This case focused on impact fees, as special assessment districts and developer contributions.

The City of Bozeman, Montana (the City) is located in Gallatin County, and is Montana's third most populous city, with a population of about 45,000. It is well-situated, given its relative closeness to two national tourist attractions - Big Sky Resort and Yellowstone National Park and is also home to Montana State University and its 16,000 students. It has grown rapidly over the last two decades, and is consistently ranked one of the fastest growing micropolitan cities in the United States, as well as one of the strongest economies of its size.

Bozeman's population growth accelerated in the 1990s. After increasing by only 5 percent between 1980 and 1990, its population grew by 20% in the 1990s. The population also grew by 32% in the 2000s (with the housing stock increasing by over 50% in that decade), and is Projected to grow by another 33% in the 2010s. The City's rapid growth drove it to annex several thousand acres of land, and it currently covers 12,900 acres, 80% more than in 1996 i. Details of Bozeman's population growth can be found below in Table 1.

| Year | 1990 | 1995 | 2000 | 2005 | 2010 | 2015 | 2020 (Projected) |

|---|---|---|---|---|---|---|---|

| Population | 22,827 | 27,555 | 28,210 | 34,983 | 37,326 | 43,399 | 50,000 |

By the 1990s, Bozeman's growth started to strain its resources. Because of this, City leadership implemented impact fees in March 1996 as a way to fund the infrastructure necessary to accommodate this growth. Impact fees were charged to new developments in Bozeman to pay for the capital aspects of key services - specifically the roads, sewers, water and fire/EMS that the construction of these new developments would drive. Bozeman policymakers took the view that new users were the drivers of increased capital needs, rather than existing users, and therefore they felt that impact fees were a much fairer way to pay for this construction than increased property taxes on existing developments. These fees were charged to builders of new homes, and businesses, in other words anyone who connects to water or sewer, or contracts with the City for fire protection while Property taxes cover basic municipal services and operations.

Impact fees in Bozeman are set based on formal studies estimating the cost of growth and assigning a proportionate share to new construction. The amount of impact fees is dependent on the key development attributes, such whether the development is commercial, residential, or industrial, the size of the development, and other characteristics such as the number of bathrooms, parking lot size, and greenspaces. The City reviews the level of impact fees every 3 - 5 years.

When impact fees were first established, Bozeman's authority to charge them was unclear under the Montana State Constitution. The City had started studying impact fees a decade prior to implementing them, when it hired a private attorney based in Helena, the state capital, to study their legality, along with a team of City and county lawyers. In spite of the City's significant legal preparation in advance of launching its impact fee program, it faced challenges almost immediately from the inception of the program. In December 1996, less than a year after impact fees were launched, Myles Eaton, executive director of the Business and Consumers Bureau of Montana Inc., requested an official legal opinion on the program from Montana's attorney general. He pointed to language in Montana's state constitution stating that cities do not have self-governing powers, but "only those powers expressly given them by legislature iii." The City, on the other hand, believed that given its express jurisdiction over services such as fire, water and streets, it also had the right to raise money for these services. This dispute between the City of Bozeman and developer advocates continued for several years, and is outlined further in Section 2.3.

In 2005, the Montana State House and Senate passed SB 185, which gave Bozeman and other local governments the clear authority to impose impact fees. SB 185 was a compromise bill which also included some safeguards that developers had sought in order to limit the scope of these fees. For example, SB 185 established limits around the use of impact fees, disallowing their use to pay for services, and requiring that they be used for capital improvements. SB 185 also restricted the collection of impact fees to five types of public facilities: water supplies, sewers, transportation, stormwater, and emergency services - including police, EMS, and fire protection. Any impact fees beyond those five categories have to be approved by a two-thirds vote of the city council. Finally, the law established advisory committees to review how funds were spent. iv

Impact fees have facilitated improvement of Bozeman's infrastructure as it continued to expand in population and size. To accommodate these ongoing changes and determine the impact fee levels that approximate the cost of providing new infrastructure, the City regularly hires consultants to conduct market studies on its impact fees - gauging how population expansion and certain types of developments such as retail, restaurants and industrial developments, will affect traffic, and in turn affect road needs, based on person-miles added to the system. Bozeman then calculated how many city roads and state roads will need be built according to the City's Transportation Master Plan, at a cost of $3.3M per lane-mile, and determines how to allocate these newly needed roads across new developments. Each person-mile of travel of travel has been estimated to have a cost of $319. Bozeman also began calculating and allocating bicycle and pedestrian miles created from new developments, and includes new lane and sidewalk construction as part of a more holistic transportation impact fee. v

Through this process, Bozeman was able to calculate the maximum allowable impact fee for each new development. This maximum allowable impact fee has increased with each study as costs and needs have also increased. City Council then decides what percentage of the maximum allowable amount to charge. Bozeman has raised these fees several times, and in 2008, Street impact fees were raised to 60% of the maximum allowed in 2008, causing the fees for a 1,500 to 2,499-square-foot single family home to increase from $2,380 to $3,238 and those for a bank to nearly double, from $10,470 to $19,024 per 1,000 square feet. Industry advocates viewed impact fees as having a harmful impact on the housing market, especially as the economy was struggling at the time. For example, a 2007 study by the National Association of Home Builders concluded that every $819 charged at the time of construction would add $1,000 to the final price of a home. vi Nonetheless, Bozeman still went ahead with this fee increase because its need for funds was so high. After implementation the City still expected to be short $7.4M over five years for street projects in its capital improvement program. vii Between 2011 and 2012, Bozeman considered cutting street impact fees by 1/3 to stimulate sluggish home building in the aftermath of the recession. However, a reduction in impact fees would have required the City to raise property taxes to cover its costs of growth, which many residents and politicians in the region consider an unfair distribution of responsibility, and the proposal was not implemented. viii The housing market quickly recovered, and in 2013 Bozeman voted to charge the maximum allowable amount of street impact fees. ix

From the first year impact fees were implemented, Bozeman faced several legal challenges over this program, a timeline of these disputes is below:

Although impact fees enjoyed broad support, even sympathetic citizens and councilmembers were concerned that they could harm the City's economy. As Bozeman sought to woo several national commercial chains, it found that many of its efforts failed or came close to failure. Citing impact fees, Kohl's threatened to scrap its plans for a new Bozeman store, although it ultimately relented. Meanwhile, Qdoba and Best Buy scoped Bozeman for potential locations but both chose not to open sites in the City, with Qdoba choosing to locate two hours away in Billings, Montana instead. It was uncertain if impact fees were the true motivation behind these stores' misgivings. However, it was clear that Bozeman had higher fees than other cities in Gallatin County, other Montana Cities, and other regional hubs - such as Boise and Spokane. xii

Bozeman made several tweaks to impact fees, in concert with - or at least mindful of - the business community, in order to limit any negative impacts that they could have on development and economic growth. For example, when Bozeman increased road impact fees to 60% in 2008, it included special incentives for retail spaces so that their street impact fees dropped from $6,672 to $5,599, as the City's retail market was especially sluggish. xiii In 2013, by unanimous vote, Bozeman also began permitting developers to defer payment of street impact fees until the structure was ready to be occupied - rather than when construction began, in line with an argument that developers had made at least since 1997. To reduce the risk of nonpayment, the impact fee deferral process required a $50 application fee, a lien against the property, a $1,000 penalty, interest, and responsibility for the City's legal costs if fees are not paid on time. xiv

Furthermore, in order not to increase property taxes to pay the remaining capital needs, in 2015, Bozeman established an "Arterial and Collector Special Assessment." The City funded the remainder of its $7.9M roadway capital needs from this assessment on all property owners within the Bozeman city limits to fund streets classified as "arterials and collectors." xvi, xvii The City's Arterial and Collector fund also included significant monies from owner or developer payback agreements, state and federal grants, reimbursements, and other sources.

A much larger share of Bozeman's capital costs for streets come from impact fees than in Montana's larger cities, in part because its small size precluded access to federal funds for streets. xviii

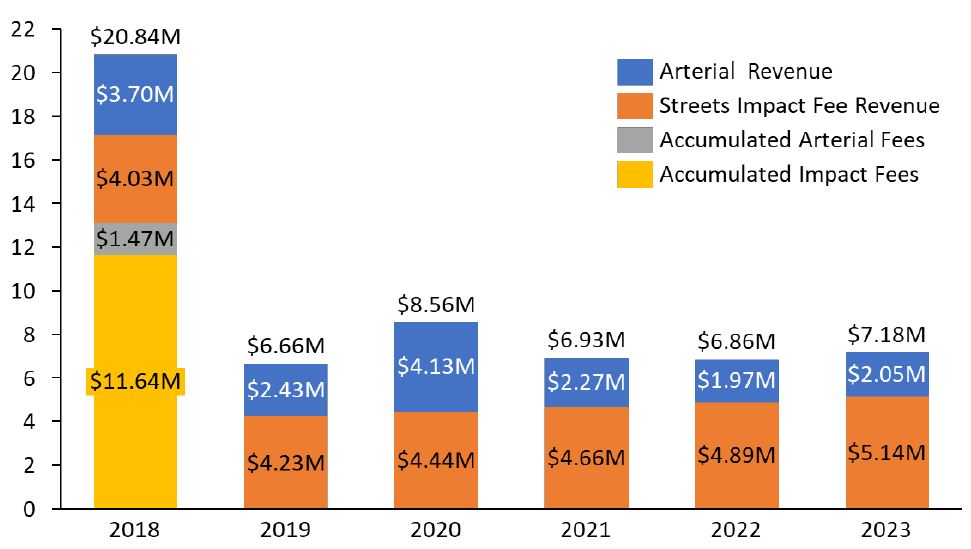

The impact fees calculated in Bozeman's most recent draft study (conducted in May 2018) would, when adopted, generate an average of $3.5 million to $5.0 million per year through 2040, or a total of $80 million to $115 million over the next 23 years. xix The most recent (FY18 - FY 23) Capital Improvement Plan accounts for about $57M in total improvements, utilizing accumulated funds from past years and projected impact fee and arterial revenue from between 2018 and 2023. About 70% of this capital funding is expected to come from road impact fees, with arterial revenue funding the balance.

Table data for Figure 1

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Arterial Revenue | $3.70M | $2.43M | $4.13M | $2.27M | $1.97M | $2.05M |

| Streets Impact Fee Revenue | $4.03M | $4.23M | $4.44M | $4.66M | $4.89M | $5.14M |

| Accumulated Arterial Fees | $1.47M | |||||

| Accumulated Impact Fees | $11.64M | |||||

| Totals | $20.84M | $6.66M | $8.56M | $6.93M | $6.86M | $7.18M |

i Robert Peccia and Associates, Alta Planning and Design. City of Bozeman. (2017). Bozeman Transportation Master Plan.

ii Google Public Data. (2018, September 18). Retrieved from https://www.google.com/publicdata/

iii Shontzler, G. (1996, December 9). Attorney General Declines Request for Impact Fee Opinion. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/attorney-general-declines-request-for-impact-fee-opinion/article_3b0c3487-7fed-5858-87a4-4e7347888a2d.html

iv Williams, W. (2005 December 7). County May Study Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/county-may-study-impact-fees/article_245282f4-1655-5e76-837c-91b5ca96d37b.html

v Tindale Oliver Consulting. City of Bozeman. (2018). City of Bozeman Transportation Impact Fee Update Study. Tampa Florida: Tindale Oliver.

vi Ricker, A. (2008 June 21). City to Consider Tripling Fire Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city-to-consider-triplingfire-impact-fees/article_91600ade-6499-512a-9e81-83c9ba0952a7.html

vii Ricker A. (2008 January 14). City Vote Upholds Impact Fee Increase. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city-vote-upholds-impact-fee-increase/article_25870262-9a2f-5191-991e-595289f74707.html

viii Ricker A. (2011 October 23). Bozeman to Consider Cutting Street Impact Fees Monday. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city/bozeman-to-consider-cutting-street-impact-feesmonday/article_38845172-fd3b-11e0-b4d8-001cc4c03286.html

ix Ricker A. (2013 February 5). Bozeman Votes To Charge Full Amount For Street Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city/bozeman-votes-to-charge-full-amount-for-street-impactfees/article_f002ba3c-6fae-11e2-9c48-001a4bcf887a.html

x Knauber A. (1997 March 30). Developers Fight Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/developers-fight-impact-fees/article_5a79d055-efd8-577a-97a0-743eda547da5.html

xi Dietrich E. (15 June 2017). SWMBIA Again Suing Bozeman Over City Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city/swmbia-again-suing-bozeman-over-city-impactfees/article_d8bca7ae-d777-54d5-8ef9-13e97e462dc5.html

xii Ricker, A. (2011 July 31). Chamber, Developers Say Impact Fees Driving Buxinesses Away From Bozeman, But City Says It Would Have To Raise Taxes Without The Fees. Bozeman Daily Chronicle. https://www.bozemandailychronicle.com/news/chamber-developers-say-impact-fees-driving-businesses-away-frombozeman/article_903b4002-bafa-11e0-9e91-001cc4c002e0.html

xiii Ricker A. (2008 January 14). City Vote Upholds Impact Fee Increase. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city-vote-upholds-impact-fee-increase/article_25870262-9a2f-5191-991e-595289f74707.html

xiv Ricker A. (2013 April 2). Bozeman Builders Will Be Allowed to Defer Impact Fees. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city/bozeman-builders-will-be-allowed-to-defer-impactfees/article_af8b45d6-9b47-11e2-9bcd-001a4bcf887a.html

xv City of Bozeman. City of Bozeman. (2015). City Manager's Recommended Budget For Fiscal Year 2016.

xvi Arterial and Collector Street Special Assessment. (n.d.). Retrieved from: https://www.bozeman.net/government/finance/special-assessments/arterial-and-collector-street-special-assessment

xvii Dietrech, E. (2015 December 16). Building Industry To Audit Bozeman Impact Fee Program. Bozeman Daily Chronicle. Retrieved from: https://www.bozemandailychronicle.com/news/city/building-industry-to-audit-bozeman-impact-feeprogram/article_d0cbb86c-3091-5e21-abdb-7f43109a727e.html

xviii Ricker, A. (2011 July 31). Chamber, Developers Say Impact Fees Driving Buxinesses Away From Bozeman, But City Says It Would Have To Raise Taxes Without The Fees. Bozeman Daily Chronicle. https://www.bozemandailychronicle.com/news/chamber-developers-say-impact-fees-driving-businesses-away-frombozeman/article_903b4002-bafa-11e0-9e91-001cc4c002e0.html

xix Tindale Oliver Consulting. City of Bozeman. (2018). City of Bozeman Transportation Impact Fee Update Study. Tampa Florida: Tindale Oliver.