Value Capture: Capitalizing on the Value Created by Transportation - Presentation

November 8, 2018

Presenters

- Stefan Natzke, Office of Planning, Environment, & Realty, FHWA

- Kevin Moody, Office of Technical Services, FHWA

- Leon Corbett, Director for Financial Solutions, MGT Consulting Group (formerly FDOT

- Sasha Page (facilitator), Principal, IMG Rebel

Agenda

- What is the EDC-5 Value Capture initiative?

- Why is Value Capture needed?

- Value Capture Overview and Benefits

- FHWA Role

- Case Study

- Q&A/Do you know?

What is the EDC-5 Value Capture initiative?

EDC 5 Value Capture Initiative

Promotes the use of value capture mechanisms as part of a mixed funding and innovative finance strategy to accelerate project delivery and provide equitable funding for sustainable transportation investments.

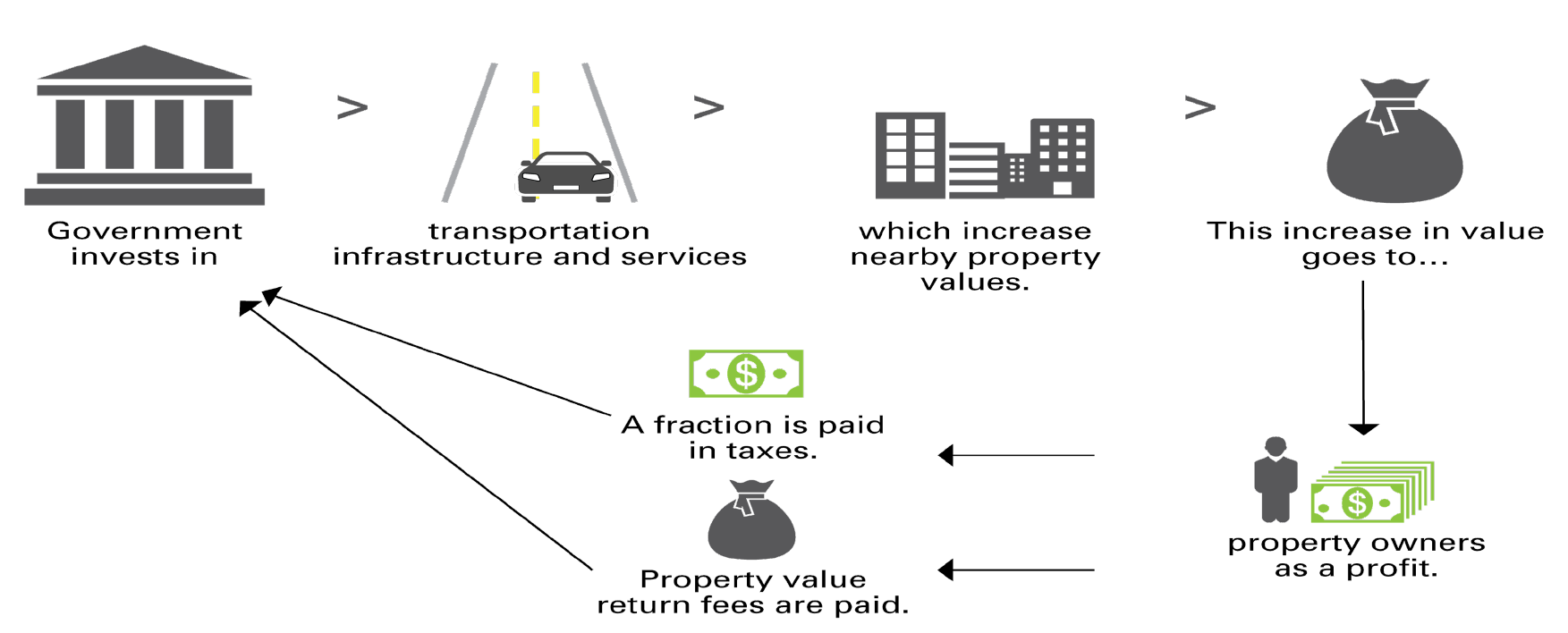

What is Value Capture?

- Government invests in infrastructure and services which increase nearby property values.

- This increase in value goes to property owners as a profit.

- A fraction is paid in taxes.

- Property value return fees are paid.

Example: Value Capture Funds Corridor Improvement

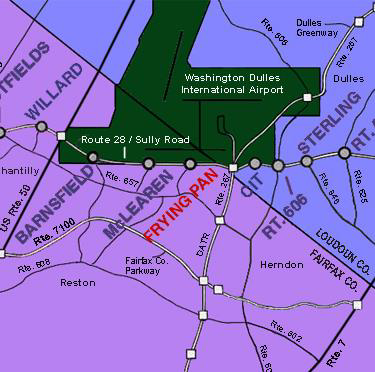

Virginia Route 28 Transportation Improvement District

- District formed in 1987 jointly by Loudon and Fairfax Counties

- Maximum tax rate of $0.20 per $100 of assessed value

- Raises ~ $23 million in revenue

- $138 million, 14-mile widening from two to six lanes completed in 1991

- District and State share project costs 75/25

Virginia Route 28 Transportation Improvement District project profile

Why is Value Capture needed?

The Case for Value Capture

- Federal funding availability

- Local project funding

- Untapped revenue source

- Equitable

- Sustainable economic development

FHWA Roles in Value Capture Tools

- FHWA seeks to improve consideration of all revenue and finance options in the project development process

- FHWA seeks to build capacity for consideration and implementation of revenue options/value capture tools

- USDOT's Build America Bureau offers innovative financing through the TIFIA and RRIF programs that can leverage value capture monies

Value Capture Overview & Benefits

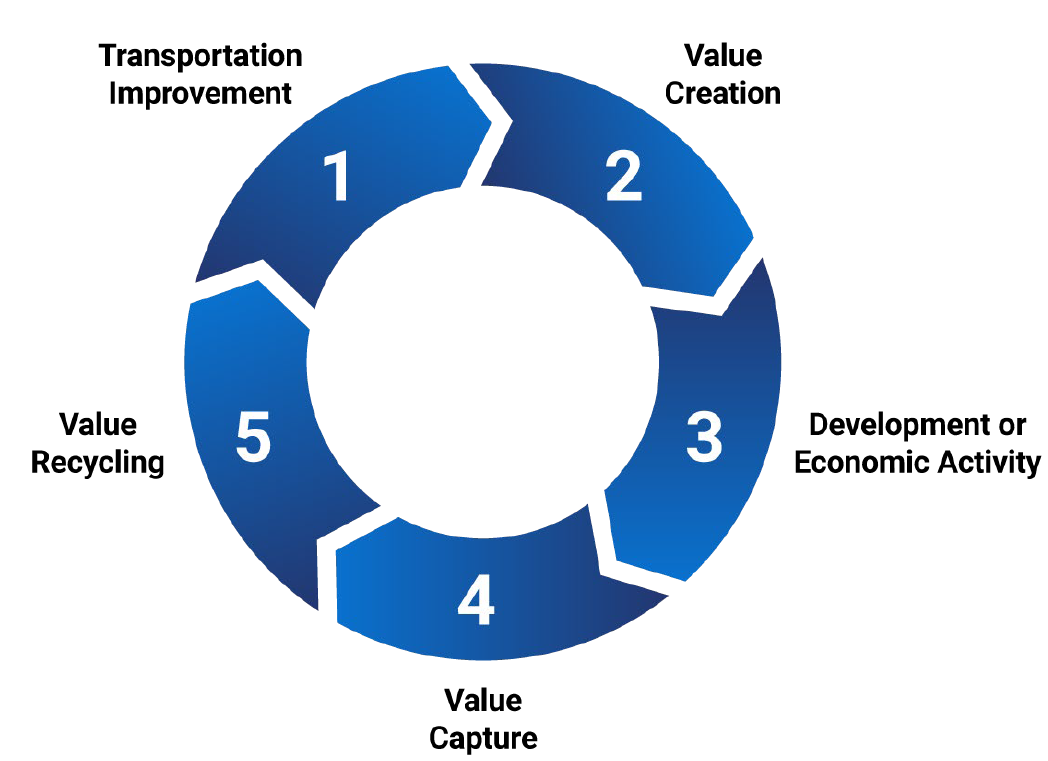

What is Value Capture?

- Transportation Improvement

- Value Creation

- Development or Economic Activity

- Value Capture

- Value Recycling

Value Capture Beneficiaries

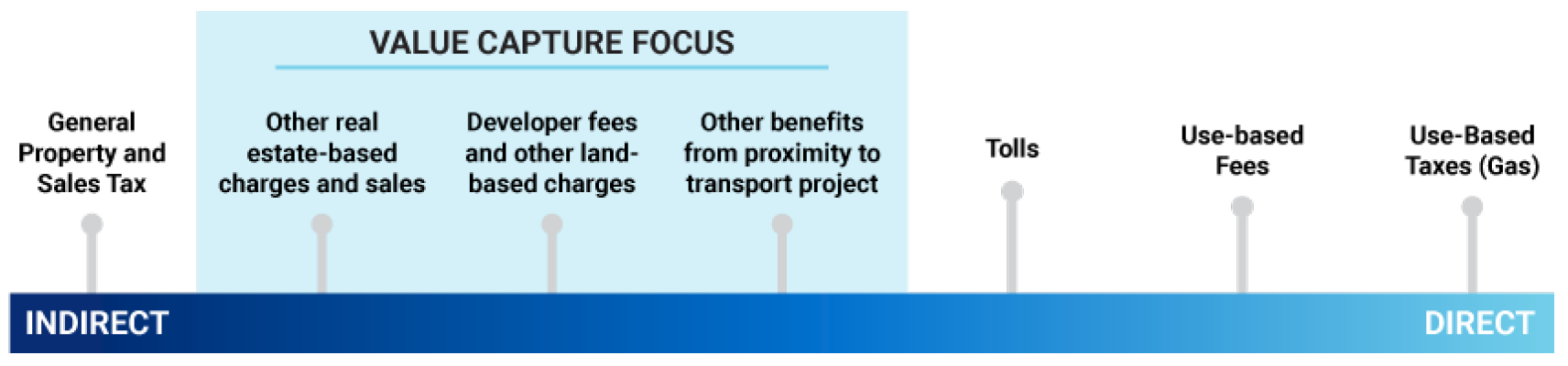

Text of Value Capture Focus chart

- General Property and Sales Tax

- Other real estate-based charges and sales (Value Capture Focus)

- Developer fees and other land-based charges (Value Capture Focus)

- Other benefits from proximity to transport project (Value Capture Focus)

- Tolls

- Use-based Fees

- Use-Based Taxes (Gas)

Potential Benefits of Value Capture

Provide gap funding sources for highway improvements & infrastructure life cycle costs

- Facilitate access to ongoing revenue stream to Local Public Agencies

- Accelerate project delivery & safety Improvements

- Induce private investment

Value Capture Techniques

How is the Value Captured?

- Developer Contributions

- Impact fees

- Negotiate Exaction and Ongoing developer contributions

- Transportation Utility Fees (TUFs)

- Special Tax and Fee Approaches

- Special assessment district

- Sales tax district

- Business improvement district

- Land value tax

- Incremental Growth Approaches

- Tax increment financing (TIF)

- Transportation reinvestment zones (TRZ)

- Joint Development

- ROW Use Agreements

- Concessions, leasing

- Airspace (above or below)

- Parking

- Fiber-optic leasing

- Pipelines or other utilities not addressed by Utility Accommodation Policies or State Law

- ROW Use Agreements

- Advertising Rights and Sales

- Naming rights

- Other

- Transportation Corporation (TC)

- Section 63-20 Corporation

Challenges

- Every jurisdiction is different

- Must target projects with economic benefits for leveraging

- Stakeholder involvement process can be lengthy, due to:

- Coordination between multiple jurisdictions

- Discussions with private developers and property owners

- Establishing project location and design

- Considering legal issues

- Securing political support

- Perceived as another tax

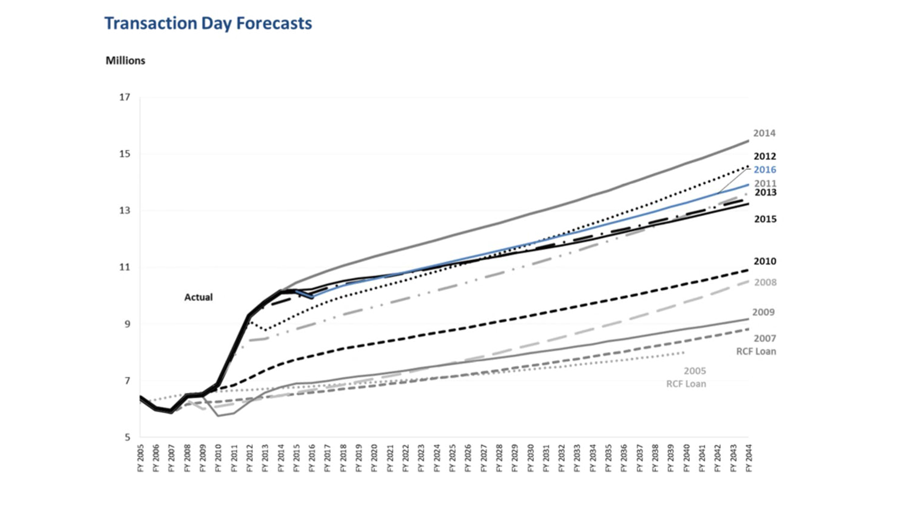

- Requires accuracy of activity and real estate projections:

- If I build it, will they come?

- If I build it, will developers build on nearby property?

- Identify the magnitude benefits & boundary of value capture technique

Ingredients of a Successful Value Capture Project

- Identified in long-term planning/capital improvement program - primarily local

- Incorporated early in the project development process

- Right technique selected for the right project

- Integrated funding and finance strategy

- Community support generated through effective outreach

Value Capture Summary

Value Capture is...

- A set of powerful funding tools that can help address funding gaps. (USDOT supports Value Capture)

- Can be part of the mix of funding sources for transportation improvement solutions

- Can accelerate project delivery, save time and money when done properly

Federal Role

FHWA Roles in Value Capture

- Build capacity among partners

- Assemble VC Implementation Team

- Interact with key stakeholders

- Develop VC Implementation manual

- Develop clearinghouse for VC resources

- Conduct various peer exchanges, training, and technical assistance activities

- Funding

Value Capture Implementation Team

- Co-Leads

- Thay Bishop, FHWA Office of Innovative Program Delivery

- Stefan Natzke, FHWA Office of Planning, Environment, and Realty

- Members

- Jennifer Ahlin, Virginia Department of Transportation

- Janine Ashe, FHWA District of Columbia Division

- John Duel, FHWA Office of Planning, Environment, and Realty

- Ben Hawkinson, FHWA Transportation Policy Studies

- Kathleen Hulbert, FHWA Infrastructure Office

- Chip Millard, FHWA Freight Management & Operation

- Diane Mobley, FHWA Chief Counsel Office

- Kevin Moody, FHWA Resource Center

- Ben Orsbon, South Dakota Department of Transportation

- Jill Stark, FHWA Office of Planning, Environment, and Realty

- Lindsey Svendsen, FHWA Office of Planning, Environment, and Realty

- Jim Thorne, FHWA Office of Planning, Environment, and Realty

- Marshall Wainright, FHWA Resource Center

VCIT Focus Areas

- Communication

- Developing the tools to help FHWA staff and others promote Value Capture to local public agencies (Value Capture Implementation Manual)

- Technical assistance

- Providing technical assistance to local public agencies interested in pursuing Value Capture (Peer Program)

- Clearing House

- Identification of best practices and lessons learned and promoting further discussion on innovative funding options for local public agencies, lessons learned from past and current efforts, etc. Clearing House website.

Key Stakeholders

- State Department of Transportations

- Federal Agencies (HUD, USDA, FTA)

- Metropolitan Planning Organizations (MPOs, RTPOs)

- Local & Tribal Governments

- Transportation Providers (Transit Operators)

- Business Communities

- Developers

- Community residents

Value Capture Activities

- Webinars

- Workshops

- Peer Exchanges

- Case Studies

- Sponsorships (local, regional, & national events)

- Technical Assistance

- Website (Clearinghouse)

Value Capture Clearinghouse

- Currently under development

- Value Capture Manual "How to" implement value capture under development

- Clearinghouse for best practices/lessons learned

Case Study - Osceola County Florida

Transportation Impact Fees & Funding

Kenneth E. Atkins, P.E., FHWA

Minimize The Frustration

- Periods of Dynamic Growth Are Frustrating

- Crowded Roads

- Developers were frustrated w/ County

- Poor Levels of Service

- Locals were frustrated w/ changing culture

- Strategic Planning Minimizes The Problems

- Vision of The End Product Helps

Transportation Impact Fee Background

- Approved in 1989

- Implemented in 1990

- Last update in 2007

- Suspension/ moratorium in 2011 & Repealed 2012

- Replace with Mobility Fee, effective date June 22, 2015

Value Capture Advances Roadway & Bridge Program

- Osceola County impact fees are assessed on new development to provide funding for the County to create improvements needed to serve that development's users

- Impact fees are assessed at the time a building permit is issued and are paid prior to the issuance of a Certificate of Occupancy

- See: Case study Osceola County Bridge Roadway

- Projects bundled using Alternative Contracting Methods (ACMs)

- Countywide 11 projects with 13 bridges

- Bridges were part of roadway projects

- 1 billion dollar program - started w/ bundling $350- million

- 100% locally funded by Value Capture -impact fees

Transportation Mobility Fee

Transportation system charge on development that allows local governments to assess the proportionate cost of transportation improvements needed to serve the demand generated by development projects.

MOBILITY FEE =equals

Additional transportation demand from development

Xtimes

Identified cost for transportation improvements to mitigate associated development impact

The Results

- Most accelerated program in Nation

- 11 Major Roadways in 1-year

- Returned $80 million to local economy in first 4 months of construction

- 11 times previous production

- Returned 36 million dollars in savings to the County's budget

- Start of design to ground breaking as fast as 15 months

- Saved numerous local contractors from going out of business

Case Study

Miami Rental Car Facility, Leon Corbett

Discussion Roadmap

- Miami Intermodal Center (MIC) Mega Project

- Rental Car Facility Component of MIC

- Funding and Financing Innovations

- Performance Metrics

- Pros and Cons of Value Capture

- Wrap Up

Miami Intermodal Center (MIC)

- $2 billion mega project with multiple components

- Model for infrastructure development and partnership

- Partners:

- FDOT

- USDOT

- Miami-Dade County (Transit and Aviation)

- Miami-Dade Expressway Authority

- South Florida Regional Transportation Authority

- Private sector: 16 rental car companies

$395M Mic Rental Car Facility Construction Funding

- Financing with TIFIA loans totaling $270 million

- Low interest rate pegged to U.S. Treasury rate

- Flexible repayment structure

- Repaid with Customer Facility Charges from rental transactions

- Contingent rent backstop

- Additional Funding

- CFC Revenues

- State Transportation Trust Fund

- FHWA and FTA

Complexity Of Financing

- Financial model

- Third parties (advisor, fiscal agent, verification agent)

- Annual credit rating surveillance

- Numerous funds to track - an accountant's dream come true!!!

RCF Funds and Accounts

- Revenue Fund

- Administrative Expenses Fund

- Operating Expense Fund

- IRCF Operating Expense Account

- Consolidated Busing Operating Expense Account

- IMIA Mover Operating Expense Account

- Operating Expense Reserve Account

- Debt Service Fund

- Interest Account

- Principal Account

- Debt Service Reserve Account

- Land Acquisition Fund

- IRCF Secondary Reserve Fund

Pros And Cons

Pros

- Customer Facility Charge revenue stream reduced traditional funding burden

- Less up-front construction funding for government agencies

- Long-term support of operations and maintenance costs

- Leverage public and private partnerships

- Performance of rental car transactions far exceeding expectations

Cons

- Inherent risks with isolated funding source (ex. 9/11 delayed start)

- Complexity of loan and ongoing administrative burden

- Multiple partnerships add to complexity

Wrap Up

MGT Consulting Group

Financial Solutions Director

850.386.3191

Leon.corbett@mgtconsulting.com

Sources and Credits:

- Miami-Dade Aviation Department

- FDOT

- USDOT/FHWA/TIFIA

Questions & Answers Session

Do you know? Value Capture Techniques

Thank You

Jill Stark & Chip Millard

Co-leads:

Stefan Natzke: Stefan.Natzke@dot.gov

Thay Bishop: Thay.Bishop@dot.gov