple majority vote and tax increases that would require either a

two-thirds vote of the legislature or a majority vote of the people. The Task Force also recommended that the Legislature expand funding options that can be enacted at the local level to support the transportation system. The Task

Force also recommended that the State begin planning now for a transition to more sustainable funding sources for transportation. This could include mechanisms such as direct user fees based on miles traveled, wear-and-tear on the

roadways, or other direct impact upon the transportation system, allowing the system to be managed and funded as a statewide transportation utility, with rates based upon use.

Medium term revenue increases to fund the $21 billion investment could include:

- Tolling

- A $2 increase in driver record abstract fees

- A $10 increase in vehicle title fees

- A $20 increase in fees for new drivers licenses and $15 for renewals

- A $5 per tire studded snow tire fee

- A $100 annual electric vehicle fee

- A 10 percent increase in the gross vehicle weight fee

- State impact fees or tax increment financing

- Tax increases directed to a dedicated maintenance fund account

- Increases in state motor fuel taxes

- State-wide motor vehicle excise tax

- A tax on all barrels of oil refined in Washington State

- A tax on the sale of hazardous substances

- An increase in the tax on the sale or lease of vehicle

- A vehicle miles traveled (VMT) tax

- An emission tax levied on the carbon content of fuel

- Local option fuel taxes

- Local property taxes

- Local tolling

- Parking stall fees

- City street utility authorities

- Transportation district vehicle license fees

- Expanded use of employee taxes

- Local emission fees

- Elimination of exemptions on the sales tax on gas

West Virginia

Blue Ribbon Commission on Highways

In August 2012 the Governor appointed a commission to create a set of recommendations for improving highway transportation in the state. The Commission studied the condition and needs of the State's transportation system and steps to developing

a long-term improvement plan. The Commission was comprised of representatives from statewide government, constituency groups, members of the state legislature, local counties and municipalities, as well as citizens. The recommendations

include:

- Create a package to raise DMV fees to provide $77 million in addition funding per year for the state Road Fund.

- Impose a new fee of $100 to $200 per year on vehicles that use alternative fuels.

- Dedicate state sales taxes collected on auto repairs and parts to contribute an additional $25 million annually to the state Road Fund.

- Reauthorize the State's Parkways/Turnpike Authority to maintain tolls on the West Virginia Turnpike, and finance $600 million to $1 billion to fund "expansion" projects across the state.

- The Commission also engaged in several studies regarding transportation including how to meet the State's growing transportation maintenance needs (estimated at more than $100 million per year); examination of how to general added

efficiencies and savings from the state Division of Highways; and whether the state should consider a change to the gasoline tax, similar to the change recently implemented by Virginia.

Wisconsin

The Wisconsin Commission on Transportation Finance and Policy

Wisconsin faces a daunting challenge when it comes to meeting the growing needs of its multimodal transportation network. To address this challenge, the Legislature, as part of the 2011-13 state biennial budget, created the 10-member Wisconsin

Transportation Finance and Policy Commission. The Commission held over a dozen public meetings and several public listening sessions and focus group meetings to examine issues related to the future of transportation finance and policy

in Wisconsin, among them:

- State highway programs

- Local road, bridge and aid programs, including bicycle-pedestrian facilities and transit

- Freight and multimodal programs, including airports, harbors, and railroads

- Transportation Fund revenue projections and debt service; and

- Revenue and finance alternatives

The Commission's overall goal was to develop policy changes and financing options to balance projected transportation needs with revenues over the next 10 years. The Commission was required to submit a report to the Governor and state

legislative leadership by March 1, 2013.

The Commission developed funding recommendations to maintain current physical conditions and congestion levels through 2023. In order to accomplish this, the Commission made the following recommendations:

- Raise the state motor fuel tax by five cents per gallon.

- Adopt a new mileage-based registration fee for passenger cars and light trucks of approximately one cent per mile travelled.

- Increase annual registration fees for commercial vehicles by 73 percent.

- Increase the fee for an eight-year driver license by $20.

- Eliminate the sales tax exemption on the trade-in value of a vehicle.

Under the Commission's recommendations, fuel taxes and registration fees for the owner of a typical passenger vehicle would increase by approximately $120 annually, or 33 cents per day.

In addition, the Commission offered additional recommendations and findings to address policy issues related to transportation funding and finance in Wisconsin:

- The Commission supports legislation to allow regional transportation authorities to raise funds through a one-half-cent maximum sales tax, with voter approval, for transportation purposes.

- The Commission supports legislation to authorize a maximum one-half-percent local option sales tax, for transportation purposes, in counties with populations less than 100,000.

- The Commission supports capping debt service payments for transportation projects at a manageable level compared with annual transportation revenues.

- The Commission supports indexing the state motor fuel tax and/or vehicle registration fees to provide inflationary adjustments over time.

- The Commission supports the proposed state constitutional amendment to protect the integrity of Wisconsin's Transportation Fund.

- The Commission found that current federal regulations on tolling create an obstacle to its implementation in Wisconsin. The Commission encourages the Wisconsin Congressional Delegation to support federal legislation that allows states

more flexibility to toll on the National Highway System.